Asia-Pacific Defibrillators Market Size, Share, Trends & Growth Forecast Report By Product (Implantable and External), End User and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific Defibrillators Market Size

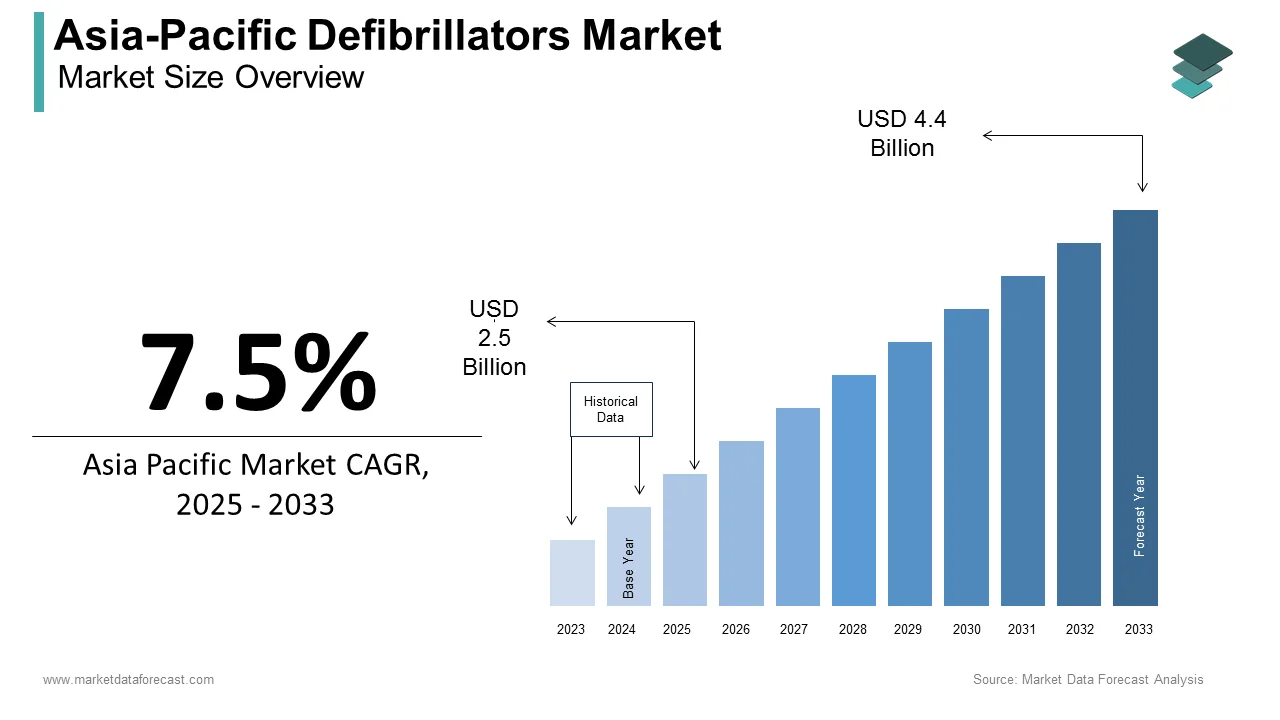

The defibrillators market size in the Asia-Pacific was valued at USD 2.3 billion in 2024. The Asia-Pacific market size is expected to experience a CAGR of 7.5% from 2025 to 2033 and be worth USD 4.4 billion by 2033 from USD 2.5 billion in 2025.

A defibrillator is a vital tool in cardiopulmonary resuscitation indicated in cardiac arrhythmia. As per the 2015 report issued by the Institute of Medicine, approximately 600,000 people are victims of cardiac arrest per year in the U.S., with about 65% of cases in out-of-hospital settings. The survival rate of the out-of-hospital environment is below 6%, whereas it is 24% in hospital settings. Inadequate operational knowledge among consumers regarding defibrillators and CPR results in a degenerate survival rate in out-of-hospital cardiac arrest cases.

MARKET DRIVERS

The Asia-Pacific market is considered an emerging market due to CHD, stroke, and other heart conditions. It has grown moderately due to several factors, including rising healthcare costs, improving infrastructure and economics, and increasing living standards. Developing healthcare systems, large-scale CVD, the spread of stroke and heart disease, and private-sector investment are expected to drive the market over the next few years. The defibrillation procedure involves electrical shock to the heart to depolarize the myocardium and restore normal electrical impulses. The increasing focus of public and private sector defibrillators (PADs) on publicly available defibrillators (PADs) is driving market growth. Besides, advanced defibrillator devices, a rapidly increasing aging population at high risk of target disease, and an increased incidence of heart disease across all age groups are driving the regional market growth.

MARKET RESTRAINTS

Factors such as weak defibrillation policy reimbursement policies, under-equipped medical infrastructure, limited medical and patient awareness of various therapeutic devices, and high device costs challenge market growth.

SEGMENT ANALYSIS

By Product Insights

REGIONAL ANALYSIS

The Asia-Pacific captured a considerable share of the global defibrillators market in 2024 and is likely to be the one of the fastest-growing regional markets globally over the forecast period. The healthcare sector in the region is predicted to increase drastically, with huge advancements in the defibrillator industry in particular. The industry has grown significantly as a result of the adoption of innovative devices and technical advancements. In addition, due to lower surgery and treatment expenses, India, China, and Japan are medical tourism destinations for various countries. As a result, patients go great distances to receive high-quality care at low costs. In addition, medical tourism and an increase in heart patients in the region are driving up demand for implanted operations and devices.

China Dominated the Defibrillator Market in the Asia-Pacific in 2024

The Chinese market is also anticipated to account for a dominant share of the APAC Defibrillators market during the forecast period. China has witnessed technological advancements in the healthcare sector, which provides lucrative growth opportunities for the country's market players. In addition, government investment, the availability of advanced infrastructure, and the growing geriatric population are propelling market growth.

Japan Is Anticipated To Hold A Promising Occupancy Of The Regional Market Over The Forecast Period.

Japan is forecasted to grow at a promising CAGR during the forecast period. In Japan, out of a total population of 126 million, about 27% of the population was over 65 years old. In 2023, the population is expected to drop to 123 million, with the geriatric population expected to rise. Compared to the younger population, the incidence of heat stroke in the elderly population is relatively high. According to the Institute for Health Metrics and Evaluation, ischemic heart disease affects roughly 0.2 million people in Japan. Ischemic heart disease affected 3.5 million people in the preceding decade, but this number has risen to 3.7 million, contributing to market growth.

Australia Is Projected To Do Well In the Coming Years.

Australia is estimated to be one of the most lucrative regional markets in the Asia-Pacific region. According to the Australian Institute of Health and Welfare, 4,578 persons died in 2017 due to heart failure or cardiomyopathy. As a result, over the forecast period, the increased morbidity and mortality of cardiovascular illnesses and the efficacy of these devices in managing arrhythmias for a long time are likely to fuel the segment's growth.

KEY MARKET PLAYERS

A few of the noteworthy companies operating in the APAC Defibrillators Market profiled in the report are Medtronic PLC (Ireland), St. Jude Medical, Inc. (U.S.), Boston Scientific Corporation (U.S.), BIOTRONIK SE & Co. KG (Germany), LivaNova PLC (U.K.), Koninklijke Philips N.V. (Netherlands), ZOLL Medical Corporation (U.S.), Cardiac Science Corporation (U.S.), Physio-Control, Inc. (U.S.), and Nihon Kohden Corporation (Japan).

MARKET SEGMENTATION

This research report on the Asia-Pacific defibrillators market is segmented and sub-segmented into the following categories.

By Product

- Implantable Defibrillators

- Transvenous Implantable Cardioverter Defibrillator (T-ICDs)

- Subcutaneous Implantable Cardioverter Defibrillator (S-ICDs)

- Cardiac Resynchronization Therapy- Defibrillator (CRT-D)

- External defibrillators

- Manual External Defibrillator

- Automated External Defibrillator (AEDs)

- Wearable Cardioverter Defibrillator (WCDs)

By End User

- Hospitals

- Prehospital

- Public Access market

- Alternate Care Market

- Home

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com