Asia Pacific Feed Additives Market Size, Share, Trends & Growth Forecast Research Report, Segmented By Type, Livestock, Form, Source, and Country (India, China, Japan, South Korea, Australia & New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC), Industry Analysis (2025 to 2033)

Asia Pacific Feed Additives Market Size

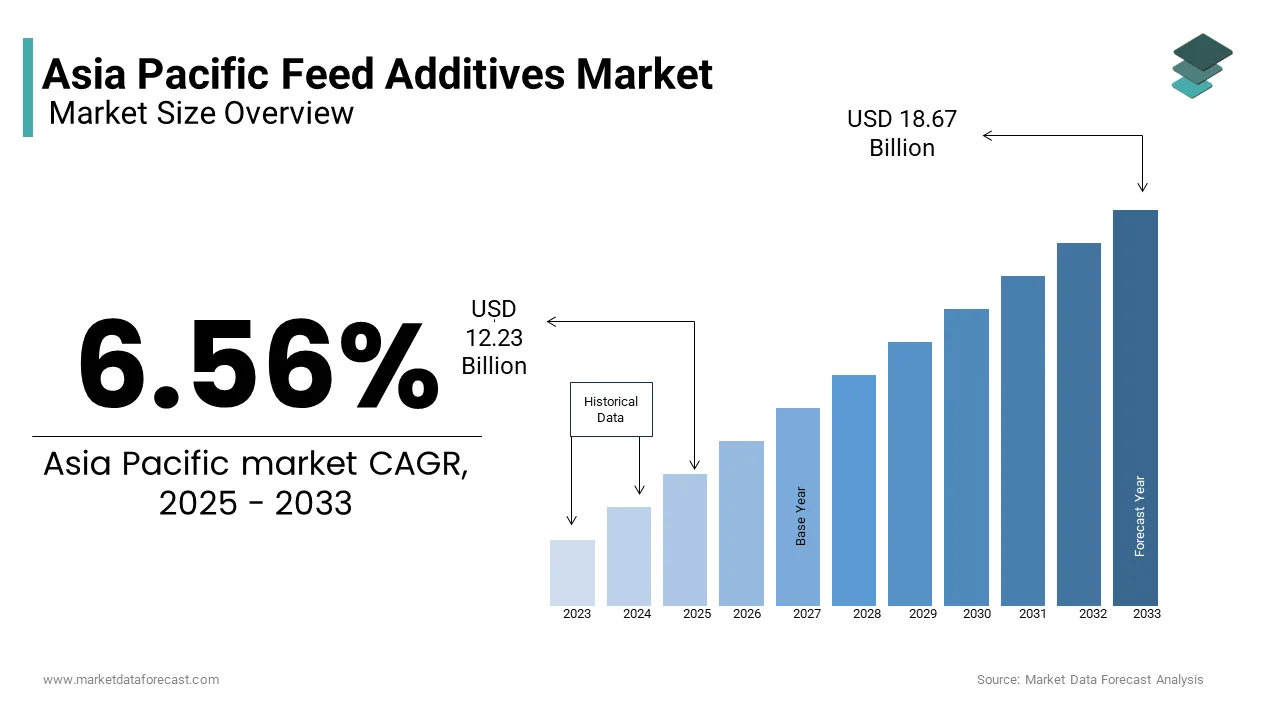

The Asia Pacific feed additives market was valued at USD 10.54 billion in 2024 and is anticipated to reach USD 11.23 billion in 2025 from USD 18.67 billion by 2033, growing at a CAGR of 6.56% during the forecast period from 2025 to 2033.

The Asia Pacific feed additives market has emerged as a cornerstone of the global livestock and aquaculture industries. It is driven by rapid urbanization, rising disposable incomes, and increasing demand for high-quality animal protein. Also, the market’s growth is fueled by stringent food safety regulations mandating the use of feed additives to enhance animal health and productivity. Additionally, advancements in biotechnology hubs in countries like South Korea and Australia have fostered innovations in enzyme-based feed additives, reducing production costs.

MARKET DRIVERS

Rising Demand for High-Quality Animal Protein

The growing demand for high-quality animal protein is a primary driver of the Asia Pacific feed additives market, driven by rising urbanization and changing dietary preferences. According to the United Nations Population Division, a major share of the region’s population resides in urban areas, where consumers increasingly prioritize protein-rich diets, including meat, eggs, and dairy. This shift has amplified the need for feed additives that enhance animal growth, immunity, and productivity. For instance, China’s adoption of amino acids like lysine and methionine in poultry and swine feed has grown since 2020, driven by their ability to improve feed efficiency and reduce mortality rates. Similarly, India’s booming aquaculture industry relies heavily on feed additives such as vitamins and minerals to meet international export standards.

Stringent Food Safety Regulations

Stringent food safety regulations are another significant driver of the Asia Pacific feed additives market, compelling industries to adopt sustainable and safe feed solutions. Like, the implementation of these regulations has led to an increase in the adoption of bioactive feed additives since 2021. Similarly, in Australia, the use of enzyme-based additives in livestock feed has reduced antibiotic dependency, aligning with global trends toward antibiotic-free farming. These regulatory frameworks not only address food safety concerns but also promote sustainable practices, further amplifying demand for innovative feed additives across the region.

MARKET RESTRAINTS

High Production Costs

High production costs pose a significant restraint to the Asia Pacific feed additives market, impacting its competitiveness against synthetic alternatives. While feed additives offer superior nutritional benefits, their production involves complex processes such as microbial fermentation and chemical synthesis, which require expensive raw materials and energy-intensive equipment. For example, the cost of producing high-purity amino acids is nearly higher than that of traditional feed supplements, creating financial strain for small-scale producers. Additionally, fluctuations in the availability of raw materials, such as soybean meal and fishmeal, exacerbate the issue.

Limited Awareness Among Small-Scale Farmers

Limited awareness among small-scale farmers about the benefits of feed additives also hinders market expansion. While large-scale commercial farms in the Asia Pacific region are increasingly adopting advanced feed solutions, smallholders often lack access to information about sustainable alternatives. For instance, according to the Food and Agriculture Organization, only a limited share of rural households in Southeast Asia are aware of enzyme-based feed additives, compared to those in urban areas. This knowledge gap restricts demand in agricultural applications, where traditional feed formulations remain dominant. Moreover, reliance on low-cost inputs and limited access to credit further impede adoption.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets in the Asia Pacific region offer untapped potential for the feed additives market, driven by industrial growth and infrastructure development. Countries like Vietnam, Bangladesh, and the Philippines are witnessing rapid urbanization, creating demand for high-quality animal protein and sustainable feed solutions. For instance, Vietnam’s aquaculture industry relies heavily on feed additives like vitamins and enzymes to meet international export standards. Also, Bangladesh’s poultry sector, which contributes majorly to its GDP, requires feed additives to enhance productivity and profitability. Investing in localized production facilities and distribution networks can help companies cater to these regions effectively. Moreover, partnerships with local governments and NGOs can facilitate the adoption of feed additives in rural areas, where animal health remains a persistent issue.

Advancements in Biotechnology and Enzyme-Based Solutions

The development of advanced biotechnological solutions presents a lucrative opportunity for the Asia Pacific feed additives market, aligning with the global push toward sustainable agriculture. Innovations in enzyme-based additives have significantly enhanced their efficacy in improving feed digestibility and nutrient absorption. For example, South Korea’s investments in microbial fermentation technologies have expanded since 2020, driven by government incentives and consumer demand. These advancements enable the production of high-performance feed additives tailored for specific applications, such as ruminant nutrition and aquaculture. According to the Confederation of Indian Industry, the adoption of next-generation enzyme formulations in India’s poultry sector has reduced feed costs, as they comply with stringent regulatory standards.

MARKET CHALLENGES

Competition from Low-Cost Alternatives

The dominance of low-cost feed alternatives poses a significant challenge to the Asia Pacific feed additives market, as they remain widely available despite their inferior nutritional benefits. For instance, China’s livestock industry still relies heavily on traditional feed formulations, overshadowing the adoption of advanced additives. While modern feed additives offer superior health and productivity benefits, their higher pricing limits their penetration in price-sensitive markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.56% |

|

Segments Covered |

By Type, Livestock, Form, Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the d Rest of APAC |

|

Market Leaders Profiled |

Evonik (SEA) Pte. Ltd., DuPont Asia-Pacific Ltd, Novozymes (China) Investment Co. Ltd, BASF Asia-Pacific, DSM Dyneema, Adisseo Asia-Pacific Pte Ltd, Cargill Asia-Pacific Holdings Pte Limited, Lonza Biologics Tuas Pte Ltd, ADM (Shanghai) Management Company, and Chr. Hansen (Beijing) Trading Co., Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The amino acids segment commanded the Asia Pacific feed additives market, with a 30% of the total share in 2024. This dominance is driven by their critical role in enhancing animal growth, immunity, and productivity. For instance, China’s adoption of lysine and methionine in poultry and swine feed has grown notably since 2020, driven by their ability to improve feed efficiency and reduce mortality rates. Similarly, India’s booming aquaculture industry relies heavily on amino acids to meet international export standards. Further, advancements in biotechnology have reduced production costs, making amino acids more accessible to small-scale farmers. The growing emphasis on sustainable agriculture has also amplified demand, particularly in urban areas where consumers prioritize high-quality animal protein.

The phytogenics have the swiftest growth, with a projected CAGR of 9.8% through 2033. This acceleration is because of their natural origin and ability to enhance animal health without relying on antibiotics. For example, South Korea’s use of phytogenic feed additives in livestock farming has grown in recent years, driven by government incentives for antibiotic-free farming. Like, in Australia, phytogenics have reduced antibiotic dependency, aligning with global trends toward sustainable practices. Innovations in extraction technologies have also enhanced their efficacy, making them ideal for applications such as ruminant nutrition and aquaculture.

By Livestock Insights

The poultry segment represented the largest one by commanding a 40.6% share of the Asia Pacific feed additives market in 2024. This is due to the region’s growing demand for affordable and high-quality protein sources. India’s poultry industry relies heavily on feed additives like vitamins and enzymes to enhance productivity and meet export standards. Besides, rising urbanization has amplified consumption. Rising disposable incomes have also fueled the adoption of premium poultry products, making feed additives a critical component of the sector.

The aquatic animals segment is accelerating, with a calculated CAGR of 8.5%. This development is caused by the booming aquaculture industry, particularly in countries like Vietnam and Bangladesh. For example, Vietnam’s aquaculture sector relies heavily on feed additives like carotenoids and probiotics to meet international export standards. Similarly, Bangladesh’s shrimp farming industry has adopted enzyme-based additives to enhance growth rates and profitability. Advancements in formulation technologies have also improved their efficacy, aligning with consumer preferences for sustainable seafood.

By Form Insights

The dry form feed additives segment prevailed in the Asia Pacific market, with 60.4% of the total share in 2024. This prominence is propelled by their ease of storage, transportation, and application, making them ideal for large-scale commercial farms. For instance, China’s livestock industry relies heavily on dry amino acids and vitamins to enhance animal health and productivity, as per the Ministry of Agriculture. Also, advancements in drying technologies have improved the stability and shelf life of dry additives, reducing spoilage and waste. The growing emphasis on cost-effective solutions has also amplified demand, particularly in rural areas where infrastructure remains limited.

The liquid form feed additives segment is the rapidly growing segment with a predicted CAGR of 8.2% through 2033. This progress is influenced by their superior bioavailability and ease of mixing with liquid feeds, making them ideal for precision feeding systems. Similarly, in Australia, liquid enzymes have improved feed digestibility, aligning with global trends toward sustainable practices. These factors position liquid form additives as a transformative force in the market.

By Source Insights

The synthetic feed additives segment dominated the Asia Pacific market by accounting for 55.8% of the total share in 2024. This dominance is driven by their cost-effectiveness and scalability, making them ideal for large-scale commercial farms. For instance, China’s livestock industry relies heavily on synthetic amino acids and vitamins to meet the demands of its growing population. Also, advancements in chemical synthesis have reduced production costs, making synthetic additives more competitive against natural alternatives.

The segment of natural feed additives is the fastest-growing segment, with a projected CAGR of 9.5%. This is fueled by increasing consumer awareness about food safety and sustainability. For example, Japan’s adoption of natural probiotics and phytogenics in livestock farming has grown since 2021, driven by their ability to enhance animal health without relying on antibiotics. Similarly, in India, natural additives have reduced antibiotic dependency, aligning with global trends toward sustainable practices.

COUNTRY ANALYSIS

Top 5 Leading Countries in the Asia Pacific Market

China dominated the Asia Pacific feed additives market with a 35.8% share in 2024. This is due to its status as the world’s largest producer and consumer of livestock products, leveraging advanced biotechnology infrastructure to produce cost-effective feed additives. Like, China’s investments in microbial fermentation technologies have grown significantly in the last few years, enhancing production efficiency. Urbanization has further amplified demand. Rising disposable incomes have also fueled the adoption of high-quality animal protein, making China the linchpin of the regional market.

India is a leading country in the Asia-Pacific feed additives market, which is supported by its robust agricultural base and growing awareness about sustainable practices. The country’s poultry sector depends mainly on feed additives like vitamins and enzymes to meet international export standards. In addition, government initiatives promoting sustainable agriculture have boosted the adoption of natural feed additives. India’s strategic location as a global supplier of raw materials has also facilitated international trade, positioning it as a key growth engine in the Asia Pacific market.

Japan’s market is expanding because of its advanced technological capabilities and stringent food safety regulations. Its emphasis on sustainability has fostered innovation in feed additives, with over substantial share of industries adopting eco-friendly alternatives. Besides, Japan’s aging population has increased demand for high-quality animal protein, amplifying the use of feed additives in livestock farming. Urban consumers’ preference for green solutions further amplifies demand, particularly in cities like Tokyo and Osaka.

South Korea is a growing market for feed additives within the Asia-Pacific region. The country’s “Green Growth Strategy” has spurred businesses to adopt natural feed additives like phytogenics and probiotics, leading to a surge in usage since 2020. Moreover, the livestock industry, a key contributor to GDP, has embraced feed additives for their ability to enhance animal health and productivity.

Australia has a substantial feed additives market and is driven by its robust regulatory framework and high consumer awareness about sustainability. The country’s aquaculture sector leverages feed additives for sustainable seafood production, with a notable growth in usage. Additionally, Australia’s thriving livestock industry uses feed additives to enhance productivity, aligning with environmental goals. Urban consumers’ preference for renewable energy further amplifies demand, particularly in cities like Sydney and Melbourne.

KEY MARKET PLAYERS

Some of the key players in the Asia Pacific feed additives market are Evonik (SEA) Pte. Ltd., DuPont Asia-Pacific Ltd, Novozymes (China) Investment Co. Ltd, BASF Asia-Pacific, DSM Dyneema, Adisseo Asia-Pacific Pte Ltd, Cargill Asia-Pacific Holdings Pte Limited, Lonza Biologics Tuas Pte Ltd, ADM (Shanghai) Management Company, and Chr. Hansen (Beijing) Trading Co., Ltd.

Top Players in the Market

Cargill, Incorporated

Cargill, Incorporated is a global leader in the feed additives market, with a strong presence in the Asia Pacific region. Cargill’s strategic partnerships with local farmers and industries have strengthened its market position. By offering customized solutions for diverse livestock and aquaculture applications, Cargill has established itself as a trusted provider of high-quality feed additives globally, contributing significantly to advancements in animal nutrition.

BASF SE

BASF SE is a key player in the Asia Pacific feed additives market, renowned for its expertise in developing advanced nutritional solutions like vitamins, carotenoids, and acidifiers. BASF’s emphasis on collaboration with regional stakeholders ensures its products align with local regulatory frameworks and consumer preferences. Its robust distribution network across the region has facilitated widespread adoption of its sustainable feed additive solutions. Through its proactive approach to circular economy practices, BASF continues to shape the global feed additives landscape.

DSM Nutritional Products

DSM Nutritional Products stands out for its specialization in producing high-performance feed additives derived from natural and synthetic sources. With a strong foothold in the Asia Pacific region, the company focuses on delivering solutions that meet the unique demands of urbanized and industrialized areas. DSM’s dedication to quality and safety has earned it recognition among leading manufacturers and regulatory bodies. By investing in state-of-the-art production facilities and fostering partnerships with local governments, DSM has reinforced its reputation as a pioneer in sustainable animal nutrition.

Top Strategies Used by Key Market Participants

Strategic Acquisitions and Collaborations

Key players in the Asia Pacific feed additives market have increasingly turned to acquisitions and collaborations to strengthen their market position. These collaborations also facilitate knowledge-sharing and innovation, enabling participants to stay ahead of evolving consumer preferences.

Investment in R&D and Innovation

Another major strategy involves substantial investments in research and development to create cutting-edge feed additive solutions. Companies are focusing on developing cost-effective and scalable products that comply with stringent environmental regulations. Innovations such as enzyme-based formulations and microbial fermentation techniques have been introduced to address specific industry needs. By prioritizing R&D, players can differentiate themselves in a competitive market while meeting the growing demand for sustainable alternatives.

COMPETITION OVERVIEW

The Asia Pacific feed additives market is characterized by intense competition, driven by the presence of both global giants and regional players striving to gain a larger share of the rapidly growing sector. The market’s competitive landscape is shaped by the increasing demand for sustainable and effective animal nutrition solutions, which has prompted companies to innovate and differentiate their offerings. Global players leverage their technological expertise and economies of scale to maintain dominance, while regional players focus on customization and localized strategies to carve out niches. Sustainability remains a central theme, with companies competing to offer the most eco-friendly and cost-effective solutions. Additionally, the rise of industrialization and urbanization has intensified competition, as companies vie to secure contracts with major industries and municipalities.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Cargill Incorporated partnered with a leading Indian poultry association to launch a nationwide initiative promoting enzyme-based feed additives. This move strengthened its leadership in the domestic livestock market.

- In June 2023, BASF SE announced the acquisition of a small-scale feed additive production facility in Thailand to bolster its supply chain resilience and expand its footprint in Southeast Asia.

- In February 2023, DSM Nutritional Products signed a memorandum of understanding with a South Korean aquaculture firm to co-develop next-generation carotenoids for shrimp farming, aligning with consumer trends toward sustainable seafood.

- In September 2022, Cargill, Incorporated opened a state-of-the-art R&D center in Malaysia to explore innovations in probiotic-based feed additives, positioning itself as a pioneer in gut health solutions.

- In November 2021, BASF SE launched a joint venture with an Australian livestock company to supply acidifier-based feed additives for ruminant nutrition, enhancing its presence in the industrial animal farming segment.

MARKET SEGMENTATION

This research report on the Asia Pacific feed additives market is segmented and sub-segmented into the following categories.

By Type

- Vitamins

- Acidifiers

- Amino acids

- Phosphates

- Carotenoids

- Enzymes

- Mycotoxin detoxifiers

- Flavors & sweeteners

- Antibiotics

- Minerals

- Antioxidants

- Non-protein nitrogen

- Phytogenics

- Preservatives and probiotics

By Livestock

- Ruminants

- Dairy

- Beef

- Calf

- Goats

- Sheep

- Poultry

- Broilers

- Layers and breeders

- Swine

- Starter

- Sow and grower

- Aquatic animal

- Others, such as equine and pets

By Form

- Dry

- Liquid

By Source

- Natural

- Synthetic

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What Is The Expected Growth Rate Of The Asia Pacific Feed Additives Market?

The Asia Pacific feed additives market is expected to grow at a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2033.

What Are The Dominating Factors In Asia Pacific Feed Additives Market?

The mineral segment holds a prominent share of the regional market in terms of volume as they are essential for sustaining and improving the health of the livestock.

What Are The Key Market Players Involved In Asia Pacific Feed Additives Market?

Some of the key players in the Asia Pacific Feed Additives market are Evonik (SEA) Pte. Ltd., DuPont Asia-Pacific Ltd, Novozymes (China) Investment Co. Ltd, BASF Asia-Pacific, DSM Dyneema, Adisseo Asia-Pacific Pte Ltd, Cargill Asia-Pacific Holdings Pte Limited, Lonza Biologics Tuas Pte Ltd, ADM (Shanghai) Management Company, and Chr. Hansen (Beijing) Trading Co., Ltd.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com