Asia Pacific Footwear Market Research Report – Segmented By Type (Athletic Footwear, Non-Athletic Footwear), End-User, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Footwear Market Size

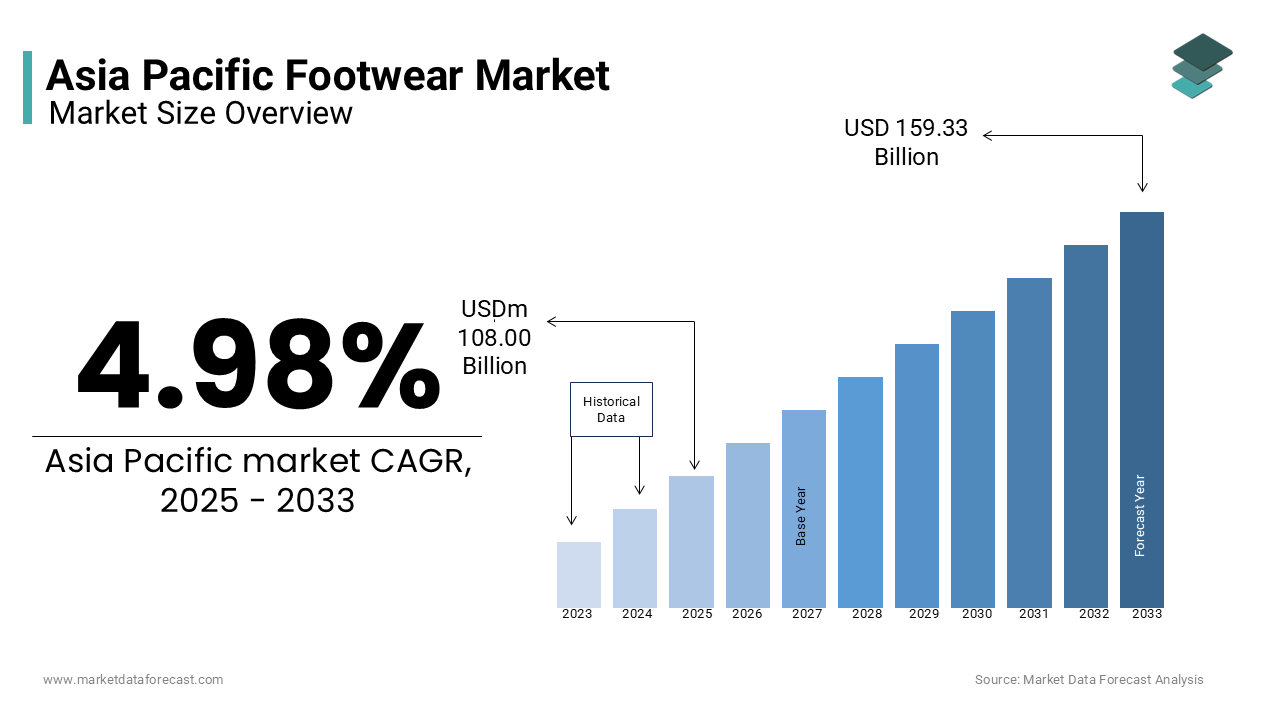

The Asia Pacific footwear market was worth USD 102.85 billion in 2024. The Asia Pacific market is expected to reach USD 159.33 billion by 2033 from USD 108.00 billion in 2025, rising at a CAGR of 4.98% from 2025 to 2033.

MARKET DRIVERS

Rising Disposable Income and Urbanization

The surge in disposable income across the Asia Pacific region has significantly bolstered consumer spending on footwear. According to the World Bank, the average GDP per capita in emerging economies like India and Indonesia grew between 2018 and 2022, enabling households to allocate more resources toward premium and branded footwear. Urban centers, in particular, exhibit heightened demand, with cities like Shanghai, Tokyo, and Mumbai driving sales of high-end products such as sneakers and designer shoes. This trend aligns with rapid urbanization, which the Asian Development Bank projects will add 1 billion urban residents by 2050. As cities expand, so does the appetite for fashion-forward and functional footwear, creating a fertile ground for market expansion.

Growing Popularity of Athletic and Sports Footwear

The increasing popularity of athletic and sports footwear is a significant driver of the Asia Pacific footwear market. Brands like Nike, Adidas, and Puma have capitalized on this trend by introducing innovative designs that combine comfort, style, and performance. Additionally, government initiatives promoting fitness, such as India’s Fit India Movement, have encouraged participation in physical activities, further boosting demand. The integration of advanced technologies, such as cushioning systems and lightweight materials, enhances user experience, making athletic footwear a preferred choice for both casual and professional use.

MARKET RESTRAINTS

High Production Costs and Labor Challenges

Rising production costs and labor challenges pose significant restraints for the Asia Pacific footwear market, particularly in manufacturing hubs like China and Vietnam. According to a report by the International Labour Organization, labor costs in these regions have increased by 10-15% annually over the past five years, driven by stricter labor laws and rising wages. For instance, China’s shift toward higher-value industries has led to a shortage of skilled workers in traditional footwear manufacturing. This trend forces manufacturers to either absorb higher costs or pass them on to consumers, impacting affordability. Also, supply chain disruptions caused by geopolitical tensions and pandemics exacerbate production challenges.

Environmental Concerns and Regulatory Pressures

Environmental sustainability is another pressing challenge impacting the Asia Pacific footwear market. Like, the footwear industry contributes to global greenhouse gas emissions, with synthetic materials like polyester and PVC being major culprits. Governments are increasingly enforcing stringent regulations to curb environmental degradation, such as China’s Green Manufacturing Standards, which mandate the use of eco-friendly materials and processes. Compliance with these regulations often necessitates substantial financial outlays, with firms spending a notable share of their annual budgets on sustainable initiatives. Additionally, consumer awareness about sustainable practices is growing. However, transitioning to greener alternatives, such as biodegradable materials or waterless dyeing techniques, involves technical complexities and higher costs.

MARKET OPPORTUNITIES

Expansion of E-commerce Platforms

The proliferation of e-commerce platforms presents a lucrative opportunity for the Asia Pacific footwear market, enabling brands to reach a broader audience and enhance accessibility. China leads this charge. This digital shift allows brands to bypass traditional distribution barriers, particularly in rural and semi-urban areas where physical stores are scarce. For example, Xiaomi leveraged online channels to launch affordable yet stylish footwear, capturing a 20% market share in India within a year, targeting price-sensitive consumers. Apart from these, the integration of augmented reality (AR) tools on e-commerce sites allows customers to virtually try on shoes, enhancing purchasing decisions. With internet penetration high in urban areas, the potential for growth remains vast.

Growing Demand for Sustainable and Ethical Products

The increasing demand for sustainable and ethically produced footwear offers another significant opportunity for the Asia Pacific market. Brands like Allbirds and Veja have gained traction by using renewable materials such as bamboo, cork, and recycled plastics, appealing to environmentally conscious buyers. Additionally, certifications like Fair Trade and B Corp are becoming important differentiators. For instance, a large number of millennials in Australia and Singapore prioritize brands that demonstrate transparency in their supply chains. Furthermore, governments are incentivizing sustainable practices, with subsidies offered for green manufacturing. A report by the Asian Development Bank states that adopting circular economy models can reduce production costs, enhancing profitability while meeting consumer expectations.

MARKET CHALLENGES

Intense Price Competition and Marginal Profits

Price wars among manufacturers pose a formidable challenge to profitability in the Asia Pacific footwear market. In highly saturated markets like India and Indonesia, brands such as local manufacturers and multinational giants aggressively undercut competitors, eroding profit margins. This relentless focus on affordability often compromises product quality, leading to shorter lifespans and increased waste. Moreover, smaller players struggle to compete with established giants, resulting in market consolidation. With consumer expectations for low-cost, high-performance products rising, companies face the daunting task of balancing innovation with cost management. This pressure threatens long-term sustainability, forcing firms to explore alternative revenue streams or risk obsolescence.

Rapid Technological Obsolescence and Innovation Pressure

The pace of technological advancement in the Asia Pacific footwear market introduces the challenge of rapid obsolescence and innovation pressure. This trend is particularly pronounced in categories like athletic and smart footwear, where hardware upgrades occur biannually. For example, Nike's introduction of self-lacing sneakers rendered previous models less appealing, impacting resale values and consumer loyalty. Additionally, the constant need for innovation drives up R&D costs. Consumers, accustomed to frequent upgrades, exhibit shorter brand loyalty, exacerbating the issue. This cycle not only strains manufacturers financially but also contributes to mounting waste. Navigating this challenge requires strategic planning to extend product lifespans while maintaining relevance in a fast-evolving market.

SEGMENTAL ANALYSIS

By Type Insights

The athletic footwear segment dominated the Asia Pacific market by capturing 55.5% of the total revenue in 2024. This prominence is propelled by the growing emphasis on health and wellness across the region. Also, the rise of athleisure culture has further amplified demand, with brands like Nike and Adidas introducing designs that combine style and functionality. Besides, government initiatives promoting fitness, such as India’s Fit India Movement, have encouraged participation in physical activities, boosting sales. A report by McKinsey highlights that athletic footwear accounts for nearly 40% of all online footwear purchases in China, underscoring its widespread appeal. The integration of advanced technologies, such as cushioning systems and lightweight materials, enhances user experience, making athletic footwear a preferred choice for diverse demographics.

The non-athletic footwear segment is swiftly moving ahead, with a projected CAGR of 8.5%. This development is caused by increasing demand for formal and casual footwear, particularly in emerging markets like India and Indonesia. Urbanization trends have also contributed, with cities like Mumbai and Bangkok driving sales of stylish designs tailored for office and social settings. Additionally, the rise of sustainable materials, such as vegan leather and recycled fabrics, has attracted environmentally conscious consumers. According to a report by Accenture, over 65% of millennials in Australia and Singapore prioritize eco-friendly footwear, boosting adoption rates.

By End-User Insights

The women's segment accounted for the largest share of the Asia Pacific footwear market, i.e., 45.6% of total sales in 2024. This influence is attributed to the growing emphasis on fashion and personal grooming among female consumers. Additionally, social media influencers and digital marketing campaigns targeting women have amplified awareness, with platforms like Instagram driving engagement. The availability of diverse designs, from high heels to sneakers, further enhances appeal.

The children’s footwear segment is experiencing significant growth, with a projected CAGR of 9.2% from 2025 to 2033. This expansion is driven by rising disposable incomes and increased parental spending on quality products for their children. For example, brands like Clarks and Bata have introduced durable yet stylish designs, appealing to health-conscious parents seeking comfort and functionality. Additionally, the rise of e-commerce platforms has made children’s footwear easily accessible, particularly in tier-2 and tier-3 cities.

REGIONAL ANALYSIS

China was the dominant contributor to the Asia Pacific footwear market, with a 40.5% of the regional share in 2024. This dominance is underpinned by robust manufacturing capabilities and aggressive investments in consumer education. A large share of urban households in cities like Shanghai and Beijing have adopted international brands, driven by campaigns promoting fashion and lifestyle. For instance, the Chinese National Textile and Apparel Council has launched initiatives to educate consumers about global trends, boosting adoption rates. Apart from these, the proliferation of e-commerce platforms like Alibaba and JD.com has made these products easily accessible, particularly in tier-2 and tier-3 cities.

The Indian footwear market is experiencing substantial growth. Known for its vibrant fashion scene, India excels in developing affordable yet stylish footwear catering to diverse demographics. For example, brands like Bata and Liberty have introduced models priced competitively to appeal to middle-class consumers. According to the Indian Ministry of Commerce, a significant share of households in urban areas prefer branded footwear, driven by rising disposable incomes and urbanization. In addition, government initiatives promoting local manufacturing, such as "Make in India," have spurred investments, creating a robust ecosystem for domestic and international players.

Japan holds a pivotal position in the Asia Pacific footwear market. Renowned for its precision engineering and focus on quality, Japan excels in producing high-end footwear with advanced features like ergonomic designs and sustainable materials. For example, Asics and Mizuno have introduced models equipped with cushioning systems and lightweight materials, appealing to health-conscious consumers. In addition, the country’s aging population has increased demand for orthopedic designs.

South Korea is a rapidly growing player in the Asia Pacific footwear market. The country’s fashion-conscious population has embraced footwear as part of its broader lifestyle agenda. Cities like Seoul have witnessed a surge in demand for athleisure wear, integrating sports shoes into daily attire. Like, over 70% of millennials in the country view athletic footwear as an essential tool for maintaining a polished appearance. Besides, government initiatives promoting preventive healthcare have spurred adoption, particularly among urban professionals. These strengths position South Korea as a dynamic participant in the footwear landscape.

Australia is smaller but it is still a substantial and growing Asia Pacific footwear market. The country’s affluent population and high disposable incomes enable the adoption of premium footwear, particularly among urban professionals. Additionally, the rise of sustainable footwear with features like vegan leather and recycled materials has captured the attention of eco-conscious users. According to the Australian Fashion Council, sustainable footwear sales grew in urban areas, supporting their popularity.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Nike, Inc., Adidas AG, Puma SE, ASICS Corporation, Skechers USA, Inc., Bata Corporation, New Balance Athletics, Inc., Under Armour, Inc., Woodland Worldwide, and Li-Ning Company Limited are some of the key market players.

The Asia Pacific footwear market is characterized by intense competition, driven by a mix of established multinational corporations and regional players vying for dominance. Global giants like Nike, Adidas, and Puma compete fiercely with local manufacturers such as Bata and Liberty, creating a dynamic landscape marked by rapid innovation and aggressive pricing strategies. The market’s diversity—spanning developed economies like Japan and Australia to emerging markets like India and Vietnam—requires companies to adopt multifaceted approaches to succeed. While larger firms leverage economies of scale and technological expertise, smaller enterprises focus on affordability and niche innovations to carve out their share. Regulatory pressures, environmental concerns, and shifting consumer behaviors further intensify rivalry, compelling brands to prioritize sustainability and digital transformation. E-commerce platforms have also leveled the playing field, enabling new entrants to disrupt traditional distribution channels.

Top Players in the Asia Pacific Footwear Market

Nike Inc.

Nike is a global leader in the Asia Pacific footwear market, renowned for its innovative designs and cutting-edge technology. The company’s focus on athletic footwear has enabled it to capture a significant share of the market, particularly among health-conscious consumers. Nike leverages collaborations with athletes and celebrities to promote its products, enhancing brand visibility. Its commitment to sustainability is evident in initiatives like the "Move to Zero" campaign, which emphasizes eco-friendly materials and circular economy practices.

Adidas AG

Adidas is a key contributor to the Asia Pacific footwear market, known for its robust product portfolio catering to various demographics. The brand’s emphasis on style and performance appeals to both casual wearers and professional athletes. Adidas’ marketing strategies, including partnerships with sports leagues and influencers, have amplified its reach across the region. By integrating sustainable practices, such as using recycled plastics in its designs, Adidas reinforces its reputation as a responsible innovator.

Puma SE

Puma is a major player in the Asia Pacific footwear market, leveraging its expertise in sports and lifestyle products. The company’s focus on innovation ensures superior performance and reliability, appealing to health-conscious consumers. Puma’s localized strategies, such as offering affordable yet high-quality products, enable it to penetrate emerging markets like India and Indonesia. By emphasizing user-centric designs and advanced features, such as lightweight materials and cushioning systems, Puma enhances consumer satisfaction.

Top Strategies Used by Key Market Participants

Strategic Collaborations with Influencers and Athletes

Key players in the Asia Pacific footwear market often collaborate with influencers, athletes, and celebrities to enhance brand visibility and credibility. For instance, brands like Nike and Adidas partner with local sports stars and social media personalities to promote their products, resonating with younger demographics. These alliances not only amplify awareness but also position companies as advocates for fitness and lifestyle trends.

Emphasis on Sustainability and Eco-Friendly Practices

Sustainability remains a cornerstone of success in the footwear sector. Leading companies invest heavily in R&D to develop eco-friendly materials, such as recycled plastics and vegan leather. For example, brands like Puma and Adidas integrate sustainable practices into their production processes, appealing to environmentally conscious buyers. Additionally, certifications like Fair Trade and B Corp serve as important differentiators, reinforcing brand trust.

Localization and Affordability Initiatives

To resonate with Asia Pacific consumers, key players adopt localized strategies tailored to specific countries and cultures. This involves customizing product features, pricing models, and marketing campaigns to align with local preferences. For instance, affordable solutions are introduced in price-sensitive markets like India and Indonesia, while premium editions target affluent buyers in Japan and Australia. Brands also leverage social media influencers and regional celebrities to amplify their messaging.

REGIONAL ANALYSIS

- In April 2024, Nike launched a regional campaign in collaboration with Indian cricketer Virat Kohli to promote its latest line of athletic footwear. This initiative aimed to tap into the growing sports culture in tier-2 and tier-3 cities, boosting adoption rates.

- In June 2023, Adidas partnered with a leading K-pop group in South Korea to launch a limited-edition sneaker collection. This collaboration focused on highlighting style and performance, capturing the attention of fashion-conscious millennials.

- In September 2023, Puma introduced an affordable range of children’s footwear in Indonesia, priced competitively to appeal to middle-income households. This move aimed to increase penetration in rural areas and strengthen its regional presence.

- In February 2024, Bata expanded its e-commerce platform in India, offering exclusive online discounts and personalized recommendations. This strategy targeted first-time buyers and enhanced accessibility for tech-savvy consumers.

- In November 2023, Asics conducted a series of workshops in Australian schools to educate students about the importance of proper footwear for physical activities. This initiative positioned the brand as a trusted advocate for preventive care, boosting consumer trust.

MARKET SEGMENTATION

This research report on the Asia Pacific footwear market is segmented and sub-segmented into the following categories.

By Type

- Athletic Footwear

- Non-Athletic Footwear

By End-User

- Women

- Children

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving the growth of this market?

Key growth drivers include rising consumer spending on fashion, increasing demand for sports and athleisure footwear, the growing influence of e-commerce, and expansion of global brands across urban and semi-urban areas.

What trends are shaping the future of this market?

Major trends include the rise of sustainable and eco-friendly footwear, increasing preference for customized designs, growth in sports and fitness culture, and adoption of smart and tech-integrated shoes

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]