Asia Pacific Low Voltage Drives Market Size, Share, Trends & Growth Forecast Report By Power Range (Micro, Low), By Capacity, By Drive (AC, DC, Servo), By Technology (Standard, Regenerative), By System (Open Loop, Closed Loop), By Application, By End-Use, and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Low Voltage Drives Market Size

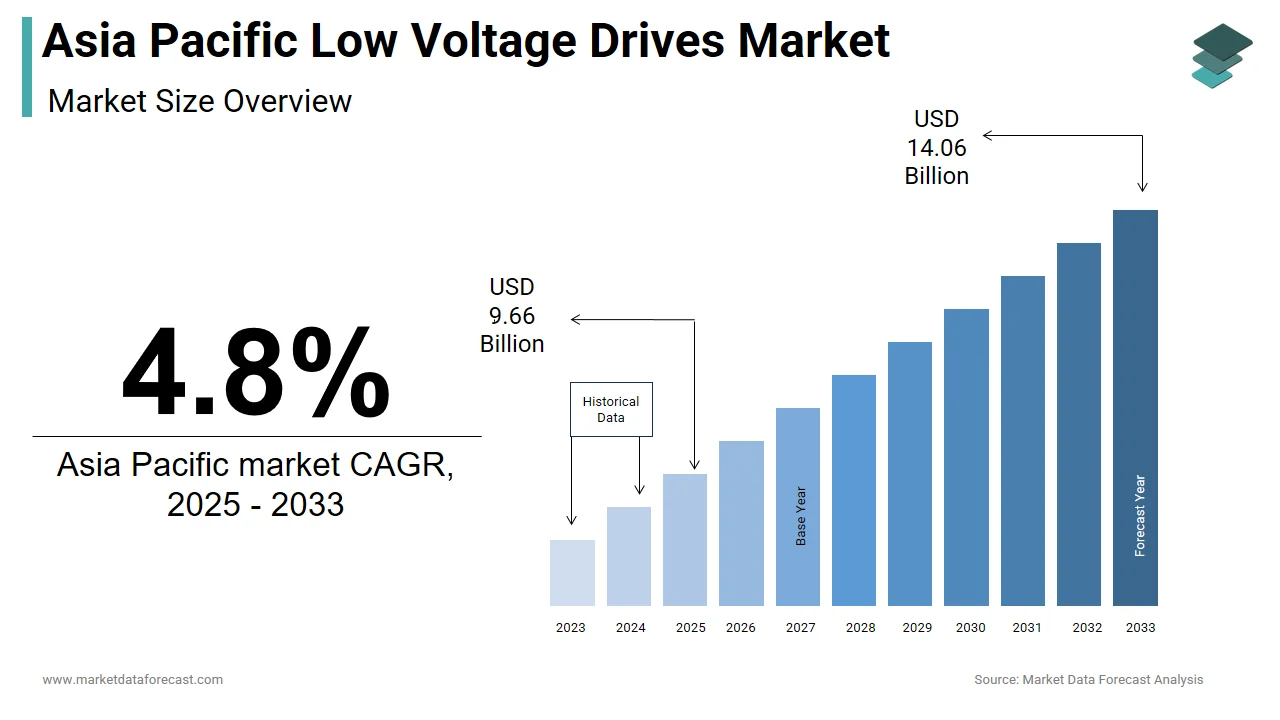

The size of the Asia Pacific low voltage drives market was worth USD 9.22 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 4.8% from 2025 to 2033 and be worth USD 14.06 billion by 2033 from USD 9.66 billion in 2025.

The Asia Pacific low voltage drives are the devices that regulate motor speed and torque in applications under 1 kV. These drives, also known as variable frequency drives (VFDs) or adjustable speed drives (ASDs), are integral to optimizing energy consumption across industries such as manufacturing, oil and gas, water treatment, and HVAC systems. The region’s rapid industrialization, coupled with stringent energy conservation policies, has positioned it as a global leader in adopting advanced drive technologies. According to the International Energy Agency, electricity demand in Asia Pacific is projected to grow by nearly 60% by 2040, driven by urbanization and industrial expansion.

MARKET DRIVERS

Increasing Adoption of Industrial Automation

The Asia Pacific region is witnessing an unprecedented surge in industrial automation, fueled by the Fourth Industrial Revolution and the integration of technologies like IoT, AI, and robotics. Low voltage drives play a pivotal role in this transformation by enabling precise control of motor speeds, which enhances operational efficiency and reduces energy wastage. For instance, China’s manufacturing sector, which contributes approximately 28% of its GDP, is increasingly deploying low voltage drives in conveyor systems, pumps, and compressors to achieve higher throughput and lower operational costs. Low voltage drives complement these advancements by ensuring seamless integration of motors with automated machinery, thereby driving their demand.

Stringent Energy Efficiency Regulations

Governments across Asia Pacific are implementing stringent energy efficiency regulations to combat rising energy consumption and carbon emissions. For example, India’s Bureau of Energy Efficiency mandates the use of energy-efficient motors and drives in industrial applications by aligning with its goal to reduce energy intensity by 33% by 2030. Similarly, Japan’s Top Runner Program sets ambitious targets for energy-saving technologies, including low voltage drives, which are instrumental in achieving compliance. According to the Asian Development Bank, energy efficiency measures in the region could save up to 1,300 terawatt-hours annually by 2040, equivalent to the total electricity consumption of Southeast Asia in 2020. Low voltage drives are central to these efforts, as they enable variable speed operation by reducing energy losses during partial load conditions. In Australia, initiatives like the National Australian Built Environment Rating System (NABERS) incentivize the adoption of energy-efficient technologies that will further propel the growth of the market.

MARKET RESTRAINTS

High Initial Costs

One of the primary barriers to the widespread adoption of low voltage drives in Asia Pacific is their high initial cost, which often deters small and medium-sized enterprises (SMEs) from investing in these technologies. The upfront expense of low voltage drives, which includes not only the device itself but also installation, training, and maintenance, can be prohibitive for cash-strapped enterprises. While the long-term energy savings justify the investment, the immediate financial burden remains a significant deterrent. Moreover, in rural areas where grid infrastructure is underdeveloped, the additional cost of stabilizing power supply further exacerbates the challenge. This economic constraint limits the penetration of low voltage drives in emerging economies like Bangladesh and Indonesia.

Technical Complexity and Skill Gaps

The technical complexity associated with the installation and operation of low voltage drives poses another significant restraint in the Asia Pacific market. These devices require specialized knowledge for programming, troubleshooting, and maintenance, which is often lacking in the region. According to the United Nations Industrial Development Organization, less than 30% of the workforce in Asia Pacific possesses advanced technical skills by creating a substantial skill gap. For example, in India, where the manufacturing sector employs over 100 million people, the lack of trained personnel to handle sophisticated automation equipment hampers the effective deployment of low voltage drives. Additionally, as per the World Bank, inadequate technical education systems in countries like Cambodia and Laos further exacerbate the issue. The absence of standardized training programs and certification processes complicates matters, leading to inefficient utilization of low voltage drives.

MARKET OPPORTUNITIES

Rising Investments in Renewable Energy

The Asia Pacific region is at the forefront of the global transition to renewable energy, with significant investments being directed toward solar, wind, and hydropower projects. Low voltage drives are indispensable in this context, as they optimize the performance of renewable energy systems by controlling motors in wind turbines, solar trackers, and hydroelectric generators. Similarly, India’s target of achieving 500 GW of renewable energy capacity by 2030, as per the Ministry of New and Renewable Energy, presents a lucrative opportunity for low voltage drive manufacturers. By enhancing the efficiency and reliability of renewable energy systems, these drives not only support sustainability goals but also open new revenue streams in the burgeoning green energy sector.

Expansion of Smart Cities and Urban Infrastructure

The rapid urbanization in Asia Pacific is driving the development of smart cities, which rely on advanced technologies to improve living standards and resource management. According to the United Nations, the region’s urban population is projected to increase by 1.2 billion by 2050, necessitating significant investments in smart infrastructure. Low voltage drives are crucial in this endeavor, as they enable energy-efficient operation of HVAC systems, elevators, water pumps, and wastewater treatment plants in urban settings. For example, Singapore’s Smart Nation initiative, which aims to integrate digital technologies into urban planning, has already incorporated low voltage drives in numerous public facilities to reduce energy consumption.

MARKET CHALLENGES

Intense Price Competition

The Asia Pacific low voltage drives market is highly competitive, with numerous local and international players vying for market share. This intense competition often leads to price wars, which can erode profit margins and hinder innovation. According to McKinsey & Company, the average profit margin for industrial automation products in the region has declined by 15% over the past decade due to pricing pressures. Local manufacturers in countries like China and India offer low-cost alternatives, which is making it difficult for established brands to maintain premium pricing. For instance, Chinese companies like INVT and Delta Electronics have gained significant market share by offering affordable solutions tailored to regional needs. It poses a challenge for global players who must balance affordability with quality and innovation. The pressure to reduce prices also limits investment in research and development by potentially stifling technological advancements in the market.

Supply Chain Disruptions

Supply chain disruptions remain a persistent challenge for the Asia Pacific low voltage drives market, exacerbated by geopolitical tensions, natural disasters, and logistical bottlenecks. For example, Taiwan, which supplies over 60% of the world’s semiconductors, faced production delays during the 2021 drought, impacting the availability of low voltage drives. Similarly, the Suez Canal blockage in 2021 delayed shipments of essential materials, causing ripple effects across the region. As per Deloitte, supply chain disruptions can increase production costs by up to 20%, forcing manufacturers to pass these expenses onto consumers. This volatility not only affects profitability but also undermines customer trust, as delays in delivery and inconsistent product availability hinder business operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Power Range, Capacity, Drive, Technology, System, Application, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

ABB, Beckhoff Automation, Bosch Rexroth (India) Private Limited, CG Power & Industrial Solutions Ltd., Danfoss, Delta Electronics, Inc., Eaton, Emerson Electric Co., Erhardt+Leimer, Fuji Electric Co., Ltd., GE Vernova, Hiconics Eco-energy Technology Co., Ltd., Hitachi Hi-Rel Power Electronics Private Limited, LS ELECTRIC Co., Ltd., Mitsubishi Electric Corporation, Nidec Conversion, Rockwell Automation, Schneider Electric, Siemens, WEG, YASKAWA ELECTRIC (SINGAPORE) PTE LTD., and others. |

SEGMENTAL ANALYSIS

By Power Range Insights

The low power range segment dominated the Asia Pacific low voltage drives market share in 2024 with its widespread application in industries such as HVAC, water treatment, and manufacturing, where motors operating below 1 kV are extensively used. According to the International Energy Agency, HVAC systems alone consume nearly 40% of global energy in commercial buildings, which is making low power range drives essential for optimizing energy efficiency. These drives enable variable speed control by reducing energy consumption by up to 30% in energy-intensive countries like China and India. Another key factor driving this segment’s prominence is government regulations promoting energy conservation. For instance, Japan’s Top Runner Program mandates the use of energy-efficient technologies, including low power range drives, in industrial applications. Similarly, India’s Bureau of Energy Efficiency has introduced star ratings for motors and drives by incentivizing their adoption.

The micro power range segment is projected to grow at a CAGR of 8.5% during the forecast period with the increasing adoption of automation in small-scale industries and the rising demand for precision control in consumer electronics. Another driving factor is the expansion of the electric vehicle (EV) market, which relies on micro power range drives for auxiliary functions such as cooling systems and power steering. Additionally, the growing emphasis on smart home devices, as per the Frost & Sullivan’s projection of the smart home market reaching $100 billion by 2025, further boosts demand for micro power range drives. These devices optimize energy usage in appliances like smart thermostats and automated lighting systems by aligning with consumer preferences for energy-efficient solutions.

By Drive Insights

The AC segment was the largest and held dominant share of the Asia Pacific low voltage drives market in 2024 due to their versatility and cost-effectiveness, making them ideal for applications in HVAC systems, pumps, and fans. According to the U.S. Department of Energy, AC drives can reduce energy consumption in motor-driven systems by up to 25%, which is particularly significant in energy-intensive industries like manufacturing and oil and gas. In China, the world’s largest manufacturing hub, AC drives are widely adopted to enhance operational efficiency, contributing to the country’s target of reducing carbon emissions by 65% by 2030, as per the Ministry of Ecology and Environment. Government policies also play a crucial role in driving the adoption of AC drives. For instance, Australia’s National Australian Built Environment Rating System (NABERS) incentivizes the use of energy-efficient technologies, including AC drives, in commercial buildings.

The servo drives segment is anticipated to register a CAGR of 9.2% during the forecast period owing to the increasing adoption of robotics and automation in industries such as automotive, electronics, and pharmaceuticals. According to the International Federation of Robotics, the number of operational industrial robots in Asia Pacific is expected to exceed 2 million units by 2025, with servo drives being integral to their precise motion control capabilities. Another significant factor is the rise of smart manufacturing initiatives, such as China’s “Made in China 2025” plan, which emphasizes the integration of advanced technologies in production processes.

By Technology Insights

The standard technology segment was the largest in the Asia Pacific low voltage drives market with prominent share in 2024. Their widespread adoption is attributed to their affordability and ease of integration into existing systems, making them suitable for a broad range of applications. According to the International Energy Agency, standard drives are extensively used in water treatment plants, where they help optimize energy consumption by controlling pump speeds. In India, the government’s Jal Jeevan Mission, aimed at providing clean drinking water to all households, has significantly increased the deployment of standard drives in water distribution systems. Another driving factor is the growing focus on energy efficiency in commercial buildings. For instance, Singapore’s Green Mark certification program encourages the use of energy-saving technologies, including standard drives, in HVAC systems. As per the World Green Building Council, green building projects in Asia Pacific are expected to double by 2025, which is creating substantial opportunities for standard drives. Additionally, the expansion of manufacturing hubs in Vietnam and Thailand, as per the United Nations Industrial Development Organization that propels demand for cost-effective drive solutions.

The regenerative technology segment is lucratively growing with a CAGR of 10.3% during the forecast period owing to their ability to recover energy from braking systems and feed it back into the grid, which is making them ideal for applications in elevators, cranes, and renewable energy systems. Another key factor is the increasing adoption of electric vehicles (EVs), which utilize regenerative braking systems to enhance energy efficiency. According to the International Energy Agency, EV sales in Asia Pacific are expected to grow by 25% annually, with regenerative drives playing a critical role in their operation.

By System Insights

The open loop systems segment was accounted in holding 60.5% of the Asia Pacific low voltage drives market share in 2024 due to their simplicity and cost-effectiveness, making them suitable for applications where precision control is not a primary requirement. According to the U.S. Department of Energy, open loop drives are widely used in HVAC systems, where they provide reliable performance at a lower cost compared to closed loop systems. In China, the construction of large-scale commercial buildings has significantly increased the demand for open loop drives, as per the Ministry of Housing and Urban-Rural Development. Government regulations promoting energy efficiency also contribute to the segment’s growth. For example, South Korea’s Green Growth Strategy mandates the use of energy-saving technologies in public infrastructure, driving the adoption of open loop drives in water and wastewater management systems.

The closed loop systems segment is poised to register a CAGR of 9.8% during the forecast period with their ability to provide precise control and feedback, making them ideal for applications in robotics, CNC machines, and automated manufacturing systems. According to the International Federation of Robotics, the density of industrial robots in Asia Pacific is expected to reach 150 units per 10,000 employees by 2025, with closed loop drives playing a critical role in enabling high-precision operations. In Japan, the government’s Society 5.0 initiative emphasizes the integration of IoT and AI in industrial processes, driving the adoption of closed loop drives.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific low voltage drives market with 40.4% of the share in 2024 owing to its status as the world’s largest manufacturing hub, with over 28% of its GDP originating from the manufacturing sector. According to the International Energy Agency, China’s industrial sector consumes nearly 70% of the country’s electricity, making energy-efficient solutions like low voltage drives indispensable. Government initiatives such as the “Made in China 2025” plan, which aims to modernize the manufacturing sector through automation.

India held 23.2% of the Asia Pacific low voltage drives market share in 2024. Country’s rapid industrialization and urbanization are key drivers, with the government investing heavily in infrastructure projects. According to the Ministry of Road Transport and Highways, India plans to invest $1.4 trillion in infrastructure development by 2025 by creating significant opportunities for low voltage drives in sectors like transportation and utilities. Additionally, the push for renewable energy, as per the Ministry of New and Renewable Energy, further amplifies demand.

Japan’s market growth is driven by its focus on energy efficiency and technological innovation.. Government programs like the Top Runner initiative mandate the use of energy-efficient technologies, which are boosting the adoption of low voltage drives in industries such as automotive and electronics.

South Korea low voltage drives market growth is driven by its strong industrial base and government-led green growth initiatives. According to the Korea Energy Management Corporation, the country aims to reduce energy consumption in industrial facilities by 20% by 2030 with the adoption of low voltage drives.

Australia and New Zealand are esteemed to have steady growth opportunities in the next coming years with their focus on sustainable development and energy efficiency. According to the Australian Renewable Energy Agency, the region is investing heavily in renewable energy projects, creating opportunities for low voltage drives in solar and wind applications. Additionally, the push for green building certifications, as per the Green Building Council of Australia, further supports market growth.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC low voltage drives market profiled in this report are ABB, Beckhoff Automation, Bosch Rexroth (India) Private Limited, CG Power & Industrial Solutions Ltd., Danfoss, Delta Electronics, Inc., Eaton, Emerson Electric Co., Erhardt+Leimer, Fuji Electric Co., Ltd., GE Vernova, Hiconics Eco-energy Technology Co., Ltd., Hitachi Hi-Rel Power Electronics Private Limited, LS ELECTRIC Co., Ltd., Mitsubishi Electric Corporation, Nidec Conversion, Rockwell Automation, Schneider Electric, Siemens, WEG, YASKAWA ELECTRIC (SINGAPORE) PTE LTD., and others.

TOP LEADING PLAYERS IN THE MARKET

ABB Ltd.

ABB Ltd. is a global leader in industrial automation and electrification, with a significant presence in the Asia Pacific low voltage drives market. The company’s innovative drive solutions cater to diverse industries, including manufacturing, utilities, and transportation. ABB’s commitment to sustainability is evident in its development of energy-efficient technologies that align with regional energy conservation goals.

Siemens AG

Siemens AG is renowned for its cutting-edge digitalization and automation solutions, making it a key player in the Asia Pacific low voltage drives market. The company’s focus on integrating IoT and AI into its drive systems has enabled customers to achieve higher operational efficiency. Siemens’ emphasis on sustainability and smart infrastructure aligns with the region’s growing demand for green technologies.

Schneider Electric SE

Schneider Electric SE is a pioneer in energy management and automation, contributing significantly to the Asia Pacific low voltage drives market. The company’s EcoStruxure platform offers advanced analytics and real-time monitoring capabilities, empowering businesses to optimize energy usage. Schneider Electric’s dedication to innovation and customer-centric solutions has made it a preferred choice for industries seeking reliable and efficient drive systems.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships and Collaborations

Key players in the Asia Pacific low voltage drives market have prioritized forming strategic partnerships with local firms and governments to expand their reach. These collaborations enable companies to leverage regional expertise and tailor their solutions to meet specific market needs. For instance, partnerships with renewable energy projects have allowed players to integrate their drives into solar and wind systems by enhancing their visibility and adoption.

Product Innovation and Customization

Innovation remains a cornerstone strategy, with companies investing heavily in R&D to develop advanced drive technologies. Customization plays a crucial role, as manufacturers design products that cater to the unique requirements of industries like HVAC, water treatment, and manufacturing. This approach ensures that their offerings remain competitive and aligned with evolving customer demands.

Expansion of Service Networks

To strengthen their market position, key players are expanding their service networks across the region. Establishing local service centers and training facilities allows companies to provide timely support and maintenance, ensuring customer satisfaction. This strategy also helps build long-term relationships with clients by fostering loyalty and repeat business.

COMPETITION OVERVIEW

The Asia Pacific low voltage drives market is characterized by intense competition, driven by the presence of both global giants and regional players. Global companies like ABB, Siemens, and Schneider Electric dominate the market with their advanced technologies and extensive distribution networks. However, local manufacturers are gaining ground by offering cost-effective solutions tailored to regional needs. This dynamic has led to price wars and increased pressure on innovation. Additionally, the growing emphasis on energy efficiency and sustainability has created new opportunities, prompting companies to differentiate themselves through eco-friendly products. To stay ahead, players are focusing on strategic initiatives such as partnerships, product customization, and service expansion by ensuring they remain relevant in this rapidly evolving market.

RECENT MARKET DEVELOPMENTS

- In March 2023, ABB Ltd. launched a new series of energy-efficient low voltage drives designed specifically for the Asia Pacific market. This move aimed to address regional energy conservation goals and enhance its product portfolio.

- In June 2023, Siemens AG partnered with a leading renewable energy firm in India to integrate its low voltage drives into solar power projects. This collaboration strengthened Siemens’ presence in the region’s growing renewable energy sector.

- In August 2023, Schneider Electric SE expanded its service network in Southeast Asia by opening new training centers in Thailand and Vietnam. These centers focus on providing technical expertise and support to local customers.

- In November 2023, Mitsubishi Electric Corporation introduced a next-generation low voltage drive system equipped with IoT capabilities. This innovation targeted smart manufacturing applications, aligning with the region’s Industry 4.0 initiatives.

- In January 2024, Delta Electronics acquired a local automation solutions provider in Australia. This acquisition enabled Delta to enhance its market share and offer comprehensive solutions tailored to the Australian market.

MARKET SEGMENTATION

This Asia Pacific low voltage drives market research report is segmented and sub-segmented into the following categories.

By Power Range

- Micro

- Low

By Capacity

- 2.2 kW

- 2.2 kW - 7.5 kW

- 7.5 kW - 22 kW

- 22 kW - 75 kW

- ≥ 75 kW - 110 kW

- ≥ 110 kW - 500 kW

- ≥ 500 kW

By Drive

- AC

- IE 1

- IE 2

- IE 3

- IE 4

- Others

- DC

- Servo

By Technology

- Standard

- Regenerative

By System

- Open loop

- Closed loop

By Application

- Pump

- Fan

- Conveyor

- Compressor

- Extruder

- Others

By End-Use

- Oil & Gas

- Power generation

- Food processing

- Automotive

- Mining & metals

- Pulp & paper

- Textile

- Marine

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific low voltage drives market?

The Asia Pacific low voltage drives market is driven by rapid industrialization, energy efficiency mandates, industrial automation, and government incentives for adopting advanced drive technologies

2. What challenges affect the Asia Pacific low voltage drives market?

High initial costs, technical complexity, supply chain disruptions, and intense price competition are major challenges in the Asia Pacific low voltage drives market

3. What opportunities exist in the Asia Pacific low voltage drives market?

Opportunities include growth in renewable energy projects, smart city development, rising demand for automation, and the need for energy-efficient solutions across diverse industries in the Asia Pacific low voltage drives market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com