Asia Pacific Molded Pulp Packaging Market Research Report – Segmented By Molded Type (Thick Wall, Transfer Molded, Thermoformed Fiber, Processed Pulp), Source, Product, End-User, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

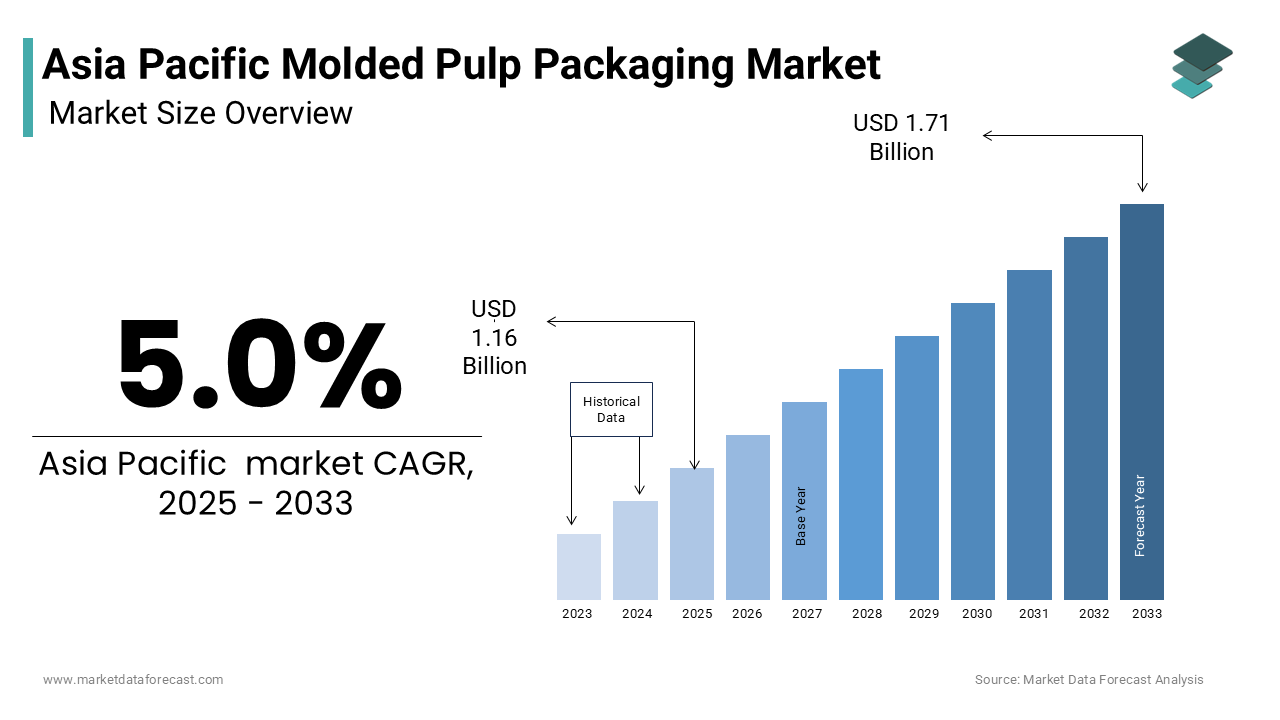

Asia Pacific Molded Pulp Packaging Market Size

The Asia Pacific Molded Pulp Packaging Market was worth USD 1.10 billion in 2024. The Asia Pacific market is expected to reach USD 1.71 billion by 2033 from USD 1.16 billion in 2025, rising at a CAGR of 5.0% from 2025 to 2033.

Molded pulp, made from renewable resources such as recycled paper, cardboard, and agricultural waste, is widely used in industries like food and beverage, electronics, and healthcare due to its biodegradability, recyclability, and cost-effectiveness. According to the World Economic Forum, over 150 million tons of plastic waste are generated annually worldwide, with Asia contributing significantly to this figure. This environmental crisis has spurred governments and businesses across the region to adopt alternatives like molded pulp packaging to reduce their carbon footprint. For instance, countries like Japan and South Korea have introduced stringent regulations to phase out single-use plastics, further accelerating the adoption of molded pulp solutions. Additionally, the rise of e-commerce and online retail has amplified the demand for protective packaging materials that are both functional and environmentally responsible. As per Deloitte, the integration of advanced manufacturing technologies, such as 3D printing and automation, has enhanced the design flexibility and production efficiency of molded pulp packaging, which is making it a preferred choice for modern supply chains.

MARKET DRIVERS

Stringent Environmental Regulations

The implementation of stringent environmental regulations across the Asia Pacific region is a significant driver of the molded pulp packaging market. Governments are increasingly imposing bans on single-use plastics and promoting sustainable alternatives to address the growing environmental crisis. For example, China’s "Plastic Ban 2021" initiative prohibits the use of non-biodegradable plastics in major cities, compelling businesses to adopt molded pulp packaging. Molded pulp packaging, being biodegradable and recyclable, aligns perfectly with these regulatory mandates. Additionally, consumer awareness campaigns led by environmental organizations have further amplified demand. A study by Nielsen revealed that over 70% of consumers in Australia and Japan are willing to pay a premium for products packaged in sustainable materials, driving companies to invest in molded pulp solutions to meet evolving preferences.

Rising Demand from E-Commerce and Food Industries

Another major driver is the exponential growth of the e-commerce and food industries, which rely heavily on protective and sustainable packaging solutions. The surge in online shopping, particularly during the pandemic, has created a robust demand for durable yet eco-friendly packaging materials. According to Statista, the e-commerce market in the Asia Pacific is projected to grow by 20% annually, with molded pulp packaging playing a critical role in ensuring product safety during transit. Similarly, the food and beverage industry is adopting molded pulp trays and containers to replace traditional plastic packaging. For instance, fast-food chains in India and Thailand are transitioning to molded pulp-based packaging to comply with local sustainability goals.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints facing the Asia Pacific molded pulp packaging market is the high production costs associated with advanced manufacturing processes. While molded pulp is derived from renewable resources, the initial investment required for machinery, automation, and skilled labor can be prohibitive, especially for small and medium-sized enterprises (SMEs). According to Frost & Sullivan, the average upfront cost of setting up a molded pulp production facility exceeds $2 million, making it challenging for smaller players to enter the market. Additionally, the shortage of skilled professionals proficient in operating advanced machinery further compounds the issue. These financial and resource constraints hinder widespread adoption in developing economies where budgetary allocations for sustainable initiatives are limited.

Limited Awareness Among Consumers

Another significant restraint is the limited awareness among consumers about the benefits and applications of molded pulp packaging in rural and underserved areas. Many consumers underestimate its potential to replace traditional plastic packaging, viewing it as less durable or cost-effective. According to Grant Thornton, over 60% of rural populations in countries like Indonesia and Vietnam remain unaware of molded pulp as a viable alternative, creating a gap in demand. This lack of awareness stems from insufficient marketing efforts and limited access to information. Furthermore, the absence of standardized labeling and certification systems exacerbates the problem, as consumers often struggle to identify truly sustainable products.

MARKET OPPORTUNITIES

Integration with Advanced Manufacturing Technologies

The integration of advanced manufacturing technologies, such as automation and 3D printing, presents a transformative opportunity for the Asia Pacific molded pulp packaging market. Automation enhances production efficiency, reduces labor costs, and ensures consistent quality, making molded pulp packaging more competitive against traditional materials. According to Deloitte, automated production lines can increase output by up to 40%, which is enabling manufacturers to meet the growing demand from industries like e-commerce and food. For instance, companies in Japan and South Korea are leveraging robotic systems to produce intricate designs and custom shapes, catering to niche markets such as luxury goods and electronics. Additionally, 3D printing allows for rapid prototyping and customization, empowering businesses to develop innovative packaging solutions tailored to specific customer needs.

Expansion into Emerging Markets

Another promising opportunity lies in expanding molded pulp packaging solutions into emerging markets within the Asia Pacific region. Countries like Vietnam, Indonesia, and the Philippines are experiencing rapid urbanization and industrialization, creating a fertile ground for sustainable packaging innovations. According to the World Bank, over 50% of the population in Southeast Asia will reside in urban areas by 2030, driving demand for eco-friendly packaging in sectors like retail, food delivery, and logistics. For example, startups in India are introducing affordable molded pulp solutions for small businesses, addressing the unique needs of local markets. Additionally, government-led initiatives promoting circular economies and waste reduction have further bolstered the market, encouraging investments in scalable and cost-effective solutions.

MARKET CHALLENGES

Shortage of Skilled Workforce

The scarcity of skilled professionals proficient in molded pulp manufacturing and advanced technologies poses a significant challenge to the market’s growth. According to Cybersecurity Ventures, the global shortage of skilled technicians and engineers is expected to reach 3.5 million unfilled positions by 2025, with the Asia Pacific accounting for nearly 40% of this deficit. In countries like Malaysia and Thailand, universities produce fewer than 500 graduates annually with relevant expertise, far below industry requirements. This shortage forces manufacturers to either outsource critical functions or operate with understaffed teams, increasing the risk of inefficiencies and suboptimal outcomes. Additionally, the rapid evolution of manufacturing technologies necessitates continuous upskilling, which many professionals struggle to achieve due to limited access to advanced training programs. For instance, a survey by EY revealed that only 25% of manufacturers in the region receive regular training updates.

Competition from Alternative Materials

Another pressing challenge is the intense competition from alternative sustainable materials, such as bioplastics and plant-based polymers, which threaten to overshadow molded pulp packaging. While molded pulp is biodegradable and recyclable, alternative materials often offer superior durability and versatility, making them more appealing to certain industries. For instance, companies in Japan and South Korea are investing heavily in bioplastics to develop packaging solutions that combine sustainability with enhanced performance. Additionally, the lack of standardized testing and certification for molded pulp creates confusion among consumers, who may perceive alternative materials as more reliable. This competition not only hampers market penetration but also limits the potential for innovation and differentiation in the molded pulp packaging space.

SEGMENTAL ANALYSIS

By Molded Type Insights

The thickwall segment was the largest and led the Asia Pacific molded pulp packaging market with 45.3% of the share in 2024 due to its robustness and suitability for heavy-duty applications, such as industrial packaging and protective cushioning for electronics. For instance, companies like Samsung and Sony rely on thickwall packaging to ensure product integrity in regions with challenging logistics infrastructure like India and Indonesia. Additionally, the growing emphasis on sustainability has amplified demand for thickwall solutions, as they are made from renewable resources and are fully recyclable. Another driving factor is the increasing adoption of e-commerce across the region. A study by PwC revealed that e-commerce shipments in the Asia Pacific grew by 25% in 2022, which is creating a robust demand for durable yet eco-friendly packaging materials.

The thermoformed fiber segment is projected to grow with a CAGR of 18.7% in the coming years. This rapid expansion is fueled by advancements in manufacturing technologies, enabling the production of intricate designs and lightweight structures. For example, thermoformed fiber packaging is increasingly used in the food and beverage industry for items like takeout containers and trays, replacing traditional plastic alternatives. Another contributing factor is the growing consumer preference for sustainable packaging. A Nielsen survey revealed that 85% of consumers in Australia and Japan are willing to switch brands if a competitor offers environmentally friendly packaging.

By Product Type Insights

The trays dominated the Asia Pacific molded pulp packaging market with 35.4% of share in 2024. According to the World Economic Forum, trays account for over 50% of molded pulp packaging used in the food sector, where they are employed for packaging fresh produce, eggs, and ready-to-eat meals. For instance, fast-food chains in Thailand and Malaysia are transitioning to molded pulp trays to comply with local sustainability goals. Another driving factor is the increasing focus on food safety and hygiene. A study by Accenture revealed that over 75% of consumers in the Asia Pacific prioritize packaging that ensures product freshness and reduces contamination risks. Molded pulp trays, being biodegradable and free from harmful chemicals, align perfectly with these preferences, reinforcing their dominance in the market.

The clamshells segment is projected to witness a CAGR of 20.3% in the coming years. This rapid expansion is fueled by their growing adoption in the food delivery and retail sectors, where they offer secure and visually appealing packaging solutions. For instance, companies like Domino’s and KFC are using clamshells to package meals by ensuring customer satisfaction while meeting sustainability mandates. Another contributing factor is the increasing emphasis on branding and aesthetics.

By End-Use and Source Insights

The wood pulp segment accounted to hold a dominant share of the Asia Pacific molded pulp packaging market in 2024. According to the Food and Agriculture Organization (FAO), wood pulp production in the Asia Pacific exceeds 200 million tons annually, which is making it a readily accessible raw material for manufacturers. For instance, countries like China and Indonesia leverage their vast forest resources to produce high-quality wood pulp for packaging applications, ensuring a consistent supply and affordability. Another driving factor is the growing emphasis on circular economies.

The non-wood pulp segment is likely to grow with a CAGR of 22.5% in the coming years with the increasing use of agricultural waste, such as sugarcane bagasse and wheat straw, as raw materials. According to the United Nations Environment Programme (UNEP), non-wood pulp reduces reliance on forest resources by up to 40%, making it highly attractive to environmentally conscious consumers. For example, startups in India and Vietnam are producing molded pulp packaging from sugarcane waste, which is catering to the unique needs of local markets.

REGIONAL ANALYSIS

China was the largest contributor to the Asia Pacific molded pulp packaging market with 35.4% of share in 2024. The country’s massive manufacturing base and stringent environmental regulations have created a fertile ground for molded pulp adoption. Enterprises across industries like electronics, food, and healthcare rely heavily on sustainable packaging solutions to meet regulatory mandates.

Japan was positioned second by leading the Asia molded pulp packaging market with 18.4% of share in 2024 with its advanced technological infrastructure and emphasis on sustainability positioning it as a leader in adopting innovative molded pulp solutions. Japanese corporations prioritize efficiency and precision, particularly in industries like electronics and automotive. Additionally, the integration of automation into production processes has gained traction, enabling scalable and cost-effective solutions.

India’s booming population and rapid urbanization are major drivers of the Asia Pacific molded pulp packaging market growth. Indian enterprises are increasingly leveraging eco-friendly solutions to address mounting waste management challenges. According to the Ministry of Environment, Forest and Climate Change, over 50% of urban municipalities promote molded pulp packaging as part of their waste reduction initiatives. Additionally, government-led programs promoting sustainable agriculture have further bolstered the market by ensuring steady growth.

South Korea molded pulp packaging market is likely to grow with the focus on innovation and digital transformation driving the adoption of advanced molded pulp packaging solutions. South Korean enterprises in the electronics and food sectors, rely on molded pulp to manage complex packaging needs while ensuring environmental compliance. According to the Korea Chamber of Commerce and Industry, over 50% of large corporations have implemented molded pulp systems to enhance operational efficiency and sustainability. Australia’s strong emphasis on regulatory compliance and corporate governance has fueled demand for molded pulp packaging in industries like healthcare and retail. Australian enterprises spend significant resources on developing sustainable packaging solutions to meet stringent environmental standards. According to the Australian Department of Agriculture, Water and the Environment, over 40% of legal disputes arise from poorly managed packaging practices by incentivizing businesses to adopt eco-friendly alternatives.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Huhtamaki Oyj, Sonoco Products Co., Brodrene Hartmann A/S, Genpak LLC, UFP Technologies, Sabert Corporation, Fabri-Kal, Pro-Pac Packaging, Henry Molded Products, and Protopak Engineering Corporation are

The Asia Pacific molded pulp packaging market is characterized by intense competition, driven by a mix of global giants and regional innovators striving to capture market share. Established players like Huhtamaki, Pactiv Evergreen, and Orora bring extensive resources and technological expertise, enabling them to dominate key segments such as food packaging and e-commerce solutions. At the same time, regional companies leverage their deep understanding of local cultures and regulatory frameworks to carve out niche positions. The market’s dynamic nature is further amplified by rapid technological advancements, which compel vendors to continuously innovate and adapt. Strategic collaborations with governments and industry bodies play a crucial role in shaping competitive strategies, particularly in emerging markets. Additionally, the rise of digital transformation initiatives has created new opportunities for differentiation, as companies strive to offer seamless and scalable solutions. This interplay of innovation, localization, and strategic positioning ensures that the market remains vibrant and highly contested.

Top Players in the Asia Pacific Molded Pulp Packaging Market

Huhtamaki Group

Huhtamaki Group is a global leader in the molded pulp packaging market, renowned for its innovative and sustainable solutions tailored to industries like food, beverage, and healthcare. The company’s focus on circular economy principles has enabled it to develop biodegradable and recyclable packaging products that align with regional environmental mandates. By leveraging advanced manufacturing technologies, Huhtamaki ensures consistent quality and scalability, catering to both large enterprises and small businesses.

Pactiv Evergreen Inc.

Pactiv Evergreen Inc. specializes in cost-effective and durable molded pulp packaging solutions, serving sectors such as e-commerce, food delivery, and retail. The company’s emphasis on material innovation and process optimization has allowed it to produce lightweight yet robust packaging products that meet diverse customer needs. Pactiv Evergreen has deepened its engagement in the Asia Pacific by investing in automation and expanding its production facilities by ensuring timely delivery and competitive pricing. Its commitment to sustainability and operational excellence reinforces its dominance in the global molded pulp packaging space.

Orora Limited

Orora Limited is a prominent player in the molded pulp packaging market, offering customizable and scalable solutions for industries like agriculture, electronics, and logistics. The company’s focus on design flexibility and customer-centric innovation has enabled it to address unique regional challenges, such as urbanization and waste management. Orora’s partnerships with startups and academic institutions have accelerated the adoption of advanced technologies by enhancing its product portfolio.

Top Strategies Used by Key Players in the Asia Pacific Molded Pulp Packaging Market

Integration of Automation and Advanced Technologies

Leading players are increasingly incorporating automation and advanced manufacturing technologies into their operations to enhance production efficiency and reduce costs. These innovations enable manufacturers to produce intricate designs and custom shapes, catering to niche markets such as luxury goods and electronics. For instance, robotic systems and 3D printing allow for rapid prototyping and customization, empowering businesses to meet evolving customer preferences. This strategy not only improves operational efficiency but also differentiates vendors in a competitive market by positioning them as innovators in the sustainable packaging space.

Expansion Through Strategic Partnerships

Strategic partnerships with local enterprises, governments, and industry bodies have become a cornerstone of success in the Asia Pacific molded pulp packaging market. Collaborations with public sector organizations help promote awareness campaigns and regulatory compliance initiatives, fostering trust among stakeholders. Additionally, partnerships with technology firms facilitate the integration of advanced tools, ensuring scalability and reliability. These alliances enable companies to expand their reach and influence across diverse markets, addressing the unique needs of industries such as food, retail, and logistics.

Focus on Localization and Customization

Key players are prioritizing localization and customization to address the unique needs of businesses in the Asia Pacific region. By offering multilingual interfaces and region-specific features, vendors can cater to diverse consumer preferences. This approach not only enhances user experience but also fosters brand loyalty. Additionally, customization allows companies to adapt their solutions to specific industries, such as rural healthcare and telemedicine, ensuring relevance and applicability in diverse operational contexts.

RECENT MARKET DEVELOPMENTS

- In April 2024, Huhtamaki launched a new line of biodegradable molded pulp trays specifically designed for the food delivery sector in Southeast Asia. This initiative aims to enhance its market presence by offering region-specific solutions that align with local sustainability goals.

- In June 2023, Pactiv Evergreen partnered with a leading e-commerce platform in Japan to integrate its molded pulp packaging solutions into the firm’s logistics network. This collaboration seeks to streamline supply chain operations and improve product safety during transit.

- In September 2023, Orora introduced a blockchain-enabled feature to ensure tamper-proof records for its packaging materials in India. This move strengthens its prominence in ethical governance practices and addresses growing concerns about transparency.

- In February 2024, Huhtamaki acquired a regional startup specializing in agricultural waste-based molded pulp solutions. This acquisition allows Huhtamaki to expand its capabilities in sustainable packaging, catering to the evolving needs of enterprises in the Asia Pacific region.

- In November 2023, Pactiv Evergreen collaborated with a government agency in Singapore to promote the adoption of molded pulp packaging among small and medium-sized enterprises (SMEs). This initiative aims to foster digital resilience and increase market penetration among underserved segments.

MARKET SEGMENTATION

This research report on the Asia Pacific molded pulp packaging market is segmented and sub-segmented into the following categories.

By Molded Type

- Thick Wall

- Transfer Molded

- Thermoformed Fiber

- Processed Pulp

By Source

- Wood pulp

- Nonwood pulp

By Product

- Food

- Trays

- Clamshells

- Cups

- Plates

- Bowls

- Others

By End Use

- Food Service Disposables

- Food Packaging

- Healthcare

- Electronics

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

Which factors are driving the growth of the molded pulp packaging market in Asia Pacific?

Growth is driven by increasing environmental awareness, government bans on single-use plastics, rising demand for sustainable packaging, and growth in the food delivery and electronics sectors.

What trends are shaping the Asia Pacific molded pulp packaging industry?

Key trends include increasing adoption of molded fiber in premium packaging, innovations in water- and oil-resistant coatings, and expansion into non-food sectors like electronics and healthcare.

What is the future outlook for the molded pulp packaging market in Asia Pacific?

The market is expected to grow steadily due to rising environmental concerns, advancements in molded pulp technology, and increasing use across multiple industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]