Asia Pacific Paper Packaging Market Report – Segmented By Material (Corrugated Board, Molded Pulp), Packaging Type, End-Use, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Paper Packaging Market Size

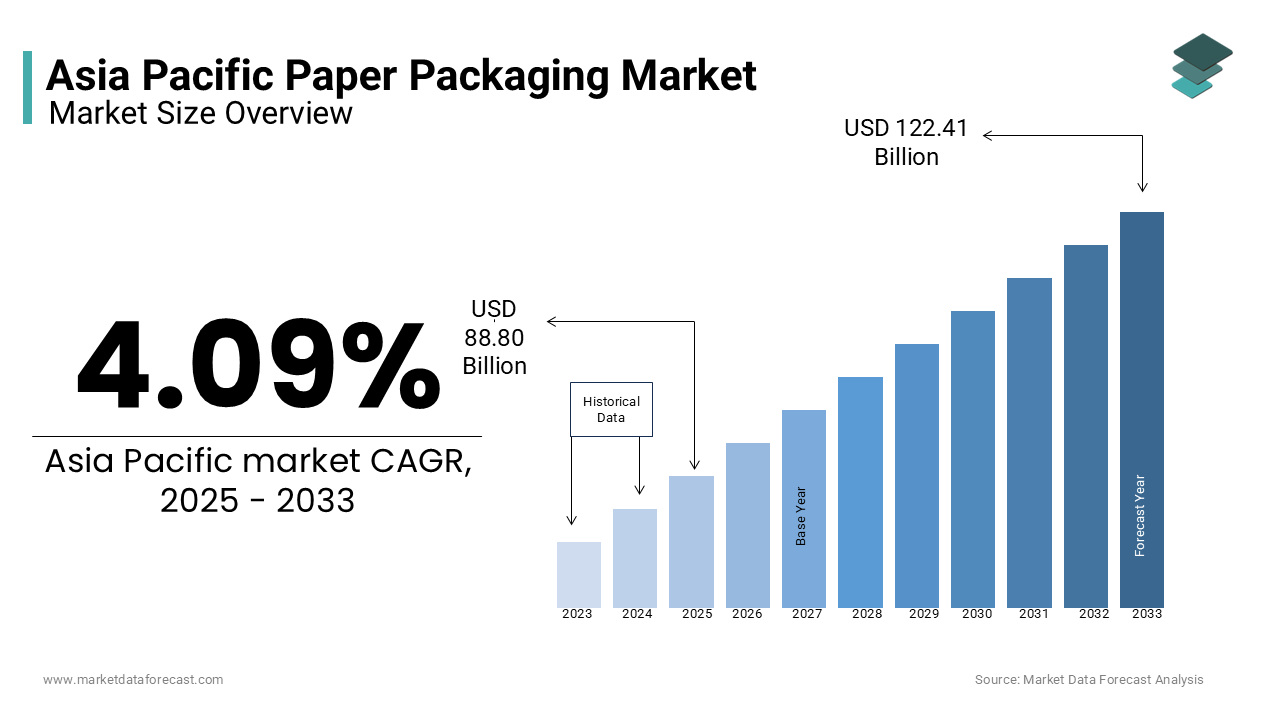

The Asia Pacific paper packaging market was worth USD 85.28 billion in 2024. The Asia Pacific market is expected to reach USD 122.41 billion by 2033 from USD 88.80 billion in 2025, rising at a CAGR of 4.09% from 2025 to 2033.

The Asia Pacific paper packaging market is a dynamic sector driven by a confluence of economic, environmental, and industrial factors. Also, the market's growth is further bolstered by the increasing adoption of sustainable practices, as industries pivot away from single-use plastics.

MARKET DRIVERS

E-Commerce Boom and Rising Urbanization

The rapid proliferation of e-commerce platforms across the Asia Pacific region serves as a significant driver for the paper packaging market. This surge has directly amplified the demand for durable and eco-friendly packaging solutions, with corrugated boxes being the preferred choice for shipping goods. Urbanization plays a complementary role, with a notable share of the region's population residing in cities. Urban consumers exhibit higher purchasing power and prefer online shopping, further fueling the need for efficient packaging. Additionally, the rise of localized fulfillment centers in metropolitan areas necessitates lightweight yet sturdy packaging materials.

Stringent Environmental Regulations

Environmental regulations across the Asia Pacific region have catalyzed the shift toward paper-based packaging. Governments are increasingly imposing bans on single-use plastics, creating a fertile ground for paper packaging alternatives. For example, Australia implemented the National Plastics Plan in 2021, aiming to phase out problematic plastics by 2025. Similarly, China’s "Zero Waste Cities" initiative mandates the use of recyclable materials in urban areas, driving industries to adopt paper-based solutions. Furthermore, consumer awareness about sustainability has surged.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

One of the primary constraints facing the Asia Pacific paper packaging market is the volatility in raw material costs. Pulp, the key raw material for paper production, is subject to price fluctuations influenced by supply chain disruptions and geopolitical tensions. For instance, during the first quarter of 2023, pulp prices in Southeast Asia surged by 15% due to export restrictions imposed by major suppliers like Brazil and Canada, as per the International Pulp and Paper Association. This unpredictability creates financial strain for manufacturers, who struggle to maintain competitive pricing while ensuring profitability. Additionally, the reliance on imported raw materials exacerbates the issue, particularly for smaller players in developing economies. According to a study by the Asian Development Bank, small-scale paper packaging manufacturers in Vietnam experienced a significant decline in margins during periods of raw material price spikes.

Limited Recycling Infrastructure

Another significant restraint is the underdeveloped recycling infrastructure in several parts of the Asia Pacific region. While paper packaging is inherently recyclable, the lack of adequate facilities and systems impedes its full potential. For example, only a small portion of paper waste in rural India is effectively recycled, with the remainder often ending up in landfills or incinerators. In Indonesia, informal recycling networks dominate, leading to inefficiencies and contamination of recyclable materials. The absence of standardized collection and processing mechanisms further compounds the problem, particularly in emerging economies. According to the World Bank, improving recycling infrastructure could notably reduce paper waste in the region, but achieving this requires substantial investment and policy intervention.

MARKET OPPORTUNITIES

Growth of Sustainable Luxury Packaging

The burgeoning demand for sustainable luxury packaging presents a lucrative opportunity for the Asia Pacific paper packaging market. High-end brands in sectors such as cosmetics, wine, and fashion are increasingly adopting premium paper packaging to align with eco-conscious consumer preferences. For instance, South Korean beauty brands have reported an increase in sales after switching to biodegradable paper packaging. In addition, advancements in printing and finishing technologies allow manufacturers to create visually appealing designs without compromising environmental standards.

Expansion into Emerging Markets

Emerging markets in the Asia Pacific region offer untapped potential for the paper packaging industry. Countries like Bangladesh, Myanmar, and Cambodia are witnessing rapid industrialization and urbanization, creating new avenues for growth. According to the Asian Development Bank, Bangladesh’s FMCG sector is projected to expand by 10% annually over the next five years, driving demand for affordable and sustainable packaging. Similarly, Myanmar’s agricultural exports have surged by 18% since 2021, as reported by the Food and Agriculture Organization, necessitating reliable packaging solutions for perishable goods. Investing in localized production facilities can help manufacturers cater to these markets cost-effectively. Moreover, partnerships with local governments and NGOs can facilitate the adoption of paper packaging in rural areas, where plastic usage remains prevalent.

MARKET CHALLENGES

Intense Competition from Alternative Materials

The Asia Pacific paper packaging market faces stiff competition from alternative materials such as bioplastics and reusable containers, which are gaining traction due to their perceived environmental benefits. In countries like Japan and South Korea, bioplastics are increasingly viewed as superior alternatives due to their durability and compostability. Furthermore, reusable packaging models are gaining popularity, particularly in urban centers. For example, Singapore’s Zero Waste SG initiative has encouraged businesses to adopt reusable containers, resulting in a 20% reduction in single-use packaging, as per the National Environment Agency.

SEGMENTAL ANALYSIS

By Material Insights

The corrugated board segment commanded the Asia Pacific paper packaging market, with a 45% share in 2024. This widespread adoption is due to its versatility, durability, and cost-effectiveness, making it indispensable for industries ranging from e-commerce to FMCG. A key driver of its dominance is the exponential growth of online retail. The surge has fueled demand for corrugated boxes, which are preferred for their lightweight yet robust structure, ideal for shipping fragile goods. Additionally, environmental concerns have bolstered the segment’s growth, as corrugated board is highly recyclable. The Recycling Council of Australia notes that over 85% of corrugated packaging is recovered and recycled in the region, aligning with sustainability goals. Another factor is the rise of organized retail chains, particularly in urban areas. For instance, China’s hypermarket industry expanding in recent years, driving the need for durable shelf-ready packaging solutions.

The molded pulp segment is emerging as the fastest expanding material, predicted to grow at a CAGR of 7.8% in the future. This development is propelled by its unique ability to replace plastics in applications such as food containers, egg trays, and protective packaging. One of the primary drivers is the increasing regulatory push against single-use plastics. For example, Japan’s Plastics Resource Circulation Act mandates businesses to adopt biodegradable alternatives, spurring molded pulp adoption. Similarly, the use of molded pulp in food packaging increased in Southeast Asia between 2020 and 2022. Furthermore, advancements in production technologies have reduced costs, making molded pulp competitive with traditional materials. South Korea’s Ministry of Environment highlights that investments in automated molding equipment have cut manufacturing times.

By Packaging Type Insights

The segment of corrugated boxes accounted for 50.8% of the Asia Pacific paper packaging market in 2024. Their prevalence is caused by their adaptability across industries, from logistics to retail. One significant factor is the booming e-commerce sector, which relies heavily on corrugated boxes for secure and efficient transportation of goods. Another contributing factor is the shift toward sustainable practices. India’s Central Pollution Control Board reports that corrugated boxes are recycled at a high rate, making them an environmentally responsible choice. Moreover, innovations in design and printing have enhanced their appeal. For instance, brands in Japan are adopting high-definition printing on corrugated surfaces to create visually striking packaging. These developments are complemented by the growing preference for lightweight packaging, which reduces shipping costs.

The cups and trays segment is emerging at a rapid pace, with a projected CAGR of 8.5%. This progress is credited to the rising demand for sustainable foodservice packaging, particularly in urban centers. For example, Australia’s National Plastics Plan aims to eliminate single-use plastic cups by 2025, creating opportunities for paper-based alternatives. Also, the consumption of paper cups in Southeast Asia has surged in the last few years, driven by the proliferation of coffee chains and quick-service restaurants. Apart from these, advancements in coating technologies have addressed concerns about liquid resistance, enhancing usability. South Korea’s Ministry of Environment highlights that biodegradable coatings now extend the shelf life of paper cups. Another factor is the growing trend of on-the-go dining.

By End-Use Industry Insights

The food and beverage industry represented the largest end-use segment by capturing 35.5% of the Asia Pacific paper packaging market in 2024. This dominance is attributed to stringent regulations mandating the use of eco-friendly packaging. For instance, China’s “Zero Waste Cities” initiative requires restaurants to phase out plastic containers, leading to an increase in paper-based packaging adoption. Additionally, the rise of health-conscious consumers has spurred demand for premium packaging. In Japan, organic food sales grew in recent years, with brands opting for kraft paper wraps to emphasize natural qualities. Urbanization further amplifies this trend, as convenience foods gain popularity.

On the other hand, the e-commerce segment is the fastest-growing end-use industry, with a CAGR of 9.2% through 2033. This rapid expansion is driven by the exponential rise in online shopping, fueled by digital transformation and changing consumer habits. This surge has created an unprecedented demand for protective packaging, particularly corrugated boxes and padded envelopes. In addition, the focus on reducing carbon footprints has accelerated the adoption of paper-based solutions. Like, a significant portion of e-commerce companies now prioritize sustainable packaging to enhance brand loyalty. Innovation also plays a critical role, with advancements in smart packaging enabling tracking and tamper-proof features. South Korea reports an annual surge in the use of QR-coded paper packages.

REGIONAL ANALYSIS

China was the undisputed leader in the Asia Pacific paper packaging market by accounting for 60.4% of the region’s total share in 2024. The country’s dominance is underpinned by its status as a global manufacturing hub, with industries ranging from electronics to textiles relying heavily on paper packaging for exports. According to the National Bureau of Statistics, China’s paper packaging industry grew by 12% in 2022, driven by government initiatives promoting green packaging. Additionally, urbanization has fueled consumption. Rising disposable incomes have further propelled the FMCG sector, which contributes significantly to packaging demand.

The Indian paper packaging market is experiencing strong growth. It’s rapid industrialization and a growing middle class that have catalyzed demand for paper packaging. India’s e-commerce sector has been a major driver, necessitating robust packaging solutions for online deliveries. Furthermore, government policies promoting sustainability have encouraged the adoption of paper-based alternatives. The Central Pollution Control Board states that plastic bans in 25 states have led to a 35% increase in paper packaging usage. Agricultural exports also play a vital role, with the Ministry of Commerce reporting a 20% annual growth in shipments, requiring reliable packaging for perishables.

Japan is among the key markets within the Asia Pacific region where the demand for processed and convenience foods is driving the growth of the paper packaging market. Also, the country’s emphasis on sustainability has fostered innovation in recyclable packaging, with a large amount of paper waste being recycled. Besides, the aging population has increased demand for healthcare products, which rely heavily on paper packaging. The Pharmaceuticals and Medical Devices Agency reports an annual growth in pharmaceutical packaging, showing this trend. Japan’s strong retail sector, particularly in urban areas, further bolsters demand. For instance, Tokyo’s organized retail chains grew notably in 2022.

South Korea is a major player in the market. The country’s “Zero Waste City” initiative has spurred businesses to adopt biodegradable packaging, resulting in a notable increase in paper packaging usage. Moreover, the cosmetics industry, a key contributor to GDP, has embraced sustainable luxury packaging. In addition, a significant portion of beauty brands now use recyclable materials. Urbanization also plays a crucial role, with Seoul’s population density driving demand for compact and eco-friendly solutions.

Australia holds a significant position in the market which is driven by its robust regulatory framework and high consumer awareness about sustainability. Additionally, the country’s thriving agricultural sector relies on paper packaging for exports, with a considerable growth in shipments. Urban consumers’ preference for eco-friendly products further amplifies demand, particularly in cities like Sydney and Melbourne.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Mondi Group, Smurfit Kappa Group, Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, DS Smith Plc, WestRock Company, International Paper Company, Tetra Pak International S.A., Lee & Man Paper Manufacturing Ltd., and Nine Dragons Paper (Holdings) Limited are some of the key market players.

The Asia Pacific paper packaging market is characterized by intense competition, driven by the presence of both global giants and regional players striving to gain a larger share of the rapidly growing sector. The market’s competitive landscape is shaped by the increasing demand for sustainable packaging solutions, which has prompted companies to innovate and differentiate their offerings. Global players leverage their technological expertise and economies of scale to maintain dominance, while regional players focus on customization and localized strategies to carve out niches. Sustainability remains a central theme, with companies competing to offer the most eco-friendly and cost-effective solutions. Additionally, the rise of e-commerce and urbanization has intensified competition, as companies vie to secure contracts with major retailers and logistics providers.

Top Players in the Asia Pacific Paper Packaging Market

International Paper

International Paper is a global leader in the paper packaging industry, with a strong foothold in the Asia Pacific region. The company has established itself as a pioneer in sustainable packaging solutions, leveraging its extensive R&D capabilities to develop innovative products tailored to regional demands. Its commitment to reducing carbon footprints and promoting circular economies has earned it significant recognition among eco-conscious consumers and industries. By collaborating with local governments and businesses, International Paper has played a pivotal role in shaping regulatory frameworks that favor sustainable packaging. Its contributions to the global market include setting benchmarks for recyclability and resource efficiency.

Oji Holdings Corporation

Oji Holdings Corporation is a key player in the Asia Pacific paper packaging market, renowned for its cutting-edge technologies and focus on high-quality materials. The company has consistently invested in advanced manufacturing processes to produce durable and eco-friendly packaging solutions. Its strategic partnerships with retail giants and FMCG companies have strengthened its presence in the region. Oji’s emphasis on sustainability aligns with global trends, enabling it to cater to diverse industries such as food, beverages, and e-commerce. Through its relentless innovation and customer-centric approach, Oji has solidified its reputation as a trusted provider of premium packaging solutions worldwide.

Mondi Group

Mondi Group stands out for its expertise in crafting customized packaging solutions that meet the unique needs of various industries. With a robust presence in the Asia Pacific region, the company has prioritized sustainability by developing biodegradable and recyclable products. Mondi’s focus on collaboration with local stakeholders, including manufacturers and policymakers, has enabled it to adapt quickly to regional market dynamics. Its proactive approach to addressing environmental challenges has positioned it as a leader in the global transition toward greener packaging alternatives. Mondi’s influence extends beyond the region, contributing significantly to global advancements in sustainable packaging.

REGIONAL ANALYSIS

- In April 2024, International Paper launched a new line of biodegradable molded pulp packaging designed specifically for the foodservice industry. This move was aimed at addressing the growing demand for plastic-free alternatives in urban centers across Southeast Asia.

- In June 2023, Oji Holdings Corporation partnered with a leading South Korean e-commerce platform to develop recyclable corrugated boxes tailored for online retail shipments. This collaboration enhanced Oji’s visibility in the rapidly expanding e-commerce segment.

- In February 2023, Mondi Group announced the acquisition of a small-scale recycling facility in Vietnam to bolster its supply chain resilience and reduce dependency on imported raw materials.

- In September 2022, International Paper signed a memorandum of understanding with the Indian government to promote sustainable packaging practices under the “Green India Mission.” This initiative strengthened its reputation as a sustainability leader in the region.

- In November 2021, Oji Holdings Corporation opened a state-of-the-art manufacturing plant in Thailand to cater to the rising demand for premium folding cartons in the cosmetics and pharmaceutical sectors. This expansion reinforced its presence in Southeast Asia.

MARKET SEGMENTATION

This research report on the Asia Pacific paper packaging market is segmented and sub-segmented into the following categories.

By Material

- Corrugated Board

- Molded Pulp

By Packaging Type

- Corrugated Boxes

- Cups & Trays

By End-Use Industry

- Food & Beverage

- E-commerce

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific paper packaging market?

The market is growing due to increasing environmental concerns, government regulations on plastic use, and rising demand for sustainable and recyclable packaging solutions.

What are the challenges facing the paper packaging market in Asia Pacific?

Key challenges include raw material price volatility, competition from alternative packaging materials, and the need for technological upgrades.

What is the future outlook for the Asia Pacific paper packaging market?

The market is expected to witness steady growth due to ongoing sustainability trends, innovation in packaging designs, and expanding end-use industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]