Asia Pacific Network Security Market Research Report – Segmented By Solution (Firewall, Secure Web Gateway (SWG)), Network Environment, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Network Security Market Size

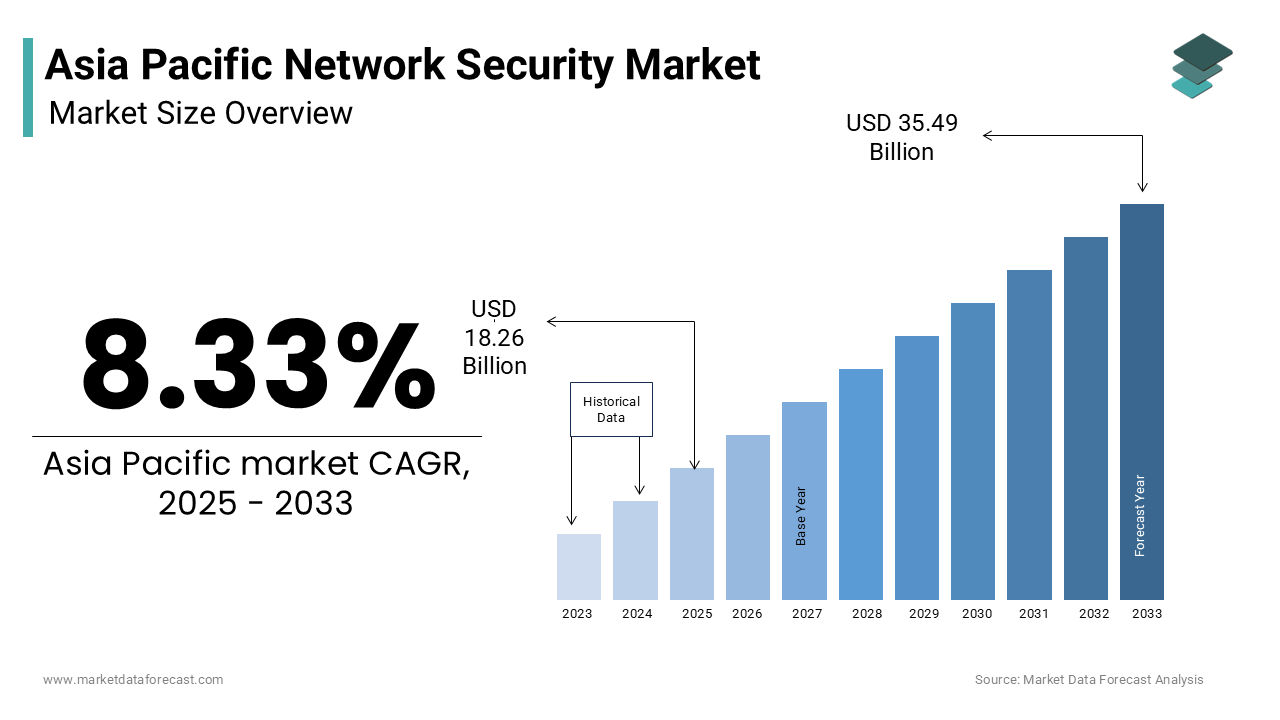

The Asia Pacific Network Security Market was worth USD 17.26 billion in 2024. The Asia Pacific market is expected to reach USD 35.49 billion by 2033 from USD 18.26 billion in 2025, rising at a CAGR of 8.33% from 2025 to 2033.

The Asia Pacific network security market encompasses a dynamic and evolving landscape that addresses the protection of digital assets, networks, and systems from malicious cyber threats. According to the International Telecommunication Union, the Asia Pacific region accounts for over 50% of global internet users, which is making it a critical focal point for cybersecurity advancements. Additionally, as per the United Nations Conference on Trade and Development, this region leads in mobile broadband subscriptions, with over 2.8 billion active connections which is amplifying the demand for secure communication channels. The geopolitical significance of the Asia Pacific adds another layer of complexity, with increasing state-sponsored cyberattacks targeting critical infrastructure. For instance, the Australian Cyber Security Centre reported a 13% rise in cybercrime incidents in 2022 compared to the previous year. Furthermore, cultural shifts towards remote work and cloud adoption have heightened vulnerabilities, pushing enterprises to prioritize proactive cybersecurity strategies.

MARKET DRIVERS

Increasing Cyber Threat Landscape

The escalating frequency and sophistication of cyberattacks are among the most compelling drivers of the Asia Pacific network security market. As per the Global Cybersecurity Index published by the International Telecommunication Union, the region ranks second globally in terms of vulnerability to cyber threats, with countries like India, Indonesia, and Vietnam witnessing exponential growth in cybercrime cases. For example, Singapore’s Cyber Security Agency revealed that ransomware attacks surged by 154% in 2021 alone, which is causing substantial financial losses for businesses. Such trends have prompted both governments and private entities to invest heavily in advanced network security solutions. This alarming statistic has fueled demand for real-time threat detection tools, endpoint protection software, and managed security services. Enterprises are increasingly prioritizing compliance with regional regulations such as Australia’s Privacy Act and Singapore’s Personal Data Protection Act, which mandate stringent data protection protocols.

Digital Transformation Initiatives

Digital transformation initiatives across industries act as another significant driver for the Asia Pacific network security market. The region is witnessing unprecedented adoption of emerging technologies such as artificial intelligence, the Internet of Things (IoT), and 5G networks. Similarly, South Korea’s Ministry of Science and ICT reported that 5G penetration reached 46% of the population in 2022, making it one of the highest globally. These technological advancements have expanded the attack surface, compelling organizations to deploy comprehensive network security solutions. Additionally, the proliferation of smart cities in countries like China and Japan has led to increased reliance on interconnected systems, further driving demand for cybersecurity. For instance, China aims to develop 100 smart cities by 2025, requiring next-generation firewalls and secure gateways to safeguard critical infrastructure.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints impeding the growth of the Asia Pacific network security market is the high cost associated with implementing advanced cybersecurity solutions. Deploying cutting-edge technologies such as artificial intelligence-based threat detection systems, zero-trust architecture, and cloud security platforms requires significant capital investment. According to Gartner, the average expenditure on cybersecurity tools for large enterprises in the Asia Pacific exceeds $1 million annually, posing a financial burden, particularly for small and medium-sized enterprises (SMEs). A study conducted by KPMG revealed that nearly 70% of SMEs in the region lack sufficient budgetary allocations for cybersecurity, leaving them vulnerable to attacks. Moreover, the shortage of skilled cybersecurity professionals exacerbates the issue, as organizations often rely on external consultants or managed service providers, further inflating costs. For instance, the annual salary of a certified cybersecurity expert in countries like Australia and Japan averages $120,000, according to Robert Walters, adding to operational expenses. These financial constraints hinder widespread adoption, especially in developing economies where regulatory enforcement is weak, and businesses prioritize immediate operational needs over long-term security investments.

Fragmented Regulatory Frameworks

Another major restraint is the fragmented nature of regulatory frameworks governing cybersecurity across the Asia Pacific region. While countries like Singapore and Australia have established robust data protection laws, others lag behind in enacting comprehensive legislation. According to the Asia-Pacific Economic Cooperation (APEC), only 40% of member economies have enacted national cybersecurity strategies, leading to inconsistencies in compliance requirements. For example, India’s Information Technology Act does not adequately address modern cyber threats, while Indonesia’s data privacy framework remains underdeveloped. This lack of harmonization complicates cross-border operations for multinational corporations, forcing them to navigate multiple regulatory landscapes. Furthermore, differing standards for encryption protocols and data localization policies create additional barriers.

MARKET OPPORTUNITIES

Growing Adoption of Cloud-Based Security Solutions

The increasing adoption of cloud computing presents a lucrative opportunity for the Asia Pacific network security market. Organizations across the region are transitioning to cloud-based infrastructures to enhance scalability and operational efficiency. This shift has created a demand for cloud-native security solutions such as Secure Access Service Edge (SASE) and Cloud Access Security Brokers (CASBs). For instance, Alibaba Cloud reported a 50% increase in enterprise clients adopting its cloud security services in Southeast Asia during the same period. The flexibility and cost-effectiveness of cloud-based security tools make them particularly appealing to SMEs, which constitute a significant portion of the regional economy. Additionally, the rise of hybrid work models has amplified the need for secure remote access solutions. As per IDC, the market for cloud security services in the Asia Pacific is expected to grow at a compound annual growth rate (CAGR) of 22% through 2026.

Rising Government Investments in Cybersecurity

Government-led initiatives aimed at bolstering national cybersecurity capabilities offer another promising opportunity for the market. Countries in the Asia Pacific are increasingly recognizing the strategic importance of cybersecurity by leading to substantial investments in research, development, and workforce training. For example, Japan’s National Center of Incident Readiness and Strategy for Cybersecurity allocated $300 million in 2023 to enhance its cyber defense mechanisms. These initiatives not only foster innovation but also create opportunities for local and international vendors to collaborate on large-scale projects. Furthermore, public awareness campaigns and capacity-building programs are driving demand for educational resources and training modules, opening new revenue streams for cybersecurity firms.

MARKET CHALLENGES

Shortage of Skilled Cybersecurity Professionals

The scarcity of skilled cybersecurity professionals poses a significant challenge to the Asia Pacific network security market. Despite the growing demand for expertise in areas such as ethical hacking, incident response, and threat intelligence, the talent pool remains insufficient. In countries like Malaysia and Thailand, universities produce fewer than 500 cybersecurity graduates annually, as per Frost & Sullivan. This shortage forces organizations to either outsource critical functions or operate with understaffed teams, increasing the risk of breaches. Additionally, the rapid evolution of cyber threats necessitates continuous upskilling, which many professionals struggle to achieve due to limited access to advanced training programs.

Lack of Awareness Among SMEs

Another pressing challenge is the lack of cybersecurity awareness among small and medium-sized enterprises (SMEs) in the Asia Pacific. Many SMEs underestimate their susceptibility to cyber threats, viewing cybersecurity as a secondary concern rather than a business-critical priority. According to a report by Grant Thornton, over 60% of SMEs in the region do not have a formal cybersecurity strategy in place. This complacency stems from limited understanding of potential risks and the perceived complexity of implementing security measures. Furthermore, the absence of dedicated IT departments in smaller organizations exacerbates the problem, as employees often lack the technical knowledge to identify and mitigate threats. This lack of awareness not only increases the likelihood of breaches but also undermines broader efforts to create a secure digital ecosystem, as compromised SMEs can serve as entry points for larger supply chain attacks.

SEGMENTAL ANALYSIS

By Solution Insights

The firewall segment dominated the Asia Pacific network security market with 28.4% of the share in 2024 due to its foundational role in safeguarding enterprise networks against unauthorized access and malicious activities. Firewalls have evolved from basic packet filtering tools to advanced next-generation firewalls (NGFWs) that integrate intrusion prevention systems (IPS), deep packet inspection, and application awareness. The increasing complexity of cyber threats has driven organizations to adopt NGFWs, which offer granular control over network traffic. According to Gartner, the number of connected devices in the Asia Pacific region will exceed 15 billion by 2025 by creating a vast attack surface that firewalls are uniquely positioned to secure. Enterprises are deploying firewalls at the network perimeter to monitor and filter incoming and outgoing traffic, ensuring compliance with regional regulations such as Singapore’s Personal Data Protection Act. Another factor is the rise of remote work, which has necessitated robust perimeter defenses. A survey by Cisco revealed that 67% of businesses in the region accelerated their firewall upgrades in response to the pandemic-induced shift to hybrid work models. Additionally, government mandates for critical infrastructure protection have bolstered demand. For instance, Japan’s National Center of Incident Readiness and Strategy for Cybersecurity requires utilities and transportation sectors to deploy firewalls as part of their cybersecurity frameworks.

The Secure Web Gateway (SWG) solutions segment is projected to grow at a CAGR of 18.5% during the forecast period. This rapid expansion is fueled by the growing reliance on cloud applications and the need to secure web-based activities. Organizations are increasingly adopting SWGs to enforce acceptable use policies, block malicious websites, and protect sensitive data from exfiltration. Also, the surge in remote workforces accessing corporate resources via unsecured networks will promote the growth of the segment. As per Deloitte, over 40% of employees in the Asia Pacific continue to work remotely, making SWGs essential for securing internet traffic. For example, Australia’s Department of Home Affairs reported a 45% increase in phishing attacks targeting remote workers in 2022, with the urgency for SWG adoption. Furthermore, the integration of artificial intelligence (AI) into SWGs enhances their ability to detect zero-day threats and anomalous behavior patterns.

By Network Environment Insights

The data center network security segment held 35.4% of the Asia Pacific network security market share in 2024 owing to the central role data centers play in housing mission-critical applications and sensitive information. Industries such as banking, healthcare, and telecommunications heavily rely on data centers to process and store vast amounts of data, making them prime targets for cybercriminals. The increasing adoption of hybrid cloud architectures has further amplified the need for robust security measures within data centers. According to Seagate, the Asia Pacific region generates over 40 zettabytes of data annually, with much of it stored in data centers. This has led organizations to invest in advanced security solutions like micro-segmentation, encryption, and virtual firewalls to protect data integrity. Additionally, the rise of edge computing has expanded the footprint of data centers, necessitating scalable security frameworks.

The branch campus network security segment is poised to witness a CAGR of 20.3% in the next coming years with the increasing decentralization of organizational operations. With enterprises expanding their geographical presence, branch offices have become integral to business continuity, necessitating robust security measures tailored to distributed environments. The adoption of Software-Defined Wide Area Networks (SD-WAN) technologies is also to propel the growth of the segment. According to IDC, SD-WAN deployments in the Asia Pacific grew by 35% in 2022 by enabling secure connectivity between headquarters and branch locations. However, this trend also introduces new vulnerabilities, prompting organizations to deploy unified threat management (UTM) systems and secure access service edge (SASE) solutions. Another factor is the rising incidence of ransomware attacks targeting branch offices. As per Check Point Research, ransomware incidents targeting small branches surged by 75% in 2022 with the need for endpoint protection and intrusion detection systems.

REGIONAL ANALYSIS

China led the Asia Pacific network security market with 28.4% of the share in 2024 with a massive digital economy and a stringent regulatory environment. The Cybersecurity Law of China mandates that organizations implement robust security measures, including firewalls and encryption, to protect personal and corporate data. Additionally, the Belt and Road Initiative has spurred investments in secure communication infrastructure, boosting demand for advanced security solutions. According to the China Academy of Information and Communications Technology, the domestic cybersecurity market reached $10 billion in 2022, reflecting a 22% year-over-year growth. The widespread adoption of 5G technology and IoT devices further amplifies the need for scalable security frameworks by positioning China as a powerhouse in the regional market.

Japan was positioned second in holding 18.5% of the Asia Pacific network security market share in 2024. The country’s emphasis on technological innovation and industrial automation has created a fertile ground for network security advancements. Japanese enterprises are heavily investing in zero-trust architecture and AI-driven threat detection systems to combat sophisticated cyberattacks. According to the National Police Agency, cybercrime cases in Japan increased by 40% in 2022, prompting businesses to strengthen their security postures. Japan’s aging population also drives demand for automated security solutions, ensuring sustained growth in the market.

Australia’s network security market growth is driven by the stringent data protection laws, such as the Privacy Act and Notifiable Data Breaches scheme, which compel organizations to adopt comprehensive security measures. The financial services sector, which accounts for 10% of GDP, is a major contributor to cybersecurity spending. Additionally, the government’s Cyber Security Strategy 2020 allocated $1.67 billion to enhance national resilience, fostering innovation and adoption of cutting-edge solutions.

India’s rapid digital transformation with initiatives like Digital India and Make in India, has created immense opportunities for network security vendors. The Reserve Bank of India mandates that financial institutions implement multi-layered security protocols, driving demand for firewalls and intrusion prevention systems. The proliferation of mobile payments and e-commerce platforms further escalates the need for robust security frameworks, which is propelling the Indian network security market.

South Korea’s hyper-connected society and advanced IT infrastructure make it a hotspot for cybersecurity innovations. South Korea ranks first globally in 5G penetration, with 46% of the population using the technology, as per GSMA Intelligence. This has driven demand for secure 5G networks and IoT security solutions. The gaming and entertainment industries, which contribute significantly to GDP, also prioritize cybersecurity, ensuring steady market growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cisco Systems Inc., Fortinet Inc., Palo Alto Networks Inc., Check Point Software Technologies Ltd., Juniper Networks Inc., IBM Corporation, Dell Technologies Inc., Broadcom Inc., Trend Micro Incorporated, and Kaspersky Lab are some of the key market players in the Asia Pacific network security market.

The Asia Pacific network security market is characterized by intense competition, driven by a mix of global giants and regional innovators vying for dominance. Global players like Palo Alto Networks, Fortinet, and Cisco Systems bring extensive resources and cutting-edge technologies, allowing them to capture significant market share. Meanwhile, regional companies often leverage their deep understanding of local regulations and cultural nuances to carve out niche positions. The market’s competitive dynamics are further intensified by the rapid pace of technological advancements, which compels vendors to continuously innovate. Strategic collaborations with governments and industry associations also play a crucial role in shaping competitive strategies. Additionally, the rise of cloud computing and IoT has created new battlegrounds for differentiation, as vendors strive to offer seamless integration and scalability. This dynamic interplay between innovation, localization, and strategic positioning ensures that the market remains vibrant and highly contested.

Top Players in the Asia Pacific Network Security Market

Palo Alto Networks

Palo Alto Networks is a trailblazer in the Asia Pacific network security market, renowned for its next-generation firewalls and cloud security solutions. The company has played a pivotal role in shaping the global cybersecurity landscape by offering advanced threat intelligence platforms that leverage machine learning and automation. Its Cortex portfolio has been instrumental in helping enterprises adopt zero-trust architectures, ensuring robust protection against evolving cyber threats. Palo Alto Networks’ commitment to innovation and collaboration with regional governments has strengthened its dominant position by enabling it to address the unique challenges faced by diverse industries across the Asia Pacific.

Fortinet

Fortinet has emerged as a key player in the Asia Pacific network security market, driven by its comprehensive suite of solutions, including unified threat management (UTM) and secure SD-WAN. The company’s FortiGate platform has become a cornerstone for organizations seeking scalable and integrated security frameworks. Fortinet’s emphasis on addressing the cybersecurity skills gap through its training programs, such as the Network Security Expert (NSE) certification, has further solidified its reputation.

Cisco Systems

Cisco Systems continues to be a dominant force in the Asia Pacific network security market, leveraging its expertise in networking technologies to deliver cutting-edge security solutions. The company’s SecureX platform exemplifies its ability to provide end-to-end visibility and automation across hybrid environments. Cisco’s focus on integrating artificial intelligence into its security offerings has enabled businesses to detect and respond to threats more effectively.

Top Strategies Used by Key Players in the Asia Pacific Network Security Market

Strategic Partnerships and Collaborations

Key players in the Asia Pacific network security market have prioritized forming alliances with local technology firms and government bodies to enhance their reach and capabilities. These partnerships enable vendors to tailor their solutions to regional requirements, such as compliance with data sovereignty laws. For instance, collaborations with telecommunications providers have facilitated the deployment of secure 5G networks, addressing the growing demand for high-speed, low-latency connectivity. Such strategic moves also foster trust among stakeholders, strengthening the vendors’ market presence.

Product Innovation and Diversification

To stay ahead in the competitive landscape, leading companies are investing heavily in research and development to introduce innovative products. This includes integrating artificial intelligence and machine learning into their offerings to deliver proactive threat detection and automated response capabilities. Additionally, diversifying portfolios to include cloud-native security solutions and SASE frameworks has allowed vendors to cater to the evolving needs of enterprises adopting hybrid work models. These innovations not only enhance customer satisfaction but also create new revenue streams.

Expansion Through Acquisitions

Acquisitions have become a critical strategy for key players aiming to consolidate their market position and expand their technological capabilities. By acquiring niche startups specializing in emerging technologies like IoT security or blockchain-based authentication, established vendors can quickly integrate cutting-edge features into their existing solutions. These acquisitions also help companies tap into underserved markets within the Asia Pacific region by enabling them to address unmet demands and strengthen their competitive edge.

REGIONAL ANALYSIS

- In April 2024, Palo Alto Networks launched a dedicated cybersecurity innovation hub in Singapore. This initiative aims to accelerate the development of AI-driven security solutions tailored to the Asia Pacific region, enhancing its competitive edge.

- In June 2023, Fortinet announced a strategic partnership with NTT Communications in Japan to deliver integrated SD-WAN and security services. This collaboration strengthens Fortinet’s ability to support enterprises undergoing digital transformation.

- In September 2023, Cisco Systems expanded its SecureX platform to include advanced threat intelligence capabilities specifically designed for the Asia Pacific market. This move amplifies Cisco’s commitment to addressing regional cybersecurity challenges.

- In February 2024, Check Point Software Technologies acquired a leading Australian cybersecurity startup specializing in cloud-native security. This acquisition bolsters Check Point’s portfolio and enhances its presence in the burgeoning cloud security segment.

- In November 2023, Trend Micro established a joint venture with a South Korean AI company to develop predictive analytics tools for ransomware defense. This action amplifies Trend Micro’s focus on leveraging AI to combat sophisticated cyber threats in the region.

MARKET SEGMENTATION

This research report on the Asia Pacific Network Security Market is segmented and sub-segmented into the following categories.

By Solution

- Firewall

- Secure Web Gateway (SWG)

By Network Environment

- Data Center Network Security

- Branch Campus Network Security

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific Network Security Market?

Key drivers include rising cyber threats, increased digitalization, remote work adoption, growth in IoT and cloud services, and stricter data protection regulations.

What are the key challenges in this Asia Pacific Network Security Market?

Challenges include rapidly evolving threats, shortage of cybersecurity professionals, high costs of implementation, and compliance with region-specific regulations.

What is the forecast for Asia Pacific Network Security Market growth?

The market is expected to witness robust growth driven by the increasing complexity of threats, expansion of IT infrastructure, and government initiatives for cybersecurity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]