Asia Pacific System Integration Market Size, Share, Trends & Growth Forecast Report By Services (Infrastructure Integration, Application Integration, Consulting), End-Use (IT & Telecom, BFSI, Healthcare, Transportation), Enterprise Size (Large Enterprises, SMEs), and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific System Integration Market Size

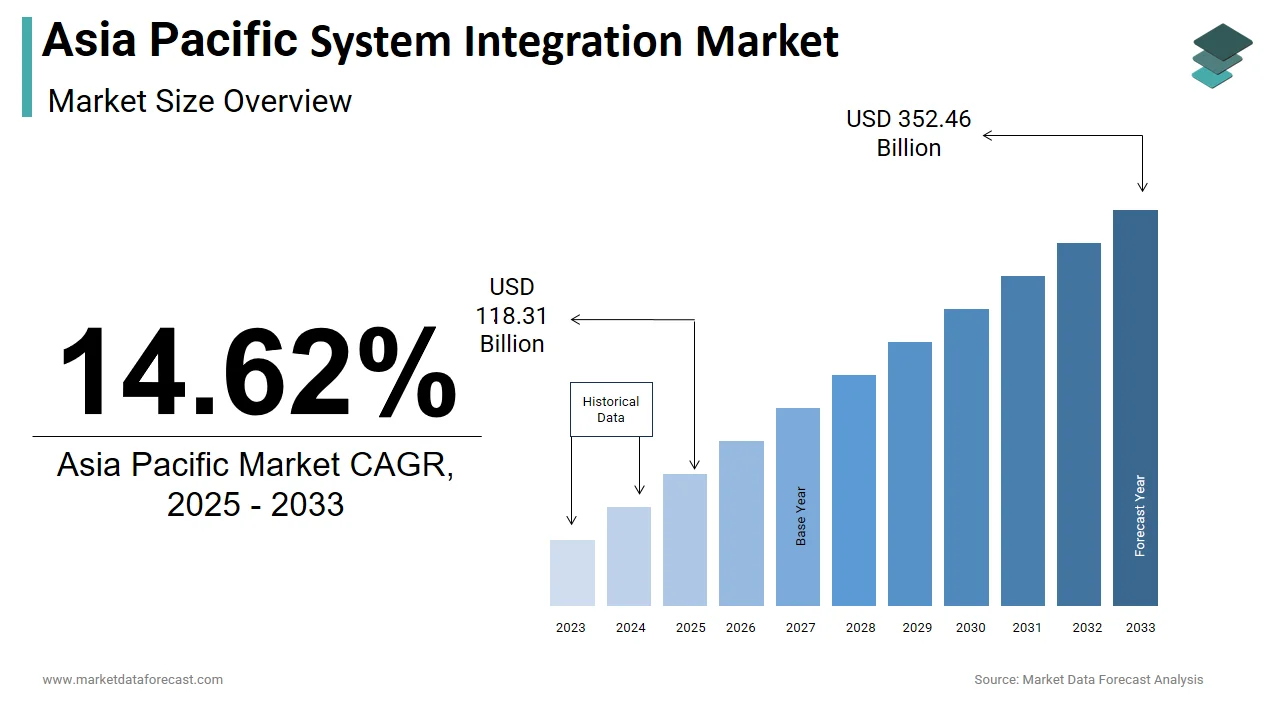

The size of the Asia Pacific system integration market was worth USD 103.22 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 14.62% from 2025 to 2033 and be worth USD 352.46 billion by 2033 from USD 118.31 billion in 2025.

System integration involves the seamless unification of hardware, software, and network infrastructure to create cohesive ecosystems that enhance operational efficiency and scalability.

MARKET DRIVERS

Digital Transformation Initiatives

The rapid adoption of digital transformation initiatives across industries is a significant driver for the Asia Pacific system integration market. Organizations are increasingly investing in technologies such as cloud computing, artificial intelligence, and Internet of Things (IoT) to enhance operational efficiency and customer experiences. According to Gartner, a large number of enterprises in the region have prioritized digital transformation as a strategic goal by 2023, creating immense demand for system integration services. Additionally, the shift toward hybrid IT environments, where businesses operate both on-premises and cloud-based systems, necessitates advanced integration solutions.

Rising Adoption of Cloud-Based Solutions

Another key driver is the growing adoption of cloud-based solutions, which amplifies the demand for system integration services to ensure seamless interoperability. For instance, Australia’s National Broadband Network uses cloud-based integration platforms to streamline its distributed operations, reducing latency and improving service delivery. Additionally, the proliferation of multi-cloud environments, where businesses leverage multiple cloud providers, creates complexities that require specialized integration expertise.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints in the adoption of system integration solutions is the high cost associated with implementation and customization. Advanced integration platforms often require significant investments in technology, skilled personnel, and infrastructure upgrades. According to the Confederation of Indian Industry, small and medium-sized enterprises (SMEs) in the region allocate a small share of their annual revenue to IT budgets, limiting their ability to adopt comprehensive integration services. Besides, ongoing expenses related to maintenance, updates, and employee training add to the financial burden.

Lack of Skilled Workforce

Another restraint stems from the shortage of skilled professionals capable of managing complex system integration projects. Moreover, the rapid evolution of technologies like IoT and AI requires continuous upskilling, which many organizations cannot afford. This skills gap leaves companies reliant on external consultants, increasing project timelines and costs, thereby slowing market growth.

MARKET OPPORTUNITIES

Expansion of IoT and Smart City Projects

The expansion of IoT and smart city projects presents a significant opportunity for the Asia Pacific system integration market. These initiatives rely heavily on interconnected systems to manage utilities, transportation, and public safety, creating demand for advanced integration solutions. For instance, Singapore’s Smart Nation initiative integrates IoT-enabled sensors and data analytics platforms to optimize resource allocation. Also, the rise of Industry 4.0 frameworks in manufacturing sectors necessitates specialized integration tools to connect machines, supply chains, and enterprise systems.

Growth of Hybrid IT Environments

Another promising opportunity lies in the growing adoption of hybrid IT environments, which combine on-premises infrastructure with cloud-based platforms. Moreover, the complexity of managing multi-cloud environments necessitates specialized expertise to ensure data consistency and security. These requirements position system integrators as critical enablers of modern IT ecosystems, fostering innovation and adoption across industries.

MARKET CHALLENGES

Resistance to Change Among Traditional Organizations

Another challenge is resistance to change among traditional organizations, particularly in rural and semi-urban areas. According to the International Labour Organization, a large share of businesses in the region are family-owned or operated, relying on outdated IT practices that fail to address modern integration needs. These organizations often perceive advanced integration solutions as unnecessary expenses that disrupt established workflows. Apart from these, cultural and generational factors contribute to this resistance, with older business owners preferring manual oversight over automated systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Services, Enterprise Size, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Accenture; NEC Corporation; Atos SE; Boomi; Capgemini; Cisco Systems, Inc.; Cognizant; Deloitte Touche Tohmatsu Limited; HCL Technologies Limited; IBM Corporation; Infosys Limited; Livares Technologies Pvt Ltd.; MDS SI; Mavenir; Oracle Corporation; Tata Consultancy Services Limited; Tech Mahindra Limited; and Wipro |

SEGMENTAL ANALYSIS

By Services Insights

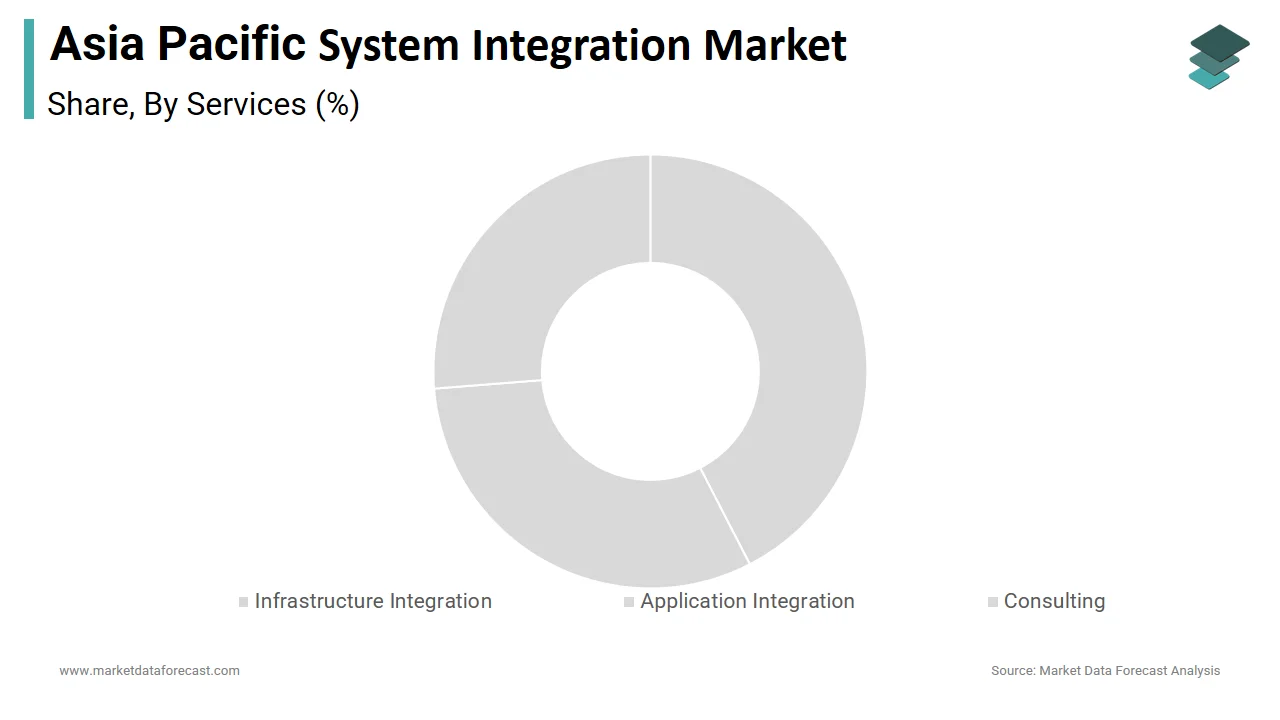

The infrastructure integration segment commanded the Asia Pacific system integration market with a 45.5% of the total share in 2024. This performance is supported by the region’s rapid adoption of cloud computing and hybrid IT environments, which necessitate seamless connectivity between on-premises infrastructure and cloud platforms. According to study, over 80% of organizations in the region are transitioning to hybrid IT models, creating immense demand for infrastructure integration solutions. For instance, India’s National Informatics Centre leverages infrastructure integration tools to unify its data centers with cloud services, ensuring scalability and operational efficiency. Another main aspect is the proliferation of smart city projects, which rely on interconnected systems to manage utilities, transportation, and public safety.

The application integration segment is quickly moving ahead in the fastest-growing segment, exhibiting a CAGR of approximately 12%. This development is influenced by the increasing adoption of enterprise applications such as ERP, CRM, and supply chain management systems, which require seamless interoperability to enhance business processes. Also, a notable share of enterprises in the region have adopted multiple enterprise applications, creating demand for integration platforms that ensure data consistency and real-time updates. Additionally, the rise of API-driven architectures has amplified demand for application integration solutions.

By Enterprise Size Insights

The large enterprises segment prevailed in the Asia Pacific system integration market by holding a 60.5% of the total share in 2024. This prominence is credited to their extensive IT budgets and complex operational requirements, which necessitate advanced integration solutions. Also, large enterprises in the region allocate a significant percentage of their annual revenue to IT initiatives, enabling them to invest in cutting-edge technologies like hybrid cloud and IoT integration. A different factor is the emphasis on compliance and security. Large enterprises often operate across multiple jurisdictions, requiring integration tools that align with stringent regulatory standards.

The segment of small and medium enterprises (SMEs) exhibits the swiftest advance, with a projected CAGR of 10%. This progress is propelled by the increasing affordability of cloud-based integration platforms, which enable SMEs to adopt advanced solutions without significant upfront investments. According to the Confederation of Indian Industry, over 40% of SMEs in the region have transitioned to cloud-based IT systems, creating demand for integration tools that bridge legacy systems with modern architectures. Apart from these, government initiatives promoting digital transformation among SMEs further amplify demand. For example, Malaysia’s Digital Economy Blueprint provides subsidies for SMEs adopting cloud and integration technologies, as noted by the Ministry of Communications and Multimedia.

By End-Use Insights

The IT & telecom sector dominated the Asia Pacific system integration market by accounting for a 35% of the total share in 2024. This is driven by the sector’s role as a pioneer in adopting advanced technologies such as cloud computing, IoT, and 5G networks. Further key factor is the growing adoption of hybrid IT environments, which combine on-premises infrastructure with cloud platforms. A study by Gartner notes that a major share of IT & telecom companies in the region use hybrid integration platforms, ensuring compatibility and operational efficiency.

The segment of healthcare segment represents the fastest-growing end-use segment, exhibiting a CAGR of 13.7%. This growth is fueled by the increasing adoption of electronic health records (EHRs), telemedicine platforms, and IoT-enabled medical devices, which require seamless integration to enhance patient care. According to the World Health Organization, over 50% of healthcare providers in the region have adopted EHR systems, creating demand for integration solutions that ensure data consistency and security. Also, government initiatives promoting digital health infrastructure further amplify demand.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific system integration market by contributing a 35% to the regional share in 2024. This performance is underpinned by the country’s status as the world’s largest manufacturing hub and a leader in digital transformation. According to the Ministry of Industry and Information Technology, over 50% of enterprises in China have adopted advanced integration solutions to harmonize legacy systems with modern technologies. Another factor is the government’s push for self-reliance in IT infrastructure, as outlined in the "Made in China 2025" initiative. Investments in IoT and AI-driven integration platforms have enabled organizations to streamline operations and enhance productivity.

India has been witnessing a significant rise. The country’s rapid digitalization and rising internet penetration drive demand for system integration solutions. According to the Telecom Regulatory Authority of India, internet users in the country exceeded 800 million in 2022, fostering e-commerce and remote work trends. In addition, government initiatives like "Digital India" promote the adoption of integration tools across industries. For instance, the Smart Cities Mission integrates IoT-enabled systems into urban infrastructure, ensuring seamless connectivity and operational efficiency.

Japan has demonstrated a rise in the Asia-Pacific System Integration Market. The country’s advanced technological infrastructure and aging population drive demand for integration solutions tailored to specific industry needs. According to the Japanese Ministry of Economy, Trade and Industry, over 60% of organizations have adopted AI-driven integration tools to address labor shortages and improve operational efficiency. Another factor is the focus on sustainability. IoT-enabled systems help optimize energy consumption and reduce waste, aligning with Japan’s carbon neutrality goals.

South Korea has experienced a rise in the Asia-Pacific System Integration Market, particularly in recent years, driven by factors like the U.S.-China trade war, the growing demand for advanced technologies like AI and 5G, and strategic positioning within the region. While the country has benefited from increased exports and market share gains, particularly in sectors impacted by tariffs, it also faces challenges like economic uncertainties and potential shifts in investment patterns.

Australia and New Zealand is moving ahead a decent rate which is due to their focus on hybrid IT environments and cloud-based integration. Like, a significant share of organizations use hybrid integration platforms to ensure data consistency and security. Another factor is the emphasis on compliance, ensuring ethical adoption of integration tools.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC system integration market profiled in this report are Accenture; NEC Corporation; Atos SE; Boomi; Capgemini; Cisco Systems, Inc.; Cognizant; Deloitte Touche Tohmatsu Limited; HCL Technologies Limited; IBM Corporation; Infosys Limited; Livares Technologies Pvt Ltd.; MDS SI; Mavenir; Oracle Corporation; Tata Consultancy Services Limited; Tech Mahindra Limited; and Wipro

TOP LEADING PLAYERS IN THE MARKET

Tata Consultancy Services (TCS)

Tata Consultancy Services (TCS) is a global leader in system integration, with a significant presence in the Asia Pacific region. The company specializes in delivering end-to-end integration solutions, from cloud migration to IoT-enabled ecosystems, tailored to diverse industries like banking, healthcare, and manufacturing. TCS’s contribution to the global market lies in its ability to leverage AI-driven tools and automation frameworks to streamline complex IT environments. Its focus on innovation and scalability ensures that enterprises can adopt advanced technologies without compromising efficiency. Also, TCS’s strong partnerships with cloud providers like AWS and Microsoft Azure position it as a preferred partner for hybrid IT transformations.

Accenture

Accenture is a key player in the Asia Pacific system integration market, renowned for its expertise in digital transformation and enterprise-wide integration. The company’s offerings span application integration, infrastructure modernization, and API management, enabling seamless interoperability across systems. Accenture’s commitment to innovation is evident in its investments in emerging technologies like AI, blockchain, and IoT, which enhance its integration capabilities. Globally, Accenture plays a pivotal role in shaping the future of IT ecosystems by introducing scalable and user-friendly solutions.

Fujitsu

Fujitsu is a leading provider of system integration solutions, with a strong foothold in the Asia Pacific market. The company focuses on integrating legacy systems with modern architectures, ensuring compatibility and operational efficiency for enterprises undergoing digital transformation. Fujitsu’s contributions to the global market include pioneering innovations in hybrid cloud integration and smart city projects. Its emphasis on localized solutions tailored to regional regulatory frameworks further amplifies its impact on the integration landscape. Fujitsu’s strategic collaborations with governments and private entities underscore its leadership in the industry.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Strategic Partnerships and Collaborations

Key players in the Asia Pacific system integration market have increasingly relied on strategic partnerships to expand their technological capabilities and market reach. By collaborating with cloud service providers, technology firms, and government agencies, companies gain access to innovative solutions and regional expertise.

Focus on Cloud-Native Integration Platforms

Cloud-native integration platforms remain a cornerstone of competitive strategies adopted by leading players. Companies invest heavily in developing scalable and flexible solutions that cater to hybrid IT environments. This approach not only enhances operational efficiency but also reduces costs for enterprises transitioning to cloud-based systems.

Expansion of Industry-Specific Solutions

To cater to the growing demand for tailored integration services, key players are expanding their industry-specific offerings. Implementing customized solutions for sectors like healthcare, manufacturing, and retail ensures that enterprises can address unique challenges while enhancing productivity.

COMPETITION OVERVIEW

The Asia Pacific system integration market is characterized by intense competition, driven by the presence of both global giants and regional innovators vying for dominance. Global leaders like Tata Consultancy Services (TCS), Accenture, and Fujitsu leverage their extensive experience, advanced technologies, and strong distribution networks to maintain leadership positions. Meanwhile, regional players focus on niche markets, offering cost-effective solutions tailored to local regulatory frameworks and industry needs.

The competitive landscape is further shaped by rapid advancements in cloud computing, IoT, and AI, which redefine the capabilities of integration solutions. Players must continuously innovate to keep pace with evolving customer expectations and technological trends. Additionally, stringent compliance standards compel companies to adopt ethical practices while ensuring security and scalability.

RECENT MARKET DEVELOPMENTS

- In February 2023, Tata Consultancy Services partnered with a leading Indian e-commerce platform to deploy hybrid integration solutions across its logistics network. This initiative aimed to streamline operations and reduce delivery times, enhancing customer satisfaction.

- In May 2023, Accenture launched a cloud-native integration platform tailored for small and medium-sized enterprises (SMEs) in Southeast Asia. This move aimed to democratize access to advanced integration tools, fostering inclusivity in the market.

- In July 2023, Fujitsu collaborated with a South Korean telecommunications provider to integrate IoT-enabled devices with 5G networks. This initiative focused on enhancing network performance and ensuring seamless connectivity.

- In October 2023, Infosys expanded its integration services to rural areas in Indonesia. This initiative aimed to enhance digital literacy and accessibility, particularly for first-time internet users.

MARKET SEGMENTATION

This Asia Pacific system integration market research report is segmented and sub-segmented into the following categories.

By Services

- Infrastructure Integration

- Application Integration

- Consulting

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-Use

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What are the key factors driving the Asia Pacific steam turbine market?

The Asia Pacific steam turbine market is driven by escalating electricity demand, rapid urbanization, industrial growth, and power sector expansion, as well as the integration of renewables like concentrated solar power (CSP) and biomass.

2. What challenges are impacting the Asia Pacific steam turbine market?

The Asia Pacific steam turbine market faces challenges from stringent environmental regulations on emissions, high maintenance costs for aging infrastructure, and increasing competition from alternative technologies such as wind and solar.

3. What opportunities exist in the Asia Pacific steam turbine market?

The Asia Pacific steam turbine market offers opportunities in modernizing old power plants, expanding combined-cycle projects, integrating digital monitoring, and supporting clean energy transitions with advanced turbine technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]