Asia Pacific Non-Alcoholic Beer Market Research Report – Segmented By Product (Alcohol-free, Low Alcohol), Category, Material, Sales Channel, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Non-Alcoholic Beer Market Size

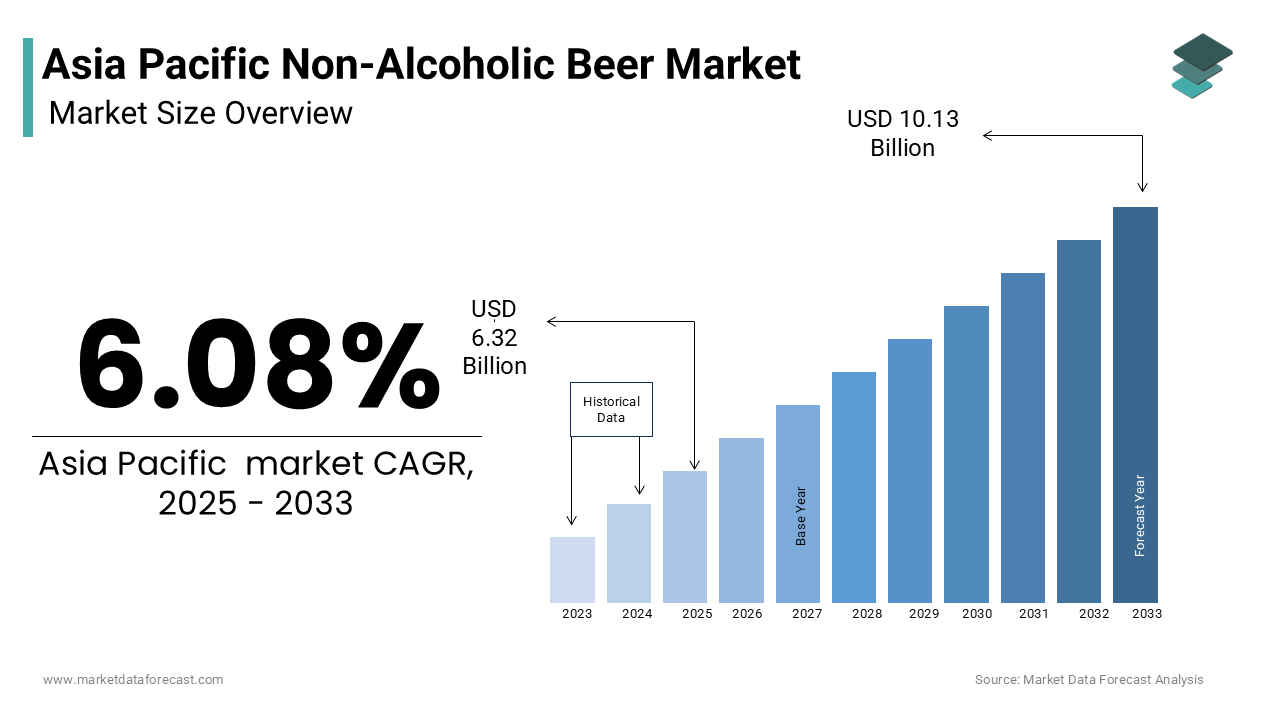

The Asia Pacific Non-Alcoholic Beer Market was worth USD 5.95 billion in 2024. The Asia Pacific market is expected to reach USD 10.13 billion by 2033 from USD 6.32 billion in 2025, rising at a CAGR of 6.08% from 2025 to 2033.

The Asia Pacific non-alcoholic beer market represents a rapidly evolving segment within the broader beverage industry, catering to a growing demographic of health-conscious consumers and those seeking moderation in alcohol consumption. This market encompasses a variety of beverages that mimic the taste, aroma, and experience of traditional beer but contain less than 0.5% alcohol by volume.

MARKET DRIVERS

Rising Health Awareness and Wellness Trends

A significant driver propelling the Asia Pacific non-alcoholic beer market is the heightened awareness of health and wellness among consumers. Across the region, there is an observable shift toward mindful consumption habits, influenced by both governmental health campaigns and private initiatives. For instance, the Ministry of Health in Singapore launched the "War on Diabetes" campaign, which indirectly encouraged reduced alcohol consumption as part of a broader lifestyle modification strategy. This trend is particularly pronounced among millennials and Gen Z, who are more inclined to adopt preventive healthcare measures. In addition, data indicates that the wellness economy in the Asia Pacific grew notably between 2017 and 2022, reflecting a strong alignment with non-alcoholic beer as a healthier alternative. The perception of non-alcoholic beer as a low-calorie, hydrating option further enhances its appeal, especially among fitness enthusiasts.

Stringent Alcohol Regulations and Social Norms

Another critical driver is the implementation of stringent alcohol regulations and evolving social norms across the Asia Pacific. Governments in countries like India and Indonesia have imposed high taxes and restrictions on alcohol sales, creating a conducive environment for non-alcoholic beer adoption. Similarly, Japan introduced stricter advertising guidelines for alcoholic beverages, which inadvertently promoted non-alcoholic alternatives. Socially, younger generations are increasingly associating sobriety with sophistication, as evidenced by the rise of "sober curious" movements in urban hubs like Sydney and Hong Kong. Furthermore, workplace wellness programs, adopted by a large share of multinational corporations in Asia Pacific emphasize responsible drinking, thereby amplifying the acceptance of non-alcoholic beer.

MARKET RESTRAINTS

Limited Consumer Awareness and Misconceptions

One of the primary restraints hindering the growth of the Asia Pacific non-alcoholic beer market is the limited awareness and prevailing misconceptions about these beverages. In many parts of the region, non-alcoholic beer is still perceived as a niche product, often associated with inferior quality or lack of authenticity compared to traditional beer. Misconceptions persist, with some consumers erroneously believing that non-alcoholic beer contains residual alcohol or lacks the flavor profile of regular beer. This skepticism is particularly pronounced in culturally conservative regions like parts of India and Indonesia, where traditional attitudes toward alcohol dominate. The absence of aggressive promotional strategies leaves many potential consumers uninformed about the benefits and advancements in brewing technology that ensure the taste and quality of non-alcoholic beer.

High Production Costs and Pricing Challenges

Another significant restraint is the elevated production costs associated with manufacturing non-alcoholic beer, which often translates into higher retail prices. The process of removing alcohol while preserving flavor involves advanced techniques such as vacuum distillation and reverse osmosis, which require substantial investment in specialized equipment. Consequently, the final product tends to be priced at a premium, deterring price-sensitive consumers prevalent in developing economies like Vietnam and the Philippines. Moreover, the lack of economies of scale exacerbates the issue, as smaller production volumes fail to offset high fixed costs. While affluent urban consumers may be willing to pay a premium, the broader market remains constrained by affordability concerns.

Expansion into Emerging Markets with Untapped Potential

A promising opportunity for the Asia Pacific non-alcoholic beer market lies in its potential to expand into emerging markets, particularly in Southeast Asia and South Asia, where the beverage landscape is undergoing rapid transformation. Countries like Vietnam, the Philippines, and Bangladesh present untapped opportunities due to their large populations and growing middle-class segments. Urbanization rates in these regions are equally compelling; for instance, the United Nations estimates that urban populations in Vietnam and the Philippines will increase by 2030, fostering demand for modern lifestyle products. Non-alcoholic beer manufacturers can capitalize on this trend by introducing affordable yet high-quality variants tailored to local tastes. Collaborations with regional distributors and leveraging e-commerce platforms can further enhance accessibility. Also, government initiatives promoting healthy living, such as Thailand’s "Healthy Lifestyle Campaign," provide a supportive regulatory environment for non-alcoholic beer adoption.

Innovations in Product Offerings and Flavor Profiles

Another significant opportunity arises from innovations in product formulations and flavor profiles, which can attract a wider consumer base and differentiate non-alcoholic beer from its alcoholic counterparts. Brands can experiment with locally inspired ingredients such as lemongrass, ginger, and matcha to create region-specific variants that resonate with cultural preferences. For example, Japanese brewers have successfully introduced green tea-infused non-alcoholic beers, appealing to domestic and international audiences alike. Furthermore, advancements in brewing technology allow for the creation of craft-style non-alcoholic beers that replicate the complexity and depth of traditional brews. By investing in research and development, companies can cater to diverse palates while maintaining the authenticity of their offerings.

MARKET CHALLENGES

Cultural Resistance and Traditional Perceptions

A significant challenge confronting the Asia Pacific non-alcoholic beer market is the deeply entrenched cultural resistance and traditional perceptions surrounding alcohol consumption. In many parts of the region, beer is not merely a beverage but a symbol of social bonding and celebration, making it difficult for non-alcoholic alternatives to gain widespread acceptance. For instance, in countries like China and South Korea, where communal drinking is a cornerstone of social interactions, non-alcoholic beer is often viewed as an inadequate substitute. This cultural bias is further reinforced by generational divides, with older consumers being less receptive to change. In rural areas, traditional beliefs regarding the medicinal properties of moderate alcohol consumption persist. Even in urban centers, where younger demographics are more open to experimentation, the stigma of choosing non-alcoholic beer at social gatherings remains a deterrent.

Intense Competition from Alternative Beverage Categories

Another pressing challenge is the intense competition faced by non-alcoholic beer from other beverage categories, including soft drinks, functional beverages, and traditional non-alcoholic options like tea and coconut water. The Asia Pacific market is saturated with a wide array of affordable and readily available alternatives, many of which already enjoy strong brand loyalty and established distribution networks. Functional beverages, fortified with vitamins and antioxidants, also pose a significant threat. Moreover, traditional beverages like green tea and herbal infusions continue to dominate in countries like Japan and India, supported by centuries-old consumption habits. Non-alcoholic beer manufacturers must contend with these entrenched competitors while also addressing pricing disparities, as many alternative beverages are significantly cheaper. The multiplicity of options creates a fragmented market landscape, making it challenging for non-alcoholic beer to carve out a distinct identity and secure a loyal customer base amidst such fierce competition.

SEGMENTAL ANALYSIS

By Product Insights

The alcohol-free segment dominated the Asia Pacific non-alcoholic beer market by commanding a market share of a 65.5% in 2024. This dominance is driven by its alignment with the growing health-conscious consumer base in the region. A key factor propelling this segment is the increasing prevalence of lifestyle-related diseases, such as obesity and diabetes, which have prompted consumers to adopt healthier beverage choices. This has led to a surge in demand for zero-alcohol beverages that offer a guilt-free experience without compromising on taste. Also, government initiatives promoting sobriety and responsible drinking have further bolstered the popularity of alcohol-free beer. For instance, Japan's Ministry of Health launched a campaign encouraging reduced alcohol consumption, which resonated with urban professionals. Another driving factor is the rise of fitness trends, particularly among millennials and Gen Z.

The low-alcohol segment is projected to grow at a CAGR of 12.3% during the forecast period. This rapid growth is fueled by the segment's ability to cater to moderate drinkers seeking a transitional option between full-strength beer and complete abstinence. One driving factor is the cultural shift toward "mindful drinking," where consumers aim to balance social enjoyment with health-conscious decisions. Another factor is the introduction of innovative flavors and premium packaging, which appeal to affluent consumers. For example, craft breweries in Australia are experimenting with botanical infusions in low-alcohol beers, attracting niche audiences willing to pay a premium. Furthermore, regulatory support plays a role, with countries like Thailand imposing stricter alcohol advertising laws, indirectly promoting low-alcohol alternatives.

By Category Insights

The plain category held the largest market share in 2024. This segment's influence is associated to its universal appeal and alignment with traditional beer-drinking habits across the Asia Pacific. A significant factor driving its prowess is the perception of authenticity and simplicity, which resonates with older demographics who prioritize familiarity over novelty. Also, the affordability of plain non-alcoholic beer makes it accessible to a broader audience, particularly in price-sensitive markets like Indonesia and Vietnam. Data from the Asian Development Bank indicates that disposable incomes in rural Southeast Asia are still relatively low, making cost-effective options more appealing. Another driving factor is the widespread availability of plain variants through established distribution channels.

The flavored category is experiencing the highest growth, with a CAGR of 14.7%. This quick expansion is driven by the increasing demand for unique and exotic flavor profiles, particularly among younger consumers. A key factor is the influence of global food and beverage trends, which emphasize innovation and personalization. Another factor is the integration of local ingredients, such as lemongrass, ginger, and matcha, which resonate with regional tastes. Furthermore, marketing strategies targeting health-conscious consumers play a crucial role. Flavored variants often show natural ingredients and low-calorie content, appealing to fitness enthusiasts.

By Material Insights

The malted grains segment accounted for a substantial share of the material category in the Asia Pacific non-alcoholic beer market in 2024. This is driven by their role as the primary ingredient in brewing, providing the foundational flavor and texture of beer. A main aspect is the widespread cultivation of barley and wheat in the region, ensuring a steady and cost-effective supply chain. A different driving point is the versatility of malted grains, which can be adapted to produce both plain and flavored variants. This flexibility allows manufacturers to cater to diverse consumer preferences without significant changes to their production processes. In addition, advancements in brewing technology have enhanced the quality of malted grain-based beers, addressing earlier criticisms about the inferior taste of non-alcoholic options.

The hops segment is predicted to advance at a CAGR of 13.5%. This growth is fueled by the increasing emphasis on aroma and bitterness, which are essential components of the beer experience. A major factor is the rising popularity of craft-style non-alcoholic beers, which rely heavily on hops to replicate the complexity of traditional brews. Another element is the development of low-bitterness hops, which appeal to novice drinkers and those transitioning from soft drinks. Furthermore, sustainability initiatives are boosting the segment's appeal, with organic and locally sourced hops gaining traction.

By Sales Channel Insights

The segment of convenience stores represented the biggest sales channel by capturing a 60% of the market in 2024. This is propelled by their extensive reach and accessibility, particularly in densely populated urban areas. A basic factor is the proliferation of 24/7 convenience stores across the Asia Pacific, with chains like 7-Eleven and FamilyMart expanding rapidly in countries like Thailand and the Philippines. Like, convenience store penetration in Southeast Asia grew notably between 2019 and 2022, making them the go-to destination for everyday purchases. A further driving factor is the ease of impulse buying, as non-alcoholic beer is often displayed prominently at checkout counters. Additionally, partnerships with local distributors ensure a steady supply of non-alcoholic beer, even in remote areas. For instance, in Indonesia, local retailers collaborate with manufacturers to stock affordable variants, catering to rural consumers.

Online retail is the quickest surging sales channel, with a CAGR of 16.2%. This rise is caused by the increasing adoption of e-commerce platforms, particularly among tech-savvy millennials and Gen Z. A primary factor is the convenience of home delivery, which aligns with the busy lifestyles of urban professionals. Another factor is the rise of subscription-based models, which allow consumers to receive regular deliveries of their favorite non-alcoholic beer brands. Furthermore, targeted marketing campaigns on social media platforms like Instagram and TikTok are driving awareness and engagement.

REGIONAL ANALYSIS

Japan was a leading player in the Asia Pacific non-alcoholic beer market by holding a market share of a 25% in 2024. The country's advanced economy and high disposable incomes enable consumers to experiment with premium non-alcoholic options. A key driver is the aging population, with a significant portion of Japanese citizens aged 65 or above. This demographic prioritizes health-conscious products, fueling demand for non-alcoholic beer. In addition, strict alcohol regulations, such as Tokyo's recent ban on public drinking, have accelerated the shift toward sober alternatives. Another factor is the influence of corporate wellness programs.

Australia accounts for a major share of the market, driven by its progressive attitudes toward health and wellness. A significant factor is the country's robust fitness culture. This has created a receptive audience for low-calorie, non-alcoholic beer. Another driver is the rise of craft breweries, which are introducing innovative variants tailored to local tastes. Additionally, government initiatives promoting moderation, such as Victoria's "DrinkWise" campaign, have further supported market growth.

China is a key player in the market and is propelled by its massive population and urbanization trends. A key driver is the growing middle class. Their increasing disposable incomes enable them to explore premium non-alcoholic beverages. A further factor is the influence of Western lifestyle trends, particularly among urban youth. Furthermore, the government's anti-alcohol campaigns, such as Beijing's restrictions on nightlife, have encouraged the adoption of sober alternatives.

South Korea commands a notable market share and is driven by its tech-savvy population and strong e-commerce infrastructure. A significant factor is the popularity of "sober curious" movements, with a key share of urban professionals in Seoul participating in alcohol-free social events. Another driver is the influence of K-pop culture, which promotes healthy living and moderation. Besides, stringent alcohol advertising laws have indirectly promoted non-alcoholic alternatives.

India holds a smaller market share. This is propelled by its youthful demographic and rising health consciousness. A key factor is the growing awareness of the harmful effects of alcohol. A different driver is the affordability of non-alcoholic beer, which appeals to price-sensitive consumers. Also, the expansion of retail chains like Big Bazaar has improved accessibility, further boosting demand.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Anheuser-Busch InBev SA/NV, Heineken N.V., Carlsberg Group, Asahi Breweries, Suntory Beer, Erdinger Weißbräu, Krombacher Brauerei, Bernard Brewery, Big Drop Brewing Co., and Royal Swinkels Family Brewers are some of the key market players.

The Asia Pacific non-alcoholic beer market is characterized by intense competition, driven by the presence of established global players and emerging regional brands. Multinational corporations like Asahi Group Holdings, Kirin Holdings, and Heineken Asia Pacific dominate the landscape, leveraging their extensive resources, advanced brewing technologies, and robust distribution networks. These companies focus on innovation, introducing premium and craft-style non-alcoholic beers to cater to evolving consumer preferences. Meanwhile, smaller regional players emphasize affordability and localization, targeting price-sensitive markets and niche demographics. The competitive dynamics are further intensified by the growing popularity of flavored variants and the rise of e-commerce as a sales channel. To maintain their edge, key players adopt strategies such as product diversification, strategic partnerships, and sustainability initiatives.

Top Players in the Asia Pacific Non-Alcoholic Beer Market

Asahi Group Holdings

Asahi Group Holdings is a dominant player in the Asia Pacific non-alcoholic beer market, leveraging its extensive brewing expertise and strong brand portfolio. The company has successfully introduced innovative non-alcoholic variants that cater to health-conscious consumers across Japan, Australia, and Southeast Asia. Asahi’s commitment to quality and authenticity has positioned it as a trusted name in the global market.

Kirin Holdings

Kirin Holdings has established itself as a key innovator in the non-alcoholic beer segment, particularly in Japan and neighboring countries. The company’s emphasis on research and development has enabled it to create products that closely mimic the taste and experience of traditional beer. Kirin’s strategic partnerships with local distributors and its focus on sustainability have strengthened its global footprint.

Heineken Asia Pacific

Heineken Asia Pacific plays a pivotal role in expanding the non-alcoholic beer market through its flagship brand, Heineken 0.0. The company’s ability to blend global appeal with localized marketing strategies has made it a preferred choice for urban professionals and millennials. Heineken’s efforts to integrate non-alcoholic beer into mainstream culture have influenced global trends, encouraging other players to adopt similar approaches.

Top Strategies Used by Key Players in the Asia Pacific Non-Alcoholic Beer Market

Product Innovation and Diversification

Key players in the Asia Pacific non-alcoholic beer market prioritize product innovation to meet diverse consumer preferences. Companies are experimenting with unique flavors, infusing local ingredients, and enhancing brewing techniques to replicate the taste and aroma of traditional beer. This strategy not only attracts health-conscious consumers but also appeals to younger demographics seeking novel experiences.

Strategic Partnerships and Collaborations

Collaborations with local distributors, retailers, and e-commerce platforms are critical for expanding market reach. Leading players leverage these partnerships to enhance distribution networks and improve accessibility, particularly in rural and underserved areas. Additionally, collaborations with fitness centers and wellness organizations help position non-alcoholic beer as a lifestyle product, aligning with broader health and wellness trends.

Sustainability Initiatives

Sustainability is a cornerstone of many players’ strategies, with a focus on eco-friendly packaging, responsible sourcing, and energy-efficient production processes. By adopting sustainable practices, companies not only reduce their environmental impact but also appeal to environmentally conscious consumers. This approach enhances brand loyalty and differentiates them from competitors, reinforcing their commitment to social responsibility and long-term growth.

RECENT MARKET DEVELOPMENTS

- In April 2023, Asahi Group Holdings launched a new line of non-alcoholic beer infused with natural botanicals, targeting health-conscious consumers in Japan and Australia. This move was aimed at diversifying their product portfolio and appealing to the growing demand for wellness-oriented beverages.

- In June 2023, Kirin Holdings partnered with a leading fitness chain in Singapore to promote its non-alcoholic beer as a post-workout hydration option. This collaboration helped position the brand as a lifestyle choice aligned with fitness and wellness trends.

- In August 2023, Heineken Asia Pacific expanded its distribution network by signing agreements with major e-commerce platforms in Southeast Asia. This initiative improved accessibility and allowed the company to tap into the growing online retail market.

- In October 2023, Suntory Beverage & Food Asia Pacific introduced eco-friendly packaging for its non-alcoholic beer range, emphasizing sustainability. This action resonated with environmentally conscious consumers and enhanced the brand’s reputation.

- In December 2023, Carlsberg Asia collaborated with local farmers in Thailand to source organic barley for its non-alcoholic beer production. This initiative highlighted the company’s commitment to responsible sourcing and supported local agricultural communities.

MARKET SEGMENTATION

This research report on the Asia Pacific Non-Alcoholic Beer Market is segmented and sub-segmented into the following categories.

By Product

- Alcohol-free

- Low Alcohol

By Category

- Plain

- Flavored

By Material

- Malted Grains

- Hops

- Yeasts

- Enzymes

- Others

By Sales Channel

- Convenience Stores

- Liquor Stores

- Supermarkets

- Restaurants & Bars

- Online Stores

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific Non-Alcoholic Beer Market?

Key growth drivers include increasing health consciousness, growing awareness of alcohol-related health risks, rising demand for low-calorie beverages, and a cultural shift toward mindful drinking.

What challenges does the Asia Pacific Non-Alcoholic Beer Market face?

Challenges include consumer perception that non-alcoholic beer lacks flavor, higher production costs, and regulatory variations in defining "non-alcoholic" across countries.

What is the future outlook for the Asia Pacific Non-Alcoholic Beer Market?

The market is expected to grow steadily, supported by innovation, health-focused product launches, and an increasing number of consumers seeking alcohol alternatives.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com