Asia Pacific Ophthalmic Drugs Market Size, Share, Trends & Growth Forecast Report By Therapeutic Class, Product Type, Distribution Channel, Disease Indication, Dosage Form, Technology and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Ophthalmic Drugs Market Size

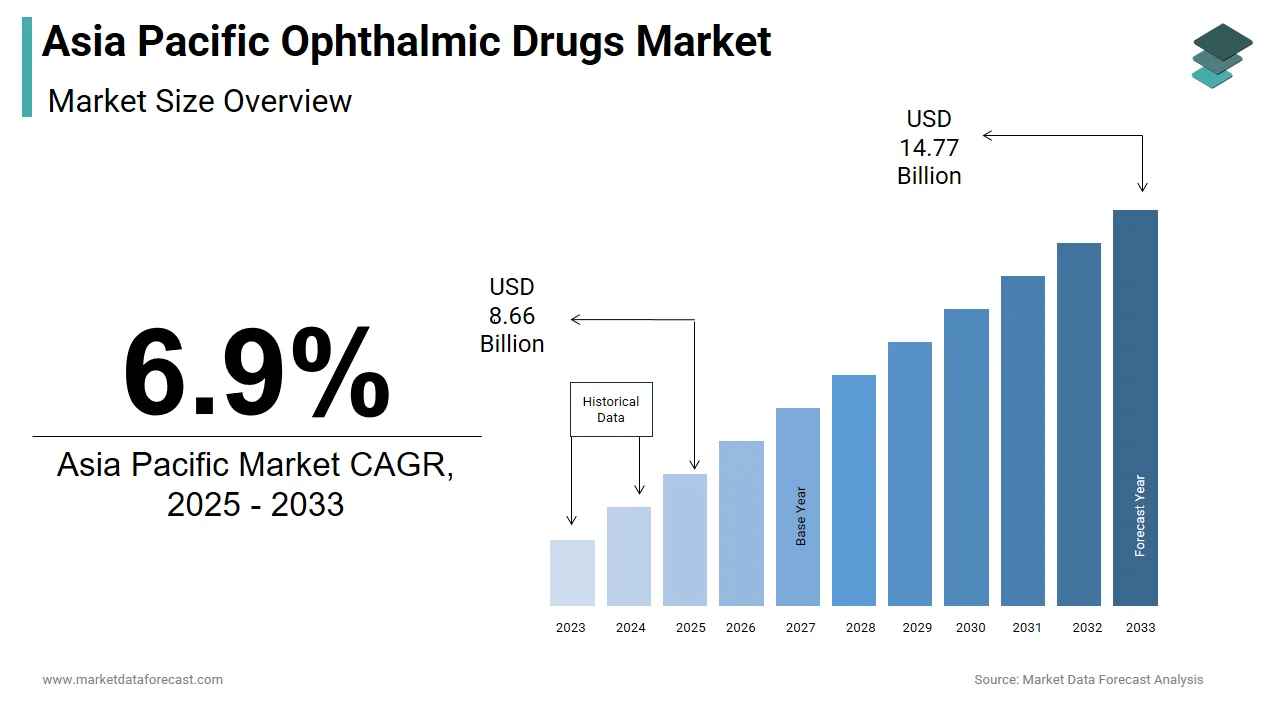

The size of the Asia Pacific ophthalmic drugs market was worth USD 8.10 billion in 2025. The Asia Pacific market is anticipated to grow at a CAGR of 6.9% from 2025 to 2033 and be worth USD 14.77 billion by 2033 from USD 8.66 billion in 2025.

MARKET DRIVERS

Rising Glaucoma Cases and Advancements in Combination Therapies Fuel

The growth of the APAC ophthalmic drugs market is majorly driven by the rising number of individuals suffering from glaucoma and tremendous innovation and funding in developing combination therapies. In addition, the ocular pharmaceuticals market is driven by increased FDA approvals, which raise medication approvals and increase surgeries in the ophthalmology industry due to the high prevalence of reactive defects. In addition, the market is expanding as the population ages, the incidence of eye disorders rises, healthcare spending rises, and the use of minimally invasive surgeries rises.

As the prevalence of eye problems increases, the global need for ophthalmic medications is growing. Eye diseases have already emerged as potential threats to people’s visual experience in many developed and developing countries. As the prevalence of diabetes has increased in many areas, diabetes medicines have been introduced. Glaucoma has been on the public health agenda for years due to difficulties recognizing it early and the need for long-term treatment.

MARKET RESTRAINTS

Patent Expiries, R&D Delays, and Low Awareness Hamper

However, the development of new pharmaceuticals is impeded by undesirable side effects and long gestation periods, limiting market expansion. Two issues limit the industry’s growth: well-known pharmaceuticals falling off-patent and big players being hampered by the time it takes for new drugs to join the market. In addition, risks associated with ocular disorders and the lack of public understanding of ophthalmology threaten the market.

GEOGRAPHICAL ANALYSIS

The Asia Pacific is the fastest-growing market. As a result, the ophthalmic drugs market is expected to witness significant growth during the forecast period. The market growth is attributed to the expanding patient population suffering from vision disorders, advanced medications for treating ophthalmic diseases, and improving the healthcare sector. The growth contributors in the region are China, India, China, Japan, and Australia.

China held the largest share of the ophthalmic drugs market and is anticipated to record a promising share during the forecast period. The market growth is fuelled by the availability of advanced Medical infrastructure and increased health insurance coverage, and high healthcare spending.

Government measures to fund eye care research are also expected to fuel the Australian ophthalmic medicines market during the projected period. The government’s financing would go toward various ophthalmic research initiatives to develop advanced medicines to help Australia’s ophthalmology drugs market grow. In Japan, there are a large number of people aged 65 and up. Glaucoma is also more common as people get older. As a result, increased glaucoma prevalence and rising healthcare spending are propelling the market growth.

On the other hand, according to the statement of clinical and experimental vision and eye research, the ophthalmic drugs market in India is predicted to be one of the three top pharmaceutical markets. As per the National Health Policy, Glaucoma is the leading cause of blindness in India, with at least 12 million people affected and 1.2 million blinded over the recent period.

KEY MARKET PLAYERS

A few promising companies in the Asia-Pacific ophthalmic drugs market profiled in this report are Carl-Zeiss AG, Ellex Medical Lasers Ltd., Hoya Corporation, Novagali Pharma S A, Abbott Medical Optics, Inc., Essilor International S.A. Other players in the market include Insight Vision Inc., Nidek Co.Ltd, Topcon Corporation, and Ziemer Ophthalmic Systems AG.

MARKET SEGMENTATION

This Asia Pacific ophthalmic drugs market research report is segmented and sub-segmented into the following categories.

By Therapeutic Class

- Anti-inflammatory Drugs

- Anti-infective Drugs

- Anti-glaucoma Drugs

- Anti-allergy Drugs

- Anti-VEGF Agents

- Others

By Product Type

- Prescription Drugs

- Over-the-Counter Drugs

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Independent Pharmacies

- Drug Stores

By Disease Indications

- Dry Eye

- Glaucoma

- Infection/Inflammation

- Retinal Disorders

- Allergy

- Uveitis

- Others

By Dosage Form

- Liquid Ophthalmic Drug Forms

- Solid Ophthalmic Drug Forms

- Semisolid Ophthalmic Drug Forms

- Multicompartment Drug Delivery Systems

- Other Ophthalmic Drug Forms

By Technology

- Biologics

- Cell Therapy

- Gene Therapy

- Drug Delivery

- Small molecule

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com