Global Ophthalmic Drugs Market Size, Share, Trends & Growth Forecast Report By Therapeutic Class (Anti-inflammatory Drugs, Anti-infective Drugs, Anti-glaucoma Drugs, Anti-allergy Drugs, Anti-VEGF Agents and Others), Product Type (Prescription Drugs and OTC drugs), Distribution Channel, Disease Indications, Dosage Form, Technology, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Ophthalmic Drugs Market Size

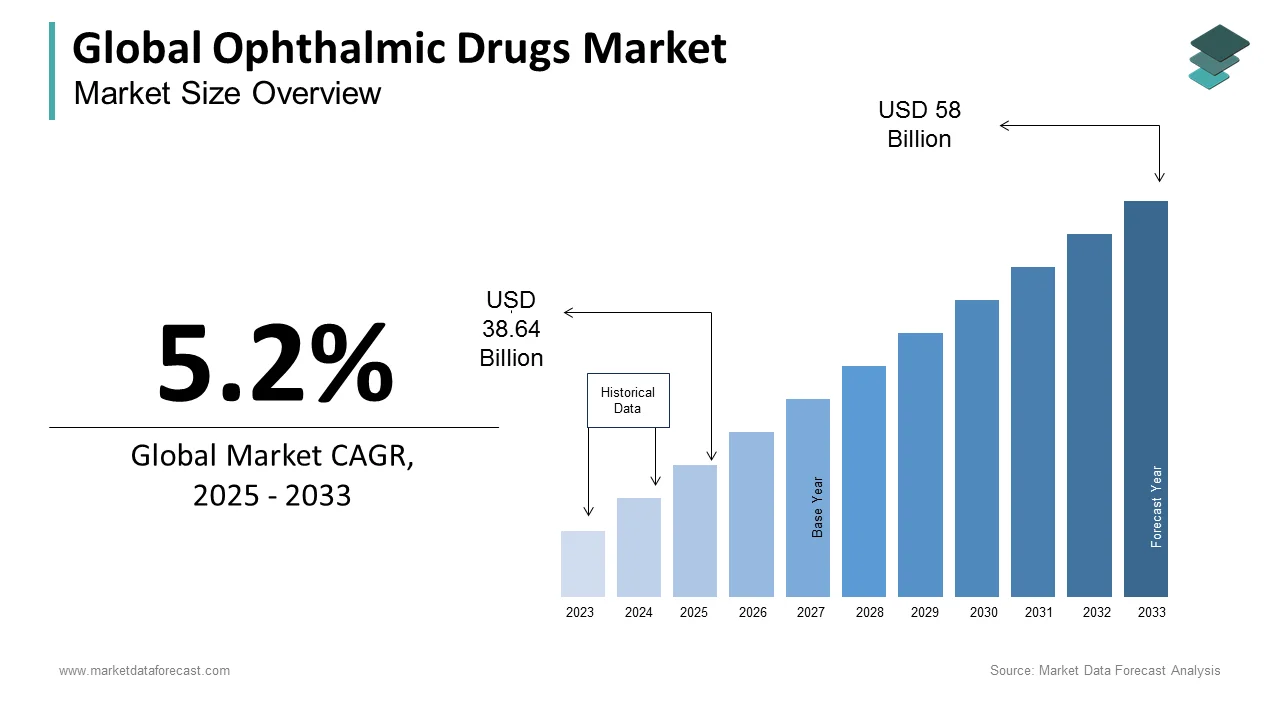

The size of the global ophthalmic drugs market was worth USD 36.73 billion in 2024. The global market is anticipated to grow at a CAGR of 5.2% from 2025 to 2033 and be worth USD 58 billion by 2033 from USD 38.64 billion in 2025.

Presently, the ophthalmic drugs market grows rapidly. There is a progressive demand for better ocular medicines using optimal drug delivery systems in 2024. Current issues for novel ophthalmic therapies and their delivery methods, include duration, adherence, the frequency of dosing, and ineffectual bioavailability at the intended intraocular tissues. Moreover, nanoparticles, ocular implants, and in situ gels make up the modern formulations commonly employed in clinical practice. Also, one key and evolving theme of this drug administration mechanism is the trend toward eliminating preservatives in formulations.

- In 2022, the iVizia range of OTC eye care products by Thea Pharma became accessible in the United States market. iVizia is an eye drop which is free from preservatives with a unique, innovative cartridge and optimised bottle design for improved patient ergonomics, lower threat of contamination, enhanced accuracy in drug delivery calibration. Also, this line of products comprises a preservative-free lubricant eye gel, packaged in a single-use contamination.

It has become highly important for today’s optometrists to realize the nuances of modern optic medication delivery systems. Likewise, in the last 2-3 years, the market witnessed numerous inventions or advances in treating dry eye disease (DED), presbyopia, In-office dilation and the reversal of mydriasis, and Retinal disease and new ophthalmic injectables.

- For instance, a partnership between Novaliq and Bausch + Lomb, Miebo (perfluorohexyloctane ophthalmic solution; formerly NOV03) was devised to greatly lower tear evaporation. As of now, it is the only FDA-permitted remedy for dry eye disease that was particularly created to decrease tear evaporation.

MARKET DRIVERS

The growing prevalence of eye diseases primarily drives the global ophthalmic drug market growth.

The number of people suffering from various eye diseases such as age-related macular degeneration (AMD), cataracts, glaucoma, diabetic retinopathy, dry eye syndrome, retinal detachment, conjunctivitis, and others is growing significantly worldwide, which is expected to result in growth of the ophthalmic drugs market. Due to age-related macular degeneration, people who are aged above 50 years are likely to experience vision loss. According to an article published by the BrightFocus Foundation, an estimated 20 million adults have been experiencing some age-related macular degeneration in the United States. As per the same source, an estimated 288 million people are expected to suffer from age-related macular degeneration by 2040. Glaucoma is the second most significant cause worldwide, causing vision loss in people. As per the statistics published by the World Health Organization (WHO), glaucoma causes blindness in 4.5 million people. According to the National Health Portal of India, an estimated 12 million people in India are suffering from irreversible blindness caused by glaucoma, out of which 1.2 million went blind.

The increasing patient population suffering from diabetes worldwide is expected to boost the ophthalmic drug market growth. The risk of developing eye problems in diabetic patients is high. People with diabetes may suffer from various eye diseases such as diabetic retinopathy, cataracts, and glaucoma when effective disease management is lacking. In specific, diabetic retinopathy is a risky condition and can potentially result in vision loss if ignored in the early stage. To address the risk of eye diseases, diabetic patients often consume ophthalmic drugs. Likewise, the growing number of people diagnosed with diabetes is expected to fuel the demand for ophthalmic drugs. According to the statistics published by the IDF Diabetes Atlas, an estimated 537 people aged between 20 to 79 years had diabetes in 2021, which was also one in every ten people and caused USD 966 billion in health expenditure for diabetes.

The growing aging population is one of the key factors propelling the ophthalmic drugs market growth. The older people population across the world is significantly growing. According to the United Nations statistics, people 65 years or older are estimated to reach 1.5 billion by 2050. It is a known fact that the aged population is likely to be diagnosed with eye-related disorders, which is expected to support the global ophthalmic drugs market actively. The number of patients with age-related macular degeneration is rising to 288 million by 2040.

The growing patient population in developed and developing countries and the increasing healthcare spending on eye-related disorders further propel market growth. Approximately 7.32 million in the United States are projected to have primary open-angle glaucoma, from 3.15 million in 2015. Furthermore, the growing number of people suffering from glaucoma across the globe is driving the market. Nearly 90% of glaucoma cases remain undiagnosed in the country. The key market participants are putting rigorous R&D efforts into developing and manufacturing effective ophthalmic drugs and formulations, further fuelling the global market's growth rate.

MARKET RESTRAINTS

Lack of awareness among people regarding the use of ophthalmic drugs and lack of adequate health insurance coverage in some countries hamper the market growth. In addition, side effects associated with the consumption of ophthalmic drugs, such as itching in the eyes and allergy, hinder the growth rate of the ophthalmic drug market in the coming years. Furthermore, the high cost of ophthalmic drugs is projected to limit the market's growth rate. Furthermore, factors such as the availability of alternative treatment methods to ophthalmic drugs and lengthy and complex approval processes for new drugs to enter the market are estimated to inhibit the growth rate of the ophthalmic drugs market.

MARKET OPPORTUNITIES

The frequency of approvals of ophthalmic medicines, drug discovery, and research and development initiatives. The future of ophthalmic drugs market appears promising by looking at the ongoing trends and industry dynamics.

Throughout the forecast period, the DED is expected to see higher focus from the market players owing to the either absence of alternative products or lack of effective solution.

- For instance, Vevye (cyclosporine ophthalmic solution) 0.1 per cent by Novaliq is the foremost and solitary cyclosporine solution that shows effectiveness in mitigating symptoms of DED following a4-week treatment regimen. Vevye aims the comprehensive documented inflammatory primary reason for DED, constantly displaying early and clinically important efficacy in resolving both symptoms and signs.

Another factor presenting potential opportunities for the expansion of this market is the frequency of eye diseases like diabetic retinopathy, geographic atrophy, and age-related

macular degeneration (AMD) is increasing substantially as the world population becomes old. A typical patient with AMD is more than 70 years old. Interestingly, an overwhelming portion of these patients are suffering from an advanced disease state, thus turning them legally ineligible to drive. The discomfort and pain usually persist 2 to 3 days. So, repeating this procedure every four weeks places a significant burden on both patients and their caretakers. Furthermore, these programs or schedules are laden or full of inadequate or weak compliance, resulting in suffers missing out on the complete advantages of the therapy or solution.

MARKET CHALLENGES

Complex features of eye anatomy stand as a huge challenge for the expansion of the ophthalmic drugs market. Presently, diabetic retinopathy (DR), age-related degenerative (AMD), glaucoma are the most common eye diseases, and closely 39 million individuals are totally as a result of these factors.

Moreover, today, intravitreal administration is the regularly employed intervention for treating disorders affecting the posterior segment of the eye. Despite that continual intravitreal injective administration frequently leads to adverse impacts, including elevated pressure within the eye, intraocular infections, bleeding in the retina, and retinal detachments. Even though intravitreal implants can be utilised to decrease the quantity of injections and extend drug release, this invasive therapeutic approach may still cause issues such as inadequate patience compliance, haemorrhaging, endophthalmitis, infections, and surgical trauma. Therefore, it is important to develop non-invasive methods for delivering treatments aimed at ocular posterior diseases.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Therapeutic Class, Distribution Channel, Product Type, Disease Indications, Technology, Dosage Form, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Carl-Zeiss AG, Ellex Medical Lasers Ltd., Hoya Corporation, Novagali Pharma S A, Abbott Medical Optics, Inc., Essilor International S.A., and Others. |

SEGMENTAL ANALYSIS

By Therapeutic Class Insights

Based on the therapeutic class, the anti-VEGF segment had the largest share of the global ophthalmic drugs market in 2024. The segment's domination is expected to continue during the forecast period. The segment's growth can be attributed to factors such as the rising prevalence of age-related macular degeneration, growing market participants, and the rising adoption of anti-VEGF.

On the other hand, the anti-inflammatory drugs segment is predicted to showcase a healthy CAGR during the forecast period and hold a considerable share of the worldwide market during the forecast period. This is because the growing patient counts suffering from ophthalmic conjunctivitis and the increasing number of product approvals propel the segment's growth rate.

The anti-glaucoma drugs segment is forecasted to hold a substantial share of the global market during the forecast period owing to the increasing number of people suffering from glaucoma. In addition, the growing aging population is more prone to suffer from glaucoma and increasing efforts from the key market participants to bring new products to the market further promote the growth of the anti-glaucoma segment.

By Product Type Insights

Based on the product type, the prescription drugs segment is expected to capture the largest market share of the global ophthalmic drugs market during the forecast period. The growing preference towards prescription drugs from patients and the increasing incidence of various eye diseases promote the segment's growth.

The OTC drugs segment is predicted to witness a robust growth rate during the forecast period owing to the loss of patent exclusivities of effective drugs and a substantial increase in the generic perforation of ophthalmic drugs. In addition, the low cost of these drugs makes it more affordable for a vast patient base in low and middle-economic countries to bolster the segment growth globally.

By Distribution Channel Insights

The independent pharmacies and drug stores segment accounted for the largest share based on the distribution channel, with 63.0% of the total share in 2024. The dominance of this segment can be attributed to the trend of self-medication across the world. Self-treatment is a global occurrence and possible factor in human pathogen resistance against antibiotics. This tendency of people drives the sale of ocular products, as well as ophthalmic drugs market size.

- As per a study published in the journal of Ophthalmology, of the 501 patients in the ophthalmology department, 44.1 per cent reported practicing self-medication, primarily new patients (64.7 per cent). The average age of these self-treated ones was 45.61 years, and 60.2 per cent were female, largely of higher level of education (53.4 per cent).

During the forecast period, the online pharmacies segment is estimated to register a healthy growth rate owing to the advent of e-commerce platforms, the rise of mHealth, and specialised delivery services.

By Disease Indications Insights

Based on disease indications, the retinal disorders segment captured the largest market share in 2024, and the domination of the segment is expected to continue over the forecast period. The growing patient count suffering from age-related macular degeneration and diabetic retinopathy is one of the significant factors contributing to segmental growth. One in every three diabetic patients suffers from diabetic retinopathy. In addition, increasing investments by the key market participants to conduct R&D to develop innovative drugs for retinal disorders is another potential factor fuelling the segment's growth rate.

However, the glaucoma segment is anticipated to grow at the highest CAGR over the forecast period owing to the rising prevalence of glaucoma among people. On the other hand, the infection segment is predicted to showcase a healthy CAGR in the coming years.

Factors such as the rising incidence of eye infections and increasing awareness among people regarding eye infections are propelling segmental growth.

By Dosage Form Insights

Based on the dosage form, the Liquid Ophthalmic drug market sub-category is expected to retain its lead in the forecast period. It is predicted to grow with the highest CAGR in the forecast period. Eye drops, which comprehensively dominate (compared to suspensions and emulsions) under this segment, apply the medicines on the front part. Their benefits comprise of accepted constancy and administration. Moreover, increasing R&D for new drug delivery approaches that involve nanoparticles, dangerous, and dendrimers are pushing the segment.

- According to a study published in Springer Nature Link Journal, approaches to ocular delivery consist of retrobulbar, intracameral, subconjunctival, juxtascleral, intraocular, intravitreal, and topical. Over 95 per cent of advertised products lies in liquid state.

Further, various nano-system platforms have been advanced to address the disadvantages of eye drops. Cyclosporine was developed as a mucoadhesive miniature system using poly (D-L-lactide)-b-dextran. For this, Nanoprecipitation technique was accepted. Currently, the appeal of nano-technology-based carriers stemmed from their ability to contain both lipophilic and hydrophilic drugs, improve optic permeability, maintain residence time, enhance drug stability, and boost bioavailability.

By Technology Insights

Based on technology, the biologics segment is expected to have the largest share of the ophthalmic drugs market. Lately, ophthalmology and retinal delivery is drifting in the direction of treat-and-extend treatments, with rising biologics increasing the longevity to

once at six-monthly intervals following an initial loading dose injection, ultimately which is expected to elevate the segment’s market share. This is a positive shift for suffers and can considerably assist in enhance patience adherence and therapeutic benefits. In addition, the port delivery method, that involves a depot medicine chamber inserted within the eyes of patients and is regularly refilled with the medication, is an example where endurance can be prolonged beyond six months. Additionally, the segment is believed to move forward with a few of the budding strategies of improving longevity need innovations in administering technologies that can merge effortlessly in a clinical process in a retinal clinic.

On the other hand, drug delivery segment has rapidly grown in the last few years and is likely to continue in future as well. There is a growing demand for sustained -release delivery systems for the large -molecule antibody products. This can be attributed to the drawback of the anti-VEGF drugs which require regular intravitreal injections.

REGIONAL ANALYSIS

Geographically, the North American ophthalmic drugs market captured the most significant global market share in 2024. During the forecast period, the domination of the North American region is expected to continue. A considerable population of the North American region is suffering from various eye diseases, which is one of the major factors promoting regional market growth. In addition, the presence of key market participants in the North American region is another major factor fuelling the market growth. In 2024, the U.S. accounted for a significant share of the North American region, followed by Canada.

The European ophthalmic drugs market held the second most significant share of the global market in 2024 and is predicted to hold a substantial share of the global market during the forecast period. The rising demand for cosmetic procedures such as LASIK and the presence of several international market participants and small-sized eye care centers primarily drives the growth of the European market. In addition, the growing aging population in European countries and increasing awareness among people regarding eye care are further expected to boost European market growth. As a result, France occupied a significant share of the European market in 2024.

The Asia Pacific ophthalmic drugs market is the fastest-growing regional market and is expected to witness the highest CAGR during the forecast period. The growth of the APAC region growth is attributed to the improved healthcare infrastructure and a growing substantial patient population suffering from eye-related problems. Development of breakthrough medicines for the treatment of eye disorders.

The Latin American ophthalmic drugs market is anticipated to occupy a considerable global market share during the forecast period.

The ophthalmic drugs market in MEA is expected to showcase a moderate CAGR during the forecast period.

KEY MARKET PARTICIPANTS

Some promising companies dominating the global ophthalmic drugs market are Carl-Zeiss AG, Ellex Medical Lasers Ltd., Hoya Corporation, Novagali Pharma S A, Abbott Medical Optics, Inc., Essilor International S.A. Other players in the market include Insight Vision Inc., Nidek Co.Ltd, Topcon Corporation, and Ziemer Ophthalmic Systems AG., and Others.

RECENT MARKET DEVELOPMENTS

- In December 2024, Gland Pharma Limited reported via press release that it had secured approval from the United States Food and Drug Administration (USFDA) for its Latanoprost Ophthalmic Solution, 2.5 mL Fill (0.005 percent). The pharmaceutical company’s new product is functionally identical to Xalatan which is a drug listed as reference and is held by UPJOHN US 2 LLC. In addition, the ophthalmic solution is devised to deal or address high intraocular pressure (IOP) in individuals suffering from ocular hypertension or open-angle glaucoma.

- In May 2024, the Food and Drugs Administration (FDA) officially permitted Opuviz (aflibercept-yszy) and Yesafili (aflibercept-jbvf) as biosimilars that are interchangeable with Eylea (afilbercept). It is approved for the treatment of ophthalmic conditions comprising diabetic retinopathy, macular edema, and neovascular age-related macular degeneration (AMD). Both Opuviz (aflibercept-yszy) by Samsung Bioepis and Yesafili (aflibercept-jbvf) by Biocon Biologics are VEGF (vascular endothelial growth factor) inhibitors that are delivered intravitreally as a 2 mg injectable solution (0.05 mL of 40mg/mL) for patient treatment. The adverse occurrences and the side effects connected to biosimilars are akin to the preference product. Moreover, the sanctioning of these two with interchangeability desigations will allow Yesafili and Opuviz to be exchanged for the reference item at the pharmacy level. This enables patients to avoid waiting for physician’s approval before making the switch.

MARKET SEGMENTATION

This market research report on the global ophthalmic drugs market has been segmented and sub-segmented based on the therapeutic class, distribution channel, product type, disease indications, technology, dosage form, end-user, and region.

By Therapeutic Class

- Anti-inflammatory Drugs

- Nonsteroidal Anti-inflammatory Drugs

- Steroids

- Anti-infective Drugs

- Anti-fungal Drugs

- Anti-bacterial Drugs

- Others

- Anti-glaucoma Drugs

- Alpha Agonist

- Beta-Blockers

- Prostaglandin Analogs

- Combined Medication

- Others

- Anti-allergy Drugs

- Anti-VEGF Agents

- Others

By Product Type

- Prescription Drugs

- Over-the-Counter Drugs

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Independent Pharmacies & Drug Stores

By Disease Indications

- Dry Eye

- Glaucoma

- Infection/Inflammation

- Retinal Disorders

- Wet Age-related Macular Degeneration

- Dry Age-related Macular Degeneration

- Diabetic Retinopathy

- Others

- Allergy

- Uveitis

- Others

By Dosage Form

- Liquid

- Solid

- Semisolid

- Multi-compartment

- Others

By Technology

- Biologics

- Cell Therapy

- Gene Therapy

- Drug Delivery

- Small molecule

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the ophthalmic drugs market worldwide in 2024?

The global ophthalmic drugs market size was valued at USD 40.65 billion in 2024.

Which segment by disease had the leading share in the ophthalmic drugs market in 2024?

Based on the disease indication, the retina disorders segment occupied the leading share in the ophthalmic drugs market in 2024.

Which region is growing the fastest in the global ophthalmic drugs market?

Geographically, the Asia-Pacific region is estimated to showcase the highest CAGR among all regions in the global market during the forecast period.

Who are a few of the promising companies in the ophthalmic drugs market?

Carl-Zeiss AG, Ellex Medical Lasers Ltd., Hoya Corporation, Novagali Pharma S A, Abbott Medical Optics, Inc., Essilor International S.A. Other players in the market include Insight Vision Inc., Nidek Co.Ltd, Topcon Corporation, and Ziemer Ophthalmic Systems AG are some of the notable players in the ophthalmic drugs market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com