Global Over the Counter (OTC) Drugs Market Size, Share, Trends & Growth Forecast Report By Product Type (Analgesics, Cough, Cold, and Flu Products, Vitamins and Minerals, Dermatological Products, Gastrointestinal Products, Ophthalmic Products, Sleep Aid Products, Weight Loss/Diet Products and Others) & Region, Industry Analysis From 2025 to 2033

Global Over-the-Counter Drugs Market Size

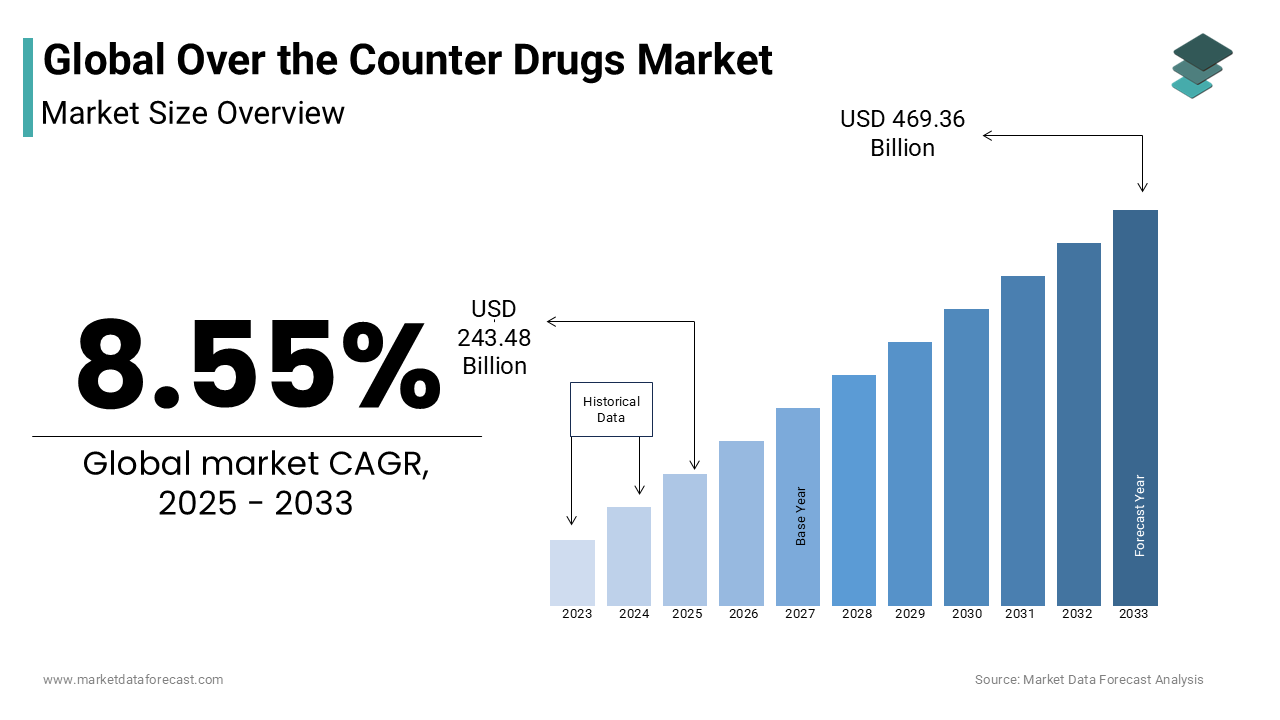

The global over the counter (OTC) drugs market was valued at USD 224.3 billion in 2024. The global market is predicted to value USD 469.36 billion by 2033 from USD 243.48 billion in 2025, growing at a CAGR of 8.55% between 2025 to 2033.

The global over-the-counter (OTC) drugs market is experiencing significant growth due to increasing consumer demand for self-medication, rising healthcare costs, and the growing availability of OTC products. These drugs, which do not require a prescription, are widely used for managing common ailments such as headaches, colds, and allergies. The market's expansion is further fueled by an aging population and the increasing prevalence of lifestyle-related diseases.

Over-the-Counter Drugs Market Trends

Rising Consumer Preference for Natural and Herbal OTC Products

A significant trend in the global over-the-counter (OTC) drugs market is the increasing consumer demand for natural and herbal remedies. Many individuals seek safer, more holistic treatments with fewer side effects. According to a 2024 survey, 62% of consumers reported a preference for plant-based or natural ingredients in their medications. This shift is driving pharmaceutical companies to invest in developing and marketing herbal OTC products for common ailments like digestive issues, colds, and sleep disorders. The global market for herbal medicines is expected to grow at a compound annual growth rate (CAGR) of 7.22% from 2025 to 2033 and be valued at USD 215.4 bn by 2024. This trend highlights consumer interest in wellness and prevention, leading to more OTC products labeled “natural” or “organic.”

Growth in Online Retail for OTC Drugs

The rise of e-commerce has significantly impacted the OTC drugs market. Online platforms provide consumers with the convenience of purchasing OTC products from home, often at competitive prices. Companies like Amazon, Walgreens, and CVS have capitalized on this trend by offering a wide selection of OTC products online. The COVID-19 pandemic accelerated this growth, as many people turned to online shopping for their healthcare needs. E-commerce also allows brands to reach rural or underserved populations, expanding their customer base.

Self-medication and Consumer Awareness

The increasing awareness of health conditions and a desire for self-care have driven the OTC market's expansion. Consumers are more inclined to manage minor ailments themselves to avoid healthcare costs and visits to medical facilities. According to a 2022 report, around 70% of consumers in the U.S. preferred using OTC drugs for managing mild conditions like pain, cold, or allergies. This trend is especially pronounced in developing countries, where healthcare access may be limited. The World Health Organization (WHO) estimates that 60% of global healthcare spending is out-of-pocket, prompting consumers to turn to more affordable OTC solutions. Companies are responding by expanding product lines and focusing on consumer education about self-medication.

MARKET DRIVERS

Increasing Healthcare Costs

One of the primary drivers of the global OTC drugs market is the rising cost of healthcare services. As medical consultations, hospitalizations, and prescription medications become more expensive, consumers increasingly turn to OTC drugs as an affordable alternative. According to the World Health Organization (WHO), over 60% of global healthcare spending is out-of-pocket, especially in developing nations. This has led to a growing preference for self-medication. Consumers can manage minor health issues like colds, allergies, and headaches without incurring the high costs of professional healthcare, thus driving the demand for OTC drugs. This trend is expected to continue, with the OTC market projected to grow as more consumers seek cost-effective treatment options.

Aging Population

The global aging population is another major driver of the OTC drugs market. Older individuals are more prone to chronic conditions such as arthritis, digestive disorders, and pain, which can often be managed with OTC medications. By 2030, the number of people aged 65 and over is expected to reach 1 billion globally, according to the United Nations. This demographic shift increases the demand for OTC drugs, particularly in categories like pain relief, digestive aids, and supplements. As the elderly seek convenient and accessible healthcare solutions, OTC medications become a preferred option for managing recurring conditions without the need for constant medical supervision.

Rising Consumer Health Awareness

A growing awareness of health and wellness is also driving the OTC drugs market. Consumers are increasingly knowledgeable about self-care and are actively seeking ways to manage their health without frequent visits to doctors. This trend has been supported by the widespread availability of health information online and through mobile apps, enabling consumers to research symptoms and potential treatments. A 2021 study showed that 70% of U.S. adults turn to OTC medications for the management of minor ailments such as cold symptoms, allergies, and digestive issues. With growing awareness, consumers are more empowered to take proactive steps toward managing their health, further boosting the demand for OTC products.

MARKET RESTRAINTS

Regulatory Challenges

Stringent regulations around the approval and marketing of over-the-counter (OTC) drugs are a significant restraint on the market. Many countries require strict labeling and safety testing for OTC products, slowing down the introduction of new products. For example, the U.S. Food and Drug Administration (FDA) has complex guidelines for OTC drugs, making it time-consuming and costly for manufacturers to bring products to market. Non-compliance can lead to fines or product recalls, negatively impacting market growth. Global disparities in regulatory frameworks further complicate the issue, creating challenges for international companies.

Risk of Misuse and Self-Medication

The misuse of OTC drugs presents a growing concern, limiting market growth. Easy accessibility of these drugs increases the risk of overuse or improper use without medical supervision. A 2022 report highlighted that nearly 20% of people in the U.S. had misused OTC pain relievers, contributing to adverse health outcomes. Conditions like liver damage from excessive acetaminophen consumption or dependence on nasal decongestants illustrate the risks. Rising concerns over self-medication misuse have prompted governments to implement stricter controls, which could hinder the market’s expansion by reducing consumer access to certain products.

Competition from Prescription Drugs

Another restraint on the OTC market is the increasing competition from prescription medications, particularly as many drugs switch from prescription-only to OTC. While some prescription drugs transition to OTC status, others remain preferred by healthcare providers due to their more targeted or potent effects. In many cases, physicians recommend prescription drugs over OTC options for treating chronic conditions or more severe symptoms. This preference for prescriptions often considered more reliable and stronger, can limit the growth of certain OTC categories, particularly for pain management and chronic condition treatments.

Impact of COVID-19 on Over-the-Counter Drugs Market

The COVID-19 pandemic significantly impacted the over-the-counter (OTC) drugs market, driving a sharp increase in demand for products like pain relievers, cough medicines, and immune boosters. Consumers stockpiled these products to manage symptoms at home, avoiding healthcare facilities. Sales of vitamins and supplements surged, with growth exceeding 16% during the height of the pandemic. The pandemic also accelerated the shift toward e-commerce, with many consumers opting for online purchases of OTC drugs due to lockdowns. However, supply chain disruptions affected product availability temporarily, causing shortages in some areas.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Formulation Type, Distribution Channels, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson and Johnson, Novartis, Bayer, Pfizer, Boehringer Ingelheim, Sanofi, Takeda, and PGT Healthcare |

SEGMENTAL ANALYSIS

By Product Insights

The vitamins and minerals supplements segment accounted for the largest share of the global over-the-counter drugs market and covered a 28.5% share in 2023. The growth of the segment is majorly driven by increasing consumer awareness around immunity and overall health, particularly following the COVID-19 pandemic. Rising demand for preventive healthcare and natural supplements fuels growth, with a focus on vitamin D, zinc, and multivitamins. E-commerce has significantly contributed to expanding this segment’s reach globally.

The analgesics & pain relief segments are another lucrative segment in the global over-the-counter (OTC) drugs market. The high prevalence of pain-related conditions such as arthritis and migraines is driving the expansion of the analgesic and pain relief segments. The growth of the segment is further driven by the increasing demand for self-medication and a growing aging population. Common products include ibuprofen and acetaminophen. Market growth is further supported by the rise in e-commerce sales and expanded consumer access to pain relief solutions without prescriptions.

The weight loss and diet products segment is witnessing steady growth, driven by increasing awareness of obesity and lifestyle-related health issues. The rising prevalence of obesity globally is primarily boosting segmental growth. The availability of supplements claiming to enhance metabolism, curb appetite, or block fat absorption has grown, especially in North America and Europe. Expanding health consciousness is the primary driver behind this segment.

By Formulation Insights

The tablets segment holds a significant share in the global OTC drugs market due to its convenience, longer shelf life, and easy dosing. Tablets are preferred for a wide range of conditions, including pain relief, cold, and flu management. The rising demand for cost-effective, portable, and precise dosage forms drives this segment’s growth. Popularity across all age groups, especially the elderly, further contributes to its market dominance.

The liquids segment is also an essential part of the OTC drugs market, particularly for pediatric and geriatric consumers who may have difficulty swallowing tablets. The growth of the liquids segment is majorly attributed to the increasing demand for flavored, easy-to-swallow formulations. Liquid OTC products are commonly used for cough, cold, and gastrointestinal treatments. The growing focus on user-friendly products for children and the elderly fuels this segment's growth.

By Distribution Channel Insights

The pharmacies dominate the global OTC drugs market, holding the largest share due to their accessibility and consumer trust. The growing demand for OTC drugs for self-medication and chronic disease management is propelling the growth of the pharmacies segment. Pharmacies offer a wide range of products and personalized advice, enhancing customer satisfaction. The segment benefits from its established infrastructure, especially in urban areas.

Convenience stores are a growing distribution channel, particularly for impulse purchases of OTC products like pain relievers and cold medications. The driving factors include longer store hours, widespread locations, and ease of access. Convenience stores play a crucial role in expanding OTC availability in rural or underserved areas.

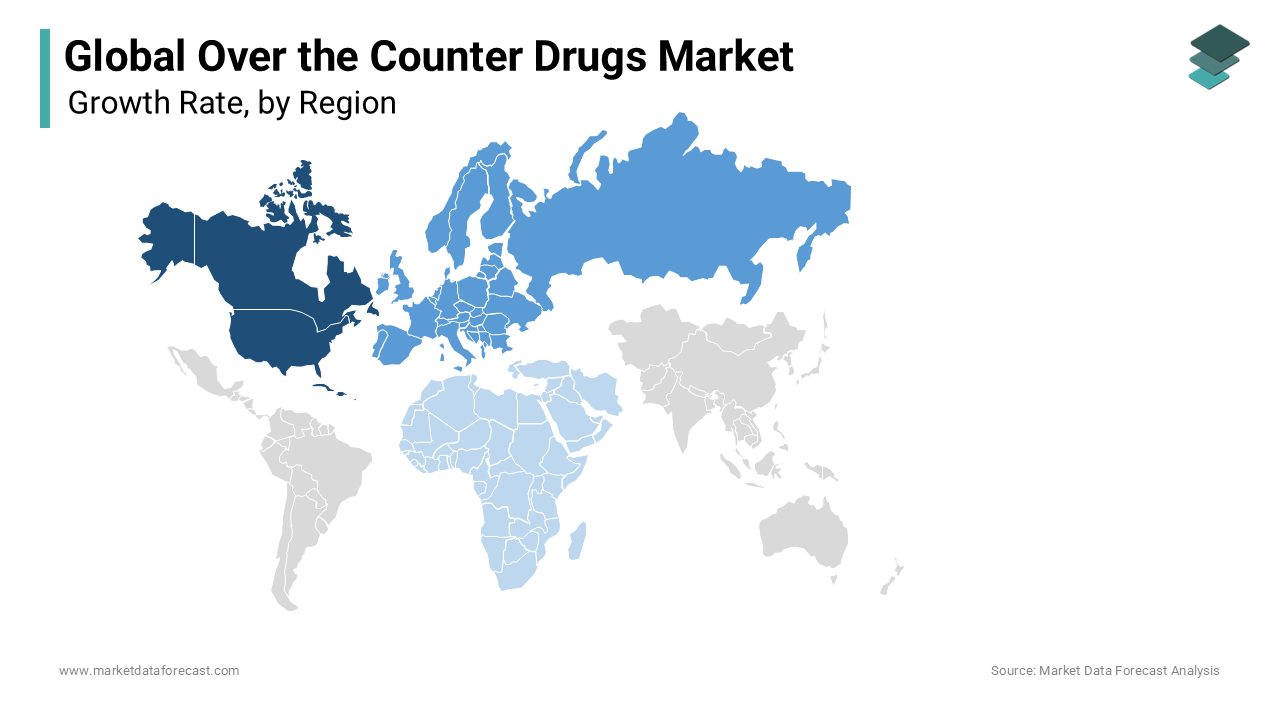

REGIONAL ANALYSIS

North America and Europe are the top contributors to the global over-the-counter (OTC) drugs market, followed by Asia-Pacific. During the forecast period, the Over-the-Counter Drugs Market in North America is anticipated to grow at a promising CAGR. The strong consumer preference for self-medication, high disposable incomes, and an established healthcare infrastructure are primarily contributing to the OTC drugs market growth in North America. The U.S. leads the market with its advanced retail networks and regulatory approvals for new OTC products. In Canada, the demand for natural and herbal OTC remedies is growing rapidly. Key drivers include rising healthcare costs and a growing aging population with increased demand for OTC solutions for chronic conditions.

The European region had a substantial share of the global market in 2024. Key drivers include increasing self-medication trends and government support for reducing prescription drug costs. Germany, the U.K., and France lead the region’s market, benefiting from high consumer awareness and trust in OTC products. Germany is the largest contributor, driven by a well-regulated healthcare system and increasing demand for vitamins and pain relief medications. The U.K. market is boosted by the rising popularity of e-commerce, while France shows strong growth in herbal and homeopathic OTC products.

On the other hand, the Asia-Pacific Counter Drugs Market is expected to showcase the fastest CAGR among all the regions in the global market. The region’s growth is fueled by rising healthcare awareness, growing middle-class populations, and increasing access to OTC products. China, Japan, and India are the leading markets. In China, the expansion of online pharmacies and a growing elderly population are significant drivers. Japan’s aging population supports strong demand for OTC medications like pain relief and vitamins, while India’s growth is fueled by increasing urbanization and healthcare accessibility. The region’s shift towards preventive healthcare also drives market expansion.

The Over-the-Counter Drugs Market in Latin America is anticipated to grow at a steady CAGR during the forecast period. The rising healthcare awareness and expanding retail distribution channels are driving the regional market expansion. Brazil and Mexico are the leading markets, benefiting from growing consumer demand for self-care products. Brazil’s market is supported by a large population and increased demand for digestive and pain relief products. In Mexico, OTC sales are rising due to growing health consciousness and the proliferation of pharmacies. Economic recovery in the region and expanding e-commerce channels are further driving the market.

The MEA Over the Counter Drugs Market is expected to be valued at USD 23.09 billion by 2033. Saudi Arabia, the UAE, and South Africa are the leading markets, driven by increasing healthcare investments and a growing focus on self-medication. Saudi Arabia's government initiatives to enhance healthcare access, such as digital health platforms, support market growth. In South Africa, rising healthcare costs and a preference for herbal OTC products contribute to the market’s expansion. However, limited healthcare infrastructure and regulatory challenges in parts of Africa constrain the market.

KEY MARKET PLAYERS

GlaxoSmithKline, Johnson and Johnson, Novartis, Bayer, Pfizer, GSK Boehringer Ingelheim, Sanofi, Takeda, and PGT Healthcare are the top companies contributing to the Over the counter (OTC) drugs market. GlaxoSmithKline, Johnson and Johnson, Novartis, and Sanofi possess the maximum market share. The extension of OTC services for drugs dealing with chronic diseases like diabetes and hypertension is a new trend.

RECENT HAPPENINGS IN THIS MARKET

- In June 2023, Mckesson Corporation, a leading pharmaceutical company, announced the launch of Foster and Thrive, a curated private brand of OTC health and wellness products. This initiative clearly demonstrates the industry's commitment to meeting consumer demand and ensuring the availability of high-quality OTC products.

- In October 2022, Viatris, a biopharmaceutical company made from the merger between Mylan and Pfizer's Upjohn, plans to expand revenue by selling its European consumer health products. The company has discussed offering a $ 3 billion deal for its European Over the Counter Drugs Market with its business partner Biocon Biologics. The other party with whom the deal is to be signed is yet to be released, and the company hopes to earn profits through this sale.

- In October 2022, Predictions of economic downfall and constraints for generic drugs by trade groups in Europe based on rising energy prices, COVID-19, and the Ukraine conflict have been brushed off and denied by the second largest market holder company for generic drugs, Novartis Sandoz unit CEO Narasimhan.

- In October 2022, WHO red-flagged a pill after testing and finding sub-standardized quality in their production in the lab results. The Kerala-based pharmaceutical company Maiden Pharmaceutical is in big trouble after the intervention of the international health organization. The pills are over-the-counter prescription-based type-2 diabetes painkillers whose quality seems to have been compromised in production.

- In October 2022, the Middle East established itself as a region with fast-growing pharmaceutical development. Egypt is expanding the pharmaceutical industry with the German company Bayer investing in an over-the-counter drug service in the region in partnership with several local pharmaceutical companies. The expansion is expected to benefit both the buyers and the native companies involved in the deal.

MARKET SEGMENTATION

This research report on the global over-the-counter (OTC) drugs market is segmented and sub-segmented based on the product type, formulation type, distribution channels, and region.

By Product Type

- Analgesics

- Cough, Cold, and Flu Products

- Vitamins and Minerals

- Dermatological Products

- Gastrointestinal Products

- Ophthalmic Products

- Sleep Aid Products

- Weight Loss/Diet Products

- Others

By Formulation Type

- Tablets

- Liquids

- Ointments

- Sprays

By Distribution Channels

- Pharmacies

- Supermarkets/Hypermarkets

- Convenience stores

- Others (Online Drug Stores)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much was the global over the counter drugs market worth in 2023?

The global over-the-counter drugs market was valued at USD 206.7 billion in 2023.

Does this report include the impact of COVID-19 on the over the counter drugs market?

Yes, we have studied and included the COVID-19 impact on the global over-the-counter drugs market in this report.

Which segment by product had the major share of the over the counter drugs market in 2024?

Based on the product, the cold, cough and flu product segment accounted for the largest market share in 2024.

Which region led the over the counter drugs market in 2024?

The North American region accounted for the dominating market share in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]