Global Thin Film Drugs Market Size, Share, Trends & Growth Forecast By Product (Oral Thin Film (Sublingual Film and Fully Dissolving Dental/Buccal Film), & Transdermal Thin Film), Disease Indication (Schizophrenia, Migraine, Opioid Dependence, & Nausea & Vomiting), Distribution Channel (Hospital Pharmacies, Drug Store, Retail Pharmacies & E-Commerce) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Thin Film Drugs Market Size

The global thin film drugs market was valued at USD 25.6 billion in 2024. The global market is expected to reach USD 62.9 billion by 2033 from USD 28.3 billion in 2025, growing at a CAGR of 10.50% from 2025 to 2033.

Thin-film drugs are poised to gain attention in the healthcare industry as they eliminate the drawbacks associated with conventional dosages, such as the inconvenience of administration, lower bioavailability, and patient non-compliance. The growing demand for efficient drug delivery systems has amplified the uptake of thin-film drugs due to their efficiency and effectiveness. The convenience of transportation and storage has encouraged patients to opt for these drugs. Thin-film drugs also permit precise dosages to accomplish desired outcomes, aiding the growth of Global Thin Film Drugs. The growing investments in research and development of newer polymeric thin films as a method of drug delivery have also invigorated the market growth.

MARKET DRIVERS

The rapid adoption of technological advancements in OTF drugs is one of the significant factors propelling the global thin film drugs market.

The increase in the widespread or not tending spread of the treatment is the factor that drives the market forward. The main assets of thin film drugs are accessibility for the patient, a simple manufacturing process, and appetence, which drives the market growth. In addition, the growing investments in R&D activities by the market participants are boosting the global thin film drugs market growth. The growing demand for successful profits producing drug delivery systems and research developing new kinds of polymer thin films are the factors that drive the market growth. Also, the funds from different organizations and the government for the manufacturing industries are leveling up the growth rate of the thin-film market.

The significant advantages for the growth of the thin film drugs market include the ease and accessibility provided changes the patient's experience and the pharmaceutical industry, as a whole, since people could access prepackaged pills as a form of treatment, delivering a consistent dose in an easy-to-administer way, where buccal mucosa is the preferred region over the sublingual mucosa. Thin films target sensitive sites that are difficult to reach with tablet or liquid formulations, can improve the onset of drug action, allow the drug to bypass first-pass metabolism, eliminate drug side effects, improve drug efficacy, and reduce significant metabolism caused by proteolytic enzymes. The most beneficial one is reduced dose frequency, making the drug more bioavailable.

Due to the advancements in the industry of thin film drugs, various products for buccal administration have been marketed for diseases like trigeminal neuralgia and diabetes, becoming an advanced alternative to traditional tablets, capsules, and liquids. In addition, thin film strips are generally designed for oral administration as breath fresheners or others. Others have entered the market for flu, snoring, cold, and gastrointestinal medications, which would further provide prescription drugs using the thin-film dosage form and more growth opportunities for the market.

The formulation of oral drug strips involves the application of aesthetic and performance characteristics, such as strip-forming polymers, plasticizers, active pharmaceutical ingredients, sweeteners, saliva-stimulating agents, flavoring agents, colorants, agent stabilizers, and thickeners. From a regulatory point of view, all the excipients used in the formulation of the test strips. In addition, oral medications must be approved for use in the oral dosage form. Even though they revolutionized oral drug delivery systems, pills have never been the best option for all patient populations, opening up the opportunity for further advancements in drug administration technology. OTFs are absorbed directly into the systemic circulation, bypassing the gastrointestinal tract, producing a handful of significant benefits like removing some variables from the formulation process, eliminating many of the common side effects due to other orally administered medications, making an ideal method for pediatric and geriatric patients to treat their problems, leading to increase in its adoption.

MARKET RESTRAINTS

The availability of alternate drugs at a lower cost is one of the major factors hampering market growth.

Also, the cost associated with the treatment in the thin film drug market is expensive, which is one of the factors that hinder the market. The need for many research investments and challenges related to developing new drugs may restrain the growth of the thin film drugs market. In addition, factors like strict rules and guidelines to be followed and lengthy processes for the need for approvals are the ones that may hamper the market demand. On the other hand, the inability to use thin oral films to be applied in high dosages can cause ulcers and itching of the mucosa, limiting the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.50% |

|

Segments Covered |

By Product, Disease Indication, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Pfizer Inc., Novartis AG, Wolters Kluwer, Solvay, Allergan plc., Sumitomo Dainippon Pharma Co. Ltd., Indivior Plc., MonoSol Rx, IntelGenx Corp., ZIM Laboratories Limited, IntelGenx Corp., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The oral thin film sub-segment is anticipated to hold the largest share of the Product market segment, followed by a transdermal thin film. An oral thin film (OTF) is a fragile film composed of a single-layer or multi-layer polymer matrix applied in the mouth. ETFs are typically water-soluble polymers designed to deliver drugs quickly and consistently. Some OTFs include Oromucosal films, placed on or under the tongue or cheek; mucoadhesives, which adhere inside the oral cavity to release drugs directly into the patient's systemic circulation through the mucous membrane.

The transdermal thin film drug segment is foreseen to hold a good market share due to the transdermal thin film delivery-focused upcoming therapies, which would increase the demand for the product. Furthermore, it is believed that the development of transdermal thin film delivery, especially in pain management, will significantly benefit the drug class in the coming years. Transdermal drugs control and treat various conditions, such as motion sickness, hypertension, pain, migraines, etc., by reducing drug interactions. Some of the advantages offered over oral delivery are increased bioavailability, continuous drug delivery, and a visual signal through patches.

By Disease Indication Insights

The schizophrenia and migraine segments are prophesied to dominate the market over the forecast period due to its wide adoption by patients who have schizophrenia as a result of its beneficial underlying factors, rapid absorption of the drug in the mucosa, quick onset of pain relief, especially for migraine, ease of swallowing tablets, and high effectiveness.

By Distribution Channel Insights

The retail pharmacy segment is foreseen to dominate the market, owing to the easy availability of a wide range of products. In addition, checking doctors' prescriptions before dispensing medication to patients is a pharmacist's duty to ensure the proper medication is given to the patients, leading to increased preference for retail pharmacies among end users.

REGIONAL ANALYSIS

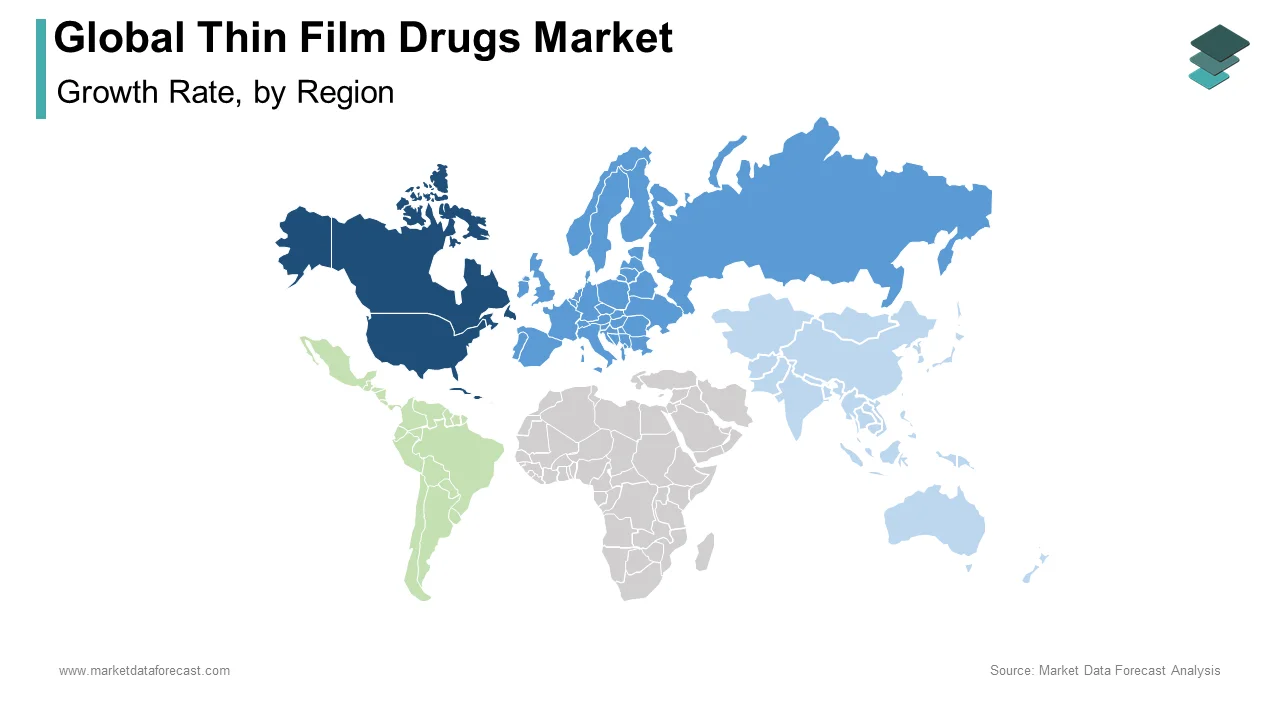

North America accounted for the largest share of the market owing to factors such as pharmaceutical research advancements and extensive research and development investments. Moreover, a steadily rising demand for novel drug delivery is further expected to aid the regional market's growth. In addition, advanced technologies used in pharmaceutical research and development, the growing demand for effective drug delivery routes, the discovery of new drug delivery techniques, and the increasing number of research partnerships are other drivers expected to augment the market growth.

Europe is anticipated to be driven by increasing thin film drug research and development activities, rising geriatric patients, increasing prevalence of Parkinson's disease, and the introduction of oral thinner films in the area.

Asia-Pacific is anticipated to be driven due to factors such as increasing government funding for innovative drug delivery models, an increase in the number of geriatric patients suffering from indicated diseases, like Parkinson's disease, which increases with age, and the increase in the introduction of oral thin films.

KEY MARKET PLAYERS

Companies leading the Global Thin Film Drugs Market profiled in this report are Pfizer Inc., Novartis AG, Wolters Kluwer, Solvay, Allergan plc., Sumitomo Dainippon Pharma Co. Ltd., Indivior Plc., MonoSol Rx, IntelGenx Corp., ZIM Laboratories Limited, and IntelGenx Corp.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, Aptar Pharma, a global leader in active materials science, collaborated with TFF Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, to test and develop the administration of dry powder vaccines for local administration using TFF Pharmaceutical's Thin Film Freezing technology and Aptar Pharma's proprietary intranasal Unidose (UDS) Powder Nasal Spray System.

- In October 2022, IntelGenx Corp., a leading pharmaceutical films drug Delivery Company collaborated with Atai Life Sciences for new formulations based on IntelGenx polymer film technologies using Atai's digital therapy for contextual settling and adjusting support to patients.

- In September 2022, TFF Pharmaceuticals, Inc. researched the use of thin layer freezing for the production of inhaled dry powder formulations of monoclonal antibodies, which has been accepted for the American Association of Pharmaceutical Scientists (AAPS) PharmSci 360 meeting,

- In March 2022, Cure Pharmaceuticals, a developer of innovative delivery formulations for drugs, and Milagro Pharmaceuticals collaborated to sell a wide range of CUREform's over-the-counter compounds, offering uniquely controlled machines designed to improve drug efficacy.

- In April 2020, IntelGenx, a top leader in manufacturing films, made a public statement that it received an acceptance from the U.S. FDA associated with its resubmission of 505 (b) (2) for its new drug application for RIZAPORT Versafilm.

- In September 2019, Allergan Plc publicly stated that it had received the U.S. FDA acceptance for using JuvedermVOLUMA XC, a hyaluronic acid gel dermal filler with a TSK STERiGLIDE. This approval is expected to level up the company's position in the market.

MARKET SEGMENTATION

This research report on the global thin film drugs market has been segmented and sub-segmented into the following categories.

By Product

- Oral Thin Film

- Sublingual Film

- Entirely Dissolving Dental/Buccal Film

- Transdermal Thin Film

By Disease Indication

- Schizophrenia

- Migraine

- Opioid Dependence

- Nausea and Vomiting

By Distribution Channel

- Hospital Pharmacies

- Drug Store

- Retail Pharmacies

- E-Commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

At What CAGR, The thin film drugs market is expected to grow from 2025 to 2033?

The thin film drugs market is expected to grow at a CAGR of 10.50% during the forecast period 2025-2033.

Which region has the highest market share in the thin film drugs market ?

North America has the highest market share and dominates the thin film drugs market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com