Global Antacids Market Size, Share, Trends & Growth Analysis Report – Segmented By Drug Class (Proton Pump Inhibitors, H2 Antagonist, Pro-motility agents and Acid Neutralizers), Formulation Type (Tablet, Liquid, Powder), Distribution Channel & Region (North America, Europe, APAC, Latin America, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Antacids Market Size

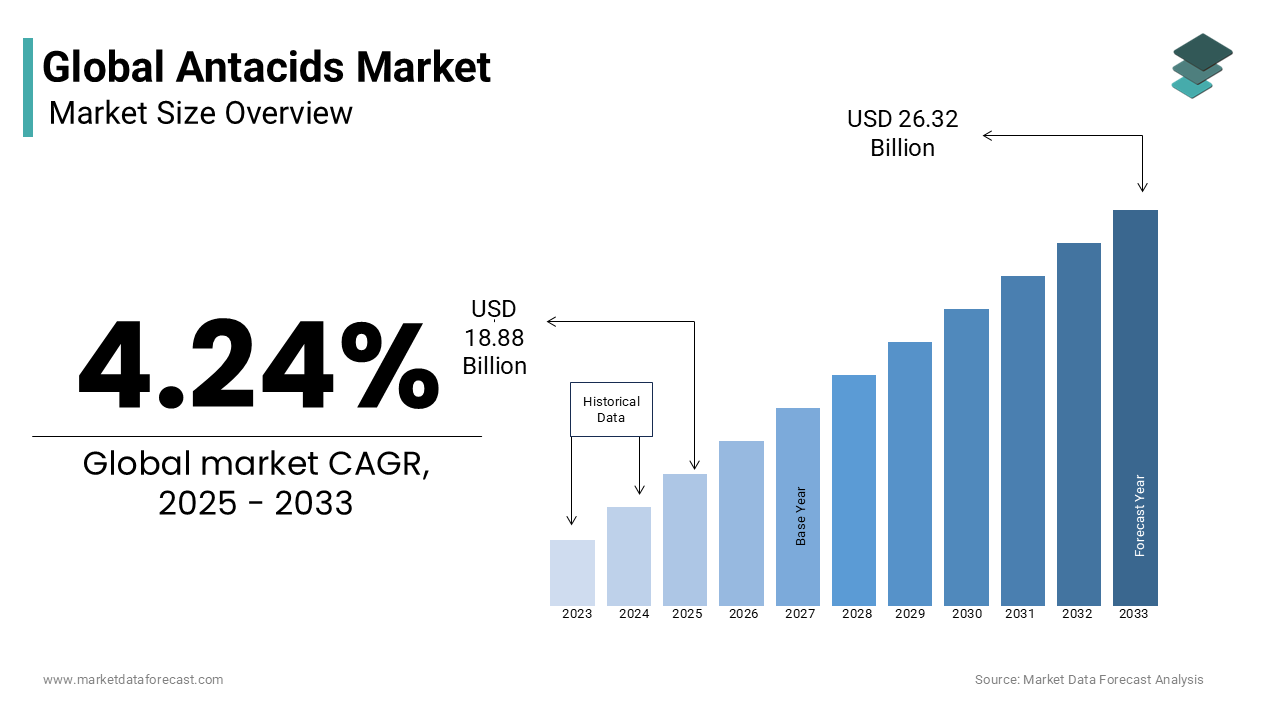

As per our report, the global antacids market is predicted to be worth USD 26.32 billion by 2033 from USD 18.88 billion in 2025, growing at a CAGR of 4.24% during the forecast period. The antacids market size was valued at USD 18.11 billion in 2024.

Antacids are a group of medications that help neutralize the content of acid reflux in the stomach. It provides fast relief of heartburn, one of the main symptoms of gastroesophageal reflux digestion, and other symptoms are nausea, bloating, or belching. Antacids include magnesium carbonate, aluminum hydroxide, and magnesium trisilicate. However, some people have reported allergic reactions to antacids. Antacids incorporate magnesium carbonate, aluminum hydroxide, and magnesium trisilicate. In addition, a few people have announced unfavorably susceptible responses to antacids.

MARKET DRIVERS

Antacids are used to neutralize acidity and should cause a dramatic increase in demand. However, according to a study conducted by the American Gastroenterological Association and published in the International Functional Foundation in February 2017, about one-third of the US population suffered from GERD. In addition, the trend toward self-medication is increasing the demand for over-the-counter digestive products to treat gastrointestinal disorders, which is estimated to reflect the growth rate of the global antacids market.

The rise in the popularity of over-the-counter drugs through digital advertisements and campaigns is lucrative to surge growth opportunities for the antacids market. The increasing prevalence of treatment for gastrointestinal problems worldwide propels the antacids market. As the Centers for Disease Control and Prevention (CDC) mentioned, an estimated 14.8 million people from the United States suffered from digestive diseases in 2018. In addition, the growing aging population is anticipated to contribute to the growth of the antacids market. Acidity complications show a higher risk in aging people. According to World Health Organization (WHO), an estimated 1 in every six people are expected to age more than 60 years by 2030.

The adoption of sedentary lifestyles also leads to several problems related to acidity, which is expected to reflect in the market growth for antacids. Growing demand for early diagnosis among individuals, increasing focus on releasing quality drugs, and a high production rate are further expected to promote the market’s growth rate during the forecast period. Furthermore, rising disposable income in urban areas and the growing priority for self-medication support the antacids market and help to register increased growth. In addition, growing awareness of the early symptoms of gastrointestinal diseases is a plus to the market growth.

Antacids improve blood sugar control in people who are suffering from diabetes. Most people worldwide have Type 2 diabetes affecting almost 10 percent of people. According to recent studies on antacids, this is used for maintaining glucose levels in diabetes patients, which drives the market forward. In addition, the availability of different antacids such as chewable, gums, and jelly drives the market forward.

MARKET RESTRAINTS

Factors such as some side effects such as constipation, laxative effect, and allergic reactions are expected to restrain the growth rate of the global antacids market. Also, people suffering from certain medical conditions are prone to adverse impacts that worsen their health. For example, heart disease may have problems due to the high amount of sodium in antacids. Pregnant women are also not recommended to take this antacid medicine containing bicarbonate. This is because these antacids are not suitable for fetal metabolic. If the usage of this antacid increases, the dosage will lead to a severe result which will restrain the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Drug Class, Formulation Type, Distribution Channel, Disease Indications, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

GlaxoSmithKline PLC, Abbott Laboratories, Pfizer, Inc., Sun Pharmaceuticals, and Dabur |

REGIONAL ANALYSIS

Global Antacids Market Analysis By Drug Class

The proton pump inhibitors segment led the market in 2023, and the trend is anticipated to continue in the forecast period. Proton pump inhibitors reduce the body's production of acid. These work for heartburn. PPIs containing a benzimidazole nucleus and diverse branch structures are available in Japan and include omeprazole, esomeprazole, lansoprazole, and rabeprazole. These medications are taken on an empty stomach, about 30 minutes before breakfast. However, the acid neutralizer segment is significant because of its occasional heartburn and availability range.

By Formulation Type Insights

The tablet segment held the majority of the share in the global market in 2023 and is anticipated to be the fastest-growing segment due to convenience in administration, low pricing, and availability.

The liquid segment is anticipated to register a healthy growth rate during the forecast period. Liquid antacids usually work faster than other forms. This liquid medication works only on acids present in the stomach. These liquids take medication by mouth, after meals as needed.

By Distribution Channel Insights

The online pharmacies, drug stores and pharmacies at the hospitals segments are expected to occupy most of the market share during the forecast period. The rising adoption of e-commerce and increased online stores boost the market's growth.

By Disease Indications Insights

The cardiovascular disorders segment captured the leading share of the global antacids market in 2023. Heart attack symptoms can also include heartburn on their own. They also include pressure, tightness, and pain in the chest. In addition, heartburn is a common symptom of gastroesophageal reflux disease. For these diseases, antacid tablets are used for primary treatment.

REGIONAL ANALYSIS

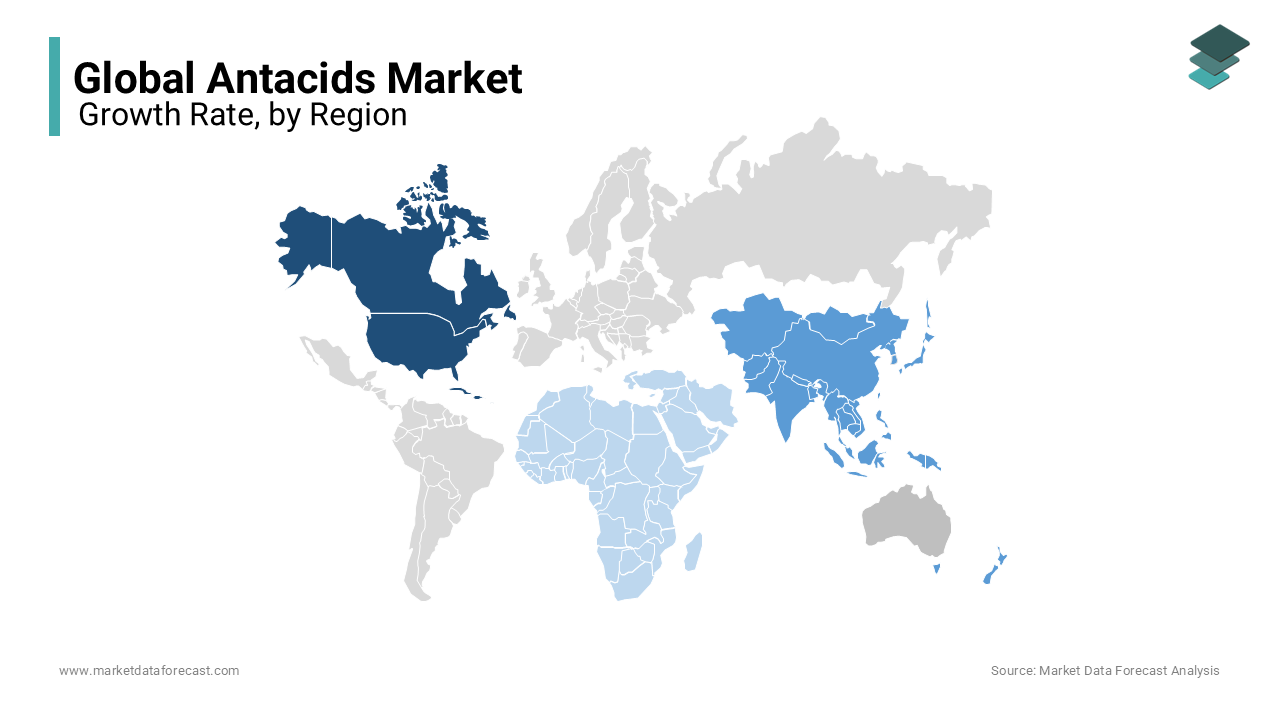

The North American region held the leading share in the overall market in 2023 due to the increasing number of gastro-oesophageal diseases and the growing senior population. Most Americans are suffering from Gastroesophageal reflux disease (GERD) due to changes in lifestyle and other reasons. In addition, due to the increase in the prevalence of heartburn at least once per week in North America, about 25% of adults report heartburn daily. Pepcid Complete is currently using an antacid drug available in Canada that contains an antacid with an H2 blocker. This drug gives fast relief from heartburn. Millions of Canadians use antacid drugs. Health Canada is guiding Canadians to specifically use the prescription stomach antacids known as proton pump inhibitors (PPIs). The FDA asked manufacturers to expand their research and testing of every antacid drug and the medication levels and side effects of this drug if they use it continuously. Based on these results, the usage period and the drugs present in the antacid should be modified to reduce the side effects. All these factors drive the antacid market forward in this region.

The Asia Pacific market stood second in accounting for a significant share of the global market in 2023. Due to improvements and healthcare services, China and India are the dominant regions. Most Indians use this Antacid Tablet to treat acidity, bloating, neutralizing, and releasing excess gas in the stomach and stomach ulcers. China also uses this antacid due to an unhealthy diet, which leads to stomach acidity problems, and drives the market forward.

The market in Europe held a substantial share of the global market in 2023. In Europe, these Antacids are commonly used in the elderly population suffering from obesity. In addition, gastro-oesophageal reflux disease has increased in this region over the past few years. In Germany, 15% of adults suffer moderate to high reflux symptoms.

The Latin American region is estimated to be growing at a CAGR of 3.9% from 2024 to 2032.

The market MEA is forecasted to be worth USD 1.58 billion by 2029. UAE and Saudi Arabia health ministries have imposed many rules and regulations on the usage of antacid tablets. For example, the UAE's Ministry of Health and Prevention (MoHAP) issued a circular to all health facilities and practitioners that there should be a clear report of their medical condition to use this antacid medicine. In these regions, researchers are working on producing antacids with fast recovery and fewer side effects. Therefore, these regions will have market share in the coming years.

KEY PLAYERS IN THE GLOBAL ANTACIDS MARKET

GlaxoSmithKline PLC, Abbott Laboratories, Pfizer, Inc., Sun Pharmaceuticals, and Dabur dominate the global antacids market.

RECENT HAPPENINGS IN THIS MARKET

- In March 2020, Lupin introduced the approved generic for Horizon Therapeutics PLC's Vimovo (naproxen/esomeprazole magnesium) delayed-release tablets in the United States The drug is a mixture of naproxen and esomeprazole magnesium, with naproxen used for the symptomatic treatment of arthritis and esomeprazole magnesium is used to reduce the risk of naproxen-associated stomach ulcers.

- In October 2020, Dr. Reddy's Laboratories reintroduced Famotidine Tablets USP, 10 mg and 20 mg, as an over-the-counter (OTC) medication in the United States.

- In January 2019, Dr. Reddy's laboratories released generic omeprazole delayed-release tablets to treat heartburn in the United States.

- In 2022, the United States Food and Drug Administration (USFDA) approved Famotidine Tablets. This is used to reduce the amount of acid in the stomach.

- In 2016, Sun Pharma launched an Ayurvedic digestive remedy called Pepmelt to compete with popular antacids such as ENO (Consumer Health), Digene (Abbott India), Pudin Hara (Dabur), and Gelusil (Pfizer).

MARKET SEGMENTATION

This market research report on the global antacids market has been segmented and sub-segmented based on the drug class, formulation type, distribution channel, disease indications, end-user, and region.

By Drug Class

- Proton Pump Inhibitors

- H2 Antagonist

- Pro-motility agents

- Acid Neutralizer

By Formulation Type

- Tablet

- Liquid

- Powder

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Disease Indications

- Cancer

- Cardiovascular Disorders

- Neurological Disorders

- Immunological Disorders

- Other Diseases

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the antacids market?

As per our research report, the global market size for antacids is expected to be worth USD 26.32 billion by 2033.

Does this report include the impact of COVID-19 on the antacids market?

Yes, we have studied and included the COVID-19 impact on the global antacids market in this report.

Which geographical region dominated the antacids market in 2023?

Geographically, the North American region accounted for the largest share of the global antacids market in 2023.

Who are the major players in the antacids market?

GlaxoSmithKline PLC, Abbott Laboratories, Pfizer, Inc., Sun Pharmaceuticals, and Dabur are a few of the noteworthy companies in the global antacids market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com