Global ePharmacy (Online Pharmacy) Market Size, Share, Trends & Growth Analysis Report - Segmentation By Drug Type (Prescription Drugs & Over the Counter Drugs), Product Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Forecast, 2025 to 2033.

Global ePharmacy Market Size

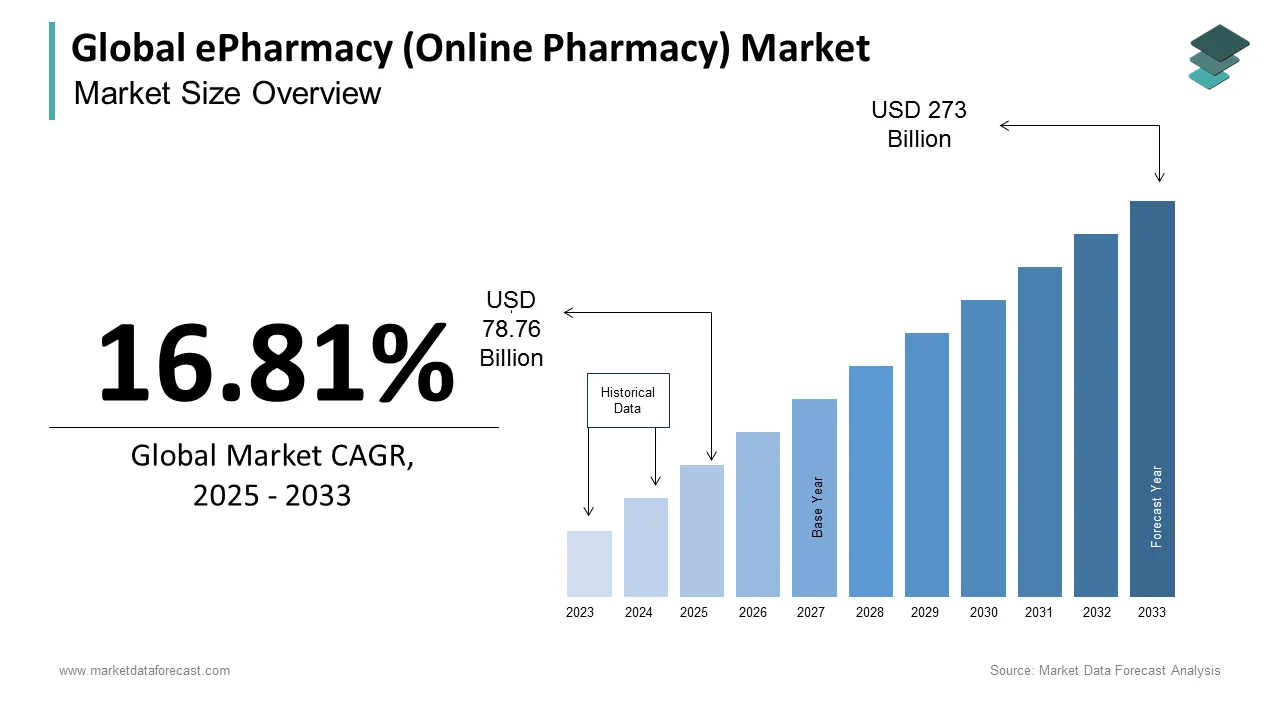

The size of the global ePharmacy market (online pharmacy market) was worth USD 67.43 billion in 2024. The global market is anticipated to grow at a CAGR of 16.81% from 2025 to 2033 and be worth USD 273 billion by 2033 from USD 78.76 billion in 2025.

The perceptions of pharmacists have been gradually changing towards selling drugs using the Internet through websites/applications, and people are also quietly adopting these changes. Overcoming the traditional way of purchasing prescribed or non-prescribed drugs in offline stores is gradually shifting online where one can order prescribed or non-prescribed drugs through the website or application using an internet connection that will be delivered to the doorstep without even moving out of the place.

-

According to the Food and Drug Administration, there are more than 35,000 online pharmacies globally with legal certifications, and today's generation of people greatly emphasizes the popularity of purchasing medications online. Elderly and disabled people can benefit from e-pharmacies as medicines can be delivered to their doorsteps.

-

According to the National Centre for Biotechnology Information, more than 10.7% of people above the age of 60 years are using online pharmacies in the U.S.

MARKET DRIVERS

The growing penetration of the Internet worldwide is contributing to the growth of the ePharmacy market.

The penetration of the Internet has grown rapidly in the last couple of decades in many countries. The growing affordability and availability of the Internet have resulted in the increasing accessibility to the Internet to many people worldwide and helped consumers access healthcare services online and order medicines using available online platforms.

- According to the data published by the International Telecommunication Union (ITU), more than 67% of people across the world will be using the Internet in 2023, which is approximately 5.4 billion people.

This trend is expected to be further fueled in the coming days owing to the growing accessibility of Internet services to people. The growing usage of the Internet is resulting in the increasing use of online channels to avail healthcare information and services, including medicines, which is one of the primary factors contributing to the increasing demand for online pharmacies as these are convenient options for consumers to purchase medicines.

The adoption of online pharmacies is growing significantly worldwide, propelling the ePharmacy market growth.

The convenience and accessibility of online pharmacies to purchase medicines have been playing a big role in the adoption of online channels for medicinal requirements. In the future, online pharmacies are predicted to replace traditional pharmacies to a considerable level. The recent COVID-19 pandemic has significantly boosted the adoption of online pharmacies as people have turned to online channels to buy their medications, contributing to the increasing demand for online pharmacies. During the COVID-19 pandemic, a few online pharmacy companies even included services such as telemedicine, rapid home delivery, and other value-based services. Online pharmacies are a much more convenient option for people suffering from chronic diseases as these people require ongoing medication management and frequently purchase medications and the growing patient population of chronic diseases is expected to drive ePharmacy market growth. Across the world, the number of people suffering from chronic diseases is growing significantly, and the mortality burden is high from chronic diseases.

- According to the World Health Organization (WHO), 41 million people die annually from chronic diseases.

Factors such as cost savings associated with online pharmacies, the growing aging population worldwide, increasing efforts from the governments of various countries to promote the usage of online pharmacies and integration with healthcare providers are fuelling the global market growth. Online pharmacies are increasingly offering personalized and customized services, such as medication reminders, dosage tracking, and tailored treatment plans, to improve patient outcomes and increase customer loyalty, which is another notable factor boosting the market growth. In addition, the high unmet needs for pharmaceutical products in developing countries and the growing penetration of e-commerce platforms worldwide favor the ePharmacy market growth. The growing trend of e-prescriptions in hospitals and other healthcare services supports the growth of the online pharmacy market. According to a survey conducted among 1055 outpatients by the National Center for Biotechnology Information (NCBI) in 2023, out of 487 participants, 89.3% of people have said that they have an awareness of online pharmacies, and 60.2% of people have already purchased drugs through online pharmacies.

Furthermore, the growing adoption of technological developments such as Artificial Intelligence (AI), Machine Learning (ML), big data analytics, and others to develop new online pharmacies and upgrade the capabilities of existing online pharmacies is predicted to boost the growth rate of the ePharmacy market. The growing implementation of e-prescription, which is an easy and convenient process for pharmaceutical companies, is expected to contribute to the growth of the ePharmacy market.

MARKET RESTRAINTS

The rise in fraud activities hampers the global market growth.

Security and privacy concerns among people and strict regulations for the sale of prescription drugs through online channels are hampering the growth of the ePharmacy market. Sales of prescription drugs through the electronics industry in North America and Europe are highly regulated. Companies must comply with various rules that could impact the growth of the ePharmacy market. Besides, not all countries have legalized the sale of prescription drugs through websites. It is believed that factors such as the unregulated sale of prescription drugs that could lead to online drug bans will lead to lower revenue in the world ePharmacy Market.

- Recently, in 2024, FDA (Food and Drug Administration) authorities issued warning letters to online pharmacies for violating the regulations issued by the U.S. Federal Foods, Drug, and Cosmetic Act and prescribing dangerous drugs to U.S. consumers.

Possible confidentiality, improper packaging, and failure to verify drug interactions are other significant challenges that can slow market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Drug Type, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

CVS Health, Walmart Stores, Inc., Walgreen Co., The Kroger Co., Rite Aid Corp, Lloyds Pharmacy Ltd., Planter, Canada Drugs, Medicate, Express Scripts Holding Company, Secure Medical Inc., Sani care A.B., Doctors Rowlands Pharmacy, Giant Eagle, Inc. AND Optus Rx, Inc. |

SEGMENTAL ANALYSIS

By Drug Type Insights

Based on drug type, the OTC drugs segment had the major share in the global online pharmacy market in 2024. The domination of the OTC drugs segment is likely to continue throughout the forecast period owing to the increasing adoption of online pharmacies to purchase OTC drugs, increasing reliability and convenience of consumers. The availability of a wide range of OTC drugs is limited in traditional pharmacies, and online pharmacies provide access to various OTC drugs, which is another major attribute contributing to the growth of the segment. According to the National Institutes of Health, more than 70% of Americans are purchasing OTC drugs through online pharmacies. OTC drugs are available at a lower price in online pharmacies than in traditional pharmacies, and due to this, consumers are showing an increased willingness to purchase OTC drugs using online pharmacies, which is fuelling the growth rate of the segment.

The prescription drugs segment accounted for a substantial share of the global market. The pharmacy market in 2023 is expected to witness a notable CAGR during the forecast period. The convenience of online pharmacies to order prescription drugs, increasing awareness among consumers regarding how to use online pharmacies to order prescription drugs and personalized services of online pharmacies such as automatic refill reminders and access to licensed pharmacists who can answer questions and provide advice are primarily contributing to the growth of the prescription segment.

By Product Type Insights

The cold and flu segment is anticipated to hold a notable share of the worldwide market based on product type. The recent COVID-19 pandemic has significantly contributed to segmental growth. During the COVID-19 pandemic, the demand for cold and flu products has grown significantly. During the COVID-19 pandemic, people's awareness of respiratory diseases has increased notably, and many have taken preventative measures such as wearing masks, washing hands frequently, and taking medications for cold and flu. Currently, many consumers have shifted to using online pharmacies to order cold and flu medications instead of visiting traditional pharmacies, and this trend is predicted to accelerate in the coming years and favors segmental growth. Furthermore, the convenience and cost savings of ordering medications online propel segmental growth.

On the other hand, the skin care segment held a considerable share of the ePharmacy market in 2023. The skin care segment is also anticipated to register a healthy CAGR during the forecast period, owing to the increasing concern towards beauty consciousness. On the other hand, skin care and nutrition are more lucrative segments than others. Nutritional factors such as vitamins and body gain and loss powder have recently influenced the e-pharmacies market. Also, females have an enormous demand for skin care products through e-pharmacies.

REGIONAL ANALYSIS

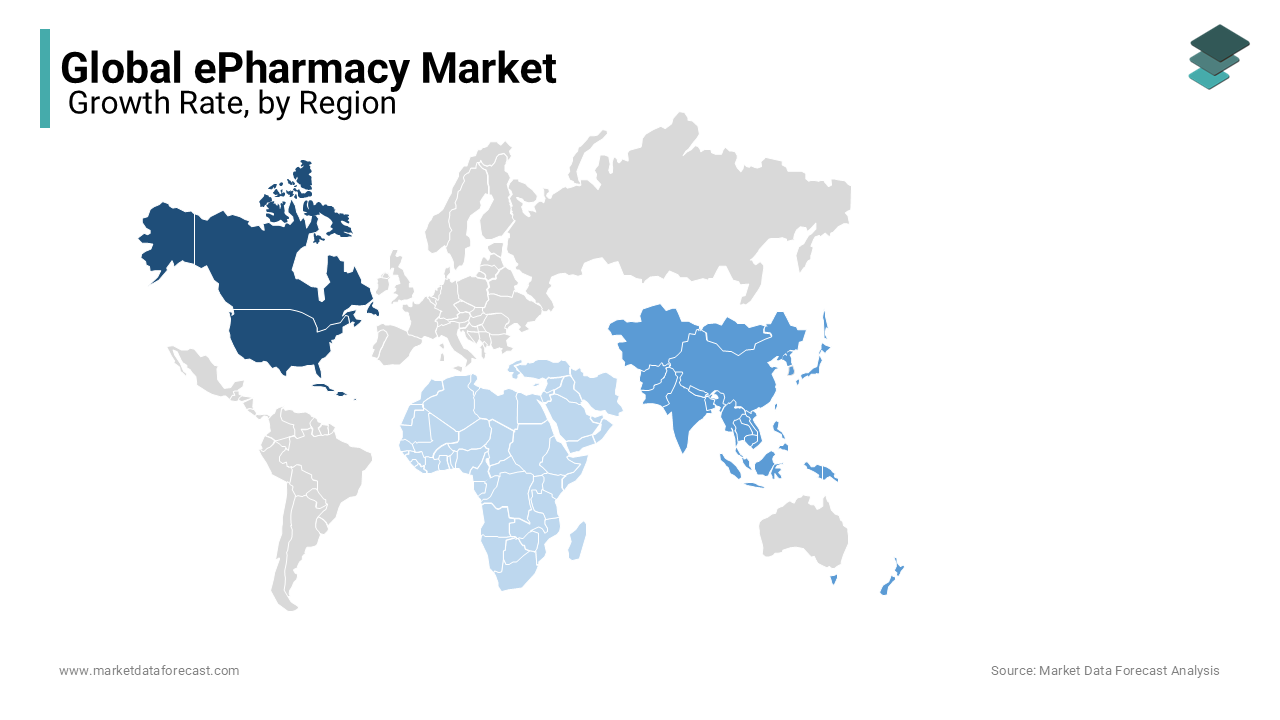

North America accounted for the dominant share of the global market in 2024.

The rapid adoption of e-commerce majorly drives the growth of the North American online pharmacy market, the increasing adoption of technological developments in the healthcare industry, and the rising usage of online pharmacies by the North American population to purchase medications. The presence of key market participants and increasing R&D efforts by the market participants are further fuelling the growth rate of the North American market. In 2023, the U.S. ePharmacy market accounted for the largest share of the North American market, followed by Canada. During the forecast period, the U.S. online pharmacy market is predicted to showcase a promising CAGR, and the growth of the U.S. market is attributed to the increasing patient population of chronic diseases and rising health consciousness among the U.S. population. The growing aging population and the presence of well-established I.T. infrastructure in the U.S. favor the growth of the U.S. ePharmacy market. Increasing support by regulatory bodies to promote awareness regarding the benefits of online pharmacies supports the U.S. market growth.

APAC stood as the second-largest regional market globally in 2024. The growth of the Asia-Pacific region in the worldwide market is primarily attributed to the growing patient population of various diseases, the presence of emerging economies, and the large population. During the forecast period, China and India are predicted to capture the leading share of the APAC online pharmacy market. The growing emphasis of international market players to capture the market potential of China and India and an increasing number of local players propel the ePharmacy market growth in China and India. The implementation of new technologies and rapid penetration of web and cloud-based technologies boost the regional market growth. In India, the number of online pharmacy stores is increasing with the government authorities' initiative. For instance, in 2024, the Government of India (GoI) and the Ministry of Health and Family Welfare (MoHFW) launched public health-oriented initiatives such as SUGAM, E-hospital@NIC, National Health Portal, and others with the help of information and communication technologies. In addition, changing lifestyles and a rising number of people suffering from non-communicable diseases such as diabetes and hypertension in India are prompting the need for medications to be purchased simply through mobile applications.

The European region accounted for a substantial share of the worldwide market in 2024. The growing adoption of online pharmacies to purchase medications by the European population, the increasing patient count suffering from chronic diseases, and the rising aging population across the European region propel the ePharmacy market growth in Europe. According to the European Commission, more than 36.% of the European population will be suffering from any kind of chronic disease in 2022. Zur Rose Group, Shop Apotheke, Pharmacy2U, and DocMorris are some of the notable companies in the European online pharmacy market. During the forecast period, Germany, France, and the U.K. are predicted to control the leading shares of the European market.

The Latin American region is predicted to occupy a considerable share of the worldwide market during the forecast period. The growth of the Latin American market can be attributed to factors such as the growing adoption of e-commerce platforms and increasing internet penetration are primarily driving the online pharmacy market growth in Latin America. Countries such as Brazil and Mexico play a vital role in the Latin American region and assist the region in registering a healthy CAGR. Countries are quietly adopting the latest trends in healthcare, and the penetration of high internet speed is one of the major factors in the growth of online pharmacies. Latin America stood as the fourth largest region in the world in utilizing the Internet, with more than 533.17 million users.

The Middle East and Africa are expected to have a favorable CAGR during the forecast period. Growing emphasis on digitization in the healthcare sector and rising internet penetration and smartphone adoption are boosting the ePharmacy market growth in MEA. On the other hand, the UAE is estimated to showcase a healthy CAGR during the forecast period. UAE is one of the prominent countries in expanding high-speed internet activities around the world. Growing expenditure on healthcare and the availability of prominent support from healthcare providers in quickly adopting the new technologies are greatly influencing the growth rate of the ePharmacy market in the Middle East & Africa.

KEY MARKET PLAYERS

Some of the notable companies playing a crucial role in the global ePharmacy market profiled in this report are CVS Health, Walmart Stores, Inc., Walgreen Co., The Kroger Co., Rite Aid Corp, Lloyds Pharmacy Ltd., Planter, Canada Drugs, Medicate, Express Scripts Holding Company, Secure Medical Inc., Sani care A.B., Doctors Rowlands Pharmacy, Giant Eagle, Inc. AND Optus Rx, Inc.

RECENT HAPPENINGS IN THIS MARKET

- In March 2019, in India, the National Association of Boards of Pharmacy (NABP) certified 1mg with LegitScript. It is the first company in India to get this certificate.

- In January 2019, Meds, a Swedish online pharmacy company, focused on expanding its business across Europe by funding USD 5.5 million. In addition, it is to increase its portfolio in the market.

- In November 2016, the Hyperlocal drug delivery app was acquired by Netmeds Marketplace, delivering an application named Pluss for an undisclosed amount.

- In June 2015, the acquisition between Rite Aid Corp and Envision Rx Options made many developments in the pharmacy market. Mail-order pharmacies, along with prescription medicines, are provided due to this acquisition. With this acquisition, Rite Aid Corp entered the market and led with the most significant share.

MARKET SEGMENTATION

This research report on the global ePharmacy market has been segmented and sub-segmented based on the drug type, product type, and region.

By Drug Type

- Prescription Drugs

- Over-the-Counter Drugs

By Product Type

- Skin Care

- Dental

- Cold And Flu

- Vitamins

- Weight Loss

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the online pharmacy market?

The global online pharmacy market size is estimated to be valued at USD 273 billion by 2033.

How much was the global ePharmacy market worth in 2024?

The global ePharmacy market size was valued at USD 67.43 billion in 2024.

Which segment by drug type accounted for the major share of the ePharmacy market in 2024?

The OTC drugs segment accounted for the biggest share of the global ePharmacy market in 2024.

Which region is anticipated to register fastest CAGR in the global ePharmacy market?

Geographically, the APAC regional market is growing aggressively and is predicted to showcase the fastest CAGR.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]