Global Pharmacy Automation System Market Size, Share, Trends and Growth Analysis Report – Segmented By Product (Automated Medication Dispensing Systems,Automated Packaging and Labeling Systems,Automated Table-Top Counters), End-User and Region - Industry Forecast (2025 to 2033)

Global Pharmacy Automation System Market Size

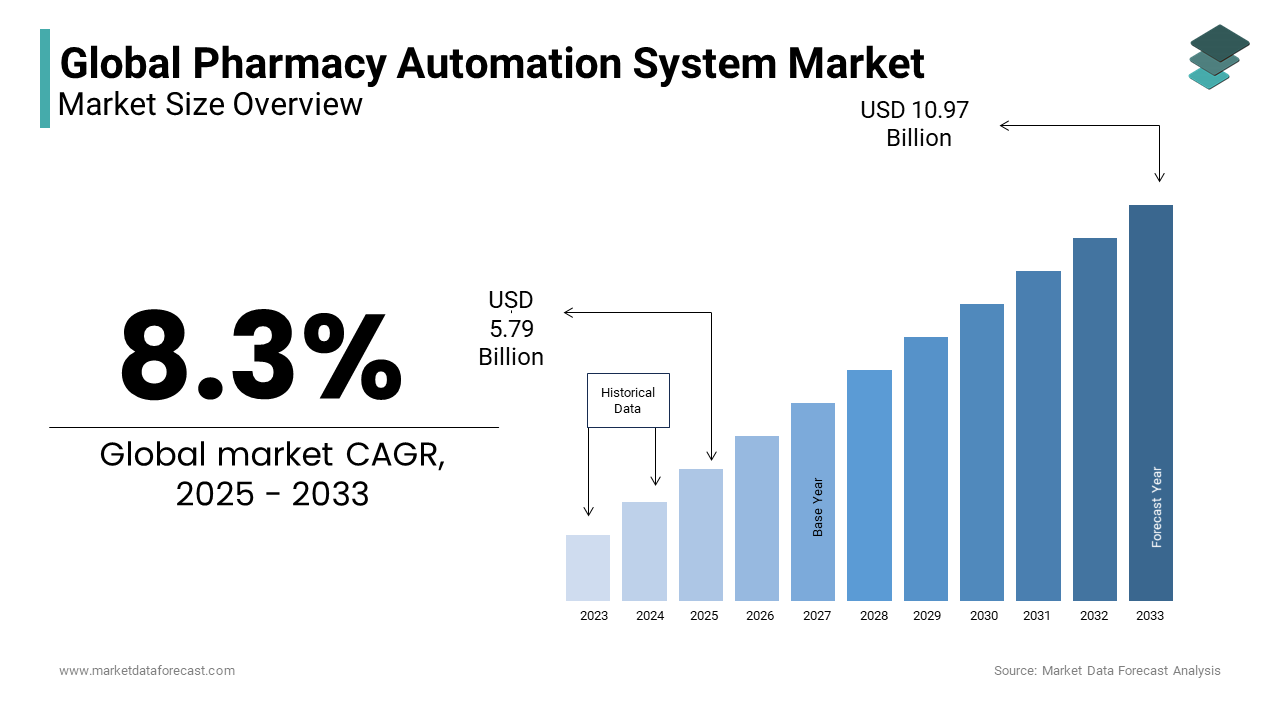

In 2024,the global pharmacy automation system market was valued at USD 5.35 billion and it is expected to reach USD 10.97 billion by 2033 from USD 5.79 billion in 2025, growing at a CAGR of 8.3 % during the forecast period.

Pharmacy automation system are used for inpatient, patient, and outpatient pharmacies to automate the routine task of a pharmacist, thereby automating the entire mechanical process of handling and distributing medications. But these systems also aid in measuring and compounding medications, updating and tracking patient information in databases, and inventory management. Pharmacy automation system also count medications more accurately and quickly. They complete the tasks in less than the projected time and reduce labor costs. Pharmaceutical industries have adopted these from the early days to maintain safety in the workflow. Besides counting the tablets, the systems also prioritize the patient’s safety as they ensure the right dosage of tablets while dispensing. The use of pharmacy automation system tends to have fewer errors and delivers the right medication at the right time.

MARKET DRIVERS

Increasing adoption and growing demand for automated solutions in pharmacies conjoined with socio-economic factors such as rising disease incidences due to a growing aging population drive the global pharmacy automation system market.

There is an increasing inclination of pharmacists for automation system since it automates time-consuming and routine tasks like medication compounding, storage, packaging, dispensing, retrieval, etc. These automation solutions streamline pharmacy workflow and decrease the risk of errors, allowing physicians to focus on direct patient-care activities. Secondary growth drivers are product innovations and growing rates of hospitalizations. Through Pharmacy Automation System, hospitals can track and manage drugs, supplies, and health information regarding patients, thereby replenishing only the needed items. This growing demand for effective and transparent tracking systems is anticipated to drive the revenue for Pharmacy Automation System as it accurately records medication expiry dates and physical quantities.

The increase in deaths and injuries caused by drug prescription errors pushes medical providers and pharmacists to achieve more effective technology. Besides, drug delivery systems are increasingly involved with the pressure to guarantee safety requirements and increase patient visits. Advanced automation technologies and solutions are becoming the most effective tool to reduce medication errors and improve patient safety. By installing an automated system, pharmacists and healthcare providers can reduce pharmacy costs. Automation can be used for tablet calculations, compound preparation, prescription management, drug packaging, dispensing, and inventory management. When integrating multiple technologies, all the benefits of each system can be realized.

The pharmacy market's automation is expected to reduce medication errors, increase the number of doses of patients, increase medical costs, and increase the pressure on the temporary efficiency of these technologies. It is expected that the increase in the demand for pharmaceutical products, the rise of technology, and the need for precision robotic equipment and tools to carry out at higher speeds are vital factors in the growth of the market. It is expected that Brazil, China, and India, together with the growing need for pharmacy and health operations automation and unexploited growth opportunities, will boost growth during the forecast period. Rigorous government regulations on packaging, labeling, and pharmaceutical mixes also accelerate the need for automated packaging and labeling technologies.

The growing prevalence of safer medications with the rise in chronic disease incidences is a significant factor for the market's growth. In addition, the increasing number of hospitals and their demand for pharmaceutical industries worldwide also fuel the need for the market. The emergence of the latest technologies and increased focus on introducing various innovative systems for the pharmacy merely surges the growth opportunities for the market. The changes in the schemes by the government in favor of the poor people are also propelling the Pharmacy Automation System market to grow further.

MARKET RESTRAINTS

But still, the cost of implementing and installing pharmacy automation system is the primary factor hindering the growth of the market over the forecast mentioned above. The lack of complete knowledge of updated systems in rural areas is restraining the growth of the market. The cost of installing and maintaining the systems is a little high, which cannot be affordable by the small-scale industry but remains challenging for the market. Additionally, high implementation costs are an important challenge for the development of this technology. Vendors will find ample opportunities in this market by developing economic technologies for small hospitals and pharmacies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.3 % |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leader Profiled |

Becton, Dickinson, and Company (U.S.), Omnicell, Baxter International, Inc. (U.S.), ScriptPro LLC (U.S.), KUKA AG (Germany)

|

SEGMENTAL ANALYSIS

By Product Insights

The automated medication dispensing systems segment is in the top position with the market's highest share based on the product.

By End User Insights

Based on end-user, Retail pharmacies are anticipated to be the fastest-growing end-user category in the pharmacy automation market during the forecast mentioned above. An increasing number of retail pharmacies and a growing workload on pharmacists are the primary factors driving the rising adoption of Pharmacy Automation Systems in retail pharmacies.

REGIONAL ANALYSIS

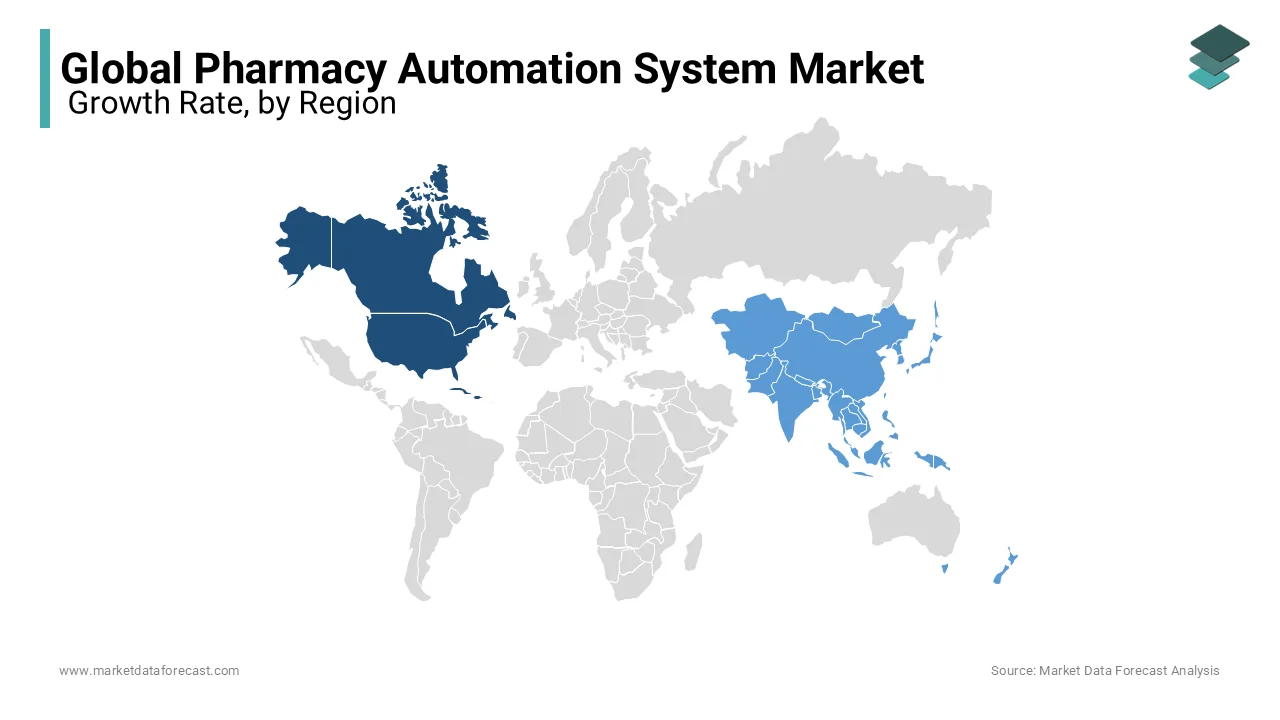

In 2023, North America accounted for the largest share of the global pharmacy automation market, primarily attributed to the increasing number of drug prescriptions at pharmacies resulting from growth in the aging population.

North America holds the Global market due to the quick adoption of the latest technologies and increased demand for patient safety. The Asia Pacific and Europe are following North America to lead the dominant shares of the market with the rise in government investments in hospitals and the emergence of software technology into the field.

Furthermore, growth in insurance coverage in the U.S. has increased the country’s healthcare system's burden, highlighting the need to improve the efficiency and management of work in North America. The rapid rise in the number of patients, demand for quality care, and significant up-gradation of the healthcare IT infrastructure is expected to positively impact the need for the Pharmacy Automation System market in APAC and Latin America.

KEY MARKET PLAYERS

Key market participants dominating the global pharmacy automation system market profiled in this report are Becton, Dickinson, and Company (U.S.), Omnicell, Baxter International, Inc. (U.S.), ScriptPro LLC (U.S.), KUKA AG (Germany), TCGRx Pharmacy Workflow Solutions (U.S.), RxSafe, Inc. (U.S.), Cerner Corporation (U.S.), Capsa Healthcare (U.S.), Parata Systems LLC (U.S), LLC (U.S.), ARxIUM Inc. (U.S.) and Talyst Systems LLC. (U.S.).

RECENT HAPPENINGS IN THIS MARKET

-

In August 2020, Capsa Healthcare acquired RoboPharma; RoboPharma delivers customized high-speed prescription filling solutions for community pharmacies, hospitals, wholesalers, and central fill operations. RoboPharma provides quick, reliable, and compact pharmacy automation system, and this move by Capsa Healthcare is expected to strengthen its existing lineup in pharmacy technology.

-

In February 2019, RxSafe announced the introduction of the PakMyMeds Network. It is an easy way to take medications, and this network promotes a 50-mile circle around participating pharmacies to patients who could benefit from developed medication.

- In October 2018, OmniSys partnered with ScriptPro to integrate Scriptpro with OmniSys Fusion-Rx interactive voice response solution if providing a single solution that manages operations and handles inbound calls for pharmacies.

- In November 2020, Omnicell, Inc. made a public statement with recent innovations to the industry's leading portfolio of medication management solutions. The latest designs and the potentiality created to help hospitals and health systems.

MARKET SEGMENTATION

This research report on the global pharmacy automation system market is segmented and sub-segmented based on the type, end-user, and region.

By Product

- Automated Medication Dispensing Systems

- Centralized Automated Dispensing Systems

- Robots/Robotic Automated Dispensing Systems

- Carousels

- Decentralized Automated Dispensing Systems

- Automated unit-dose Dispensing Systems

- Pharmacy-Based Automated Dispensing Systems

- Ward-Based Automated Dispensing Systems

- Centralized Automated Dispensing Systems

- Automated Packaging and Labeling Systems

- Automated unit-dose Packaging & Labeling Systems

- Automated Multi-Dose Packaging & Labeling Systems

- Automated Table-Top Counters

- Automated Medication Compounding Systems

- Automated Storage and Retrieval Systems

- Other Pharmacy Automation Systems

By End User

- Inpatient Pharmacies

- Acute Care Settings

- Long-Term Care Facilities

- Outpatient Pharmacies

- Outpatient/Fast-Track Clinics

- Hospital Retail Settings

- Retail Pharmacies

- Pharmacy Benefit Management Organizations and Mail-Order Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the major players in the pharmacy automation system market?

McKesson Corporation, Omnicell Inc., Cerner Corporation, and AmerisourceBergen Corporation are some of the key players in the market.

`What are some challenges faced by the pharmacy automation system market?

High initial investment required for implementing pharmacy automation solutions, the need for ongoing maintenance and upgrades, and concerns about the security and privacy of electronic health records primarily challenge the market growth.

What is the current size of the pharmacy automation system market?

The global pharmacy automation system market size was worth USD 5.35 billion in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com