Global eHealth Market Size, Share, Trends & Growth Forecast Report By Type (Telemedicine, Consumer, Information System, HER, ePrescribing, Health Information, mHealth, Health Management and Clinical Decision Support), Services, End User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global eHealth Market Size

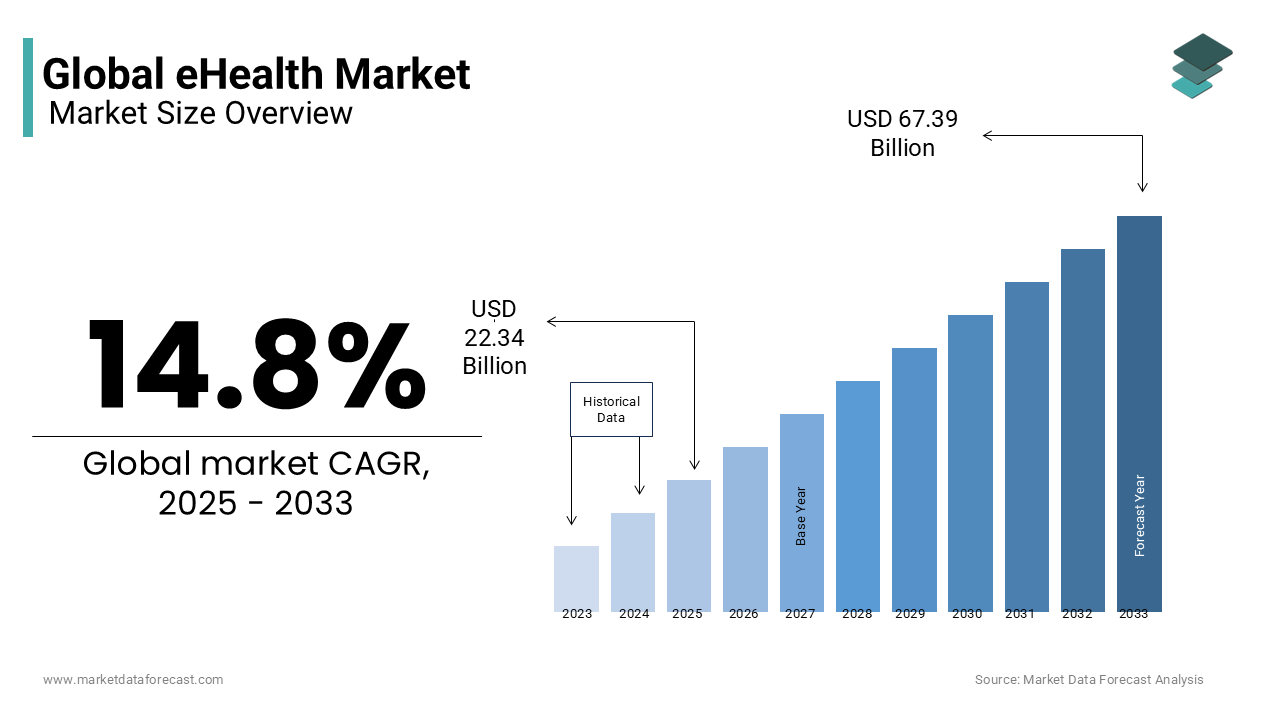

The global eHealth market size was valued at USD 19.46 billion in 2024 and the global market is expected to reach USD 67.39 billion by 2033 from USD 22.34 billion in 2025, growing at a CAGR of 14.8% during the forecast period.

The eHealth market is the fastest-growing area in the health domain. Presently, many eHealth projects are in progress by prominent medical, hi-tech, and government industries, who are trying to capture the advantages of merging health care, the internet, and technologies. Moreover, deploying eHealth solutions and digital transformation of medical systems country-wide enable quick access to information and enhance data exchange. Furthermore, the market continues to expand in the European, Asian, and North American countries. According to the European Commission, Europe is enhancing its maturity on eHealth signals. In 2023, EU27-average overall composite score rose from 72% to 79%.

MARKET DRIVERS

An Increasing Number of Initiatives from Governments Worldwide

Besides this, the North American and Asia Pacific regions are majorly taking the eHealth market forward. According to a study, around 46% of United States customers, i.e., approximately 119 million patients, connect with their medical service provider through a combination of patient websites, mobile applications, telemedicine appointments and standard in-person visits. In Europe, 76% of study participants anticipate that online means will be utilized for the delivery of medical services. Another research study discovered that 93% of primary medical care doctors and medics in 24 nations utilize digital technologies, such as electronic medical records (EMRs). The rising assistance, programs, schemes and promotions of several state authorities to go for eHealth solutions, increasing expenditure and growing demand for patient-centric healthcare delivery are propelling the eHealth market worldwide. Moreover, the rising awareness among hospitals and clinics regarding the benefits of these solutions and services is another significant growth driver. In addition, the higher prevalence of chronic diseases and technological advancements further push the eHealth market growth.

Technological Advancements

The progressive usage of loT and big data is promoting the growth of the eHealth market. eHealth utilizes big data tools and IoT to better store and retrieve healthcare data, transmit it, and develop analysis systems. These help to understand biological processes and drugs, which contributes to higher success rates in drug designs. Many pharma companies are applying big data to get results in a short period. Likewise, health insurers are also benefiting from using these types of analytics. They collect patient data and design insurance in an adapted way. The growing healthcare IT innovation and supporting regulations have facilitated the adoption of various healthcare technologies such as electronic healthcare records (EHR), remote patient monitoring, and wearable. The internet-based process right from patient entry to discharge is estimated to surge the growth of the eHealth market. Further, increasing focus on infrastructure development and key players making notable efforts to offer convenience for healthcare providers are predicted to generate promising growth opportunities for the market in the coming years. Similarly, Chatbots have surfaced as a beneficial technology for improving engagement, with 22% of people using them. A study recommends that integrating chatbots leads to twice the level of involvement. In the healthcare industry, the sales generated from chatbots are estimated to attain 498 million dollars by 2029.

Furthermore, factors such as advanced technologies available for the patient quickly boost the eHealth market growth. In addition, the standard increase in chronic diseases and the steps taken by the government to support the usage of eHealth services are also adding a boost to the market to set new growth heights. All these factors drive the market growth rate. The increasing government support and initiatives are mainly driving the growth of the eHealth market. For decades, public and government establishments have been pouring in money to develop eHealth solutions to improve healthcare accessibility to far-off and uncovered locations. The market growth rate was significantly boosted after COVID-19 after recognizing its effectiveness and importance during the crisis. The partnerships between leading private company technologies and funding and other support from governments worldwide are major accelerators for the market. Another factor influencing the demand for eHealth services is the application of IoT, big data analytics and AI in healthcare. This will assist medical professionals in gaining a deeper understanding of complicated communication between big data sets gathered in natural environments and biological systems.

MARKET RESTRAINTS

The deficiency of supporting infrastructure in emerging countries with expensive health IT tools is hampering the global eHealth market growth. Ensuring information security and protection was the biggest challenge that was highlighted. Healthcare professionals and a patient-centric imperative are in the middle of all digital innovation. Problems in the eHealth sector are limited availability of medical professionals, low medical insurance, and affordability of healthcare services, further inhibiting the eHealth market. Infrastructure gaps remain too substantial, and compliance concerns, regulatory issues, cultural and social biases, financial issues, and lack of quality mentorship are other factors obstructing market growth. The lack of understanding of its benefits and hesitation and negligence towards data generated by digital solutions continue to impede the expansion of the eHealth market. Things are still unclear for a notable section of healthcare professionals, leading to reduced trust and adoption rates. Moreover, the rising cyberattacks targeting medical facilities and patient data are also derailing the growth of the market. In January 2024, a major data breach at Viamedis and Almerys, a French Payment processor, jeopardized the private medical data of more than 33 million individuals. This impacted close to 50% of France’s population.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Type, Services, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Boston Scientific Corp., IBM, Motion Computing Inc., GE Healthcare, Epocrates Inc., Telecare Corp., CompuMed, Medisafe, SetPoint Medical, Doximity, Lift Labs, Proteus Digital Health, and Apple. |

SEGMENTAL ANALYSIS

By Type Insights

The electronic health records (EHR) segment is expected to dominate the market during the forecast period due to the system's several advantages. EHRs help provide accurate, fast, and reliable data on a patient's prior health record for proper assessment and future treatment options by the healthcare provider. In addition, EHRs improve efficiency by eradicating any significant errors caused by manual data management. Therefore, as healthcare settings shift toward IT solutions facilities, EHR is becoming increasingly prevalent.

The mHealth or mobile health segment is also expected to grow significantly during the forecast period due to the advent of new software and applications for monitoring health at home. In addition, the growing trend for home healthcare and remote healthcare services supports the advancement of the segment. Furthermore, the growing availability of various fitness-related apps and medical services-related apps like online consultations and medicine delivery at home on smartphones support the growth of the segment. Mhealth applications help patients track their daily progress and health condition, allowing complete continuous monitoring and checkups, which can be extremely useful, especially for patients with chronic conditions.

The Electronic health records (EHR) segment is believed to lead the eHealth market during the forecast period. Technological advancement is one of the drivers of the segment’s market growth. In addition, EHR provides enhanced patient care by allowing live access to information and lowers medical errors by removing the possibility of lost or misplaced documents or interpretation mistakes. As per the study, the adoption rate of EHR increased to 81.2 percent from 6.6 percent; at the same time, comprehensive systems surged to 63.2 percent from 3.6 percent.

By Services Insights

The monitoring segment held the highest share in the market due to the increasing command over self-monitoring devices that monitor different kinds of physical activities and vital signs that produce a database. The growth of this monitoring segment is further attributed to factors like the standard increase of chronic diseases, increasing lifestyle disorders, growing older people population, and high importance of home healthcare and rehabilitation.

The diagnostics segment has the following market share due to the increased patient diagnoses and the introduction of advanced diagnostics procedures. In addition, digitalizing medicine and related data will improve medical diagnosis. This eHealth will help collect all the data regarding patients undergoing diagnosis and advanced treatment for effective patient care.

The monitoring segment gained the maximum share of the eHealth market. This is because of the rising demand for self-monitoring devices. One of the most encouraging advancements in the last few years is the emergence of wearable health technology. These gadgets, starting from fitness trackers to smartwatches, are not just fashionable items but powerful instruments. Further, distant monitoring has emerged as an important part of modern healthcare, contributing to the expansion of the segment’s market share.

By End User Insights

The healthcare consumers segment dominated the eHealth market in 2023. The growth of this segment is accredited due to factors such as improving healthcare infrastructure in regions like Asia-Pacific and increasing requirements to reduce healthcare costs. Furthermore, the growing cases of chronic illness and the need for hospice care and 24/7 monitoring systems support the need for healthcare consumers. In addition, the growing cases of cardiac and diabetic problems lead to emergencies like heart attacks, further supporting the need for healthcare consumers in the ehealth market. However, the ehealth provider's segment is also expected to have significant growth during the forecast period due to the growing number of market participants like Oura ring, Vantage Health, Mendelian, Galileo Health, Doctor On Demand, Butterfly, MedWand, Peppy, etc. Additionally, the growing advancements in telehealth and mobile software and rising demand are helping the segment's growth. Healthcare consumers have become the biggest end users in the eHealth market in recent times. Clinics and medical facilities have progressively adopted digital technologies, including telemedicine systems, health data transmission platforms, and electronic health records (EHR), to enhance the delivery of complete healthcare services, optimize administrative procedures, and improve patient care.

REGIONAL ANALYSIS

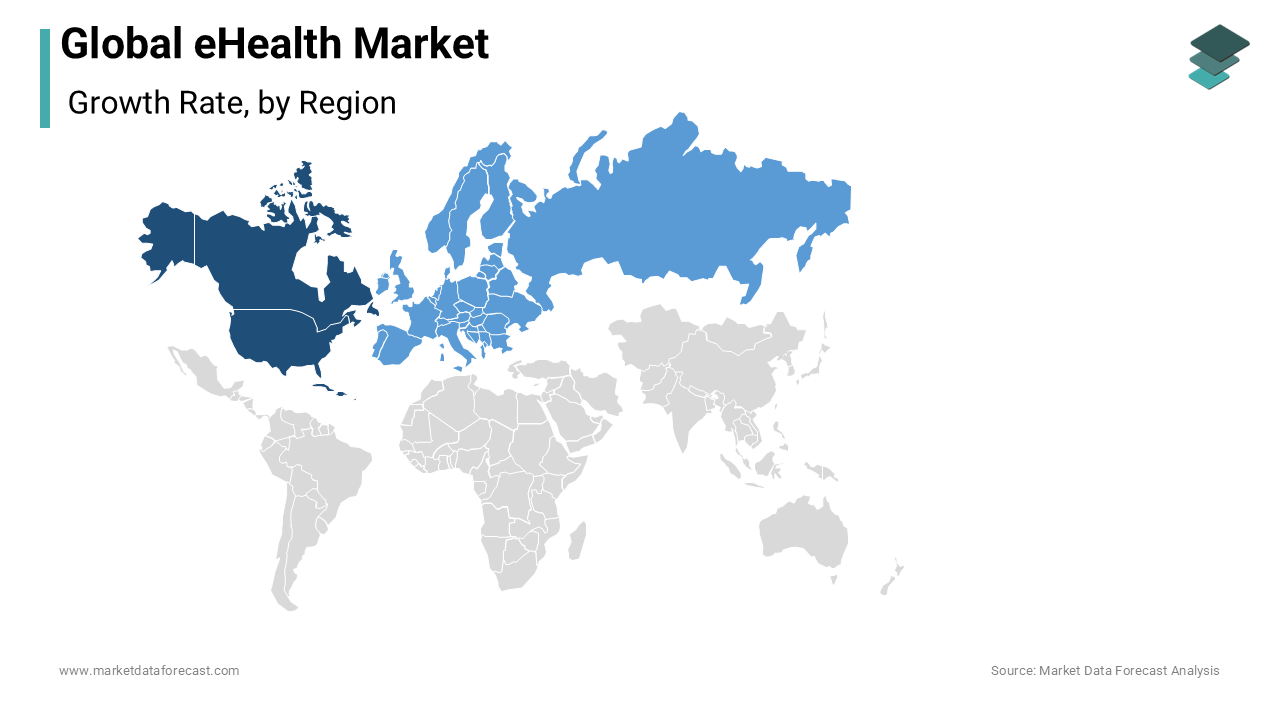

Regionally, North America is commanding the eHealth market. The region is dominated by the United States. This can be attributed to strong and mature medical infrastructure and higher investments in technological development projects. Moreover, the region hosts some of the leading companies in digital technologies for healthcare services. .

Europe is the second region, followed by North America, for the global eHealth market, which is attributed to advanced technologies and the existence of some key players. European spending of 12% of GDP on healthcare. The growth of the market in Europe is primarily driven by factors like advanced technologies and the presence of some significant players in the industry. Increasing demand for new technologies and systems for managing chronic illnesses such as diabetes, orthopedics, and cancer is propelling the market's growth rate. Other favorable government steps, like the implementation of the e-Health law, which is targeted at creating electronic health cards and infrastructure for telemedicine, also boost the market's growth rate. E-health is one of the most adopted in Germany after the passage of the Digital Care Act in 2019. Electronic patient records, app-related data, storage and analysis of health data, and video consultations are used as digital technology currently used by the German healthcare sector.

The Asia Pacific eHealth market is witnessing substantial growth in the past few years. The increased pace of urbanization and digital transformation is primarily fuelling the regional market share. In addition, the deep penetration of smartphones and wearable devices in China, India, South Korea, Japan, and other developing nations is pushing forward the market in the region.

Latin America has been observed to grow continuously over the period. The increase is responsible for the growing demand for people's health management and the necessity to reduce healthcare costs. Mexico's health has been growing in recent years due to advancements in healthcare to improve the quality of care. With the increasing population of over 120 million people, the Mexican Government and the healthcare industry are seeking new technological solutions. Hospitals are adopting the eHealth system to overcome the challenges faced by the hospitals. On the other hand, factors like utilization problems, privacy, and security concerns are estimated to hamper the Latin American market.

The market in Middle East and Africa is also expected to have a moderate growth rate during the forecast period due to growing concerns over proper healthcare services and the increasing investment and efforts of governments and the Ministry of Health to improve patient care. The developed countries of the MEA region, like UAE, Qatar, Jordan, Saudi Arabia, Turkey, Oman, etc., are pretty developed in healthcare sectors. They have an established system of E-health settings, like EHRs and even HITs (Hospital information technologies). However, even in some developed nations, the prevalence of mHealth has yet to be set, as remote patient care is still relatively uncommon in the regions. However, the developing countries of MEA are yet to undergo a complete technological transformation, and countries like Israel, Bahrain, Iran, Iraq, etc., are still struggling for promising eHealth services. Although governments are making multiple efforts to establish E-health in these regions, slow progress is expected.

KEY MARKET PLAYERS

Some of the prominent companies leading the global eHealth market profiled in the report are Boston Scientific Corp., IBM, Motion Computing Inc., GE Healthcare, Epocrates Inc., Telecare Corp., CompuMed, Medisafe, SetPoint Medical, Doximity, Lift Labs, Proteus Digital Health, and Apple.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, the Hyundai Motor India Foundation (HMIF) announced the beginning of operations of 10 telemedicine Centres and introduced 4 Mobile Medical Units in 2 union territories and four states all over India.

- In March 2024, Change Healthcare reported that it completed the establishment of a new electronic prescription service. It has tested with service with retail pharma partners and vendors. This new service is expected to bring a certain amount of support to physicians and pharmacies that have been fighting to remain in contention with the arrival of more sophisticated cyberattacks.

MARKET SEGMENTATION

This research report on the global eHealth market has been segmented based on the Type, services, end-user, and region.

By Type

- Telemedicine

- Consumer

- Information System

- EHR

- ePrescribing

- Health Information

- mHealth

- Health Management

- Clinical Decision Support

By Services

- Administrative

- Diagnostic

- Monitoring

- Financial

By End User

- Healthcare Consumers

- Providers

- Government

- Insurers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How much is the global eHealth market going to be worth by 2033?

As per our research report, the global eHealth market is forecasted to be worth USD 67.39 billion by 2033.

Which segment by type in the global eHealth market is predicted to lead in the coming years?

The ehr segment by type in the global eHealth market is predicted to showcase the fastest growth rate during the forecast period.

Which region accounted for the largest share in the global eHealth market in 2024?

Geographically, the North American regional market led the eHealth market in 2024.

Which are the companies playing a key role in the eHealth market?

Boston Scientific Corp., IBM, Motion Computing Inc., GE Healthcare, Epocrates Inc., Telecare Corp., CompuMed, Medisafe, SetPoint Medical, Doximity, Lift Labs, Proteus Digital Health, and Apple are some of the notable companies in the global eHealth market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]