Global mHealth Market Size, Share, Trends & Growth Analysis Report Segmented By Type (Blood Pressure Monitors, Glucose Meters and Pulse Oximeters), Services (Chronic Care Management, Health and Fitness, Weight Loss, Womens Health, Personal Health Record and Medication), Application (Remote Monitoring, Consultation, Fitness and Wellness and Prevention) & Region – Industry Forecast From 2025 to 2033

Global mHealth Market Size

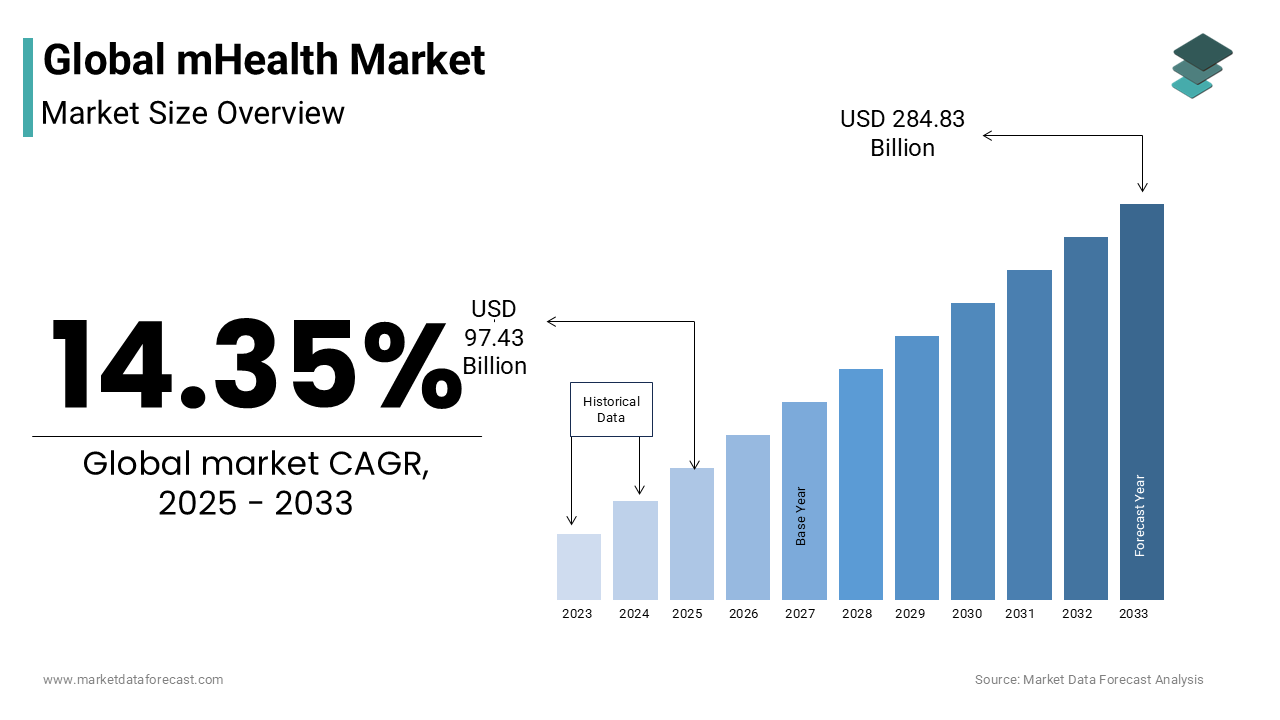

The global mhealth market was valued at USD 85.20 billion in 2024. The global mobile health market is forecasted to reach USD 284.83 billion by 2033 from USD 97.43 billion in 2024, showcasing a compound annual growth rate of 14.35% during the forecast period.

mHealth is a branch of eHealth dealing with the collection of patient data. The patient data is collected and stored using the mHealth Application and is reviewed by healthcare professionals to determine the severity of the medical condition. Wireless electronic devices like mobiles, wearable medical devices, and others play a crucial role in collecting patient data. The collected data is stored on a remote cloud using mHealth applications. In recent times of the rapid advances in digitalization and the adoption of I.T. services in the healthcare industry, mhealth apps are of growing preference among populations.

mHealth is a general term for mobile phones and other wireless technology in medical care. The most common application of mHealth is using mobile devices to educate consumers about preventive healthcare services. The population-level benefits of the mHealth apps include expanding access to healthcare services, developing more cost-effective treatment pathways, and improving communication with healthcare professionals. The global market accounted for notable growth in recent years as society is technology-driven in all industries. The global market is anticipated to grow significantly during the forecast period. Various benefits of mHealth apps, like improved efficiency with rapid healthcare delivery, reduction in healthcare costs, and ease of convenience to use in a limited time, are majorly accelerating the adoption of these technology-based apps among the people. Nearly two-thirds of Americans own a smartphone, which means that more people have the ability to monitor and manage their health. Certain health apps can be informative and educational, enhancing people's basic medical knowledge. The surge in the adoption of digital health, easy availability of fitness trackers, and escalating technological advancements will boost the market growth opportunities.

MARKET DRIVERS

The growing smartphone and internet penetration is one of the major factors propelling the mHealth market growth. The global proliferation of smartphones and internet access has been fundamental to the growth of mHealth. The concept of mobile health is enabling users to engage with health applications and telemedicine services from virtually anywhere. As of 2023, GSMA reports that more than 5.3 billion people own mobile phones and the smartphone penetration is expected to reach 80% globally by 2025. This widespread availability of smartphones and the internet is allowing individuals across both developed and emerging economies to access healthcare resources more conveniently and supporting preventive care and real-time health monitoring. Smartphones are bridging gaps by providing essential health services through mHealth apps in regions such as Africa and Southeast Asia, where healthcare access has traditionally been limited,

The rising burden of chronic diseases is further fueling the mHealth market growth. The global burden of chronic diseases such as diabetes, cardiovascular diseases, and respiratory conditions continues to rise and resulting in the need for tools that aid in disease management and preventive care. For instance, as per the statistics of the World Health Organization (WHO), chronic diseases account for approximately 71% of global deaths, and cardiovascular diseases alone contribute to 17.9 million deaths per year. mHealth applications such as blood glucose tracking for diabetes and heart rate monitoring for cardiovascular conditions are providing patients with tools to manage these diseases more effectively. For instance, the American Diabetes Association reported a 30% increase in the use of digital health tools for diabetes management since 2020. Likewise, the growing patient population of chronic diseases is promoting the usage of mHealth in chronic disease care and contributing to the global market expansion.

The rising demand for remote patient monitoring (RPM) is aiding the global market growth. Remote patient monitoring has become a key driver for mHealth. Mobile health allows patients to manage health conditions from home while staying connected with healthcare providers, and due to these benefits, patients have increasingly started using mobile health solutions to address their healthcare needs. This approach is particularly beneficial for elderly patients, especially those who have limited mobility and individuals in rural areas who might otherwise face challenges accessing in-person care. mHealth solutions integrated with RPM technologies, such as apps that transmit real-time data on vital signs to healthcare providers, significantly help improve care outcomes and reduce hospital readmissions, thereby meeting the needs of modern healthcare systems that emphasize accessibility and continuity of care.

Advancements in wearable technology are boosting the global mobile health market growth. Innovations in wearable health devices are accelerating the adoption of mHealth by providing continuous health monitoring and personalized insights. Healthcare devices such as fitness trackers, smartwatches and specialized medical wearables (e.g., continuous glucose monitors) empower users to track various health metrics such as activity levels, heart rate, and oxygen saturation. The growing consumer awareness and demand for preventive healthcare solutions are significantly contributing to the increasing demand for wearable medical devices. The integration of wearables with mHealth apps enables a seamless flow of health data, which can be analyzed to alert users to potential health risks or lifestyle adjustments. For example, Apple and Fitbit have developed health-focused wearable devices that offer functionalities for tracking irregular heart rhythms, which is a feature that can be critical in preventing severe cardiovascular events.

MARKET RESTRAINTS

The primary factors restraining the global market are data privacy and security issues. Most health apps raise data privacy concerns as the privacy policies lag in these, and even if privacy policies are present, users may need to read more carefully, which leads to a lack of understanding and use of patient data. Lack of regulation and approval is another factor hampering people's adoption of mHealth apps, restricting market share growth. According to a study published in "The Journal of the American Society of Hypertension," only 3% of the top 107 apps that used the terms "hypertension" and "high blood pressure" were developed by healthcare agencies. The FDA had approved no apps, although 14% could turn into a medical device to measure blood pressure. The study stated that such apps reveal an "urgent need for greater regulation and oversight in medical app development." Most apps provide inaccurate information as the values vary when tested, such as heart rate, stress, blood pressure, and others, which is expected to hinder the market growth due to a loss of trust among the people. The need for awareness and the expensive subscriptions for high-quality and premium apps will impede the market size growth due to limited access to the low-income population.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Devices, Applications, Services, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Cardio Net Inc., iHealth Labs Inc., QUALCOMM life, Vodafone, Dexcom, Inc., Fitbit, Inc. (Twine Health, Inc.), Koninklijke Philips N.V. (Philips), Livongo Health, Inc., Medtronic Plc., Omada Health, Inc., Omron Corporation |

SEGMENTAL ANALYSIS

By Type Insights

The blood pressure monitor is predicted to lead the global market due to the rise in the number of people suffering from various disorders. On the other hand, the segment is expected to grow because of the growing significance of remote care services and the continuous adoption of I.T. care services in the healthcare industry, leading to more technological advancements in healthcare services. Additionally, the rising preference towards home care services, especially after the pandemic outbreak, has led more people to use smartphones, further promoting the segment's rise.

The glucose meter segment is estimated to have significant growth in the forecast period. The growing number of diabetes patients worldwide and the prevalence of personalized medicine are lucratively accelerating the segment's growth rate.

However, the pulse oximeter segment also has a slightly inclined growth rate during the forecast period.

By Application Insights

The health and fitness segment is anticipated to register a significant share of the market during the forecast period. The rise in the awareness to stay healthy by doing regular exercises using applications available in Android and iOS systems is significantly promoting the demand of this segment.

In 2023, the chronic care management segment was the second-largest segment in the global market. It was estimated to register a healthy CAGR during the forecast period due to the growing incidences of chronic diseases like high blood pressure, diabetes, cancer, etc. In addition, weight loss, women's health, personal health records, and medication segments have sustainable growth opportunities in the forecast period.

By Services Insights

The remote monitoring segment had the majority share in the market in 2023. Therefore, adopting the latest technology in healthcare centers is a crucial driving factor for extensive growth. In addition, the rising preference of the patient population towards the convenience of remote care is helping the segment grow. Furthermore, remote care services are especially beneficial to the geriatric populations who have difficulty going for regular hospital visits; therefore, the rising geriatric population is helping the segment advance.

The fitness and wellness segment is deemed to have the highest CAGR during the forecast period with the launch of several fitness-related applications. In addition, the growing use of smartphones is accelerating the growth rate of these segments.

REGIONAL ANALYSIS

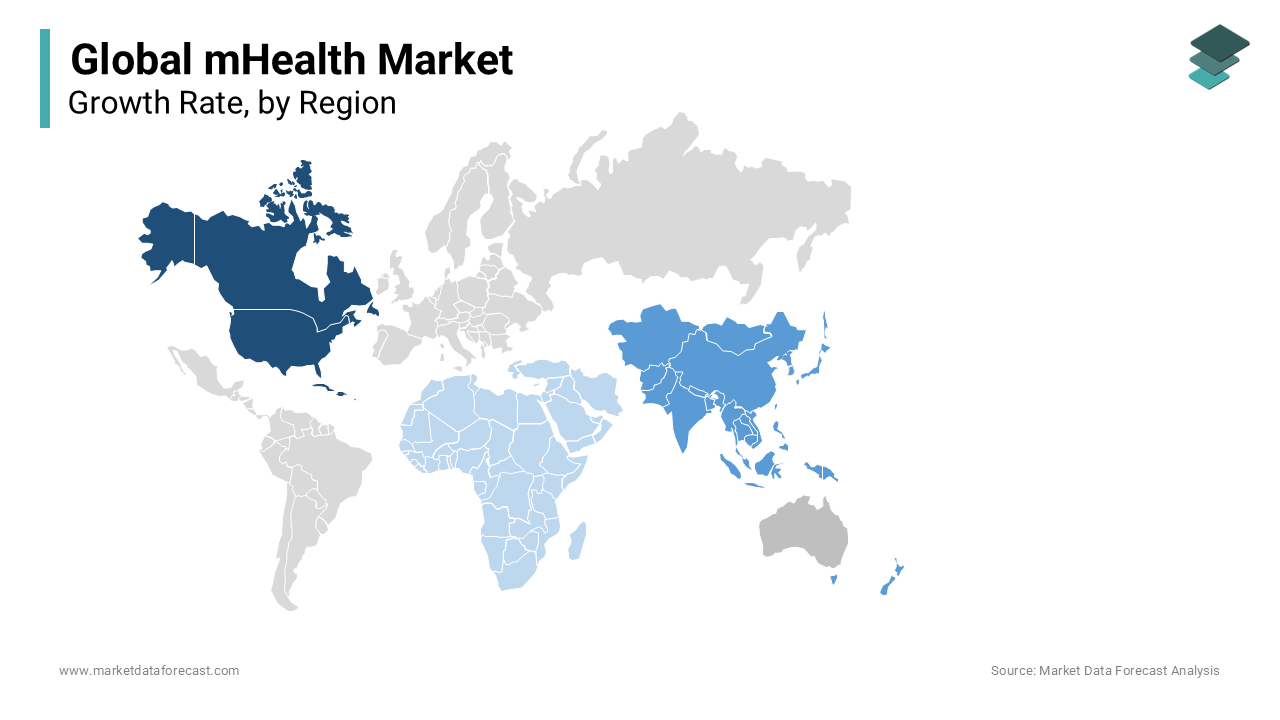

The North American region held the major share of the worldwide market in 2023 and the same trend is predicted to continue throughout the forecast period. During the forecast period, the North American region is estimated to grow at a promising CAGR owing to the introduction of further technological developments in healthcare centers. The U.S. led the North American market in 2023 and registered the most significant share. Growing awareness towards using mobile applications is to surge the market's growth. In addition, during the spread of COVID-19, this Region is making the best use of mHealth services available.

The Asia-Pacific region will dominate the global market during the forecast period. The increasing geriatric population is one of the significant factors boosting the Asia-Pacific regional market growth. Besides, improving support from the I.T. industry is likely to bolster the market's growth. As a result, India and China are the major countries contributing to the highest share of the regional market.

Europe accounted for a substantial share of the global market in 2023 and is expected to hit the highest CAGR during the forecast period due to the escalating healthcare expenditure. The United Kingdom and Germany accounted for a significant share of the European market in 2023 due to the increasing research and development centers. In addition, the launch of user-friendly applications showing positive results in emergency cases is leveling up the market's growth rate.

The Latin American region is anticipated to witness a steady CAGR in the coming years owing to the rapid adoption of mHealth applications by the Latin American population and growing disposable income. Brazil and Mexico are predicted to hold a leading share of the Latin American market during the forecast period.

The market in Middle East and Africa is predicted to have significant growth opportunities during the forecast period. Therefore, the focus on raising awareness of the benefits of using healthcare applications is solely to leverage the market's growth rate in this Region.

LIST OF KEY PLAYERS IN THE GLOBAL MARKET

A few of the notable companies operating in the global mHealth market profiled in the report are Cardionet Inc., iHealth Labs Inc., QUALCOMM life, Vodafone, Dexcom, Inc., Fitbit, Inc. (Twine Health, Inc.), Koninklijke Philips N.V. (Philips), Livongo Health, Inc., Medtronic Plc., Omada Health, Inc., Omron Corporation (Omron Healthcare, Inc.), Samsung Electronics Co., Ltd and Welldoc, Inc.

Recent Developments

- In October 2023, Cedars-Sinai, a leading healthcare provider, launched the Cedars-Sinai Connect app. This innovative mobile health application utilizes artificial intelligence technology to provide virtual care solutions for various clinical issues. The app allows patients to schedule primary care visits on the same day and offers 24/7 virtual access to medical specialists for urgent treatment. This development indicates the growing role of technology in healthcare and its potential to revolutionize how we access and receive medical care.

- In January 2023, Koninklijke Philips partnered with Masimo to augment patient monitoring capabilities in home telehealth applications with the Masimo W1 advanced health-tracking watch.

- In January 2023, Garmin launched Instinct Crossover in India, which delivers Garmin's full suite of wellness features, including Sleep Score, Advanced Sleep Monitoring, and Health Monitoring activities.

- In March 2023, Astellas Pharma Inc. announced that it has agreed with Roche Diabetes Care Japan Co., Ltd. to develop and commercialize Roche Diabetes Care's world-owned Accue-Chek Guide Me blood glucose monitoring system with advanced accuracy as a combined medical product with Blue Star.

- In November 2022, Hartford HealthCare entered into a long-term partnership with Google Cloud to advance healthcare systems with improved data analytics, digital transformation, and delivery care and access enhancement.

- In March 2022, Epic Systems Corporation launched Garden Plot, which provides small independent healthcare groups access to Epic software solutions and an interoperability network.

MARKET SEGMENTATION

This market research report on the global market has been segmented by Type, Application, services, and Region.

By Type

- Blood Pressure Monitor

- Glucose Meter

- Pulse Oximeter

By Application

- Chronic Care Management

- Health and Fitness

- Weight Loss

- Women's Health

- Personal Health Record

- Medication

By Services

- Remote Monitoring

- Consultation

- Fitness And Wellness

- Prevention

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Does this report include the impact of COVID-19 on the mHealth market?

Yes, this report include the impact of COVID-19 on the market

Which region had the major share of the global mobile health market in 2024?

Geographically, the North American region accounted for the major share in the global market in 2024.

Who are the leading players in the mHealth market?

Cardionet Inc., iHealth Labs Inc., QUALCOMM life, Vodafone, Dexcom, Inc., Fitbit, Inc. (Twine Health, Inc.), Koninklijke Philips N.V. (Philips), Livongo Health, Inc., Medtronic Plc. are a few of the notable players in the global mobile health market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com