Global Mental Health Software Market Size, Share, Trends & Growth Forecast Report – Segmented By Component (Support Services, Integrated Software and Standalone Software), Delivery Model (Subscription Models and Ownership Models), Functionality (Clinical Functionality, Administrative Functionality and Financial Functionality), End-User (Hospitals, Private Practices, Patients and Payers) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Mental Health Software Market Size

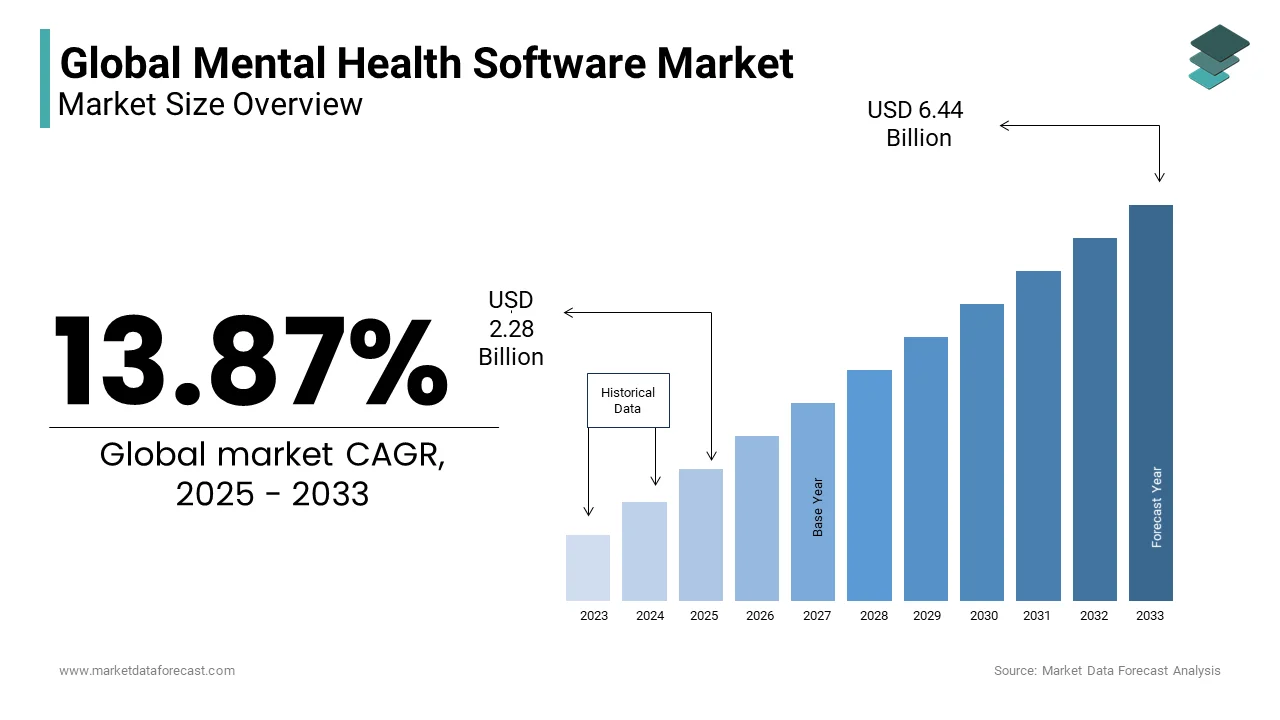

The global mental health software market size was valued at USD 2 billion in 2024. The mental health software market size is expected to have 13.87% CAGR from 2025 to 2033 and be worth USD 6.44 billion by 2033 from USD 2.28 billion in 2025.

The mental health software is developed to manage mental health and behavioral health treatment or addiction treatment practices. The growing demand for mental health software is due to rising awareness among people regarding the importance of mental health and treatment. The global mental health software market accounted for moderate growth in the past years and is projected to grow considerably during the forecast period. The global rise in the prevalence of mental health problems such as anxiety, stress, depression, and others is escalating the demand for effective and accessible mental health care, which drives the market revenue. According to data published by the Centers for Disease Control and Prevention in October 2024, the United States Census Bureau Household Pulse Survey data indicated that the percentage of U.S adults with symptoms of anxiety and depressive disorders increased nationwide from 36.5% to 41.5% from 2024 to 2032. It also reported that the disorders are commonly observed among adults aged 18 to 29. The pandemic has accelerated the usage of telehealth and remote monitoring services among people.

MARKET DRIVERS

The growing patient count suffering from mental health disorders is majorly driving the mental health software market growth.

The number of people facing mental health disorders is constantly growing worldwide. One in every eight people worldwide has issues with mental health, says WHO, and an estimated 1 Billion people suffer from mental disorders. According to the National Institute of Mental Health (NIMH), an estimated 52.9 million adults in the U.S. suffered from mental disorders in 2024, which was also equivalent to 1 in every five adults. The growing patient volume of mental disorders is resulting in the increasing demand for mental health services and contributing to the growth of the mental health software market. In addition, the number of people suffering from mental health issues such as anxiety, stress, and depression has increased significantly in recent days due to the COVID-19 pandemic and resulted in the growing usage of mental health software to manage mental health conditions.

The rising mental health awareness among people and increasing adoption of mental health software by healthcare providers and patients further fuel the market growth. People nowadays are showing a willingness to get treatment for their mental health issues, and mental health software is a convenient and accessible way to manage mental disorders. As per the data published by the American Psychological Association (APA), an estimated 87% of American adults agreed that mental disorders are common, and 86% of American adults agreed that mental disorders are treatable. In recent years, many people worldwide have realized that mental health is equally important as physical health and considering investing amounts for mental well-being, which is expected to contribute to the growth of the global mental health software market.

The growing adoption of technological advancements in mental health software is accelerating the market's growth rate.

Recent technological advancements such as AI, ML, data analytics, and virtual learning have helped mental health software to witness several advancements, and many new features have been added to the software. Integrating advanced technologies such as AI and ML has improved the accuracy of diagnoses and provided better patient outcomes. Furthermore, the growing number of initiatives from governments of various countries is anticipated to promote the growth rate of the mental health software market. For instance, the 21st Century Cures Act has several provisions for psychiatry, treats patients with severe mental conditions in the United States, and funds the development of various mental health technologies. In addition, the National Institute of Mental Health (NIMH) has launched various programs to support the development and commercialization of mental health technologies.

In addition, factors such as the shortage of mental health professionals and the cost-effectiveness of mental healthcare software are boosting market growth. Furthermore, the growing emphasis of various organizations on the mental health of their employees and the growing usage of telehealth for mental health management are expected to favor the growth rate of the mental health software market.

MARKET RESTRAINTS

Data privacy and security concerns are the primary factors hampering the global mental health software market. Mental health software consists of more sensitive information about the patient, which requires high-end security, but the increased usage of electronic health records (EHRs) to store data is enhancing the concerns about data protection. There is a high risk of data breaches and unauthorisation of the data, which is more frequently observed in the healthcare industry, hampering the expansion of the mental health software market growth. According to the HIPAA Journal report, in 2024, approximately 714 healthcare data breaches were reported in the United States. Another factor is the high costs associated with the app and website development and maintenance, which restricts access for small healthcare organizations, particularly in emerging countries, and hinders market share growth. There is a need for awareness among people regarding the benefits of utilizing mental health software to enhance mental health support, especially among people from low- and middle-income regions, which limits the expansion of the market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Component, Delivery Model, Functionality, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cerner Corporation (U.S.), Core Solutions (U.S.), Credible Behavioral Health (U.S.), MindLinc (U.S.), Epic Systems Corporation (U.S.), Netsmart Technologies (U.S.), NextGen Healthcare Information Systems, LLC (U.S.), Qualifacts (U.S.), The Echo Group (U.S.), Valant Medical Solutions Inc. (U.S.) and Welligent (U.S.). |

SEGMENTAL ANALYSIS

By Component Insights

Based on the component, the integrated software segment dominated the mental health software market in 2024 and is anticipated to continue its growth during the forecast period. The introduction of advanced technical services to manage mental healthcare practices' financial, administrative, and clinical functions is credited with the segment's growth. For example, EHR platforms provide streamlined claims and payment features that can handle complicated billing processes and a smartphone version that allows patients to access care when moving.

By Delivery Model Insights

The subscription model segment accounted for the largest market share of mental health software based on the delivery model and is likely to have a significant CAGR over the forecast period. Unlike major private practices or hospitals, many small-scale mental healthcare providers have little resources to spend on technical solutions. Due to their small practice scale, these practitioners are also unavailable for EHR incentive schemes. Due to a lack of reimbursement, EHRs in small-scale mental health practices are limited as a response. Mental health professionals are reluctant to spend thousands of dollars on software solutions. Where budgets are limited, small trends choose subscription-based software alternatives. The highest return on investment for mental health services would come from various low-cost options.

By Functionality Insights

Based on functionality, the clinical functionality segment is expected to account for the most substantial share value. It is also likely to have a high CAGR during the period. The reasons for high demand in the clinical functionality segment are increasing government initiatives to boost clinicians' adoption of the software to provide quality care to patients at lower costs.

By End-User Insights

Based on end-users, in terms of revenue, the patient segment had the highest market share in 2024 and was estimated to register the highest CAGR during the forecast period. The vast number of people who use mental health solutions in their homes or hospitals for improved self-care is a significant driver of the mental health software market for patients.

On the other hand, the Payers segment is projected to grow with an increasing CAGR during the forecast period. Favorable reimbursement policies drive segment growth. Medicare covers telehealth programs for mental health.

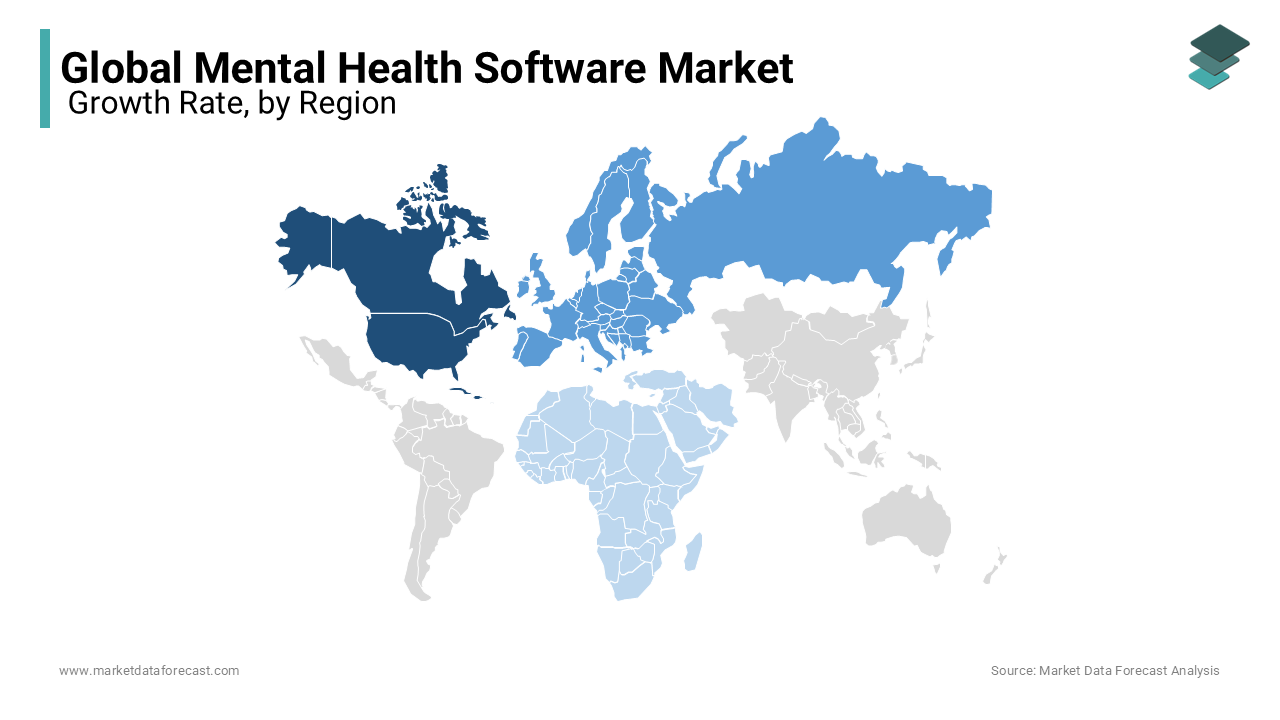

REGIONAL ANALYSIS

The North American mental health software market was the regional segment in the global market in 2024. The domination of the North American region in the global market is expected to continue during the forecast period. The growth of the North American market is primarily driven by the growing prevalence of mental health disorders, the availability of sophisticated healthcare systems, and the presence of many key market participants. In addition, the rapid adoption of healthcare technologies in the North American region is further propelling the regional market growth. The U.S. held the leading share of the North American market in 2024, followed by Canada, and this trend is anticipated to continue in the coming years.

Europe is another potential regional market for mental health software worldwide and is expected to hold a notable share of the worldwide market during the forecast period. The increasing demand for mental health services and the growing number of people suffering from depression and anxiety in European countries are majorly driving the European mental health software market growth. In addition, the growing efforts from the European governments to spread awareness among the people regarding the importance of mental health are expected to boost the market growth in Europe. During the forecast period, European countries such as the UK, Germany, Spain, Italy, and France are anticipated to capture a significant share of the European market.

APAC is anticipated to showcase a promising CAGR during the forecast period. The growing population, increasing incidence of various mental health disorders, and rising adoption of healthcare technologies such as telemedicine and mHealth promote the mental health software market in the Asia-Pacific region. China and India held the major share of the APAC market in 2024. On the other hand, Japan is expected to register a notable CAGR during the forecast period.

The Latin American market is predicted to occupy a considerable share of the worldwide market during the forecast period. During the forecast period, Brazil and Mexico are expected to play a promising role in the Latin American market.

The MEA market is expected to grow at a moderate CAGR in the coming years.

KEY MARKET PLAYERS

Some of the notable companies operating in the global behavior/mental health software market profiled in the report are Cerner Corporation (U.S.), Core Solutions (U.S.), Credible Behavioral Health (U.S.), MindLinc (U.S.), Epic Systems Corporation (U.S.), Netsmart Technologies (U.S.), NextGen Healthcare Information Systems, LLC (U.S.), Qualifacts (U.S.), The Echo Group (U.S.), Valant Medical Solutions Inc. (U.S.) and Welligent (U.S.).

RECENT HAPPENINGS IN THIS MARKET

- In January 2024, Samsung made a significant stride in the mental health software market by developing its software development kit, the Privileged Health Software Development Kit (SDK). This move will provide users with more preventive health tools through integrations with healthcare platforms. Integrating sensor data from its Galaxy Watch with specialist platforms is expected to improve people's understanding and control of health, marking a significant advancement in the field.

- In January 2024, Apollo Hospital Seshadripuram in Bangalore announced an alliance with LifeSigns, a top provider of AI-powered health monitoring technologies. Through this partnership, the hospital gains access to a wireless and remote patient monitoring system that operates continuously.

- In October 2024, the Subscription-based mindfulness app Calm will make its first foray into Calm Health, a hospital and mental health service. Calm Health consists of specific programs designed to bridge the gap between mental and physical health services.

- In September 2024, San Francisco-based Osmind upgraded its electronic health record system for mental health clinics and integrated Zoom virtual visits into its technology platform as part of its compliant ISV partner program.

MARKET SEGMENTATION

This research report on the global mental health software market has been segmented and sub-segmented based on the component, delivery model, functionality, end-user, and region.

By Component

- Support Services

- Integrated Software

- Standalone Software

By Delivery Model

- Subscription Models

- Ownership Models

By Functionality

- Clinical Functionality

- Electronic Health Records (EHRs)

- Clinical Decision Support (CDS)

- Care Plans/Health Management

- E-Prescribing

- Telehealth

- Administrative Functionality

- Patient/Client Scheduling

- Document/Image Management

- Case Management

- Workforce Management

- Business Intelligence (BI)

- Financial Functionality

- Revenue Cycle Management

- Managed Care

- Accounts Payable/General Ledger

- Managed Care

By End-User

- Hospitals

- Private Practices

- Patients

- Payers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the projected market value of Behavior/Mental Health market by 2033?

The Behavior/Mental Health market is growing at a CAGR of 13.87% and is expected to reach USD 6.44 billion by 2033.

Which product segment will dominate the behavioral health software market in the future?

The integrated Software segment will dominate the Behaviour/Mental health software market in future.

Which region holds the largest share in the flexible heater market?

Asia-Pacific is the leading region, primarily due to its large concentration of manufacturing industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com