Global Pulse Oximeter Market Size, Share, Trends & Growth Forecast Report By Type, End-Use and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Pulse Oximeter Market Size

The global pulse oximeter market was worth US$ 3.10 billion in 2024 and is anticipated to reach a valuation of US$ 6.21 billion by 2033 from US$ 3.35 billion in 2025, and it is predicted to register a CAGR of 8.02% during the forecast period 2025-2033.

MARKET DRIVERS

The key driver of the pulse oximeter market is the rising prevalence of respiratory disorders. Worldwide, the number of persons who have respiratory conditions like Asthma, Pneumonia, and Chronic Obstructive Pulmonary Disease is rising. COPD has a severe impact on high- and middle-income nations. The World Health Organisation estimates that there are 339 million asthma sufferers globally. According to information provided by the Asthma and allergy foundations of America, there are roughly 26 million asthma sufferers in the US. Patients with persistent respiratory conditions may experience low blood oxygen saturation. Pulse oximeters are utilized in these situations to keep track of the patient's oxygen saturation levels.

The expansion of the healthcare sector contributes to the expansion of the pulse oximeter market. The created devices are more precise and simpler to operate thanks to the utilization of emerging technologies. These advancements have led to a rise in the use of these gadgets. The pulse oximeter is more convenient for customers to use thanks to wireless and Bluetooth-enabled devices. The growing elderly population is another aspect pushing this industry. Pulse oximeter use is increasing as a result of the increased prevalence of chronic respiratory disorders in older adults.

The pulse oximeter market is being driven by several advantages, such as mobility, connection, and practical size. The advantages of pulse oximeters, such as an easy-to-use, painless method to check patients' oxygen saturation levels, stimulate market expansion. Additionally, the market is anticipated to be driven by the rise in the need for monitoring anesthetic patient safety. Additionally, the market for pulse oximeters is expanding as a result of more people using them in healthcare facilities, pediatric care, in setting the oxygen saturation level during exercise, technological advancements, and sports and fitness. These are the major factors that are anticipated to boost the pulse oximeter industry's growth.

MARKET RESTRAINTS

The market's expansion is constrained by the growing restrictions and errors associated with the usage of pulse oximeters. The accuracy of pulse oximeters is impacted by several variables, including poor circulation, high skin temperature, thick skin, fingernail polish, and dark skin color. Studies have demonstrated that the gadget gives African American patients erroneous readings. For instance, a study done in January 2021 by Michigan Medical School found that black patients were more likely to have low oxygen levels that the gadget overlooked. According to the study, there are moments when a black patient's actual blood oxygen saturation is substantially lower, even while the gadget displays 94%. Many governmental organizations, including the FDA, recently published guidelines addressing these errors. The real oxygen saturation (SPO2) of the blood, as measured by an FDA-cleared pulse oximeter, is typically between 86 and 94%, according to the updated FDA guidelines published in February 2021. The pulse oximeter market's expansion is constrained by the device's high price, widespread lack of knowledge about their potential advantages, and accuracy problems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.02% |

|

Segments Covered |

By Product type, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

GE Healthcare, Medtronic (Covidien), CAS Medical System Inc., Contec Medical System Co. Ltd., Omron Corporation, Smiths Medical, Edan Instruments Inc., Smiths Group plc, Halmaplc, Nihon Kohden Corporation., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

Among these, the fingertip oximeter segment dominates the pulse oximeter market. This segment had the major share of the global market in 2024. This segment is expected to show its dominance during the forecast period. The benefits of using the fingertip pulse oximeter are easy to use, portability, cost-effectiveness, and wide availability of these devices. Additionally, the increasing prevalence of respiratory diseases and continuous monitoring of the oxygen saturation level in those patients drives the market growth. An increase in awareness of the early diagnosis of respiratory diseases helps the growth of this segment, as the fingertip oximeters are easy to use and painless. The increase in demand for home-based medical devices and the developments in fingertip oximeters increases the growth of the pulse oximeter market.

The handheld oximeters held a substantial place in the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. This is due to the increased adoption of pulse oximeters from hospitals and clinics.

By End-use Insights

Among these, the hospital and healthcare facilities segment had the largest share of the global market in 2024. The domination of this segment is expected to continue during the forecasting period. The factors such as growing demand for pulse oximeter from hospitals due to rising chronic respiratory diseases.

The homecare segment is another lucrative segment and is expected to hold a significant share of the global market during the forecasting period. This is due to the increasing adoption of home-based medical devices because of the increasing acceptance of self-monitoring and home-based care and because of increased awareness of early detection.

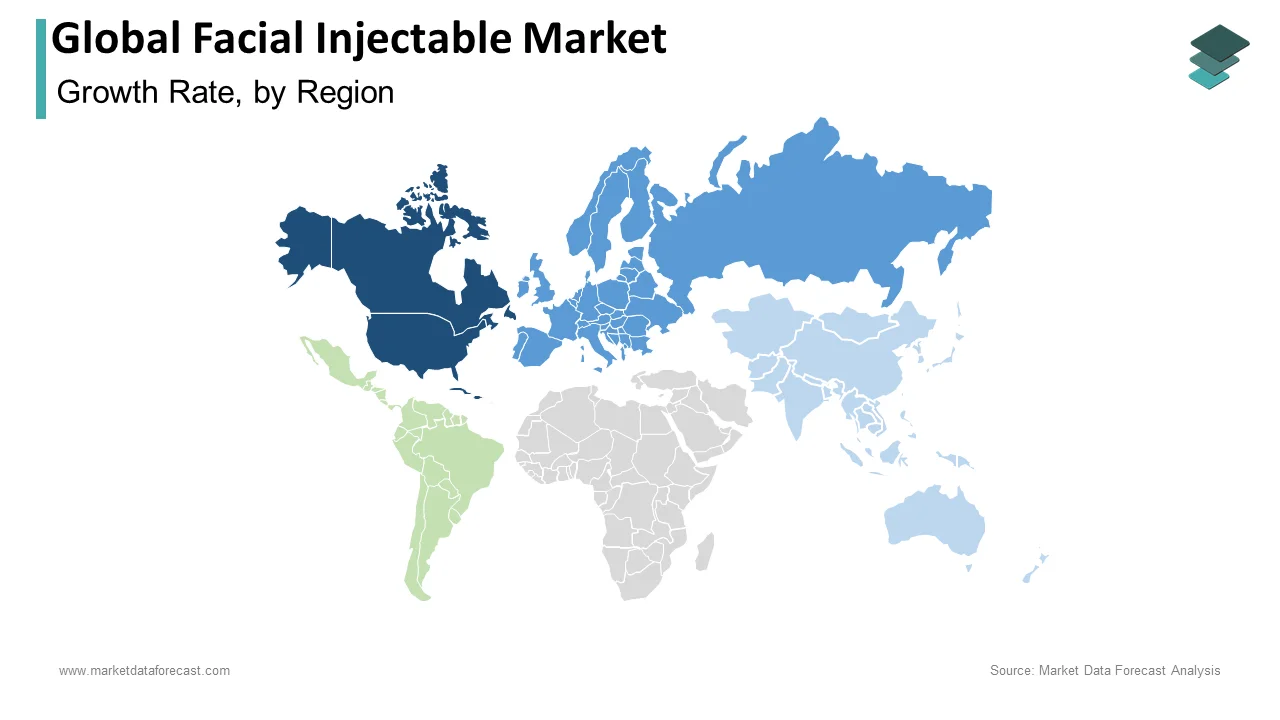

REGIONAL ANALYSIS

Regionally, North America dominates the pulse oximeter market. This region holds the largest share of the global market in 2024. The growth of this region is due to the increasing population suffering from chronic respiratory diseases in this region. In addition, the increased adoption of pulse oximeters from hospitals and the increase in the geriatric population in this region drives the growth of the North American pulse oximeter market. The increased awareness in the population regarding the early detection of diseases prevents the growth of diseases that causes major harm to patients. The U.S. led the North American market in 2024, which is followed by Canada.

Europe accounted for the second-largest share of the worldwide market in 2024 and is expected to grow at a healthy CAGR during the forecast period. Factors such as the growing penetration of digital healthcare technology, and increased demand for home-based healthcare services, these factors drive the Europe pulse oximeter market. The increased adoption of mHealth solutions and mobile apps and self-monitoring and expanding eHealth infrastructure increases the growth of this market. The UK, Germany, and France are anticipated to account for the major share of the European market during the forecasting period.

The Asia Pacific is a lucrative regional market for pulse oximeters and is expected to grow at the fastest CAGR during the forecasting period. Factors such as large and diverse populations with varying healthcare needs and challenges, the increased burden of non-communicable diseases such as diabetes, hypertension, and the growing number of government initiatives to improve healthcare access drives the growth of the APAC pulse oximeter market. The increased demand for telemedicine and remote monitoring solutions drives the pulse oximeter in this region. India, China, and Japan are estimated to hold a leading share of the Asia-Pacific market during the forecasting period.

The pulse oximeter market in Latin America had a notable share of the worldwide market in 2024 and is expected to show a healthy CAGR during the forecasting period. This is due to increased investment in healthcare infrastructure and services.

The MEA pulse oximeter market holds a moderate share of the global market.

KEY MARKET PLAYERS

Some key market players in the pulse oximeter market are GE Healthcare, Medtronic (Covidien), CAS Medical System Inc., Contec Medical System Co. Ltd., Omron Corporation, Smiths Medical, Edan Instruments Inc., Smiths Group plc, Halmaplc, Nihon Kohden corporation.

RECENT MARKET DEVELOPMENTS

- In May 2022, Medtronic received FDA clearance for Nellcor™ OxySoft™ neonatal-adult SpO2 sensor.

- In May 2022, Masimo announced the limited market release of the W1™ health watch for consumers. The first of its kind, the Masimo W1 offers accurate, continuous measurements and actionable health insights – from the leader in hospital pulse oximetry – in a personal, discreet, lifestyle-friendly wrist-worn wearable.

MARKET SEGMENTATION

This research report on the global Pulse Oximeter Market has been segmented and sub-segmented into the following categories.

By Product Type

- Handheld Oximeters

- Fingertip Oximeters

- Tabletop Oximeters

By End-use

- Hospitals and other healthcare facilities

- Home Health cares

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

who are the key players of the global pulse oximeter market ?

GE Healthcare, Medtronic (Covidien), CAS Medical Systems Inc., Philips Healthcare, Nonin Medical Inc., Contec Medical Systems Co., Ltd., Omron Corporation, Smiths Medical, and Edan Instruments, Inc. are some of the key market players.

what is the compound annual growth rate (CAGR%) of the global pulse oximeter market during the forecast period?

The global pulse oximeter market is expected to grow at a CAGR of 8.02% during the forecast period.

Which Region holds the largest revenue share during the forecast period in the global pulse oximeter market ?

The North American pulse oximeter market is expected to grow significantly and hold the largest revenue share during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com