Global Intravenous Ibuprofen Market Size, Share, Trends & Growth Forecast Report By Age Group (Pediatrics and Adults), Indication (Pain/Inflammatory and Fever) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Intravenous Ibuprofen Market Size

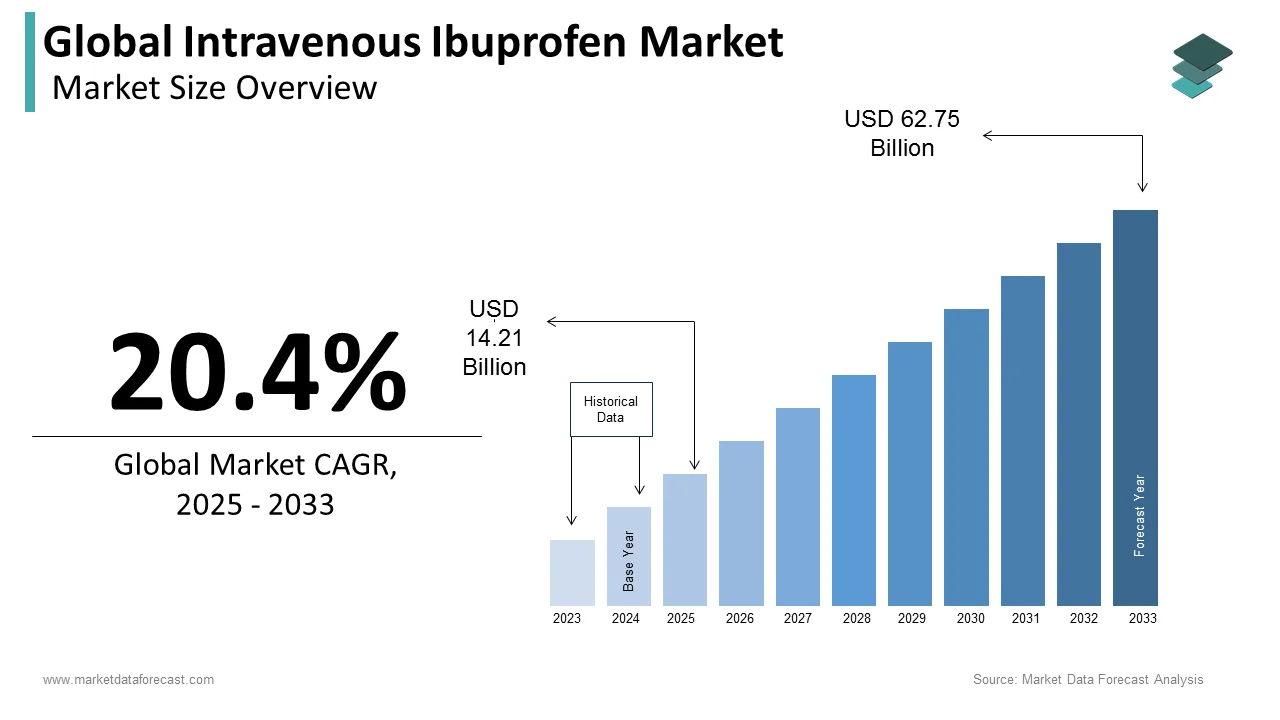

The size of the global intravenous ibuprofen market was worth USD 11.8 billion in 2024. The global market is anticipated to grow at a CAGR of 20.4% from 2025 to 2033 and be worth USD 62.75 billion by 2033 from USD 14.21 billion in 2025.

MARKET DRIVERS

The high bioavailability with rapid action and increasing diseases like CVS, osteoarthritis, rheumatoid arthritis, cancer, and headache are driving the intravenous ibuprofen market growth.

The easy availability of ibuprofen over the counter across the world is enhancing market growth. In addition, increasing awareness about rapid pain relief injections and pharmaceutical industries focusing on developing innovative drugs is accelerating the market demand. Also, the rise in disposable income in urban areas is increasing the market's growth rate. Furthermore, due to the implementation and advancement in technology and investment in R&D, it will foresee the growth of the ibuprofen injection market. In addition, the increase in the prevalence of arthritis, increasing incidence of bone and muscle disorders, increase in the prevalence of musculoskeletal diseases, increasing cardiovascular diseases and cancer, and high development of intravenous ibuprofen formulations in the global market of intravenous (IV) ibuprofen is driving the growth market.

IV Ibuprofen provides several benefits. Due to the direct analgesic and anti-inflammatory effects, combined with reduced opioid requirements, help patients recover faster and reduce opioid-related side effects when surgical patients are treated with intravenous ibuprofen. When used in conjunction with central and peripheral nerves, IV ibuprofen may even show additional synergistic multimodal analgesic effects, like the hospital floor for general pain management, the emergency department for musculoskeletal injuries and ambulatory surgery centers to expedite discharge and limit the use of narcotics.

The growing investment in research and development activities and technological advancements are boosting the growth of the intravenous ibuprofen market growth.

Shortened ibuprofen IV infusion shows robust Cmax to potentiate the analgesic effect. During the postoperative period, acute pain is a significant problem for hospitalized patients, resulting in trauma or acute illness due to surgical procedures, which is experienced by 80% of people. The sympathetic nervous system is activated by pain, increasing blood pressure, and respiratory rate, which is often not well treated by hospitals and long-term care facilities, but IV ibuprofen solves that problem.

Additionally, the increasing number of product approvals and government regulations for NSAIDs provide lucrative opportunities for the market. NSAIDs inhibit the production of the enzymes COX-1 and COX-2 to further prevent sensitization of pain receptors at the site of injury; when used with Oral ibuprofen, it provides additional properties of anti-inflammatory, antipyretic and analgesic, acting as a mainstay in the treatment of acute pain and fever. Furthermore, due to improved government regulations, previously faced limitation of lack of a commercially available parenteral formulation has been solved through its lipophilic properties to produce it in an intravenous formulation, which works mechanically, both centrally and peripherally, to reduce pain and fever. These factors further help in driving the market growth.

MARKET RESTRAINTS

Prostaglandins and COX enzymes vasodilating properties help maintain renal blood flow and glomerular filtration, and suppressing their production lowers perfusion and reduces renal function. However, side effects such as respiratory depression, drowsiness, allergic responses, and gastrointestinal issues frequently restrict their use. Some common side effects of ibuprofen injection may include vomiting, headache, dizziness, or nausea. However, the side effects of intravenous ibuprofen injection in the market and it taking a long time to introduce new products are some factors hampering the Intravenous ibuprofen global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 to 2033 |

|

Base Year |

2022 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Age Group, Indication, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Cumberland Pharmaceuticals Inc., Alveda Pharmaceuticals, Inc., CSL Limited, Sandor Medicaids Pvt Ltd., Germin MED, Grifols S.A., Harbin Gloria Pharmaceuticals Co., Ltd., Al Nabeel International Ltd., PT. Soho Industri Pharmasi and Laboratorios Valmorca, C.A. |

SEGMENTAL ANALYSIS

Global Intravenous Ibuprofen Market Analysis By Age Group

Adults are the significant consumer base for intravenous ibuprofen. The adult medication is injected into a vein for 30 minutes every 6 hours to reduce pain. To reduce fever, medication is given every 4 to 6 hours, which works by lowering body temperature and blocking certain substances that cause inflammation or fever. The maximum effect is reached within 5-10 minutes, lasting 2-4 hours. It might also be life-threatening if more than 400 mg/kg of ibuprofen is ingested.

The pediatric segment is expected to grow at a substantial CAGR during the forecast period. The Pediatrics segment is estimated to be the quickest-growing segment during the forecast period. Increasing awareness about Intravenous ibuprofen and increasing funds from government organizations escalate market growth. IV ibuprofen used for 10 minutes in children is an analgesic option for perioperative, intraoperative, and postoperative pain, which is even more safe and more effective for short-term use. A single oral dose is bioequivalent to a single IV of the same volume.

Global Intravenous Ibuprofen Market Analysis By Indication

The fever segment is projected to grow at the most significant share of the worldwide market during the forecast period owing to the growing patient population suffering from chronic diseases. Ibuprofen 400 mg IV and acetaminophen 1000 mg IV are used to reduce fever in a short period of 30 min. Acetaminophen injection is injected into a vein over 15 minutes, relieving fever for the next 4 to 6 hours.

The pain/inflammatory management segment is foreseen to hold a commanding share of the worldwide market during the forecast period. IV ibuprofen is a crucial addition to perioperative pain management in any surgical setting by reducing the narcotic analgesic requirements with an excellent safety profile.

REGIONAL ANALYSIS

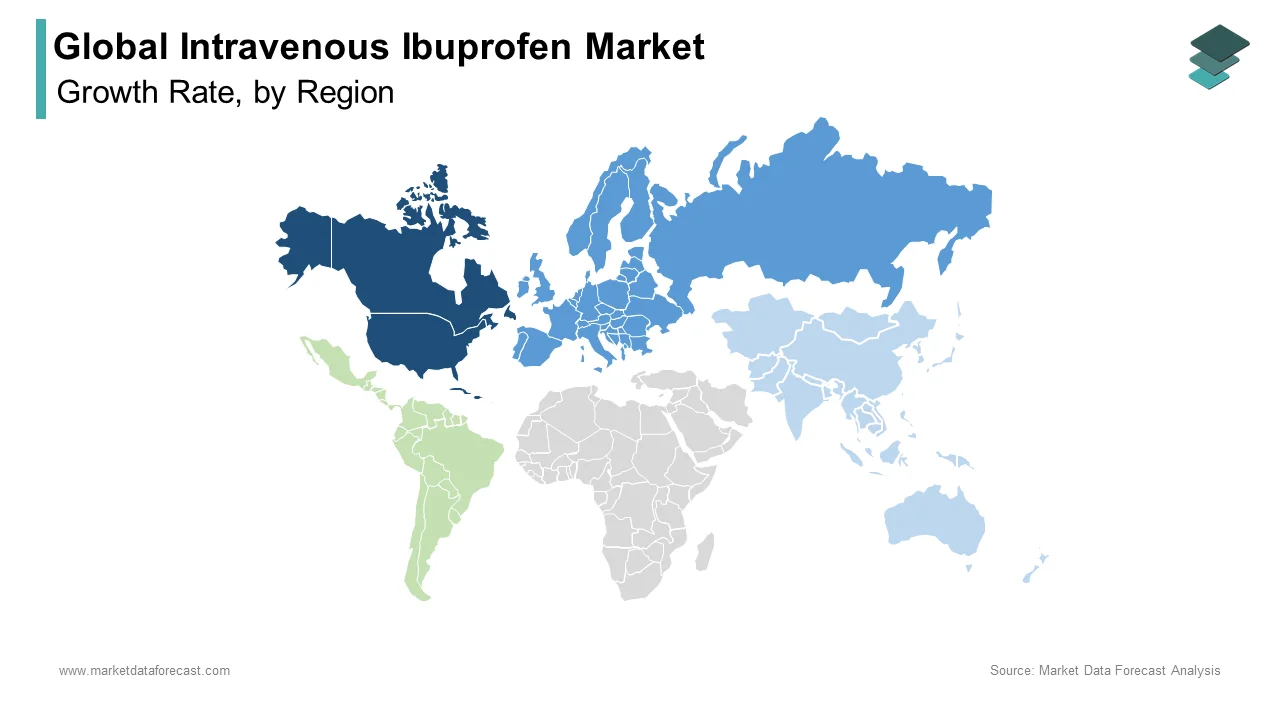

In 2024, North America was the most dominant and significant global intravenous ibuprofen market share. The U.S. and Canada are estimated to remain the highest income-producing region in this region. This market's growth is credited to the extensive use of intravenous ibuprofen for treating pain and fever.

Europe is estimated to grow at a CAGR value of 19.23% during the forecast period and has occupied the second-largest market share. Increasing awareness among people, particularly in adults, and Soaring occurrences of heart-related disorders and cancer significantly drive the market.

Asia-Pacific is expected to grow with the highest CAGR value during the period. Rising awareness of nonsteroidal anti-inflammatory drugs and transferring tendency associated with intravenous drug delivery are fuelling the market's growth rate.

Latin America is evaluated to grow prominently during the period owing to the increasing occurrences of cardiovascular diseases and growing support from the governments of the Latin American countries.

The market in Middle East and Africa is anticipated to account for a moderate share of the worldwide market. This region is attributed to pain, fever, headache, toothache, back pain, and trauma.

KEY PLAYERS IN THE GLOBAL INTRAVENOUS IBUPROFEN MARKET

Some of the major companies dominating the Global Intravenous Ibuprofen Market profiled in the report are Cumberland Pharmaceuticals Inc., Alveda Pharmaceuticals, Inc., CSL Limited, Sandor Medicaids Pvt Ltd., Germin MED, Grifols S.A., Harbin Gloria Pharmaceuticals Co., Ltd., Al Nabeel International Ltd., PT. Soho Industri Pharmasi and Laboratorios Valmorca, C.A.

RECENT HAPPENINGS IN THE MARKET

- In July 2022, a comprehensive response letter was received by Hyloris Pharmaceuticals from the United States Food and Drug Administration for clarification of Maxigesic IV, a combination of 1000 mg of acetaminophen and 300 mg of ibuprofen, to treat fever and postoperative pain.

- In November 2021, a specialty pharmaceutical company, Cumberland Pharmaceuticals Inc., announced the approval of Caldolor by the U.S. Food and Drug Administration, a formulation of ibuprofen administered intravenously, given just before surgery, and administered every six hours afterward.

- In November 2021, a combination of acetaminophen 1000 mg and ibuprofen 300 mg for intravenous (IV) infusion, Maxigesic, was accepted as a New Drug Application by Food and Drug Administration to be used for the treatment of postoperative pain.

- In January 2020, Cumberland, a pharmaceutical company, announced a new product, caldolor, to treat acute care. The latest version of caldolor is taken directly without dilution for pain relief. In addition, Caldolor is an anti-inflammatory agent that helps to reduce mild-moderate pain.

- In 2020, Cumberland Pharmaceuticals began expanding its caldolor business worldwide to treat coronavirus infections. In addition, the company provides support through caldolor access to hospitals and clinics in various countries.

- In 2020, Nashville pharmaceutical company might reduce opioid use by launching a new product, ibuprofen, in an IV bag. This IV bag helps to decrease the need for opioid analgesic drugs post-surgery.

DETAILED SEGMENTATION OF THE GLOBAL INTRAVENOUS IBUPROFEN MARKET INCLUDED IN THIS REPORT

This research report on the global intravenous ibuprofen market has been segmented based on age group, indication, and region.

By Age Group

- Pediatrics

- Adults

By Indication

- Pain/inflammatory

- Fever

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region has the highest market share in the intravenous ibuprofen market ?

North America will dominate the intravenous ibuprofen market during the forecast period.

At What CAGR, The intravenous ibuprofen market is expected to grow from 2025 to 2033?

The intravenous ibuprofen market is expected to grow at a CAGR of 20.4% during the forecast period 2025-2033.

How much is the global intravenous ibuprofen market going to be worth by 2032?

As per our research report, the global intravenous ibuprofen market size is estimated to grow to USD 62.75 billion by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com