Global Generic Drugs Market Size, Share, Trends & Growth Analysis Report By Type (Pure Generic Drugs, Branded Generic Drugs), Application (Central Nervous System (CNS), Cardiovascular, Dermatology, Oncology, Respiratory and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Generic Drugs Market Size

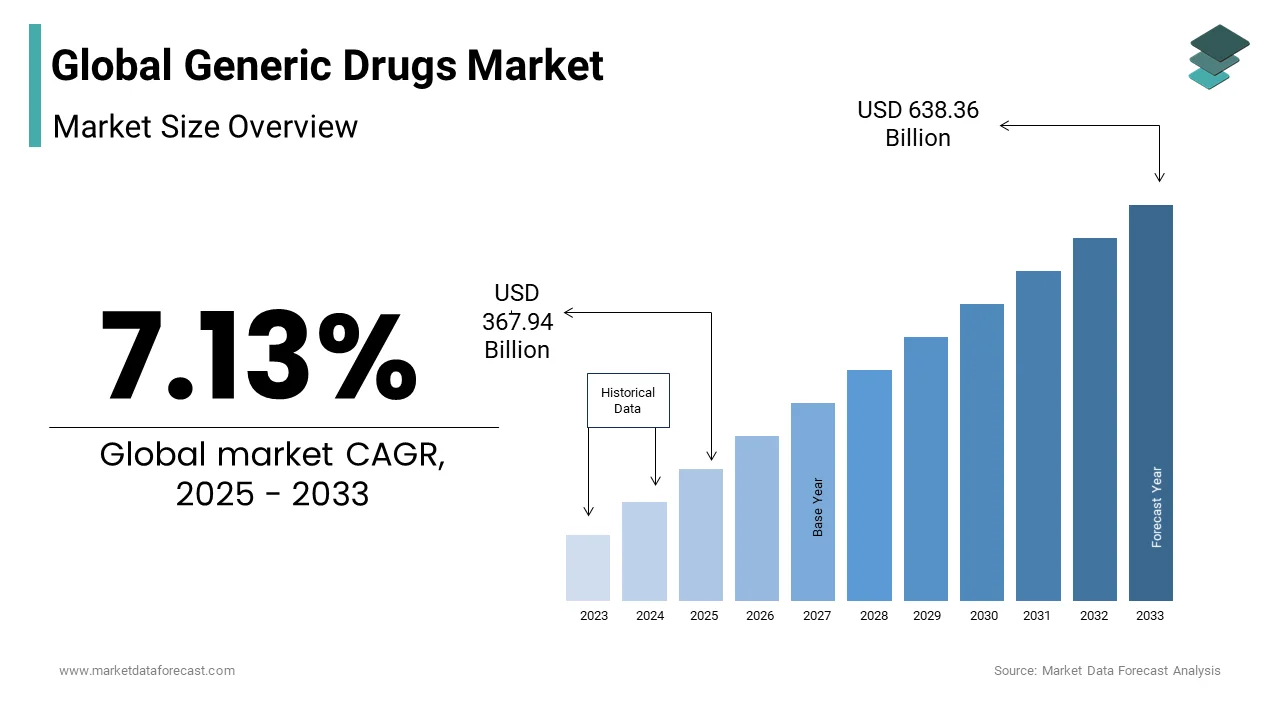

In 2024, the global generic drugs market was valued at USD 343.45 Billion and it is expected to reach USD 638.36 Billion by 2033 from USD 367.94 Billion in 2025, growing at a CAGR of 7.13% during the forecast period.

Generic drugs first appeared in 1984, when the Hatch-Waxman Act encouraged the manufacture of generic drugs and developed system regulation. In contrast to branded products, generic drugs have the same API pharmacokinetic and pharmacodynamic properties. It is also bioequivalent to currently available branded drugs but differs in fillers, preservatives, form, packaging, and flavor. Branded drug manufacturers spend money on research and development and ads for their new products, and they are granted a monopoly for a set period. However, when a patent expires, manufacturers may ask the FDA for permission to produce generic drugs. Consequently, generic medications are less expensive than marketed drugs, and almost 80% of prescription drugs are generic. Metformin, metoprolol, amphetamine salt combo, acyclovir, bupropion HCL tablet, cholestyramine, ibuprofen tablet, letrozole, and verapamil are some examples of generic drugs.

MARKET DRIVERS

Growing Patient Population of Chronic Diseases

Chronic diseases impact people of all ages throughout the globe. These are long-term illnesses caused by genetic, environmental, behavioral, and psychological factors. Non-communicable diseases (NCDs) such as cardiovascular disorders, chronic respiratory diseases such as COPD and asthma, malignancies, and diabetes are the most common. Rapid unplanned urbanization, globalization of unhealthy lifestyles, and an aging population drive these diseases. Chronic diseases necessitate long-term therapy and marketed medications are prohibitively costly. As a result, more patients choose generic drugs as demand grows with time. According to the National Health Interview Survey (NHIS), approximately 51.8 % of US adults have one chronic illness, while approximately 27.2% have several chronic conditions. In addition, chronic diseases can cause almost 38 Billion deaths per year worldwide, according to the WHO. As a result, the demand for generic drugs rises in tandem with the prevalence of chronic diseases, propelling the generic drugs market to new heights.

According to WHO, NCDs result in 41 Billion deaths each year, which is equivalent to 71% of all deaths globally, among which 17.9 Billion deaths are caused by cardiovascular diseases, followed by cancers with 9.3 Billion deaths, respiratory diseases with 4.1 billion, and diabetes with 1.5 Billion deaths, annually. Although NCDs are often associated with older age groups, WHO's research shows that NCDs occur between the ages of 30 and 69, leading to more than 15 Billion deaths yearly. Of these premature deaths, 85% occur in the middle- and low-income regions. In addition, other factors like physical inactivity, unhealthy diet, exposure to the use of tobacco, and increasing consumption of alcohol are attributing children, adults, and the elderly to vulnerable risks of these diseases.

The Rising Demand for Generic Drugs

The pharmaceutical industry has been expanding substantially over the last decade. While there is continued unrest in some regions, both economically and politically, the regional pharmaceutical market is becoming more attractive. In addition, although most of the market was held previously by the originator drugs, new guidelines favoring generic drugs are being implemented worldwide. Publicly funded health systems are under amplified pressure to reduce the ever-rising drug budgets. The government is finding ways to restore the fiscal balance by transferring more funds to patients and private health insurance. The continued rise in the expenditure on prescribed drugs and the healthcare expenditure accounting for a substantial percentage of a nation's GDP is attributed to the generic drug manufacturers producing effective products at an advantageous price. Also, it enables them to hold an attractive position to fulfill the increasing essential need for these medicines. Also, as generic-friendly policies are expected to be enacted, the market share of patented drugs is expected to erode further in the next decade, thereby resulting in the growth of the generic drugs market worldwide.

The cost-effectiveness of generic medications has increased demand for the generic drugs market. Generic drugs increase competition in the industry, leading to a drop in prices and more people being prescribed generic drugs by healthcare providers. Generic drugs are 85 % less expensive than conventional drugs, so in the United States, 9 out of 10 prescriptions are filled with generic drugs, saving almost $2.2 trillion over the past decade.

Regulatory Encouragements are a Notable Opportunity

The government must take appropriate steps to encourage global pharmaceutical firms to set up new generic facilities through joint ventures by offering tax breaks. Some amendments, such as the US Generic Drug User Fee Act, are expected to result in a much stronger focus on quality with a much shorter approval process for these generic medicines. Also, the FDA's Office of Generic Drugs (OGD) gained huge success after implementing the Generic Drug User Fee Amendments Reauthorization (GDUFA II) in the first year. The main purpose of the FDA was to promote international trade and harmonization of generic medicine development, thereby creating opportunities to gain high-quality drugs to be approved globally. Also, the low-cost development and approval procedure may promote competitiveness. Moreover, the FDA has taken a crucial step toward easing the entry of generic medicines into the market by introducing generic competition to the level of branded medicines known as complex drugs. The authorization of the first generic version of Advair Diskus in Jan 2019 for the treatment of asthma is an example of this, which creates future opportunities for the generic drug market.

MARKET RESTRAINTS

Stringent Regulations

Nonetheless, the FDA’s stringent approval and distribution process restrict the expansion of the generic drug industry. The FDA examines the side effects, accuracy, and other ingredients of generic medications. If a corporation fails to follow the requirements, the substance is recalled. For instance, Sun Pharma recalled 747 bottles of generic diabetes medication in October 2020 because they could contain cancer-causing nitroso dimethylamine above the limit. The need to know the generic drug market is the curb to the worldwide market. In developing countries, drugs are cheap, but the quality is restraining growth. Emerging markets like India and China are supposed to generate more opportunities for the generic drugs market.

The quality issues of generic drugs are another significant challenge to the global market growth. To get approval from the Food and Drug Administration (FDA), generic medicines should be demonstrated to be the same as brand-name medicines in dosage, effectiveness, strength, safety, quality, stability, and how they are taken. They have the same advantages and disadvantages as their brand-name counterparts. The FDA generic drug program conducts a thorough review before approving the medicines to ensure they meet these requirements. In the event of negative reactions or patient side effects resulting in the report, the FDA investigates and makes required changes in the usage and manufacturing of these medicines. These medicines cost less than branded medicines as they do not involve repeated animal and clinical studies required for branded medicines. However, the issue of these medicines in certain countries is about something other than being expensive but about dubious quality. The issue of cheaper generics is grounded on measurable and enforceable assurance about quality through tests and other internationally mandated parameters. In addition, the absence of a standard drug regulatory body in certain countries leads to quality issues.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Ranbaxy Laboratories, Ltd, Actavis., Viatris, Dr. Reddy’s Laboratories, Par Pharmaceutical, Inc., Sandoz International GmbH, Hospira, Inc., Apotex, Inc., Pfizer Inc. and Teva Pharmaceuticals. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the pure generic drugs segment dominated the market in 2024 and held more than half of the global market share, 51%. Therefore, the upper hand of the pure generic drugs segment is predicted to continue during the forecast period. The cost-effectiveness of these drugs and the growing adoption of pure generic drugs in developing countries primarily drive the segment's growth. In addition, the patent expiration of several blockbuster drugs is anticipated to boost the segment's growth rate.

On the other hand, the branded generic drugs market had decent occupancy in the global market in 2024 and is predicted to showcase a CAGR of 8.8% during the forecast period. The growing demand for quality drugs with a trusted brand name is majorly boosting segmental growth. Branded generic drugs have gained recognition as being of better quality than pure ones, and notable pharmaceutical companies market these. In addition, the growing patient count suffering from chronic diseases such as cardiovascular diseases, cancer, diabetes, and others is expected to propel the segment's growth rate as these drugs are used in the treatment procedures of chronic diseases.

By Application Insights

The cardiovascular segment is estimated to showcase a healthy CAGR during the forecast period. CVDs are one of the leading causes of death worldwide, including heart failure, circulatory disorders, high blood pressure, cholesterol, dyslipidemia, angina, arrhythmias, and stroke. Moreover, the cardiovascular segment covers more than 6% of the global generic drug market due to a series of cardiovascular drug patent expiration. In addition, global population growth and aging benefit the healthcare sector and the manufacturers of generic drugs.

On the other hand, the oncology segment is predicted to play the leading role in the global generic drugs market during the forecast period. The growing patient population suffering from cancer and increasing demand for drugs and treatment procedures to cure cancer propel the segment's growth. In addition, the high costs associated with branded cancer drugs and the increasing geriatric population worldwide are anticipated to boost the segment's growth rate. Furthermore, the expiration of several blockbuster cancer drug patents is one of the biggest opportunities for the oncology segment and is estimated to drive segmental growth in the coming years.

REGIONAL ANALYSIS

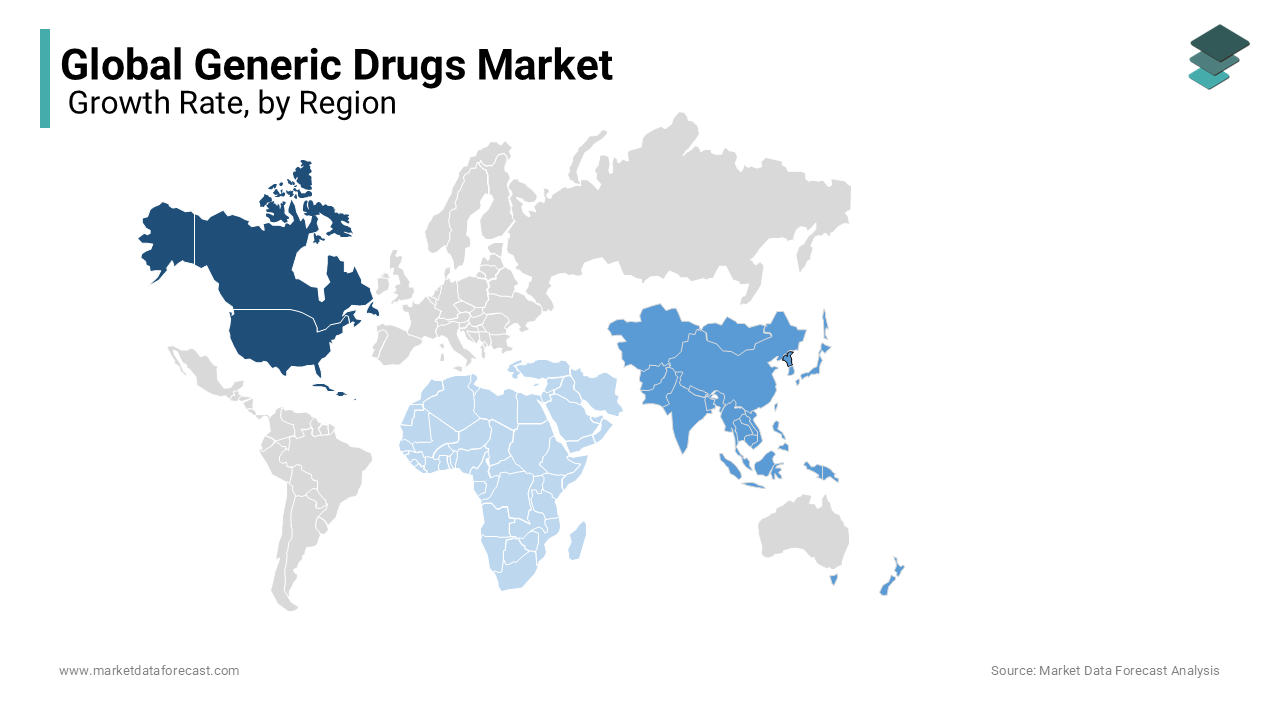

North America held the largest share of the global generic drugs market in 2024 and is predicted to maintain the same dominating position throughout the forecast period. This is mainly due to the prescription patterns mostly covered with branded generic drugs. Hence, the demand for generic drugs is high in this region. The United States had the largest market share of 92% for generic drugs in North America in 2022, followed by Canada, which had a market share of 8%.

The Asia-Pacific market is one of the promising regional markets for generic drugs worldwide. It is estimated to hold a substantial global market share during the forecast period. The APAC market held the second-largest worldwide market share in 2024, falling right behind North America. Countries such as India and China in the Asia-Pacific region dominated the global generic drugs business in volume. However, China is leading in this region, with a market share of 43% in 2022.

Europe is one of the promising regional markets for generic drugs worldwide. It is estimated to hold a substantial global market share during the forecast period. The growing demand for cost-effective drugs in the European region primarily drives market growth. Many blockbuster drugs have met their expiry in the European region in recent years, which has given the manufacturers of generic drugs a significant opportunity to grow. The increasing number of initiatives by the European governments favoring generic drugs is fuelling the European market growth. In addition, the growing aging population in the European region supports regional market growth. The presence of notable generic drug manufacturers in Europe, such as Teva Pharmaceutical Industries Ltd., Mylan NV, and Novartis International AG, favors the growth of the generic drugs market.

Latin America is anticipated to hold a considerable share of the worldwide market during the forecast period. Healthcare costs are growing significantly, making it difficult for people to afford quality healthcare. Due to this, the demand for affordable healthcare is growing in the Latin American region, driving the generic drugs market in Latin America as these drugs are an effective alternative to branded drugs. In addition, the growing chronic disease patient population in the Latin American region and the increasing number of generic drug manufacturing activities further fuel the growth of the generic drugs market in Latin America.

The market in the Middle East and Africa is expected to hold a moderate share of the worldwide market during the forecast period. The rising number of improvements in the healthcare infrastructure and healthcare system of MEA countries is favoring the generic drugs market in MEA. In addition, increasing initiatives from the MEA countries favoring generic drugs support regional market growth.

KEY MARKET PLAYERS

A few of the notable market participants operating in the global generic drugs market profiled in the report are Ranbaxy Laboratories, Ltd, Actavis., Viatris, Dr. Reddy’s Laboratories, Par Pharmaceutical, Inc., Sandoz International GmbH, Hospira, Inc., Apotex, Inc., Pfizer Inc.., Teva Pharmaceutical and others.

The key players adopt various growth strategies to accelerate the generic drug market. For instance, in May 2022, Sandoz will expand its respiratory portfolio by launching the first generic pirfenidone in the United States for patients with idiopathic pulmonary fibrosis. Sandoz was the world's leading generics manufacturer in 2020, with 9.5 Billion US dollars in revenue. Tablets, capsules, and tablets aren't the only ways to get medicine into your body; injectables are another option. They're considered the most effective because the drug's bioavailability is higher through this route than the others. Injectables are undergoing new developments. The medicine takes less time to react when taking this route.

RECENT HAPPENINGS IN THIS MARKET

- In March 2022, Teva announced the launch of Lenalidomide, a generic version of Revlimid, in the United States. Lenalidomide treats multiple myeloma, mantle cell lymphoma, and certain myelodysplastic syndromes.

- In March 2021, Biocon announced that its subsidiary would partner with Libbs Farmaceutica to launch generic drugs in Brazil. Biocon is responsible for drug development and manufacturing as a part of the partnership, while Libbs is responsible for import and distribution.

- In March 2021, ANI Pharmaceuticals, Inc. acquired Novitium Pharma, a New Jersey-based pharmaceutical company, to strengthen the generic business and R&D engine.

MARKET SEGMENTATION

This research report on the global generic drugs market has been segmented and sub-segmented based on the type, application, and region.

By Type

- Pure Generic Drugs

- Branded Generic Drugs

By Application

- The Central Nervous System (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which segment by application held the largest share in the generic drugs market?

Based on the application, the CVD segment led the generic drugs market in 2024.

Who are the major players in the generic drugs market?

Ranbaxy Laboratories, Ltd, Actavis, Mylan, Inc., Industries, Ltd., Dr. Reddy’s Laboratories, Par Pharmaceutical, Inc., Sandoz International GmbH, Hospira, Inc., Apotex, Inc., Watson Pharmaceuticals, Ltd., Teva Pharmaceutical are some of the noteworthy players in the global generic drugs market.

What was the value of the global generic drugs market in 2024

The global generic drugs market size was valued at USD 343.45 Billion in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com