Global Pharmaceutical Excipients Market Size, Share, Trends and Growth Forecast Report - Segmented By Product (Organic Chemicals and Inorganic Chemicals), Functionality (Fillers & Diluents, Binders, Suspension & Viscosity Agents, Coatings, Disintegrants, Flavoring Agents, Lubricants & Glidants, Colorants, Preservatives and Other Functionalities), Formulation Type (Oral Formulations, Tablets, Capsules, Liquid Formulations, Topical Formulations, Parenteral Formulations and Advanced Delivery Systems) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Pharmaceutical Excipients Market Size (2024 to 2032)

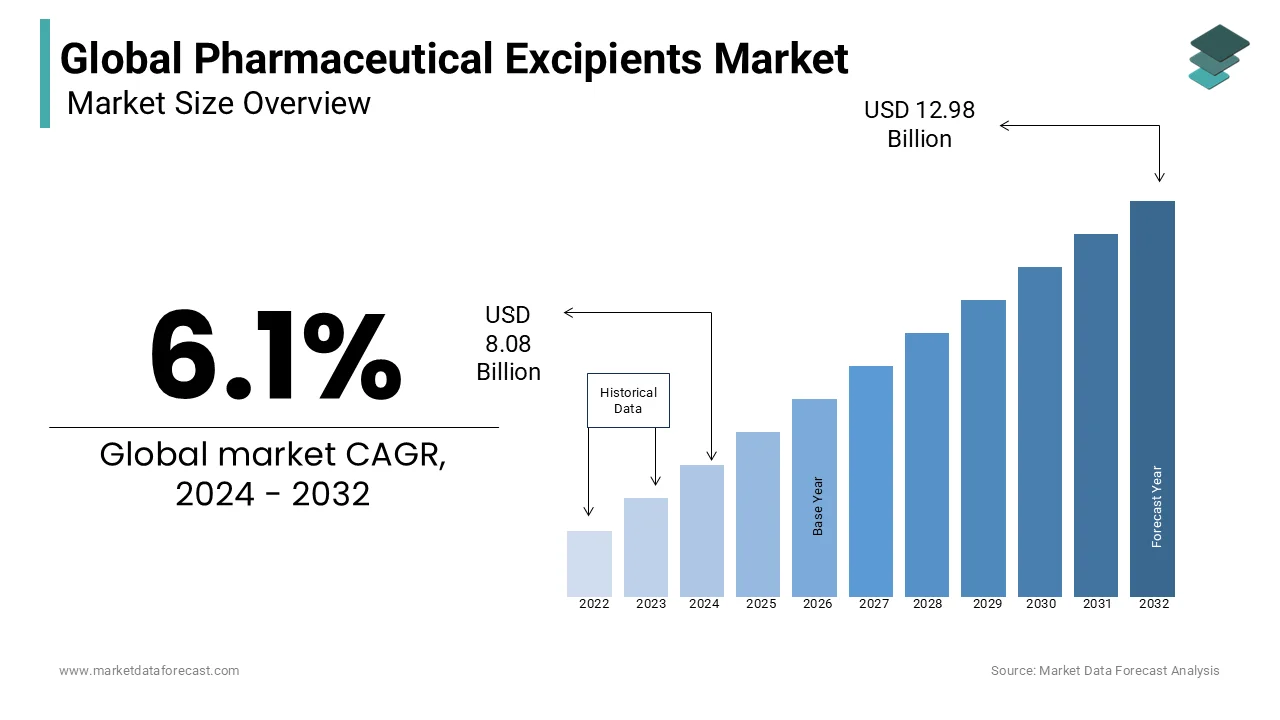

In 2023, the global pharmaceutical excipients market was valued at USD 7.62 billion and it is expected to reach USD 12.98 billion by 2032 from USD 8.08 billion in 2024, growing at a CAGR of 6.1% during the forecast period.

Excipients are inactive ingredients in the drug formulation, but they are essential to prevent contamination. In pharmaceuticals, excipients play a crucial role in stabilizing the drug for a long time and reducing viscosity. They help to have a safe chemical breakdown in the body. They increase fluidity in blood circulation and improve the drug's functionality, thanks to the active ingredients. Manufacturers mainly focus on implementing the formulation with products of biological origin, including excipients. It dramatically improves stability and also manages functionality. The excipients mainly provide the structure, properties, and application ratios used in prenatal drugs.

MARKET DRIVERS

The emergence of innovative technologies and new pharmaceutical ingredients, increasing adoption of binders in pharmaceutical products, and advancements in functional excipients are majorly driving the global pharmaceutical excipients market growth. Growing incidences of chronic diseases and other health disorders, increasing awareness of the formulations of medicines, and the rising number of research institutes to manufacture effective treatment procedures are other significant factors accelerating the growth of the global pharmaceutical excipients market.

Additionally, the rise in the economy is well-developed, and developing countries are propelling the market's growth rate. Growth opportunities for the pharmaceutical excipients market lie in the government's growing investments in healthcare centers to improve the quality of diagnosis and treatment procedures. The emergence of the latest technologies and the approval of new drugs from the US FDA fuelled the growth of the global pharmaceutical excipients market.

MARKET RESTRAINTS

Fluctuations in the availability of raw materials are slowly restraining the demand of the global pharmaceutical excipients market. The high cost of equipment for installation and maintenance is degrading the growth of the market. Besides, the investments in R&D by major companies are not up to the required standard, and increasing regulatory requirements are making it increasingly hard to get new manufacturing facilities approved are the most significant challenges to the global pharmaceutical excipients market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product Type, Functionality, Formulation Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Ashland Inc., AkzoNobel, Archer Daniels Midland Company, Associated British Foods PLC, BASF SE, Colorcon, Inc., Croda International PLC, Evonik Industries AG, FMC Corporation, Innophos Holdings Inc., J.M. Huber Corporation, Merck Millipore, Roquette Group, The DOW Chemical Company, and Lubrizol Corporation. |

SEGMENTAL ANALYSIS

Global Pharmaceutical Excipients Market Analysis By Product Type

The organic chemicals segment is expected to lead the global market during the forecast period. Increasing demand for the manufacturing of drugs with natural resources with fewer or no side effects is fuelling the growth. The high growth for oral fixed-dose combinations of pharmaceutical products, and the use of HPMC organic chemicals in life-sciences industries are propelling the growth of this segment. High adoption of cellulose and starch derivatives solid oral dosage form and increasing development in generic products worldwide further enhance the segmental growth.

Global Pharmaceutical Excipients Market Analysis By Functionality

The fillers & diluents segment is predicted to register the most significant share in the global during the forecast period. The growing prevalence of cost-effective treatment procedures is escalating the demand for this market. Diluents and fillers are used to increase and adjust the weight of the oral solid dosage form to minimize weight variation errors. The excipients having variant applications such as better compressibility, dose accuracy, and maintaining flow properties of viscous material are factors growing demands of this segment in the pharmaceutical market. Mannitol is highly used in the production of chewable tablets, especially for children. Diluents are mostly used in wet granulation manufacturing methods of tablets and capsules.

Global Pharmaceutical Excipients Market Analysis By Formation Type

During the forecast period, the oral formulations segment is forecasted to lead the global pharmaceutical excipients market based on the formulation type, mainly due to oral formulations being the most common drug delivery route. The rising demand to expand the production rate of drugs in pharmaceutical industries is magnifying the need of the market. An introduction of a novel drug delivery system and sustained released capsule to provide digestive tract function drive oral tablets and capsule formulation market growth.

The market for topical formulations is expected to witness the highest growth during the forecast period. Growth in this segment is driven mainly due to better assimilation of topical excipients with liquid APIs and increased patient compliance due to sensorial effects.

REGIONAL ANALYSIS

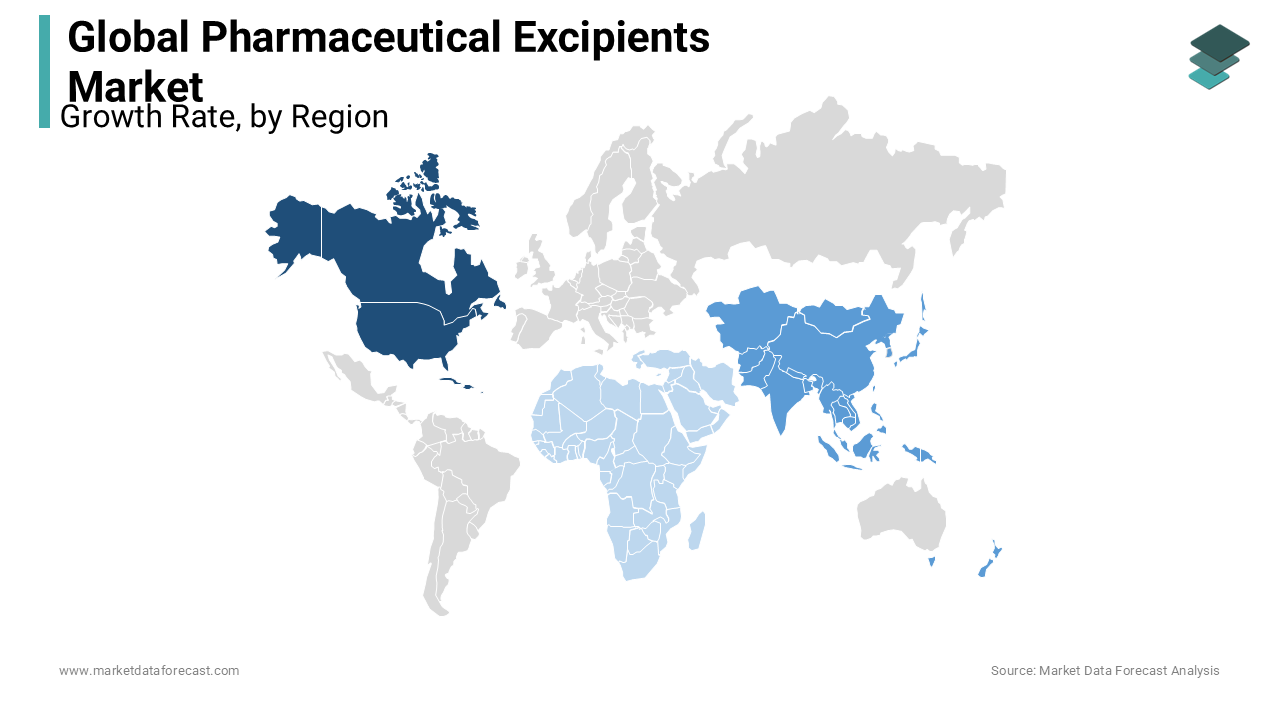

Regionally, North America and Europe combined occupied 63 % of revenue in the global pharmaceutical excipients market in 2023. The North American region holds the most significant shares of the global pharmaceutical excipients market due to the quick adoption of advanced technologies and high-quality innovation. Europe is following North America in dominating shares of the market with the rising geriatric population.

Asia Pacific witnessed the fastest growth rate in the past few years and hit the highest CAGR in the coming years. Increasing funds from private and public organizations and expanding the scale of hospitals are promoting market growth. The market should have a significant share in the Asia-Pacific region. The adoption of nanotechnology mainly accelerates market growth in this region. Increased investment in the pharmaceutical industry may increase market demand. India and China are the major countries contributing to the highest shares of the market. Changes in lifestyles and the increasing incidence of chronic diseases impact the positive growth of the market in the Asia Pacific. Japan is to have a steady growth CAGR in the coming years with the growing number of geriatric populations.

The Middle East and Africa is projected to have inclined growth rates during the forecast period.

KEY PLAYERS IN THE GLOBAL PHARMACEUTICAL EXCIPIENTS MARKET

A list of promising companies leading the global pharmaceutical excipients market profiled in this report is Ashland Inc., AkzoNobel, Archer Daniels Midland Company, Associated British Foods PLC, BASF SE, Colorcon, Inc., Croda International PLC, Evonik Industries AG, FMC Corporation, Innophos Holdings Inc., J.M. Huber Corporation, Merck Millipore, Roquette Group, The DOW Chemical Company, and Lubrizol Corporation.

Emerging players in this market are giving stiff competition to the top 10 players, who occupy almost 70% of the total market. Due to the rapid growth of the market and the opportunities it possesses in developing countries.

RECENT HAPPENINGS IN THIS MARKET

- In 2019, DuPont Nutrition entered into a partnership with Colorcon, Inc. 2019 to enhance its product portfolio.

- In Feb 2019, Indchem collaborated with Associated British Foods plc to distribute functional excipient products in India.

- In 2018, Roquette Feres collaborated with Thermo Fisher Scientific 2018 to distribute its products in Canada and the US. Roquette launched a carbohydrate excipient, which is a dominant segment in its product portfolio.

- In Jan 2019, Croda International acquired Brenntag Biosector Company to expand its pharmaceutical excipients portfolio.

DETAILED SEGMENTATION OF THE GLOBAL PHARMACEUTICAL EXCIPIENTS MARKET INCLUDED IN THIS REPORT

In this research report, the global pharmaceutical excipients market has been segmented and sub-segmented based on product type, functionality, formulation type, and region.

By Product

- Organic Chemicals

- Oleochemicals

- Carbohydrates

- Petrochemicals

- Proteins

- Other Organic Chemicals

- Inorganic Chemicals

- Calcium Phosphates

- Metal Oxides

- Halites

- Calcium Carbonates

- Calcium Sulfates

- Other Inorganic Chemicals

By Functionality

- Fillers & Diluents

- Binders

- Suspension & Viscosity Agents

- Coatings

- Disintegrants

- Flavoring Agents

- Lubricants & Glidants

- Colorants

- Preservatives

- Other Functionalities

By Formulation Type

- Oral Formulations

- Tablets

- Capsules

- Liquid Formulations

- Topical Formulations

- Parenteral Formulations

- Advanced Delivery Systems

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the size of the pharmaceutical excipients market worldwide in 2023?

The global pharmaceutical excipients market size was valued at USD 7.62 billion in 2023.

Which region is growing the fastest in the global pharmaceutical excipients market?

Geographically, the North American pharmaceutical excipients market accounted for the largest share of the global market in 2023.

At What CAGR, the global pharmaceutical excipients market is expected to grow from 2023 to 2032?

The global pharmaceutical excipients market is estimated to grow at a CAGR of 6.1% from 2023 to 2032.

Which are the significant players operating in the pharmaceutical excipients market?

Evonik Industries AG, FMC Corporation, Innophos Holdings Inc., J.M. Huber Corporation, Merck Millipore, Roquette Group, and The DOW Chemical Company are some of the significant players in the pharmaceutical excipients market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]