Global Bioactive Ingredients Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Fiber, Vitamin, Probiotic, Prebiotic & Amino Acid, Carotenoids, Phytoextract, Omega 3 Fatty Acid And Others), Application (Food & Beverages, Dietary Supplements, Cosmetics, Animal Feed And Pharmaceuticals), Sources (Plant, Animal, Microbial), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Bioactive Ingredients Market Size

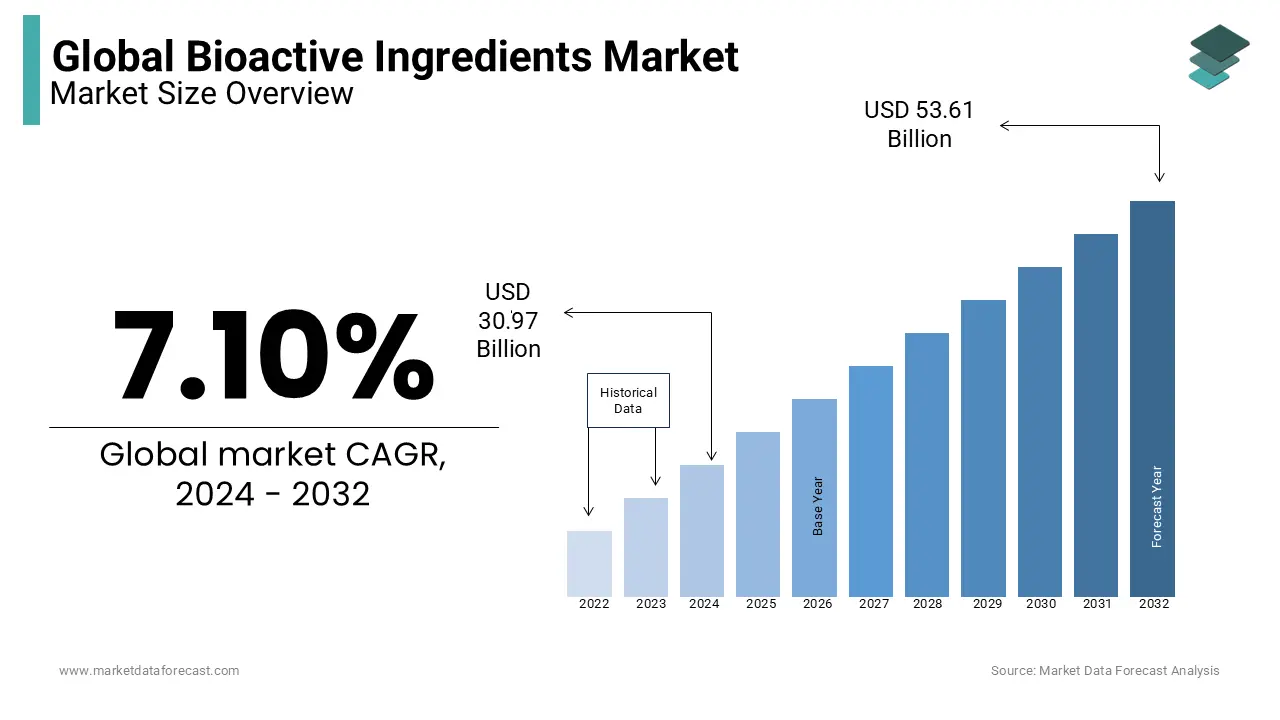

The global bioactive ingredients market size was worth USD 30.97 billion in 2024, and is anticipated to be worth USD 57.42 billion by 2033 from USD 33.17 billion in 2025, growing at a CAGR of 7.10% during the forecast period. Increased resistance to mania among people is likely to boost demand for bioactive ingredients market products.

Bioactive ingredients are naturally occurring essential compounds like prebiotics, amino acids, vitamins, and omega-three fatty acids used in food and have a positive effect on human and animal health. Bioactive ingredients are food ingredients that have a biological effect on living tissue. They are a type of biomolecules that aid in the metabolic processes of healthy molecules added to food and ingredients. This also plays a vital role in solving the problem of inadequate intake of nutritious food and the inability to maintain a balanced diet. The primary sources of biologically active ingredients are plants, animals, and microorganisms.

Bioactive ingredients are widely applied in the food and beverage industry, pharmaceutical and functional food, personal care products, and animal feed. This compound is used in functional foods to treat a variety of chronic diseases like arthritis and diabetes. Bioactive ingredients, such as carotenoids, essential oils, and antioxidants, are increasingly adopted into meals to enhance sensory characteristics or produce nutritional features. The results of several studies have established a relationship between certain bioactive compounds and their effects on various chronic disorders such as hypertension, diabetes, cancer, and heart disease. The increase in disposable income, along with increased consumer awareness of health, is assumed to help the global Bioactive Ingredients Market.

MARKET DRIVERS

Increased health awareness, coupled with an increased interest in consumer health, is presumed to drive sales across the industry.

Today, people are well aware of maintaining a balanced diet with the proper content of essential nutrients. Consumers are also aware of health, treatment, and disease prevention. Recently, the demand for bioactive ingredients has increased, and this trend is expected to continue throughout the outlook period. People are more concerned about health. They want to lead an active lifestyle without illness or disease, and bioactive ingredients fill this need. Increased awareness of the use of external components or products to meet the body's needs. This increased awareness is supporting the growth of the market. The global market for bioactive ingredients and products is anticipated to lead to innovative products due to increasing health problems and continued research and development in the field of bioactive ingredients.

As older people are more vulnerable to various chronic diseases, an aging population worldwide is suspected of leading the market, so it is best to follow a healthy diet. Since doctors generally prescribe bioactive foods to patients suffering from the chronic diseases mentioned above, the incidence of various chronic diseases such as cancer, diabetes, and hypertension is also expected to lead the market for bioactive ingredients and products. Improving foods and beverages with ingredients that provide nutritional benefits without making a significant change in taste is a major factor driving the demand for bioactive ingredients in vitamins, minerals, proteins, and other high-end industries. The bioactive food category is gaining considerable attention due to possible proposals for health benefits.

They are beneficial for enhancing endothelial function, boosting intestinal microbial diversity, reducing bone loss, and improving cognitive function as a whole. Also, it is used in food for the proper growth and development of bioactive ingredients in animals, promoting the growth of the worldwide bioactive ingredient market. With the growing demand for bioactive components in the production of functional foods and beverages and alcoholic beverages, the growth of the global bioactive ingredients market is further accelerated.

MARKET RESTRAINTS

Rigorous regulations on increasing management costs, treatment side effects, and approval of new products by governing bodies are some of the limitations of the global market for bioactive ingredients and products.

Complex extraction and manufacturing processes are key factors expected to hinder the growth of the global bioactive ingredient business during the projection period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.10 % |

|

Segments Covered |

By Product, Application, Sources, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill (U.S), Archer Daniels Midland Company (US), Koninklijke DSM N.V. (Netherlands),AJINOMOTO CO. INC (Japan), Ingredion Incorporated (US), BASF SE (Germany), Sabinsa Corporation (US), Arla Foods amba (Denmark), E. I. du Pont de Nemours and Company (US), FMC Corporation (US), Roquette Frères (France), Nuritas (Ireland), Mazza Innovation Ltd (Canada), Vytrus Biotech (Spain), and Kuehnle AgroSystems (US) |

SEGMENTAL ANALYSIS

Global Bioactive Ingredients market Analysis By Product

The vitamin segment will eventually lead to the highest share of the market. The rising risk of dietary-related diseases like cardiovascular and cancer is attributed to leveraging the growth rate of the market. Diet plays an important role in coronary artery diseases, where the need for prominent supplements like vitamins is becoming very common these days, and the growth of bioactive ingredients market is expanding eventually. Bioactive ingredients have an immense role in optimizing an individual’s health and effectively reducing the risk of many chronic illnesses. The awareness of taking these ingredients for health benefits is surging the growth rate of the market. According to the National Institute of Health, 60% of deaths across the world are due to cardiovascular diseases, cancer, and chronic respiratory illnesses, which highlights the need to adopt functional foods.

Omega 3 fatty acid is the fastest-growing segment in the bioactive ingredients market. This product is well known to boost the immune system, which can easily prevent many cardiovascular diseases.

Global Bioactive ingredients Market Analysis By Application

The food and beverages segment has been showcasing the dominant share of the market for many years and is expected to have the same growth opportunities throughout the forecast period. The trend towards shifting to healthy eating habits is conquered by the rising demand for the launch of innovative products with high nutritional value, which is certainly attributed to elevating the growth rate of the bioactive ingredients market. The rising demand from the increasing population for functional foods to maintain a healthy diet is likely to enhance the growth rate of the market.

The dietary supplements segment is next in, holding the largest share of the market. These are highly helpful for aging people and their well-being. In this modern generation, the growing risk factors of various health-related issues, irrespective of age, are showcasing numerous advantages of daily use of dietary supplements. This factor is sophisticated in bolstering the growth rate of the market.

Global Bioactive Ingredients Market Analysis By Source

The plant-sourced segment is gaining traction over the share of the market due to the increasing number of people eating only plant-based food products. 70% of Americans rely on eating only healthy-based food products, which is why the demand for plant-based bioactive ingredients has been increasing for many years. Focusing on consuming functional foods to improve wellbeing, especially with the increasing awareness from social media platforms, is additionally surging the growth rate of the market.

Animal-origin bioactive ingredients have high effectiveness in improving the health of the person effectively within no time. Drawing the attention of consumers to swiftly adopt the new changes in healthier diet options is likely to promote the growth rate of the market.

REGIONAL ANALYSIS

Geographically, the global bioactive ingredients and products market is categorized in the areas of North America, Europe, Latin America, Asia Pacific, and Middle East and Africa. North America is an essential market for bioactive ingredients. Due to the high awareness of people and doctors about the use of bioactive food and beverages in the region, it is leading the global market. Additionally, local markets can witness steady growth in 3-4 years as manufacturers focus on producing healthy nutrients in the form of solid and liquid foods and beverages. Europe and the Asia Pacific follow North America. Increased energy consumption, globalization, and lifestyle changes in the Asia Pacific region are foreseen to increase demand for bioactive ingredients in food. Furthermore, raising awareness of the benefits of bioactive components in several countries, including China, India, Indonesia, Malaysia, and Japan, is expected to spur the growth of these ingredients in the food and beverage industry in the next eight years. Along with spending on R&D operations to develop new additives in Europe, market entry for functional food producers is estimated to stimulate demand for bioactive ingredients in the near future.

The increase in disposable income, along with demand for dietary supplements and functional foods and beverages, is presumed to help the market grow. Recent Chinese medicine has also been carried out in the biosynthesis of bioactive ingredients for Chinese medicinal plants. Plants have been a rich source for drug discovery and cosmetic applications. Potential markets in South America are mainly driven by better performance in Brazil and Argentina. Brazil is the promising regional business for bioactive ingredients in Latin America due to the rising applications in the sectors like food and beverage, beauty, and personal care products The bioactive ingredients found in various cuisines of marine origin in Argentina have been shown to have protective properties in relation to hypertension, oxidative stress, inflammation, cardiovascular disease, cancer, and other human diseases.

KEY PLAYERS IN THE GLOBAL BIOACTIVE INGREDIENTS MARKET

Major Key Players in the Global Bioactive Ingredients Market are Cargill (U.S), Archer Daniels Midland Company (US), Koninklijke DSM N.V. (Netherlands),AJINOMOTO CO. INC (Japan), Ingredion Incorporated (US), BASF SE (Germany), Sabinsa Corporation (US), Arla Foods amba (Denmark), E. I. du Pont de Nemours and Company (US), FMC Corporation (US), Roquette Frères (France), Nuritas (Ireland), Mazza Innovation Ltd (Canada), Vytrus Biotech (Spain), and Kuehnle AgroSystems (US)

RECENT HAPPENINGS IN THE MARKET

- BASF SE introduced a new range of bioactive ingredients in June 2019 which can be used in the beauty business. The launch of this product uses rambutan to hydrate, revitalize and revitalize the skin. This program provides above-average income to producers who offer health insurance.

- Ingredion Incorporated acquired Penford Corporation, specializing in the production of specialty materials for food and non-food applications.

- In April 2019, Lonza launched the H2OBioEVBioactive ingredient used for skin rejuvenation. A multifunctional cosmetic ingredient that rejuvenates and rejuvenates the skin. This launch will help the company expand its business in the cosmetic market.

DETAILED SEGMENTATION OF GLOBAL BIOACTIVE INGREDIENTS MARKET INCLUDED IN THIS REPORT

This research report on the global bioactive ingredients market has been segmented and sub-segmented based on product, application, sources, & region.

By Product

- Fibre

- Vitamin

- Probiotic

- Prebiotic & Amino Acid

- Cartenoids

- Phytoextract

- Omega 3 Fatty Acid

- Others

By Application

- Food & Beverages

- Dietary Supplements

- Cosmetics

- Animal Feed

- Pharmaceuticals

By Sources

- Plant

- Animal

- Microbial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are some key trends driving the bioactive ingredients market?

Some key trends driving the bioactive ingredients market are increasing consumer awareness and demand for natural and organic products, growing interest in functional foods and dietary supplements for health and wellness, Advancements in extraction and purification technologies for bioactive compounds, and Research focusing on the health benefits of bioactive ingredients like antioxidants, polyphenols, and omega-3 fatty acids.

2. What are the growth opportunities and challenges in the bioactive ingredients market?

Opportunities include expanding into emerging markets, diversifying product portfolios, and leveraging digital marketing and e-commerce channels. Challenges involve competition from synthetic alternatives, supply chain disruptions, and the need for sustainable sourcing practices to address environmental concerns.

3. How is the bioactive ingredients market responding to regulatory challenges?

Regulatory bodies worldwide increasingly focus on safety, efficacy, and labeling requirements for bioactive ingredients. Industry players invest in research, clinical trials, and regulation compliance to ensure product quality and consumer trust.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com