Global Specialty Food Ingredients Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Enzymes, Flavors, Antioxidants, Emulsifiers, Colorants, Vitamins, Minerals, Preservatives), Application (Bakery & Confectionary, Food & Beverages, Dairy & Frozen Foods, Meat Products, Convenience Foods, Functional Foods, Dietary Supplements), Source (Natural And Synthetic), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Specialty Food Ingredients Market Size

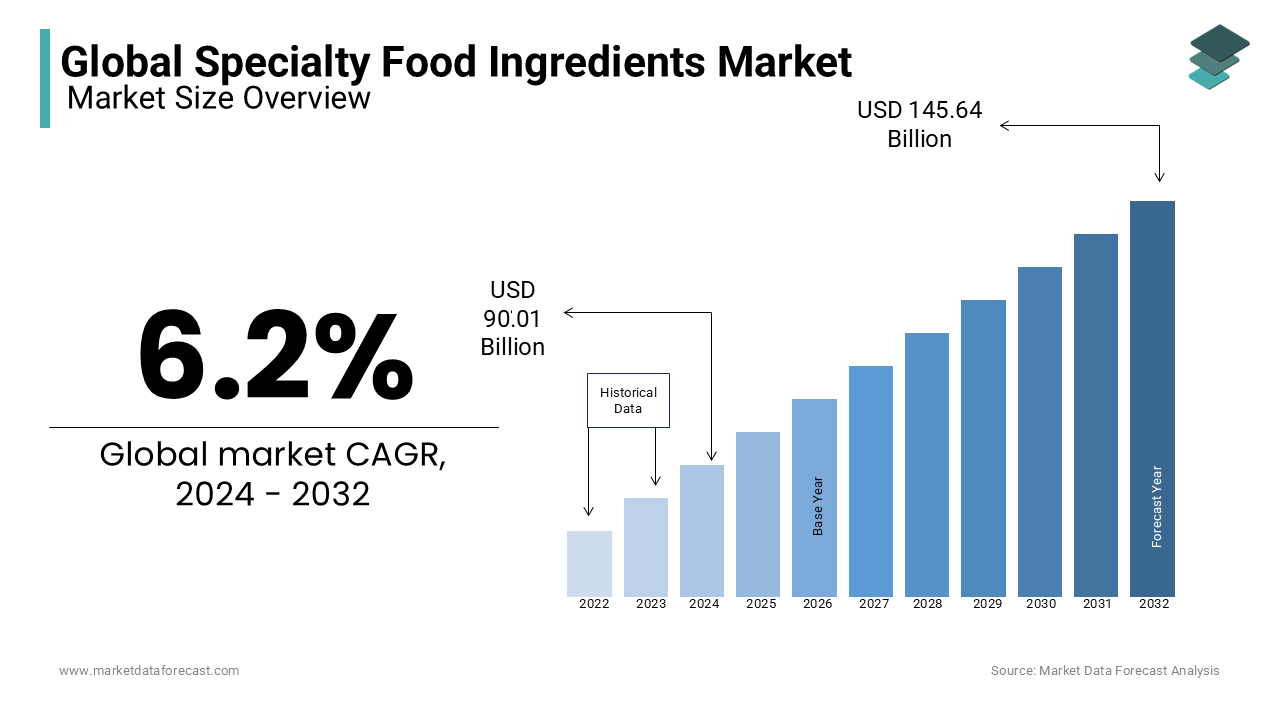

The global specialty food ingredients market size was calculated to be USD 90.01 billion in 2024 and is anticipated to be worth USD 154.67 billion by 2033 from USD 95.59 billion In 2025, growing at a CAGR of 6.20% during the forecast period.

Special food ingredients are elements commonly used in the texture, color, emulsion, and preservation of food. These ingredients improve the nutritional profile of processed foods. Specialty food ingredients provide the requirements to promote overall melting from the farm gate level to the final stage of value-added processed foods. Special food ingredients offer technical and functional benefits that play an essential role in the development of a wide range of safe, qualitative, tasty, healthy, and affordable food. Special food ingredients are synthesized naturally or artificially. These ingredients are designed and used for essential recipes and other specific purposes. Food and beverage manufacturers use unique food ingredients to improve the texture, appearance, and taste of the finished product.

In addition, these ingredients extend the shelf life of food. The US Food and Drug Administration (US FDA) and other food safety agencies around the world carefully monitor specialty food ingredients to ensure accurate labeling and safe food intake. The improvements in technology are supporting the companies functioning in this industry to create novel products and solutions. The industry is expected to grow substantially during the forecast period as the application of these products increases in the modern processing sector to meet a wide range of demands for different product qualities.

Current Scenario of the Global Specialty Food Ingredients Market

The specialty food ingredients market has experienced rapid growth in recent years. This is because of the rising consumption of nutritional ingredients. Nowadays, consumers are adopting a utopian view of health, visible in their “Good Things Only” food options. The rising consumer income and greater internet access have facilitated information about healthy choices which influences the demand for specialty food ingredients. This demand is propelling substantial innovation and progress in the food industry, with the entry of new brands and companies and officeholders also seeking to satisfy the requirements of health-conscious people. This change results in an increasing inclination towards packaged foods with active ingredients like superfoods, plant proteins, probiotics, and antioxidants. This transition is necessitating the food industry to reconsider its portfolio and give precedence to products that assist and promote healthy living.

Apart from these, the market is also witnessing an escalating need for genuinely natural food ingredients. This can be attributed to the surging popularity of influencers such as FoodPharma, Dr. Rujuta Diwekar, and Dr. Dixit. Worldwide these social media-based food influencers have a major contribution to shaping consumer trends.

According to the Specialty Food Association, in 2023, the sales of specialty food companies worldwide were 207 billion dollars and are estimated to reach 219 billion dollars in 2024.

MARKET DRIVERS

Functional foods include some bacterial strains and products of plant and animal origin that contain bioactive compounds that are beneficial to human health and help reduce the risk of chronic disease.

Increased consumer awareness of various types of functional food ingredients, including protein and amino acids, vitamins, essential oils, minerals, omega 3 and 6 fatty acids, prebiotics, probiotics, flavonoids, carotenoids, and hydrocolloids, And its health benefits are driving a significant market share in the global specialty food ingredient industry. As the demand for processed and convenience foods increases and the need for nutritious organic products increases, the industry is supposed to be boosted.

As per the Nutrition Business Journal, functional foods and beverages revenue was around 92.1 billion dollars alone in the United States and is estimated to climb to 106.9 billion dollars by 2026.

Unique ingredients are essential products to ensure the well-being of a wide range of processed foods. From a wide range of macro components like fiber, carbohydrates, fats, and specific proteins to other micro components that include minerals, vitamins, and enzymes, a variety of unique ingredients generally perform a variety of functional activities to improve the quality and taste of your diet. The health, nutrition, and technology-related features of this product make meals enjoyable, delicious, safe, healthy, and affordable. Therefore, these benefits associated with unique food ingredients are expected to be the main driving force in the industry. In addition to these benefits, these ingredients are considered one of the few top suitable options for sustainable food processing. These ingredients provide solutions that improve the efficiency of your resources by reducing downstream losses and overall value chains due to their highly effective impact on food storage and processing.

Some of the specialty ingredients, such as packaging gas and preservatives, help reduce food waste by extending the shelf life of the finished/processed product. The benefits of these factors are the main factors that are supposed to increase additional demand during the outlook period. The global industry has witnessed a large number of participants from multinational companies. There are several companies that are actively taking over and acquiring to enhance their product portfolio to meet changing consumer preferences based on the customized needs of food manufacturers. Multinational companies are acquiring medium-sized companies that specialize in technological development but lack funds for expansion. These initiatives are one of the main trends in the industry and have led the entire market in recent years.

MARKET RESTRAINTS

Stringent regulations and rigorous inspections of the food industry are key factors in slowing the growth of the worldwide specialty food ingredients market during the prediction period.

Various regulatory agencies, such as the United Nations Food and Drug Administration and the Food and Agriculture Organization, continue to monitor the use of chemicals in food. Due to these regulations, manufacturers must be approved for the manufacture and distribution of products, which delays the entire process.

MARKET OPPORTUNITIES

Mindful and deliberate eating has become more than just a trend, it has transformed into a primary aspect of everyday life. Customers actively want ingredients that provide functional advantages for both long-term and short-term health objectives. Given today’s busy lifestyles, snacks are the favoured item in the specialty food category. So, in the coming years, health-focused products are slated to provide potential opportunities for companies operating in the specialty food ingredients market. As per multiple studies, over 40 per cent of customers stated they are adopting a healthy and nutritious eating pattern as the primary way to improve their health, and ingredients recognised as refreshing and organic along with rich in nutrients are considered as a main aspect in their dietary enhancements.

COVID-19 firmly placed well-being and health as a top priority. As a consequence of this focus, customers also put more emphasis on ingredient details printed on the packaging. Of these, one-third of buyers stated they always read or find key ingredients.

According to the National Institute of Health’s Database, customers are very diligent regarding decreasing their consumption of artificial ingredients, and 60 per cent answered clean label considerations have at least some effect on their buying habits.

North America is an attractive market given that over one in five adults in the United States suffers from obesity and in Canada 2 in 3 grown-ups are overweight, followed by Europe, especially in the United Kingdom, France, and Germany, which is experiencing greater interest in artisanal and gourmet food offerings. Asia Pacific, on the other hand, is seeing rapid urbanization and shifting dietary habits. Hence, the specialty food ingredients market is expected to expand quickly in the APAC region.

MARKET CHALLENGES

Cost management is one of the key challenges in the specialty food ingredients market.

It is an important problem for market players owing to the volatile prices of raw materials. These fluctuations are caused by several factors that make management tough for companies. Disturbances in demand forecasting and supply management, transportation capacity issues, and talent management are the three most important challenges the market encounters.

Findings from 115 industry leaders revealed the primary logistics obstacles in the food and beverage industry, along with the effects of supply chain issues, geopolitical tensions, and ongoing economic instabilities.

Challenges with warehousing, product availability, and supply and demand planning are susceptible to impact large enterprises generating 500 million dollars or more, present the results. At the same time, these are also major issues for smaller food and beverage distributors or transporters, these companies more commonly highlighted store operations and shipping rates as main difficulties.

Distributors noted that the pandemic's effect on transitions in customer purchasing patterns or behaviour, port congestion and postpones, over-the-road capacity limitations, and labour have shaken activities and aggravated today’s problems. Therefore, all these factors are escalating costs and hindering the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Application, Source, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle, Naturex S.A Prinova Group LLC, HR Hansen Group, Koninklijke DSM N.V, and Royal DSM N.V. |

SEGMENTAL ANALYSIS

Global Specialty Food Ingredients Market Analysis By Type

The functional food ingredients segment is believed to be the biggest category in specialty food ingredients market. Companies over several industries are experiencing an increased consumption of these powerhouse components. From green tea and turmeric to extracts of ginger root are needed. Moreover, the trends driving the segment forward are wellness and health boom. These ingredients are recognised for their health-enhancing qualities. They have emerged as a focal point for companies targeting to align with this wellness-oriented market transition. Apart from this, the segment’s market share is also rising due to its versatility across various industries besides food and beverage, like sustainable packaging production, pharmaceuticals, and beauty and skincare. This provides opportunities for B2B market players.

According to Taranaki Bio Extracts, half of the customers, i.e. 54 per cent, purchase foods and beverages which will assist in enhancing their daily health, in contrast to 40 per cent that bought items for athletic goals.

Global Specialty Food Ingredients Market Analysis By Application

The bakery & confectionery segment is projected to be the fastest-growing category in the specialty foods ingredients market. Dried ingredients are propelling the growth of the segment owing to their flexibility and capability to maintain texture, colour, and taste. Dried berries and fruits have become a common practice to improve baked items texture, colour and flavour without adding synthetic additives. Moreover, nowadays, bakery and confectionery elements include sunflower seeds, flax, and chia. Protein, fiber, and healthy fats make these ingredients ideal for every meal. Also, hazelnuts, pistachios, and almonds are frequently added baking ingredients.

Global Specialty Food Ingredients Market Analysis By Source

The Natural segment is leading the category in the specialty food ingredients market. This can be because of the growing consumption of natural food items, the rising demand for clean-label goods, and the increasing consciousness regarding the health risks related to artificial additives. In addition, organic ingredients are also preferred as they go with the need for healthy and authentic culinary experiences. However, the synthetic segment still holds a notable market share.

REGIONAL ANALYSIS

The Asia Pacific is the world's largest regional market and is anticipated to generate more than $ 39 billion in sales by 2025, which is home to the world's largest food processing industry. China has the most significant number of unique materials manufacturing and processing companies in the region. Along with this, some industry players are moving their production bases to emerging economies such as India, Thailand, and Vietnam as skilled but affordable labor becomes available. China is also among the leading exporters of these specialty food ingredients. Due to these factors, demand in the Asia-Pacific region is expected to remain at the highest level in the world.

Europe was the second-largest market. Europe has been known for its world-famous cuisine, and with changes in consumer demand, various innovations sometimes occur in new receipts. Countries such as France, Italy and Belgium are the largest importers of unique ingredients. Production and demand for specialty food ingredients increase when there are a reasonable number of confectionery and processing companies in Germany and the UK.

KEY PLAYERS IN THE GLOBAL SPECIALTY FOOD INGREDIENTS MARKET

Major Key Players in the Global Specialty Food Ingredients Market are Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle, Naturex S.A Prinova Group LLC, HR Hansen Group, Koninklijke DSM N.V, and Royal DSM N.V.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, the Specialty Food Association (SFA) press released that for the 2024 Summer Fancy Food Show Spain will be the collaborating nation sponsor. The main product development event of the specialty food industry, the Summer Fancy Food Show includes thousands of specialty foods and beverages from across the world.

DETAILED SEGMENTATION OF GLOBAL SPECIALTY FOOD INGREDIENTS MARKET INCLUDED IN THIS REPORT

This research report on the global Specialty Food Ingredients Market has been segmented and sub-segmented based on type, application, source, & region.

By Type

- Functional Food Ingredients

- Sugar Alternatives

- Specialty Starches

- Nutraceuticals

- Preservatives

- Emulsifiers

- Enzymes

- Colors and Flavors

By Application

- Bakery & Confectionery

- Dairy & Frozen Foods

- Meat Products

- Functional Foods & Beverages

- Dietary Supplements

By Source

- Natural

- Synthetic

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key drivers driving the growth of the specialty food ingredients market?

Several factors contribute to the growth of this market, including increasing consumer demand for natural and clean-label products, rising awareness about health and wellness, the popularity of ethnic and gourmet cuisines, and advancements in food processing technologies.

2. What are the challenges faced by the specialty food ingredients market?

Challenges include the high cost of some specialty ingredients, regulatory complexities related to labeling and claims, sourcing sustainable and ethically produced ingredients, and addressing consumer concerns about allergens and food safety.

3. What are some emerging trends in the specialty food ingredients market?

Emerging trends include using alternative proteins such as insect proteins or lab-grown meats, developing plant-based alternatives for traditional dairy and meat products, innovations in natural food preservation techniques, and integrating digital technologies for traceability and quality assurance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]