Asia Pacific Peanut Butter Market By Product (Crunchy, Creamy, and Others (Flavored/Specialty)), Brand Type, Distribution Channel, and Region (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) – Industry Forecast 2025 to 2033

Asia Pacific Peanut Butter Market Size

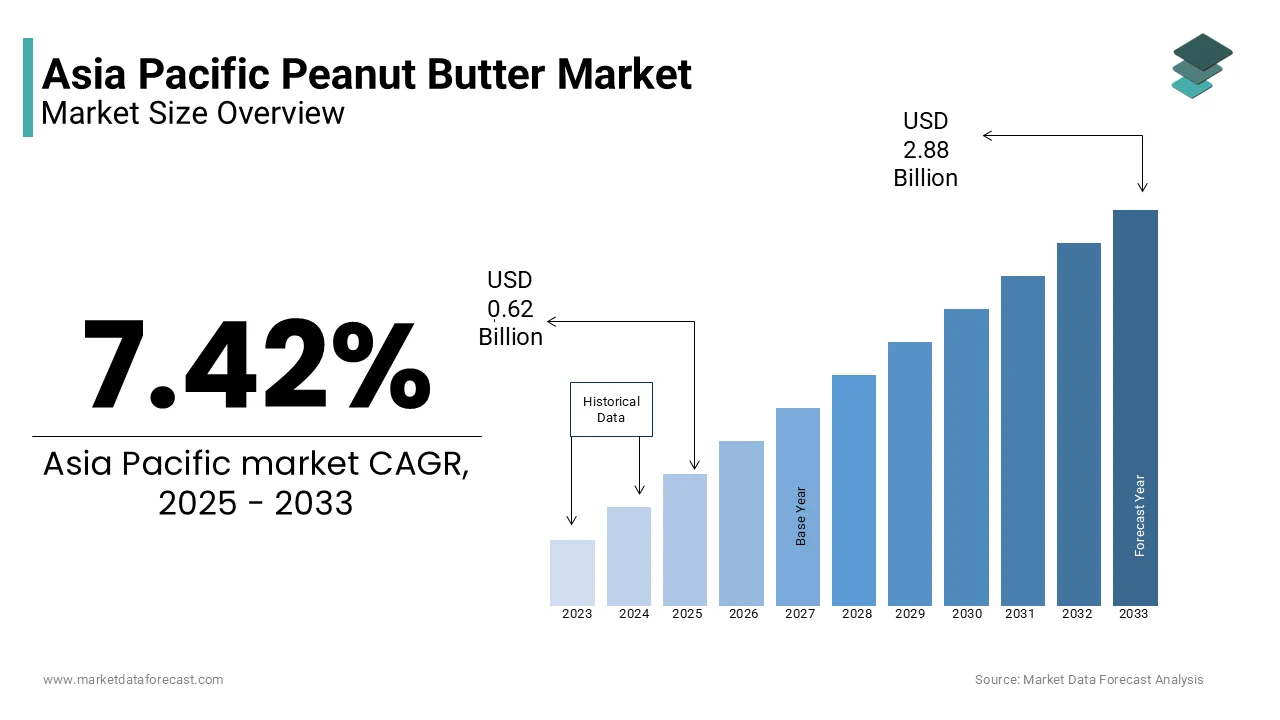

The peanut butter market size in Asia Pacific was valued at USD 1.51 billion in 2024 and is estimated to be worth USD 2.88 billion by 2033 from USD 0.62 billion in 2025, growing at a CAGR of 7.42% from 2025 to 2033.

MARKET OVERVIEW

Peanut Butter is a food paste or spread which is made from ground dry roasted peanuts. It often contains additional ingredients which modify the texture or taste, such as sweeteners, salt, or emulsifiers. Peanut butter is popular in many countries around the world. Peanut butter is served as a spread on toast, bread or crackers, and is used in making sandwiches notably the peanut butter and jelly sandwich. It is also used in numerous confections and packaged foods, such as Reese's Peanut Butter Cups which is made of chocolate-coated peanut butter, candy bars that are made from peanut butter-flavored snickers, and peanut-flavored granola bars. Comparable preparations are made by grinding other nuts. A variety of other nut butter is also sold, such as almond butter and cashew butter.

The driving factors of the Asia Pacific Peanut Butter market are the growing demand for nutritious products coupled with the increasing disposable income of consumers particularly in developing countries. Other drivers that are driving the growth of the peanut butter market are the emergence of hectic life schedules and the growing demand for low-calorie healthy food. Changing lifestyles and shifting toward the intake of convenient food are also some factors that are expected to drive the peanut butter market in the forecast period. A major constraint that is expected to hinder the growth of the peanut butter market is the availability of peanuts at competitive prices coupled with fluctuating peanut production.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.42% |

|

Segments Covered |

By Product, Brand Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Procter & Gamble, Unilever, Smucker Company, Hormel Foods Corporation, Boulder Brands Inc., Kraft Canada Inc, Algood Food Company Inc, and others. |

REGIONAL ANALYSIS

Asia Pacific region has the third largest market for peanut butter in the world by share. It is expected to grow the fastest in the world, owing to emerging economies such as India and China and the growing population in the region. Factors such as growing demand for healthy foods and changing lifestyles are expected to drive the market growth in the region.

KEY MARKET PLAYERS

Procter & Gamble, Unilever, Smucker Company, Hormel Foods Corporation, Boulder Brands Inc., Kraft Canada Inc, Algood Food Company Inc are some of the notable companies in the Asia Pacific Peanut Butter market.

MARKET SEGMENTATION

This research report on the Asia Pacific peanut butter market has been segmented and sub-segmented into the following categories.

By Product

- Crunchy

- Creamy

- Others (Flavored/Specialty)

By Brand Type

- Branded

- Private-Label

- Others (Artisanal and Specialty manufacturers)

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

By Country

- India

- China

- Japan

- South Korea

- Hong Kong

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

1. What was the size of the peanut butter market in Asia Pacific in 2024?

The peanut butter market in Asia Pacific was valued at USD 1.51 billion in 2024.

2. What factors are driving the growth of the peanut butter market in Asia Pacific?

Growth is driven by increasing health consciousness, demand for plant-based protein, and rising popularity of convenient, nutritious spreads (Note: This is inferred as specific drivers were not provided).

3. What challenges might affect the peanut butter market growth in Asia Pacific?

Challenges may include price sensitivity, competition from alternative spreads, and supply chain issues for peanuts (Note: Inferred as challenges were not specified).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]