Asia Pacific Polyacrylamide Market Research Report – Segmented By Product Type (Anionic, Cationic, Non-Ionic), Application, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

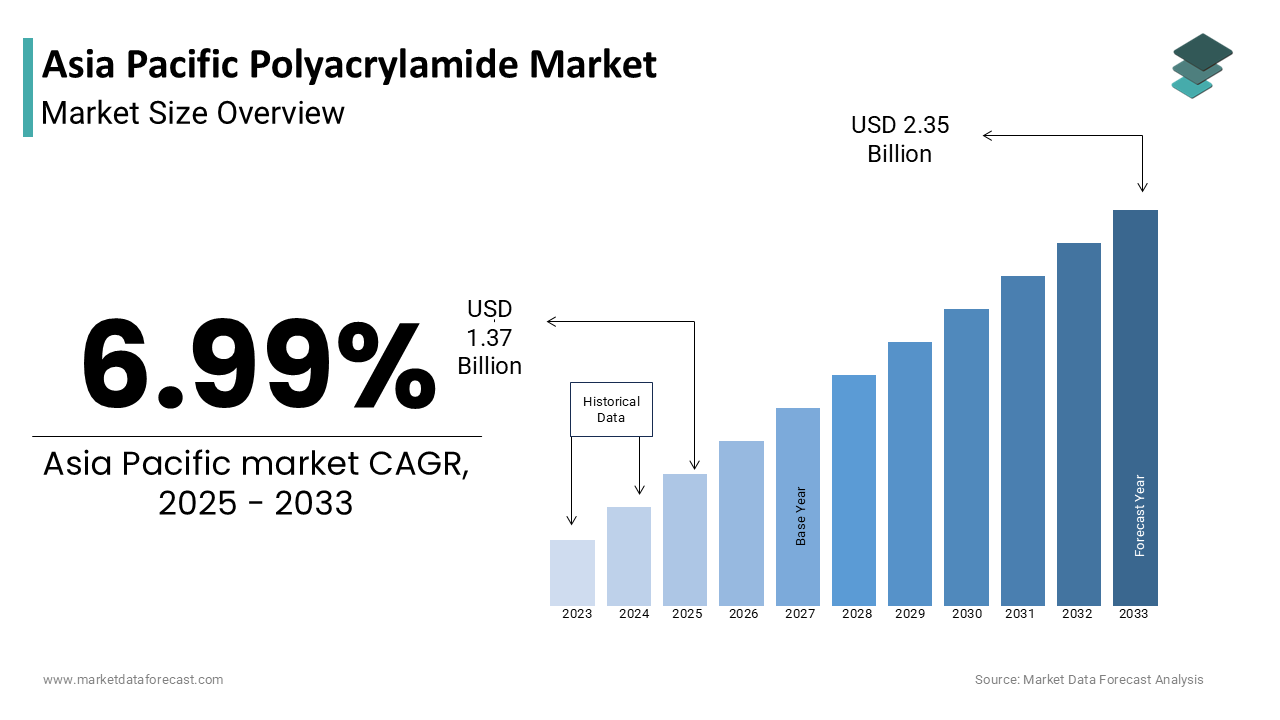

Asia Pacific Polyacrylamide Market Size

The Asia Pacific Polyacrylamide Market was worth USD 1.28 billion in 2024. The Asia Pacific market is expected to reach USD 2.35 billion by 2033 from USD 1.37 billion in 2025, rising at a CAGR of 6.99% from 2025 to 2033.

Polyacrylamide is a synthetic polymer widely used across multiple industries due to its exceptional flocculation, thickening, and stabilizing properties. In the Asia Pacific region, polyacrylamide plays a critical role in water treatment, oil & gas extraction, pulp & paper manufacturing, and mining operations. The market has seen growing traction due to increasing industrialization, stricter environmental regulations, and the rising demand for clean water solutions.

The chemical is available in various forms—non-ionic, anionic, and cationic—each tailored for specific applications. Additionally, the International Energy Agency notes that enhanced oil recovery (EOR) methods are gaining momentum in mature oilfields across Southeast Asia, where polyacrylamide serves as a vital viscosity modifier. Environmental concerns have also spurred innovation in biodegradable variants, with governments in Japan and Australia promoting sustainable alternatives. According to the Chemical Industry Association of Japan, regulatory bodies are increasingly engaging with manufacturers to ensure product safety and environmental compliance.

MARKET DRIVERS

Expanding Use in Water Treatment Infrastructure

One of the primary drivers of the Asia Pacific polyacrylamide market is the growing investment in municipal and industrial water treatment infrastructure. Countries like China, India, and Indonesia face mounting pressure to improve wastewater management and provide safe drinking water to expanding populations with rapid urbanization and industrial growth. According to the Asian Development Bank, nearly half of the region’s population lacks access to adequate wastewater treatment facilities. To address this, governments are investing heavily in upgrading sewage treatment plants and constructing new water purification systems. Additionally, stringent environmental regulations are compelling industries to treat effluent before discharge. The Central Pollution Control Board of India reported that over 700 large-scale manufacturing units were fined in 2023 for non-compliance with effluent discharge norms, prompting increased adoption of advanced treatment chemicals.

Rising Demand from Enhanced Oil Recovery (EOR) Applications

Another major driver fueling the Asia Pacific polyacrylamide market is its extensive use in enhanced oil recovery (EOR), particularly in mature oil fields across China, Malaysia, and Indonesia. Polyacrylamide acts as a viscosifier in polymer flooding techniques, which improve oil displacement efficiency and increase overall recovery rates from reservoirs.

China National Petroleum Corporation (CNPC) reported that approximately 25% of China's onshore crude oil production now relies on polymer flooding methods, with EOR contributing significantly to domestic energy security. Similarly, in Southeast Asia, Petroliam Nasional Berhad (PETRONAS) of Malaysia and Pertamina of Indonesia have ramped up their EOR initiatives to counter declining output from aging wells. As per McKinsey, polymer-based EOR is projected to account for over 40% of incremental oil production in the region by 2030.

MARKET RESTRAINTS

Environmental and Health Concerns Related to Acrylamide Residue

A significant restraint affecting the Asia Pacific polyacrylamide market is the presence of residual acrylamide monomer, which is classified as a potential neurotoxin and carcinogen by health and environmental agencies. This concern limits the application of polyacrylamide in food processing, potable water treatment, and agricultural sectors where human exposure risk is higher.

The World Health Organization (WHO) has set strict limits on allowable acrylamide content in products used for water purification and food-related applications. In response, regulatory bodies in Japan and South Korea have imposed stringent quality control measures on polyacrylamide imports and domestic production. The Ministry of the Environment in Japan mandated in 2023 that all polyacrylamide-based products used in public water treatment must contain less than 0.05% residual acrylamide, increasing compliance costs for manufacturers.

Moreover, environmental watchdogs in Australia have raised concerns about the long-term impact of polyacrylamide degradation products on aquatic ecosystems. According to the Australian Institute of Marine Science, certain degraded polymer fragments may persist in marine environments, influencing biodiversity.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuations in raw material prices, particularly acrylonitrile is a key precursor in polyacrylamide synthesis, pose a major challenge to market stability in the Asia Pacific region. Acrylonitrile prices are highly susceptible to changes in crude oil markets, petrochemical supply chain disruptions, and geopolitical tensions affecting feedstock availability. According to ICIS, a global chemical market analytics firm, acrylonitrile prices in Asia surged by more than 20% in early 2023 due to unplanned plant shutdowns in China and tighter export controls from Middle Eastern producers.

In addition to pricing instability, logistical bottlenecks continue to disrupt the supply chain. The Maritime Authority of Singapore reported that container shipping delays in Southeast Asia increased by 15% in 2023 compared to the previous year by affecting the timely delivery of raw materials and finished products. As per Deloitte, these constraints force companies to maintain higher inventory levels and buffer stocks, reducing operational flexibility and profitability in the regional polyacrylamide market.

MARKET OPPORTUNITIES

Growth in Mining and Mineral Processing Activities

The expansion of mining and mineral processing activities across the Asia Pacific region presents a substantial opportunity for the polyacrylamide market. Polyacrylamide is extensively used in mineral separation processes, sludge dewatering, and tailings management by making it indispensable in both metallic and non-metallic ore extraction. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), mineral production in the region grew by 8% in 2023, driven by increased demand for copper, lithium, and rare earth elements essential for electric vehicle and renewable energy technologies. Countries like Australia, Indonesia, and the Philippines are witnessing renewed investments in mining infrastructure, which is further boosting the requirement for efficient solid-liquid separation agents such as polyacrylamide.

Increasing Adoption in Pulp and Paper Manufacturing

The pulp and paper industry represents another promising avenue for polyacrylamide growth in the Asia Pacific region. The chemical enhances fiber retention, improves drainage efficiency, and reduces water usage during papermaking by aligning with industry efforts to boost sustainability and operational efficiency. In 2023, the Chinese Paper Association noted a resurgence in packaging paper demand due to e-commerce expansion, prompting mills to optimize production lines using advanced process chemicals. Furthermore, environmental mandates are pushing paper manufacturers toward closed-loop water systems, where polyacrylamide aids in recycling and effluent treatment. The Confederation of Indian Industry reported that 60% of large Indian paper mills had adopted chemical-assisted wastewater treatment in 2023 to comply with discharge norms. As per McKinsey, this shift not only supports environmental stewardship but also reinforces polyacrylamide’s role as a performance-enhancing additive in the evolving pulp and paper sector across the region.

MARKET CHALLENGES

Regulatory Compliance and Product Safety Standards

Meeting stringent regulatory requirements is a persistent challenge for polyacrylamide manufacturers operating in the Asia Pacific region. Governments across developed and emerging economies are tightening permissible limits on residual acrylamide content, heavy metals, and other impurities in commercial-grade polyacrylamide products.

Japan’s Ministry of Health, Labour and Welfare enforces rigorous testing protocols under the Chemical Substances Control Law, requiring manufacturers to conduct extensive toxicological assessments before market approval. Similarly, the National Medical Products Administration in China mandates detailed documentation on polymer purity and degradation behavior for use in pharmaceutical and medical applications.

These regulatory hurdles increase time-to-market and compliance costs, particularly for small and medium-sized enterprises that lack in-house R&D capabilities. According to the Korea Chemical Industry Association, nearly 20% of local polyacrylamide producers faced delays in product registration in 2023 due to evolving compliance frameworks. As global trade standards become more harmonized, companies must continuously adapt their formulations and quality assurance practices to remain competitive.

Intensifying Competition from Bio-Based and Alternative Polymers

The Asia Pacific polyacrylamide market faces growing competition from bio-based polymers and alternative flocculants such as starch derivatives, chitosan, and natural gums. These substitutes are gaining traction due to their perceived environmental friendliness, biodegradability, and lower toxicity risks, especially in water-sensitive applications. In India, government-backed research institutions such as the Council of Scientific and Industrial Research (CSIR) have been actively developing indigenous alternatives to polyacrylamide for wastewater treatment and soil stabilization.

SEGMENTAL ANALYSIS

By Product Type Insights

The anionic polyacrylamide segment was the largest and held 45.3% of the Asia Pacific polyacrylamide market in 2024 owing to its widespread use in mineral processing, water treatment, and oilfield applications where it serves as an effective flocculant for negatively charged particles. According to the Asian Development Bank, over 60% of urban wastewater in countries like India and Indonesia remains untreated, necessitating the deployment of efficient solid-liquid separation agents such as anionic polyacrylamide. Additionally, the mining industry in Australia and Southeast Asia heavily depends on anionic variants for tailings management and ore concentration. The Australian Department of Industry, Science and Resources noted a 7% increase in mineral production in 2023, directly boosting demand for this product type. As per Frost & Sullivan, these multi-sector applications continue to cement anionic polyacrylamide's position as the most consumed variant in the region.

The cationic polyacrylamide is swiftly emerging with a CAGR of 9.1% from 2025 to 2033. This growth is primarily driven by its increasing adoption in sludge dewatering, biosolids management, and advanced water purification systems. The rising emphasis on resource recovery and waste minimization in municipal wastewater treatment. According to the Central Pollution Control Board of India, biosolids generation increased by 12% in 2023 due to expanded sewage processing capacity, requiring efficient conditioning agents like cationic polyacrylamide. Another driver is the growing use of cationic variants in the pulp and paper industry in China and South Korea, where they aid in fiber retention and effluent treatment.

By Application Insights

The water treatment segment was the largest with 48.6% of the Asia Pacific polyacrylamide market in 2024 due to the chemical’s critical role in coagulation, flocculation, and sedimentation processes used to purify drinking water and treat industrial effluents. Rapid urbanization and stringent environmental regulations have significantly boosted investments in water infrastructure across the region. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), nearly 1.2 billion people in the region lack access to safely managed sanitation services, creating a pressing need for advanced treatment technologies.

The oil & gas sector segment is lucratively to grow with a CAGR of 8.7% during the forecast period. This growth is largely attributed to the increasing adoption of polymer flooding techniques in enhanced oil recovery (EOR) operations, especially in mature fields across China, Malaysia, and Indonesia. China National Petroleum Corporation (CNPC) reported in 2023 that EOR methods accounted for nearly 30% of domestic crude oil production, with polymer flooding being the most widely deployed technique.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific polyacrylamide market by accounting for 40.4% of the share in 2024, with its vast industrial base, rapid urbanization, and government-led initiatives aimed at improving water quality and enhancing energy security through oilfield development.

Water treatment remains the largest consumer of polyacrylamide in China, with the Ministry of Housing and Urban-Rural Development announcing plans to extend wastewater treatment coverage to 95% of urban areas by 2025. CNPC reported that in 2023, over 25% of onshore crude production was derived using polyacrylamide-based EOR methods.

India was positioned second with 15.4% of the Asia Pacific polyacrylamide market share in 2024 by expanding municipal water treatment infrastructure, rapid industrialization, and increasing environmental compliance requirements. The Ministry of Jal Shakti reported that in 2023, only about 37% of urban wastewater was treated before discharge, with the urgent need for improved purification systems. Under the Namami Gange program, over 150 new sewage treatment plants were commissioned, all utilizing polyacrylamide-based flocculants for sludge management.

Japan polyacrylamide market is likely to have significant growth opportunities in the coming years. The Ministry of Health, Labour and Welfare mandates stringent residual acrylamide content limits by ensuring that only premium-grade polymers enter the market.

Additionally, Japan’s semiconductor and electronics industries utilize ultra-pure polyacrylamide variants in ultrapure water filtration systems. The Semiconductor Equipment and Materials International reported that Japanese manufacturers consumed over 5,000 tons of specialty polymers in 2023 for wafer cleaning and polishing applications.

South Korea polyacrylamide market growth is driven by strong demand from industrial wastewater treatment, papermaking, and urban water supply sectors. The Ministry of Environment implemented stricter discharge standards in 2023, mandating industries to reduce suspended solids and organic load in effluent streams. The The

Australian polyacrylamide market is likely to grow steadily with the mining and mineral processing industry, where polyacrylamide plays a crucial role in tailings management and water recovery. Major mining firms such as BHP and Rio Tinto implemented advanced dewatering systems incorporating polyacrylamide to comply with sustainability targets. In addition, water-stressed regions in Western Australia and Queensland are leveraging polyacrylamide for municipal wastewater recycling.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

SNF Group, Kemira Oyj, BASF SE, Mitsui Chemicals, Inc., Ashland Global Holdings Inc., Solenis, Solvay S.A., Black Rose Industries Ltd., Anhui Jucheng Fine Chemicals, and Xitao Polymer Co. Ltd are some of the key market players.

The Asia Pacific polyacrylamide market is characterized by a mix of global chemical giants and regionally established players, all vying for dominance in a rapidly expanding yet highly regulated industry. Competition is intense, particularly in large economies such as China and India, where demand is driven by urbanization, industrial growth, and increasing environmental scrutiny. Global players leverage technological expertise, brand reputation, and extensive distribution networks to secure contracts with municipal authorities and large-scale industrial clients. Meanwhile, regional producers focus on cost-effectiveness, localized service offerings, and quicker response times to capture niche markets and underserved sectors. The competitive environment is further shaped by stringent product quality standards and environmental regulations, especially in developed markets like Japan and Australia, which favor suppliers with advanced purification technologies and sustainable practices.

Top Players in the Asia Pacific Polyacrylamide Market

SNF Group (France, with a strong presence in China and India)

SNF Group is a global leader in polyacrylamide production and holds a significant position in the Asia Pacific market. The company offers a wide range of anionic, cationic, and non-ionic polymers tailored for water treatment, oil & gas, and mining applications. With advanced R&D capabilities and local manufacturing units in China and India, SNF provides customized solutions that align with regional regulatory and industrial needs.

Kemira Oyj (Finland, with major operations in Japan and South Korea)

Kemira specializes in sustainable chemical solutions, including high-performance polyacrylamide products for pulp & paper, municipal water treatment, and industrial processes. In the Asia Pacific region, Kemira has built a strong customer base by focusing on technical service support, product innovation, and environmental compliance. Its strategic partnerships with local distributors enhance its reach across key markets.

BASF SE (Germany, with an extensive footprint across APAC)

BASF is a leading multinational chemical company that supplies polyacrylamide for diverse applications such as wastewater management, oil recovery, and soil stabilization. In the Asia Pacific region, BASF leverages its global expertise to deliver performance-driven polymer solutions. The company invests heavily in application development and collaborates closely with governments and industries to support sustainability goals and resource efficiency.

Top Strategies Used by Key Market Participants

Expansion into Emerging Markets through Local Manufacturing and Partnerships

Leading companies are strengthening their regional presence by establishing local production facilities and forming strategic alliances with domestic players. These moves allow them to reduce logistics costs, comply with local regulations, and better serve growing industrial sectors such as water treatment and mining.

Product Innovation and Customization for Diverse Applications

To meet the evolving needs of different industries, key players are investing in research and development to create specialized polyacrylamide variants. This includes developing low-residue, high-purity, and bio-compatible formulations that cater to sensitive applications like drinking water purification and pharmaceutical processing.

Focus on Sustainability and Eco-Friendly Polymer Development

Amid rising environmental concerns, manufacturers are adopting green chemistry principles and enhancing product safety profiles. This includes improving purification techniques to minimize acrylamide residue and exploring hybrid or biodegradable alternatives to maintain competitiveness in environmentally conscious markets.

RECENT MARKET DEVELOPMENTS

- In February 2024, SNF Group expanded its manufacturing facility in Zhenjiang, China, to increase production capacity for specialty-grade polyacrylamide used in municipal water treatment, reinforcing its dominance in the Chinese market.

- In May 2024, Kemira Oyj launched a new line of low-residue cationic polyacrylamide polymers tailored for biosolids dewatering in Japanese wastewater treatment plants, enhancing its product portfolio in the environmentally regulated market.

- In July 2024, BASF SE entered into a joint development agreement with a South Korean water technology firm to co-create advanced polymer solutions for industrial effluent treatment, aiming to strengthen its foothold in the Korean market.

- In October 2024, Thai Wah Public Company Limited, a regional player, acquired a small Vietnamese polymer formulation unit to expand its presence in Southeast Asia and improve supply chain efficiency for polyacrylamide-based flocculants.

- In December 2024, Solenis LLC partnered with a leading Indian engineering firm to offer integrated polymer dosing systems for the pulp & paper industry, supporting improved process efficiency and strengthening its client relationships in the Indian subcontinent.

MARKET SEGMENTATION

This research report on the Asia Pacific polyacrylamide market is segmented and sub-segmented into the following categories.

By Product Type

- Anionic

- Cationic

- Non-Ionic

By Application

- Water Treatment

- Oil & Gas

- Paper Making

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the polyacrylamide market in Asia Pacific?

Growth is driven by rapid urbanization, rising industrial activities, increasing demand for clean water, and expansion in oil & gas, mining, and paper industries.

What are the main challenges facing this market?

The market faces challenges such as raw material price fluctuations, environmental regulations, and competition from alternative treatment chemicals.

What is the future outlook for the Asia Pacific polyacrylamide market?

The market is expected to grow steadily due to increased investment in water treatment infrastructure, oil exploration, and sustainable industrial practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com