Asia Pacific Recreational Boating Market Size, Share, Trends & Growth Forecast Report By Boat Type (Yachts, Sailboats, Personal Watercrafts), Boat Size (<30 Feet, 30-50 Feet, >50 Feet), Engine Type (ICE, Electric), and Country (India, China, Japan, South Korea, Australia) – Industry Analysis From 2025 to 2033.

Asia Pacific Recreational Boating Market Size

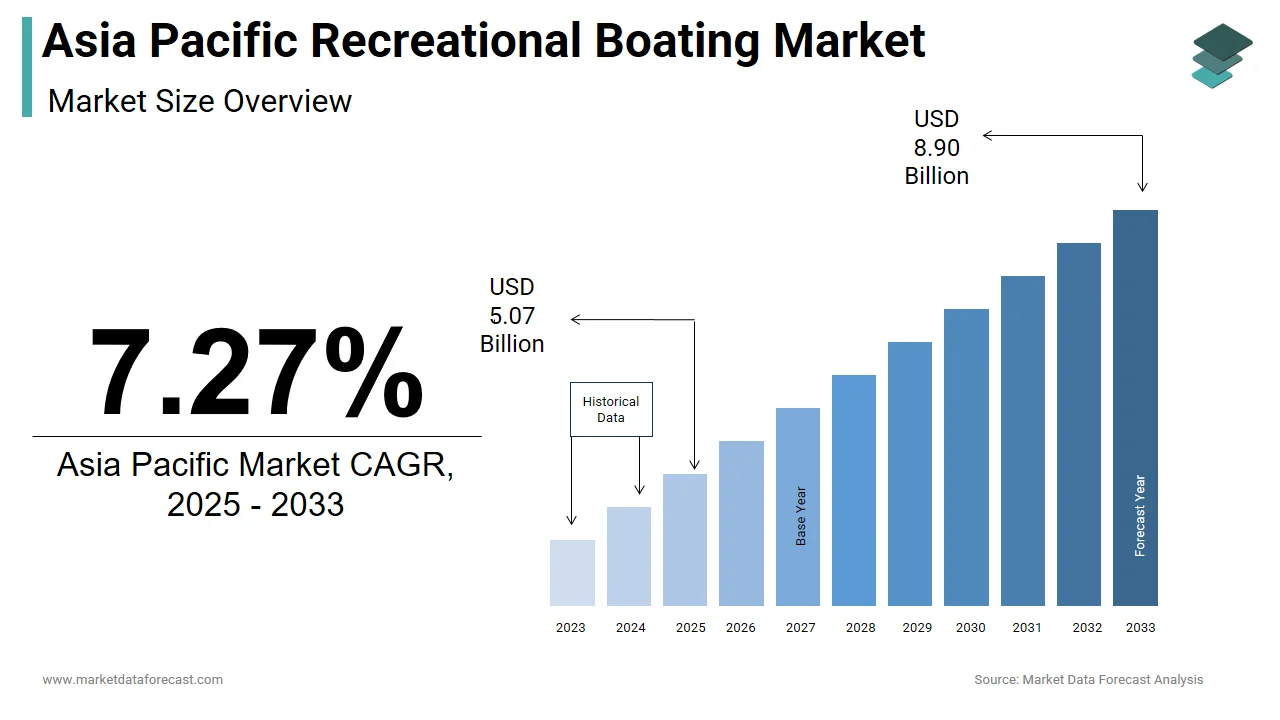

The size of the Asia Pacific recreational boating market was worth USD 4.73 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 7.27% from 2025 to 2033 and be worth USD 8.90 billion by 2033 from USD 5.07 billion in 2025.

Recreational boating encompasses a wide range of vessels, including yachts, sailboats, motorboats, and personal watercraft, designed primarily for leisure and tourism purposes.

MARKET DRIVERS

Rising Disposable Incomes and Urbanization

The escalating disposable incomes and rapid urbanization across the Asia Pacific serve as major drivers for the recreational boating market. Like, the region’s urban population is expected to grow by 30% over the next decade, with cities like Shanghai, Sydney, and Bangkok becoming hubs for luxury lifestyle pursuits. This demographic shift has fueled demand for recreational activities, including boating, as affluent urbanites seek unique experiences beyond traditional vacations. Also, a significant portion of high-net-worth individuals in the region prioritize experiential luxury, with boating emerging as a preferred choice due to its exclusivity and adventure quotient.

Moreover, the proliferation of marinas and yacht clubs has made recreational boating more accessible. For instance, Singapore’s ONE°15 Marina has become a premier destination for yacht owners, attracting both local and international visitors. In addition, government incentives, such as tax breaks for yacht purchases in Hong Kong, have further encouraged participation in recreational boating, driving market growth.

Growth of Marine Tourism

The expansion of marine tourism is another significant driver for the Asia Pacific recreational boating market. Countries like Thailand, Indonesia, and the Maldives have capitalized on their pristine coastlines and archipelagic geography to promote boating as a core component of their tourism offerings. For example, Thailand’s Phuket Yacht Show reported a 40% increase in visitor turnout in 2022, underscoring the growing popularity of boating among tourists.

In addition, the rise of eco-tourism has amplified the demand for sustainable boating experiences. Generally, over 50% of tourists prefer environmentally friendly activities, prompting operators to adopt green technologies such as electric motors and solar-powered vessels.

MARKET RESTRAINTS

High Costs and Maintenance Challenges

The substantial financial investment required for purchasing and maintaining recreational boats poses a significant restraint, particularly for middle-income consumers in the Asia Pacific. This financial burden is exacerbated by the lack of affordable financing options in many countries, deterring potential buyers. For instance, a report by the Asian Institute of Finance reveals that a small number of banks in Southeast Asia offer specialized loans for recreational boating, limiting accessibility.

Furthermore, maintenance challenges compound the issue. As per the International Council of Marine Industry Associations, a significant portion of boat owners cite maintenance as a primary concern, with corrosion and mechanical failures being common issues in tropical climates. Rural and underdeveloped areas face even greater difficulties, as they often lack the infrastructure and technical expertise necessary to support recreational boating.

Environmental Concerns and Regulatory Restrictions

Environmental concerns and stringent regulatory restrictions present another significant restraint to the Asia Pacific recreational boating market. According to the United Nations Environment Programme, marine pollution caused by recreational boating, including oil spills and plastic waste, has increased considerably over the past decade. This has led to stricter regulations governing vessel emissions and waste disposal, creating operational challenges for boating enthusiasts. For example, Australia’s Great Barrier Reef Marine Park Authority imposes fines exceeding $10,000 for violations related to environmental damage, deterring casual users.

Besides, as per a report by the International Maritime Organization, over 40% of coastal regions in the Asia Pacific have implemented zoning restrictions to protect marine ecosystems, limiting access to popular boating destinations. These measures, while essential for conservation, reduce the attractiveness of recreational boating for tourists and locals alike. Furthermore, public awareness campaigns showcases the ecological impact of boating have heightened consumer apprehension, further impeding market growth.

MARKET OPPORTUNITIES

Adoption of Eco-Friendly Technologies

The growing emphasis on sustainability presents a significant opportunity for the Asia Pacific recreational boating market. According to a study by the International Energy Agency, a large majority of consumers in the APAC are willing to pay a premium for eco-friendly products, including boats equipped with green technologies. Innovations such as electric propulsion systems, solar panels, and biofuel engines are gaining traction as viable alternatives to traditional fossil-fuel-powered vessels. For instance, New Zealand’s Silent Yachts has introduced solar-powered catamarans, achieving a reduction in operational costs while appealing to environmentally conscious buyers.

Governments are also incentivizing the adoption of sustainable boating practices. Also, countries like Japan and South Korea offer subsidies for eco-friendly vessels, encouraging manufacturers to invest in research and development. Apart from these, partnerships with environmental organizations, such as the World Wildlife Fund, have enabled companies to integrate conservation efforts into their business models, further enhancing brand reputation and customer loyalty.

Expansion of Luxury Boating Experiences

The rising demand for luxury boating experiences presents another promising opportunity for the Asia Pacific market. Companies are capitalizing on this trend by offering bespoke experiences, such as private yacht charters, gourmet dining cruises, and underwater exploration tours. Furthermore, advancements in onboard amenities have enhanced the appeal of luxury boating. Additionally, collaborations with hospitality brands, such as Four Seasons and Ritz-Carlton, have elevated the standard of service, making luxury boating a sought-after experience.

MARKET CHALLENGES

Infrastructure Gaps

Infrastructure gaps pose a formidable challenge to the growth of the Asia Pacific recreational boating market. According to the Asian Development Bank, a large share of coastal regions in the APAC lack adequate marina facilities, docking spaces, and repair services, limiting accessibility for boating enthusiasts. This issue is particularly pronounced in developing countries, where insufficient funding and planning hinder the development of marine infrastructure. Furthermore, the absence of standardized safety protocols exacerbates the problem. In addition, a notable portion of boating accidents in the APAC are attributed to inadequate infrastructure, such as poorly maintained docks and insufficient emergency response systems.

Seasonal Demand Variability

Seasonal demand variability is another significant challenge for the Asia Pacific recreational boating market. Like, a significant portion of marine tourism activities in the region are concentrated during the dry season, leaving operators with limited revenue streams during monsoon months. This uneven distribution of demand creates cash flow challenges for businesses reliant on consistent income. For example, a significant portion of boating operators in Thailand experience a decline in bookings during the rainy season, forcing them to scale back operations or lay off staff.

In addition, as per the International Council of Marine Industry Associations, seasonal fluctuations impact maintenance schedules, as operators struggle to allocate resources during off-peak periods. These dynamics not only strain business viability but also hinder long-term investments in fleet upgrades and marketing initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Boat Type, Boat Size, Engine Type, Engine Placement, Power Range,Material Type, By Activity Type, Power Source, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Brunswick corporation (US), Yamaha Motor Corporation (Japan), Groupe Beneteau (France), Ferretti Group Malibu Boats (US), and others. |

SEGMENTAL ANALYSIS

By Boat Type Insights

The Yacht segment dominated the Asia Pacific recreational boating market by commanding a 45.6% of the total market share in 2024. This segment’s leadership is driven by its association with luxury and exclusivity, appealing to affluent consumers in the region. One key factor propelling this dominance is the growing number of high-net-worth individuals (HNWIs). Also, the population of HNWIs in the Asia Pacific is projected to grow over the next decade, creating a robust consumer base for premium leisure activities like yachting. Yachts are often perceived as status symbols, making them particularly attractive to this demographic. Another driving factor is the expansion of marina infrastructure. A large share of new marinas in the APAC are designed to accommodate larger vessels like yachts, ensuring seamless accessibility for owners. For instance, Singapore’s ONE°15 Marina has become a hub for yacht enthusiasts, hosting events such as the Singapore Yacht Show, which attracts both local and international participants. Apart from these, government initiatives promoting marine tourism, such as Thailand’s “Marine Tourism Development Plan,” have further bolstered the adoption of yachts, strengthening their place in the market.

The personal watercrafts segment is the fastest-growing in the Asia Pacific recreational boating market, with a projected CAGR of 12.8% from 2025 to 2030. This is fueled by their affordability and versatility, appealing to younger demographics and first-time boating enthusiasts. One significant driver is the increasing popularity of water sports and adventure tourism. Also, a large share of tourists in the Asia Pacific engage in water-based activities, with personal watercrafts being a preferred choice due to their agility and ease of use. Another factor is the rise of rental services. Like, a significant portion of personal watercraft users in urban areas prefer renting over ownership, citing cost-effectiveness and convenience. For example, companies like Jet Ski Rentals in Bali have reported an increase in bookings over the past two years, driven by the growing demand for short-term experiences. Furthermore, advancements in lightweight materials and eco-friendly engines have enhanced the appeal of personal watercrafts, making them more sustainable and user-friendly.

By Boat Size Insights

The <30 feet boat segment prevailed in the Asia Pacific recreational boating market by holding a 55.7% market share in 2024. This segment’s place is driven by its affordability and suitability for diverse applications, including fishing, day cruising, and water sports. One major factor is the growing middle-class population in the region. Boats under 30 feet are often viewed as an accessible entry point for recreational boating, particularly among first-time buyers.

Another propelling aspect is the proliferation of inland waterways and small lakes. As per the United Nations Environment Programme, a considerable portion of recreational boating activities in the region occur on inland waters, where smaller boats are better suited for navigation. For instance, Vietnam’s Mekong Delta has seen a surge in demand for compact fishing boats and speedboats, driven by local tourism initiatives. In addition, government incentives, such as subsidies for small boat purchases in rural areas, have further amplified the adoption of this segment, ensuring its continued prominence in the market.

The >50 feet boat segment is quickly advancing, with a CAGR of 15.2%. This progress is propelled by the increasing demand for luxury and long-distance cruising experiences. One significant aspect is the rising affluence of ultra-high-net-worth individuals (UHNWIs) in the region. Like, a considerable percentage of UHNWIs prioritize experiential luxury, with large yachts and cruisers offering unparalleled comfort and customization options.

Another factor is the expansion of marine tourism infrastructure. For example, Australia’s Coral Sea Marina has introduced facilities tailored for superyachts, achieving a increase in occupancy rates within two years. Furthermore, advancements in onboard amenities, such as smart cabins and infinity pools, have enhanced the appeal of large boats, making them a preferred choice for extended voyages and luxury charters.

By Engine Type Insights

The segment of Internal combustion engines (ICE) commanded the Asia Pacific recreational boating market. This segment’s growth is driven by its reliability and widespread availability, making it the preferred choice for traditional boaters. One main factor is the established supply chain for ICE components. Like, a large majority of marine engine manufacturers in the region specialize in ICE production, ensuring consistent availability and competitive pricing. Further driving aspect is the prevalence of fueling infrastructure. A study by the Asian Institute of Technology highlights that less than 20% of coastal regions in the Asia Pacific have charging stations for electric boats, limiting the adoption of alternative propulsion systems. For instance, Thailand’s Gulf of Thailand remains heavily reliant on ICE-powered vessels due to the lack of electric charging facilities.

The electric engines segment is accelerating, with a CAGR of 18.5%. This development is fueled by the increasing emphasis on sustainability and eco-friendly technologies. One important propellent is the growing awareness of environmental issues. Like, a notable portion of consumers in the Asia Pacific are willing to adopt green technologies, including electric boats, to reduce their carbon footprint. Companies like Silent Yachts have capitalized on this trend by introducing solar-powered catamarans, achieving a major reduction in operational costs while appealing to environmentally conscious buyers. A different factor is government support for clean energy initiatives. As per the Asian Development Bank, countries like Japan and South Korea offer subsidies for electric vessels, encouraging manufacturers to invest in research and development. For example, South Korea’s Hyundai Heavy Industries has launched a line of hybrid yachts, integrating electric propulsion systems to achieve a reduction in emissions. Furthermore, advancements in battery technology have addressed concerns about range anxiety, making electric engines more viable for long-distance cruising.

COUNTRY LEVEL ANALYSIS

Australia led the Asia Pacific recreational boating market by commanding a 25% market share in 2024. The country’s vast coastline and strong maritime culture drive its prominence in the regional market. One key factor is the government’s proactive approach to marine tourism. According to the Australian Department of Tourism, the “Blue Economy Strategy” has allocated substantial amount to develop marine infrastructure, including marinas and docking facilities, enhancing accessibility for boating enthusiasts. One more factor is the growing popularity of luxury charters.

China is another key player in the market. The country’s position is bolstered by its rapidly growing middle class and urbanization. One driving factor is the increasing disposable income of urban residents. Also, a large share of China’s urban population now engages in leisure activities, with recreational boating emerging as a popular choice. A different point is the government’s focus on developing coastal tourism. As per the Ministry of Culture and Tourism, over 40% of China’s tourism revenue is generated from marine activities, underscoring the sector’s importance.

Thailand holds a significant position in the market. The nation’s archipelagic geography and pristine beaches make it a hotspot for marine tourism. One key factor is the rise of eco-tourism. Like, a considerable portion of tourists in Thailand prefer environmentally friendly activities, prompting operators to adopt sustainable practices. Another factor is the proliferation of marina facilities. A study by the International Council of Marine Industry Associations highlights that Thailand’s marina capacity grew between 2018 and 2022, catering to international visitors.

Japan secures a notable market share. The country’s advanced technological infrastructure and aging population drive boating adoption. One more factor is the integration of AI in navigation systems. According to the Japanese Ministry of Economy, Trade and Industry, over 60% of recreational boats in Japan are equipped with smart technologies, enhancing safety and usability. Another factor is the emphasis on wellness tourism.

Singapore collectively holds a small market share. The country’s strategic location and world-class marina facilities enhance its appeal as a regional hub for recreational boating. One main factor is the growth of luxury tourism. According to the Singapore Tourism Board, a significant share of high-net-worth tourists visiting Singapore engage in yacht charters, with ONE°15 Marina being a premier destination. Another factor is the government’s focus on sustainable practices. As per the National Parks Board, Singapore has implemented policies to reduce marine pollution, fostering trust among environmentally conscious boaters.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC recreational boating market profiled in this report are Brunswick corporation (US), Yamaha Motor Corporation (Japan), Groupe Beneteau (France), Ferretti Group Malibu Boats (US), and others.

TOP LEADING PLAYERS IN THE MARKET

Brunswick Corporation (United States)

Brunswick Corporation is a global leader in the recreational boating industry, with a strong presence in the Asia Pacific region. The company’s diverse portfolio includes iconic brands like Sea Ray, Boston Whaler, and Mercury Marine, catering to a wide range of consumer preferences. Brunswick has contributed significantly to the global market by pioneering innovations in boat design, propulsion systems, and digital navigation technologies. Their commitment to sustainability is evident in their development of eco-friendly engines and hybrid propulsion systems, aligning with global trends toward green marine practices.

Yamaha Motor Co., Ltd. (Japan)

The Yamaha Motor Co., Ltd. Company’s innovative approach to product development has made it a preferred choice for both casual enthusiasts and professional operators. Globally, Yamaha has played a pivotal role in advancing marine technology through its lightweight, fuel-efficient engines and cutting-edge watercraft designs. Its emphasis on user-friendly features and affordability has expanded its customer base, particularly among younger demographics.

Sunseeker International (United Kingdom)

Sunseeker International is a major contributor to the Asia Pacific recreational boating market, particularly in the luxury yacht segment. The company’s focus on bespoke craftsmanship and premium amenities has made it a preferred choice for high-net-worth individuals seeking exclusivity and comfort. On a global scale, Sunseeker has been instrumental in promoting the concept of experiential luxury through its state-of-the-art yachts equipped with smart cabins, entertainment systems, and eco-friendly technologies.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships

Key players in the Asia Pacific recreational boating market are increasingly forming strategic partnerships with marina operators, tourism boards, and local governments to co-develop innovative solutions. These collaborations enable companies to leverage complementary expertise, enhance infrastructure, and expand their reach. For instance, partnerships with tourism boards often focus on integrating boating into broader marine tourism initiatives, ensuring robustness and inclusivity in recreational offerings.

Investment in R&D

Investing heavily in research and development (R&D) is another dominant strategy adopted by market leaders. Companies are prioritizing the creation of cutting-edge technologies tailored to regional needs, such as eco-friendly propulsion systems and smart navigation tools. This focus on innovation not only enhances their competitive edge but also ensures compliance with stringent environmental regulations, fostering trust among consumers. Besides, advancements in lightweight materials and modular designs have addressed concerns about durability and customization, making these solutions more appealing to diverse demographics.

Expansion of Service Portfolios

To strengthen their market position, companies are diversifying their service portfolios by incorporating additional value-added offerings, such as rental services, maintenance packages, and training programs. By providing comprehensive solutions that address multiple pain points, these players can attract a broader customer base while reinforcing their brand as a one-stop provider for recreational boating needs. For example, integrating AI-driven diagnostics with predictive maintenance services has enabled companies to offer end-to-end solutions, enhancing customer satisfaction and loyalty.

COMPETITION OVERVIEW

The Asia Pacific recreational boating market is characterized by intense competition, driven by the presence of both global giants and regional innovators. Established players like Brunswick Corporation and Yamaha Motor Co., Ltd., compete alongside emerging startups such as Silent Yachts and local manufacturers, creating a dynamic ecosystem. The competitive landscape is shaped by rapid technological advancements, increasing demand for sustainable solutions, and supportive government policies. Companies are striving to differentiate themselves through unique value propositions, such as proprietary engine technologies, user-friendly interfaces, or specialized applications in luxury and eco-tourism. Additionally, the race to secure intellectual property rights and comply with stringent environmental regulations further intensifies rivalry. Collaborations with local governments and tourism operators also play a pivotal role in gaining market share, as they facilitate the adoption of boating technologies in underserved areas

RECENT MARKET DEVELOPMENTS

- In April 2023, Brunswick Corporation launched an AI-driven navigation platform in collaboration with several Asian tech firms. This initiative aimed to enhance safety and usability for recreational boaters, addressing critical needs in smart marine technologies.

- In June 2023, Yamaha Motor Co., Ltd. partnered with Japan’s Ministry of Environment to develop eco-friendly outboard engines. This collaboration marked a significant milestone in reducing carbon emissions and promoting sustainable boating practices across the region.

- In September 2023, Sunseeker International introduced a line of luxury yachts integrated with solar panels and energy-efficient systems. This innovation was developed in partnership with European research institutions, highlighting the company’s commitment to advancing green technologies.

- In November 2023, Silent Yachts acquired a Malaysian boat manufacturer to strengthen its foothold in Southeast Asia. This acquisition enabled the company to expand its production capacity and cater to growing demand for electric-powered vessels.

- In January 2024, Mercury Marine launched a subscription-based rental service in Australia to offer affordable access to recreational boats. This initiative was designed to attract younger demographics and first-time users, further solidifying Mercury Marine’s leadership in the market.

MARKET SEGMENTATION

This Asia Pacific recreational boating market research report is segmented and sub-segmented into the following categories.

By Boat Type

- Yachts

- Sailboats

- Personal Watercrafts

- Inflatables

- Others

By Boat Size

- <30 Feet

- 30-50 Feet

- >50 Feet

By Engine Placement

- Outboards

- Inboards

- Others

By Engine Type

- ICE

- Electric

By Power Range

- Up to 100 kW

- 100-200 kW

- Above 200 kW

By Material Type

- Aluminum

- Fiberglass

- Steel

- Others

By Activity Type

- Cruising+watersports

- Fishing

By Power Source

- Engine Powered

- Sail Powered

- Human Powered

By Distribution Channel

- Dealer Network

- Boat Shows

- Online Sales

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific recreational boating market?

The Asia Pacific recreational boating market is driven by rising disposable incomes, expanding marina infrastructure, government support for marine tourism, and growing interest in water sports and luxury experiences.

2. What challenges affect the Asia Pacific recreational boating market?

The Asia Pacific recreational boating market faces challenges such as high purchase and maintenance costs, limited financing options, environmental regulations, seasonal demand fluctuations, and infrastructure gaps.

3. What opportunities exist in the Asia Pacific recreational boating market?

The Asia Pacific recreational boating market offers opportunities in eco-friendly and electric boats, luxury yacht tourism, government subsidies for green vessels, and expanding rental and experiential boating services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]