Asia Pacific Sleep Tech Devices Market Size, Share, Trends & Growth Forecast Report By Wearables (Smart Watches and Bands, Other Wearable Products), Non-wearables (Sleep Monitors, Beds, Other Non-wearable Products), End User (Hospitals, Homecare Settings, Other End Users), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Sleep Tech Devices Market Size

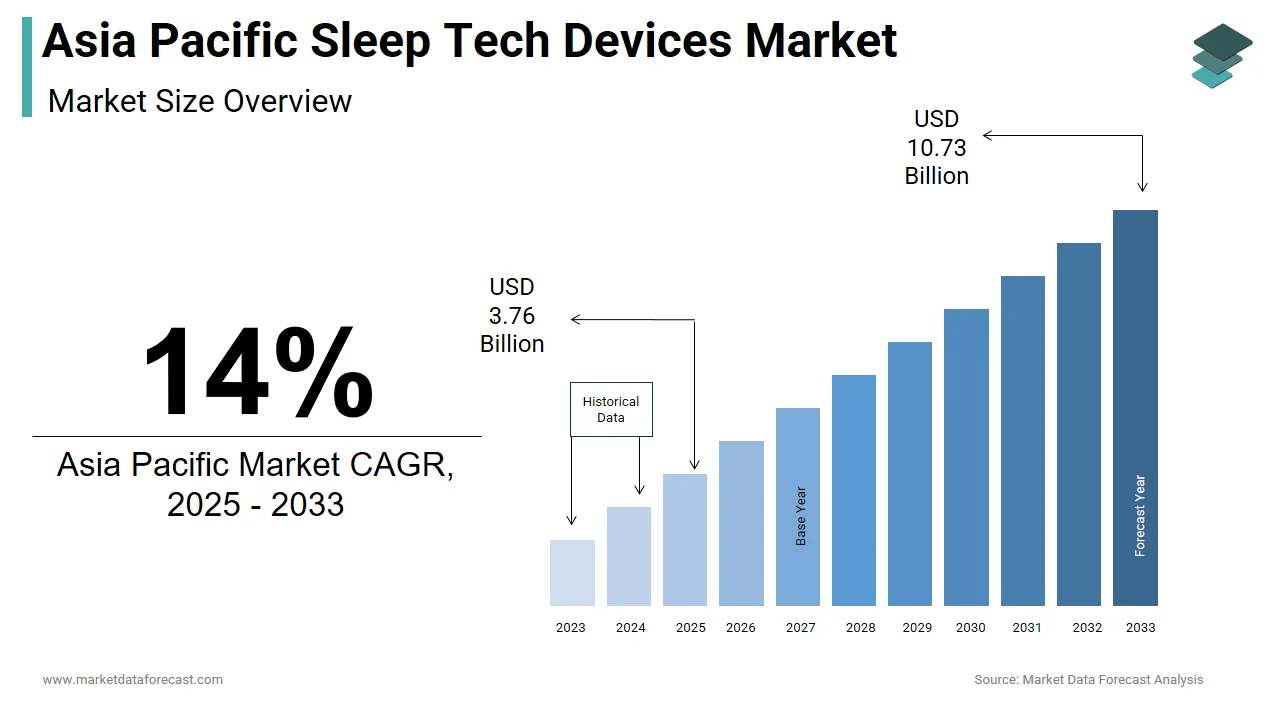

The size of the Asia Pacific sleep tech devices market was worth USD 3.3 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 14% from 2025 to 2033 and be worth USD 10.73 billion by 2033 from USD 3.76 billion in 2025.

The Asia Pacific sleep tech devices market is driven by increasing demand for technology-based solutions that monitor, analyze and enhance sleep quality among individuals affected by sleep disorders and lifestyle-related sleep disturbances. These devices Sleep Tech Devicesrange from wearable trackers and smart mattresses to bedside sensors and AI-powered mobile applications that offer personalized sleep insights and recommendations. This region is witnessing increased demand for these technologies with a rising prevalence of stress-related disorders along with urbanization-driven lifestyle changes and growing awareness about the importance of sleep health. In response, governments and healthcare providers are beginning to integrate digital health tools into wellness programs. For example, Singapore’s Ministry of Health has included sleep monitoring apps under its national telehealth initiatives to support preventive care models. In Japan, where work-related stress and long working hours are culturally prevalent companies like Panasonic and Sony are developing consumer-oriented sleep aids such as smart pillows and sound machines integrated with biometric feedback systems. In India, rising disposable incomes and an expanding middle class have led to greater spending on personal wellness products including fitness wearables with embedded sleep tracking features.

MARKET DRIVERS

Rising Prevalence of Sleep Disorders and Mental Health Issues

Increasing prevalence of sleep disorders and associated mental health issues is a major driver fueling growth in the Asia Pacific sleep tech devices market. Over 45.87% of adults in China, India and South Korea suffer from some form of sleep disturbance ranging from insomnia to obstructive sleep apnea. The rise in anxiety, depression and stress-related conditions particularly in densely populated urban centers has further exacerbated poor sleep habits. Mental health concerns have gained significant attention in recent years thereby prompting both public and private stakeholders to incorporate sleep wellness into broader healthcare strategies. Moreover, corporate wellness programs in multinational corporations across Australia and Singapore are increasingly recommending sleep tracking wearables to help employees manage stress levels and improve productivity.

Integration of Smart Technologies and Healthcare Digitization

Integration of Smart Technologies and Healthcare Digitization is another key driver behind the expansion of the Asia Pacific sleep tech devices market as consumers increasingly adopt connected health solutions to manage sleep-related issues and improve overall well-being. Governments and private healthcare providers across the region are investing heavily in e-health platforms, telemedicine and connected medical devices that allow continuous remote monitoring of patient health indicators including sleep patterns. More than half of all healthcare providers in Australia now use digital tools to track patient vitals and behavioral health metrics thereby encouraging the adoption of sleep tracking devices among users. In China, smart home ecosystems are promoted that include sleep-enhancing devices such as intelligent lighting, AI-driven sleep coaching and biometric beds.Additionally, the proliferation of smartphones, smart speakers and wearable fitness trackers has made sleep tech more accessible to consumers. Brands like Xiaomi, Huawei and Fitbit have introduced affordable smartwatches with built-in sleep stage analysis resulting in contribution to mainstream acceptance of sleep monitoring as a part of everyday health management.

MARKET RESTARINTS

High Cost and Limited Affordability in Emerging Economies

High cost and limited affordability in emerging economies pose a major challenge to the Asia Pacific sleep tech devices market. Advanced sleep monitoring and treatment technologies remain inaccessible to many consumers due to their premium pricing. While premium devices such as polysomnography-grade wearables, smart beds and AI-integrated CPAP alternatives offer enhanced functionality their high price points often place them out of reach for lower and middle-income consumers.Even mid-range options including smart rings and sleep headbands remain out of reach for large segments of the population in countries like Vietnam and Bangladesh where average disposable incomes are significantly lower compared to developed markets. Furthermore, insurance coverage for sleep-related ailments remains limited in many parts of the region thereby reducing incentives for consumers to invest in costly digital health solutions. The lack of standardization and perceived unreliability of cheaper models hinder widespread adoption while local manufacturers are attempting to bridge this gap through budget-friendly alternatives.

Lack of Awareness and Cultural Attitudes Toward Sleep Dysfunction

Lack of awareness and cultural attitudes toward sleep dysfunction is another significant constraint impacting the Asia Pacific sleep tech devices market. In rural and semi-urban areas sleep disorders are either misunderstood or considered trivial issues rather than serious health concerns. Individuals experiencing chronic sleep problems in Thailand and Malaysia seek professional diagnosis or intervention. Cultural norms in countries like Japan and South Korea often associate long working hours and minimal sleep with dedication and discipline thereby discouraging individuals from addressing sleep deficiencies. Over 35.76% of white-collar workers believed reducing sleep time was necessary for career advancement. Additionally, misconceptions regarding the effectiveness of sleep tech devices particularly among older demographics hinder consumer confidence. Many consumers still rely on traditional remedies or general fitness trackers without dedicated sleep monitoring capabilities.

MARKET OPPORTUNITIES

Expansion of Telehealth Services and Remote Diagnostics

Growing adoption of telehealth services and remote diagnostics is an expanding opportunity within the Asia Pacific sleep tech devices market. Governments and private healthcare providers across the region are rapidly deploying digital health infrastructures to improve access to medical consultations and reduce hospital congestion. In India, government-backed teleconsultation portals such as eSanjeevani have started incorporating sleep disorder screening modules are allowing physicians to recommend specific sleep tech devices based on patient data. In Australia, telehealth startups are partnering with device manufacturers to offer bundled packages that combine home-based sleep studies with physician-reviewed reports. This trend enables users to receive personalized sleep assessments without visiting clinics thus enhancing convenience and encouraging wider adoption. Sleep tech devices are well-positioned to play a central role in digital-first wellness strategies across the Asia Pacific region as remote healthcare models become more entrenched.

Growing Corporate Wellness Programs and Employee Health Initiatives

Increasing emphasis on corporate wellness programs and employee health initiatives is another significant opportunity for the Asia Pacific sleep tech devices market . Multinational corporations and domestic enterprises alike are recognizing the impact of sleep quality on workforce productivity, mental health and overall well-being. 500 companies operating in Singapore and Australia had implemented workplace well-being strategies that included sleep improvement components. These initiatives often involve distributing sleep-tracking wearables along with offering sleep hygiene workshops and integrating sleep analytics into company sponsored health apps. Some firms are even collaborating with sleep tech startups to develop customized solutions tailored to their employees needs. For instance, Japanese conglomerates such as Hitachi and Toyota have partnered with local sleep researchers to deploy smart sleep pods and biofeedback-enabled relaxation stations in office environments. The corporate sector presents a lucrative avenue for scaling sleep tech adoption beyond individual consumers thereby fostering long-term market expansion as businesses in the region place greater focus on employee engagement and mental resilience.ss

MARKET CHALLENGES

Regulatory Heterogeneity Across Regional Markets

Regulatory heterogeneity across regional markets poses a significant challenge to the Asia Pacific sleep tech devices sector. Inconsistent approval standards and fragmented compliance requirements across countries create barriers to seamless market entry and expansion. Standardized frameworks are seen in the European Union or the United States in contrast with Asia Pacific comprising diverse regulatory regimes with varying approval processes for medical and consumer-grade health devices. Companies must navigate multiple certification pathways, clinical validation procedures and labeling standards before launching products in different jurisdictions. Smaller startups and international firms with limited resources often struggle to meet these varied requirements while hindering product availability in certain markets. Additionally, inconsistent enforcement of data privacy laws complicates the deployment of cloud-connected sleep monitoring solutions. Manufacturers must adapt their offerings to align with country-specific mandates which further complicates commercialization strategies as governments introduce stricter regulations on health data collection and user consent.

Data Accuracy, Validation, and Consumer Trust Issues

Data accuracy as well as scientific validation and consumer trust is a major challenge confronting the Asia Pacific sleep tech devices market. While numerous sleep tracking devices claim to provide detailed sleep stage analysis and health recommendations along with inconsistencies in measurement methodologies and sensor reliability have raised concerns among healthcare professionals and end-users alike. Only 60.71% of consumer-grade sleep trackers demonstrated acceptable congruence with clinical-grade polysomnography readings. Many users express skepticism regarding the usefulness of device-generated insights particularly when recommendations do not align with their subjective sleep experiences. This discrepancy reduces confidence in sleep tech solutions and inhibits repeat purchases or referrals. Additionally, the proliferation of low-cost and unverified products lacking medical endorsements further undermines market credibility.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Wearables, Non-wearables, End User, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Compumedics Limited, Huawei Technologies Co., Ltd., Nihon Kohden Corporation, Koninklijke Philips N.V., and ResMed. |

SEGMENTAL ANALYSIS

By Wearables Insights

The smartwatches and smart bands segment dominated the Asia Pacific sleep tech wearables market by capturing 64.94% of total market share in 2024. Their widespread adoption is primarily driven by their dual functionality as fitness and sleep monitoring tools and makes them appealing to health-conscious consumers. Over 120 million wearable devices were shipped across the Asia Pacific region with sleep tracking being one of the most frequently used features. In China, where brands like Xiaomi and Huawei have aggressively marketed affordable yet feature-rich smartwatches consequently domestic shipments also exceeded 40 million units in 2023 alone. In Japan, corporate wellness programs have encouraged employees to use these wearables for stress and sleep management. In India, rising awareness of mental health and lifestyle disorders has led to increased demand for personal health tracking solutions.

The other wearable sleep product segment is predicted to witness a highest CAGR of 22.7% between 2025 and 2033. This category includes specialized products such as sleep headbands, smart rings and biometric patches designed specifically for detailed sleep analysis rather than general fitness tracking.Sales of dedicated sleep-focused wearables in the Asia Pacific region grew by nearly 35.84% in 2023 which is driven by increasing consumer interest in precision health data. Companies like Oura Ring and Withings have expanded their distribution networks in South Korea and Singapore where urban professionals seek discreet and high-accuracy sleep tracking options. Moreover, medical-grade wearable sleep monitors are gaining traction due to partnerships between device manufacturers and sleep disorder clinics. In Australia, telehealth providers are recommending these devices for diagnosing mild to moderate obstructive sleep apnea thus reducing the need for overnight lab studies.

By Non-Wearables Insights

The sleep monitors segment was the largest segment and held 48.05% of the Asia Pacific sleep tech wearables market share in 2024. These include contactless bedside sensors, under-mattress trackers and AI-powered audio-visual systems that analyze breathing patterns, movement and ambient conditions without requiring direct body contact. Sales of bedside sleep monitors have surged in Japan and South Korea where elderly populations and individuals with chronic insomnia prefer non-intrusive alternatives to wrist-worn devices. In China, home healthcare platforms like Alibaba Health have integrated advanced sleep sensors into smart home ecosystems thereby allowing remote monitoring of family members' sleep quality. Additionally, hospitals and sleep clinics in Australia and Singapore are adopting these monitors for preliminary diagnostics which reduces reliance on overnight polysomnography tests.

The smart beds segment is estimated to register the fastest CAGR of 25.3% from 2025 to 2033. These beds integrate pressure-sensitive sensors, adjustable firmness settings, climate control and biometric feedback systems to improve sleep comfort and track rest patterns.The global smart mattress market reached USD 1.4 billion in 2023 with Asia Pacific accounting for over 30.92% of new installations. A key driver is the aging population in countries like Japan and South Korea where companies such as Sealy and Tempur-Pedic have introduced premium smart beds tailored for elderly care. Japanese startups are also developing AI-integrated beds that adjust posture in real-time to reduce snoring and enhance deep sleep cycles. In India and Indonesia, luxury hotels and wellness resorts are increasingly incorporating smart beds into guest room amenities to differentiate themselves in competitive hospitality markets. E-commerce platforms such as Amazon India and Flipkart reported a 60.81% year-over-year increase in smart bed purchases thereby reflecting growing consumer interest in sleep-enhancing furniture solutions.

By End User Insights

The hospitals segment was the largest in the Asia Pacific sleep tech devices market by capturing 42.21% of total market share in 2024. Sleep disorder clinics and hospital-based diagnostic centers continue to rely heavily on advanced sleep monitoring equipment for the detection and treatment of conditions such as obstructive sleep apnea, insomnia and restless leg syndrome. In China, major hospitals such as Beijing Union Medical College Hospital have integrated digital polysomnography systems that provide real-time sleep data analysis and remote diagnostics. In India, the National Centre for Sleep Disorders at AIIMS Delhi has been expanding its outreach through government-funded sleep disorder screening initiatives. Australian hospitals have also adopted AI-driven sleep monitors for ICU patients leading to continuous assessment of respiratory patterns without direct physical constraints. Nearly 1.2 million sleep studies were conducted in hospitals across the country in 2023 emphasizing the critical role of institutional healthcare in driving demand for sleep tech devices in clinical settings.

The homecare settings segment is likely to experience the fastest CAGR of 23.9% between 2025 and 2033. The increasing prevalence of sleep disorders among the working-age population coupled with rising awareness of self-monitoring solutions which is fueling demand for at-home sleep tracking and therapy devices.In 2023, nearly 60.83% of employed professionals in Singapore and Malaysia reported using home-based sleep tech devices to manage work-related stress and fatigue. Additionally, telehealth providers in Thailand and Indonesia are offering bundled packages that combine CPAP machines with connected sleep monitors thus allowing clinicians to remotely assess treatment effectiveness. E-commerce platforms such as Alibaba Health and Flipkart have played a pivotal role in making these devices accessible to rural and semi-urban populations. Online sales of home-use sleep apnea monitors in India grew by 55.06% in 2023 compared to the previous year thereby reflecting strong consumer pull toward decentralized healthcare models.

COUNTRY LEVEL ANALYSIS

China outperformed other regions in the Asia Pacific sleep tech devices market and accounted for 29.6% of share in 2024.China is experiencing rapid industrialization and a growing middle class which lead to increased disposable incomes, greater awareness of sleep disorders and strong government support for digital health initiatives. Over 380 million adults in China suffer from chronic sleep disturbances thereby prompting both public and private stakeholders to invest in sleep-related health technologies.The digital health infrastructure in China supports widespread adoption of sleep tech with major players like Xiaomi, Huawei and BYD integrating sleep tracking features into mainstream wearable devices.

India’s sleep tech devices market growth is driven by shifting lifestyle patterns, increased awareness of mental health and rising smartphone penetration. Nearly 40.78% of the urban population experiences some form of sleep disturbance with insomnia and anxiety-related sleep issues on the rise. Corporate wellness programs in metropolitan cities such as Mumbai, Bengaluru and Hyderabad have started integrating wearable sleep monitoring as part of employee health initiatives. Additionally, the rollout of digital healthcare services via platforms like Apollo Telehealth and Practo has facilitated access to remote sleep diagnostics and personalized recommendations. Ecommerce channels such as Amazon India and Flipkart have played a significant role in making sleep tech devices more accessible with smartwatches featuring sleep tracking capabilities witnessing a 50.64% year-over-year sales increase in 2023.

Japan’s sleep tech devices market is likely to have significant growth opportunities during the forecast period. Over 60.77% of middle-aged workers report poor sleep quality thus leading to extensive adoption of sleep monitoring and improvement technologies. The Japanese government has endorsed preventive health strategies including the promotion of sleep hygiene apps and wearable devices in corporate settings. Major companies like Sony and Panasonic have launched smart pillows, biofeedback rings and AI-powered sound machines tailored for sleep enhancement. Furthermore, telemedicine startups such as Medley Health are collaborating with device manufacturers to offer home-based sleep assessments.

South Korea’s sleep tech devices market growth is likely to have fastest growth opportunities in the next coming years. The country’s high smartphone penetration and electronics manufacturing expertise have enabled rapid adoption of smart wearables equipped with advanced sleep tracking features. Nearly half of all smartphone users in Seoul utilize built-in sleep monitoring apps or third-party health platforms to track their rest patterns. Government-backed initiatives promoting preventive healthcare have led to collaborations between IT firms and medical institutions to develop AI-driven sleep diagnostics. Samsung Health collaborating with national hospitals and has launched sleep disorder screening modules that integrate data from Galaxy Watches and other wearables. Additionally, South Korean startups are launching innovative solutions such as neurofeedback headbands and smart bedding products which enhance the market’s diversity.

Australia’s sleep tech devices market is likely to grow with healthy CAGR in the next coming years. Over 2 million Australians suffer from sleep apnea with another 3.7 million reporting chronic insomnia symptoms thereby creating a substantial demand for monitoring and intervention technologies. The country’s telehealth infrastructure has facilitated the integration of sleep tech into remote patient care. Public health campaigns encouraging early diagnosis of sleep disorders have contributed to increased adoption of home-based sleep monitors and connected CPAP devices. Additionally, workplace wellness programs in sectors like finance and logistics have begun incorporating sleep tracking wearables to improve employee performance and reduce burnout.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC sleep tech devices market profiled in this report are Compumedics Limited, Huawei Technologies Co., Ltd., Nihon Kohden Corporation, Koninklijke Philips N.V., and ResMed.

TOP LEADING PLAYERS IN THE MARKET

Fitbit (Google Health)

Fitbit plays a central role in shaping the Asia Pacific sleep tech devices market through its advanced wearables that offer detailed sleep stage analysis. The company’s devices are widely adopted across the region particularly among health-conscious consumers and corporate wellness programs. Fitbit's emphasis on biometric tracking and integration with mobile health platforms has positioned it as a leading provider of consumer-grade sleep monitoring solutions.

Philips Healthcare

Philips is a key player known for its medical-grade sleep apnea treatments and diagnostic devices including CPAP machines and home sleep tests. In the Asia Pacific region, Philips has strategically collaborated with hospitals and telehealth providers to expand access to sleep disorder diagnostics. Its focus on integrating AI-driven analytics into sleep therapy ensures personalized treatment plans while making it a trusted name among clinicians and patients alike.

Xiaomi Corporation

Xiaomi has emerged as a major force in the Asia Pacific sleep tech market due to its affordable yet feature-rich smartwatches and fitness bands. Xiaomi successfully targets budget-conscious consumers while maintaining high product functionality with strong regional distribution networks and e-commerce presence. The company continues to drive mass adoption of sleep tracking by embedding comprehensive sleep insights into widely used wearable products.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Sleep integration with digital health ecosystems is a major strategy employed by key players thereby ensuring seamless data synchronization between sleep tracking devices and mobile health applications. This enables users to receive continuous insights and facilitates clinical interpretation in healthcare settings.

Strategic partnerships with healthcare providers and insurance companies represent another crucial approach and enable manufacturers to position their devices as essential tools for preventive care. These collaborations enhance credibility and improve reimbursement models for sleep-related health interventions.

Localized product development and marketing strategies play a vital role in expanding market reach. Companies are tailoring device interfaces, features and distribution methods to align with regional user preferences and cultural attitudes toward sleep health thereby driving higher acceptance across diverse consumer groups.

COMPETITION OVERVIEW

The competition in the Asia Pacific sleep tech devices market is characterized by a dynamic mix of global electronics giants, established medical equipment manufacturers and emerging local startups aiming to capture a share of the growing demand for sleep health solutions. Western brands like Fitbit and Philips continue to hold strong positions due to their advanced sensor technologies and brand recognition while domestic players such as Xiaomi, Huawei and various Japanese and Korean electronics firms are rapidly gaining traction with cost-effective and locally adapted offerings.Market participants are differentiating themselves through innovations in non-contact sleep monitoring, AI-based sleep stage analysis and integration with telehealth platforms. The entry of smartphone manufacturers into the wearables space has intensified competition while pushing smaller firms to focus on niche segments such as medical-grade diagnostics or specialized sleep aids. Competition is set to intensify as awareness of sleep disorders grows and digital health adoption accelerates with technology-driven innovation and strategic market expansion shaping the future of the sector.

RECENT MARKET DEVELOPMENTS

- In January 2024, Fitbit partnered with a leading Australian telehealth platform to integrate its sleep tracking data into virtual consultations.

- In March 2024, Philips launched a new line of portable sleep apnea monitors tailored for home use in China and India.

- In June 2024, Xiaomi introduced an updated version of its flagship smartwatch in Southeast Asia featuring enhanced sleep tracking algorithms powered by AI.

- In September 2024, a South Korean startup specializing in sleep neurotechnology secured a partnership with Samsung Health to integrate its brainwave-monitoring headband data into Samsung’s broader health ecosystem.

- In December 2024, a Japanese electronics firm collaborated with Tokyo University Hospital to develop a cloud-connected bed sensor system designed for elderly care facilities.

MARKET SEGMENTATION

This Asia Pacific sleep tech devices market research report is segmented and sub-segmented into the following categories.

By Wearables

- Smart Watches and Bands

- Other Wearable Products

By Non-wearables

- Sleep Monitors

- Beds

- Other Non-wearable Products

By End User

- Hospitals

- Homecare Settings

- Other End Users

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What factors are driving the Asia Pacific sleep tech devices market?

The Asia Pacific sleep tech devices market is driven by rising prevalence of sleep disorders, rapid urbanization, increasing mental health awareness, and strong demand for technology-based solutions like wearables, smart beds, and AI-powered trackers to monitor and improve sleep quality

2. What challenges does the Asia Pacific sleep tech devices market face?

The Asia Pacific sleep tech devices market faces challenges such as high costs of advanced devices, limited affordability in emerging economies, lack of awareness in rural areas, regulatory complexity, and concerns over data accuracy and privacy

3. What opportunities exist in the Asia Pacific sleep tech devices market?

Opportunities in the Asia Pacific sleep tech devices market include expanding telehealth and homecare adoption, growth in corporate wellness programs, product innovation, and increasing government and private investment in digital health infrastructure

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com