Asia-Pacific Spinal Cord Stimulation Market Size, Share, Trends & Growth Forecast Report By Application, Product Type and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific Spinal Cord Stimulation Market Size

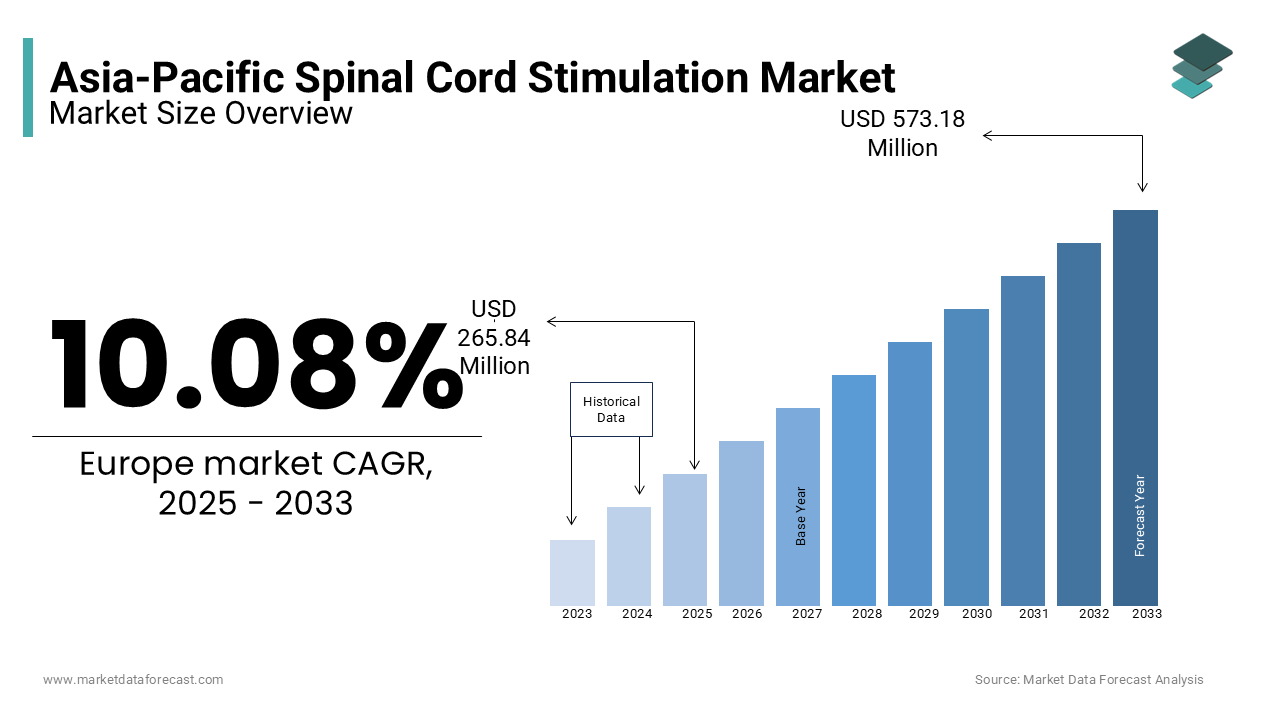

The spinal cord stimulation market size in the Asia-Pacific was valued at USD 241.5 million in 2024. The regional market size is expected to be worth USD 573.18 million by 2033 from USD 265.84 million in 2025, exhibiting a CAGR of 10.08% from 2025 to 2033. The asia-Pacific region accounts for having the highest CAGR over the forecast period due to the increasing prevalence of pain.

Spinal cord stimulation involves the implantation of a device that delivers electrical impulses to the spinal cord, effectively modulating pain signals before they reach the brain. The spinal cord stimulation market in the Asia-Pacific is estimated to register promising growth over the forecast period and this robust growth is primarily attributed to factors such as the rising incidence of conditions like failed back surgery syndrome and complex regional pain syndrome, coupled with an aging population that is more susceptible to degenerative spinal disorders. Geographically, countries like China, India, and Japan are leading the market in this region. China, for instance, has witnessed technological advancements in the healthcare sector, providing opportunities for new market players. In India, the rising number of patients suffering from neuropathic pain following spinal operations and persistent pain in the limbs due to trauma and accidents is driving the spinal stimulation market.

MARKET DRIVERS

Increasing Prevalence of Chronic Pain Conditions

The rise in chronic pain disorders, including failed back surgery syndrome (FBSS) and complex regional pain syndrome (CRPS), is a key driver of the Asia-Pacific spinal cord stimulation market. According to the World Health Organization (WHO), approximately 20% of adults worldwide suffer from chronic pain, with a significant proportion found in Asia due to its large aging population. As per the United Nations, the population aged 60 years and above in China alone is projected to reach 402 million by 2040. The aging demographic increases the prevalence of degenerative spinal disorders, driving demand for effective pain management solutions like SCS.

Technological Advancements in Spinal Cord Stimulation Devices

Innovations in spinal cord stimulation devices are fuelling market growth by enhancing patient outcomes and acceptance. Modern devices now feature advanced technologies such as high-frequency stimulation, Bluetooth-enabled programming, and longer battery life. According to the U.S. National Library of Medicine, new rechargeable SCS devices last up to 10 years, which will reduce replacement surgeries and associated costs. Additionally, the Asia-Pacific region has witnessed significant adoption of these advancements. According to the reports from the National Health and Family Planning Commission of China, a 15% annual increase in the use of implantable medical devices was noticed from 2015 to 2022. These developments ensure the continued expansion of the SCS market in the region.

MARKET RESTRAINTS

High Costs of Spinal Cord Stimulation Devices and Procedures

The substantial expenses associated with SCS devices and their implantation procedures pose a significant barrier to market expansion. In the United States, the average cost of implanting spinal cord stimulators ranges from USD 21,000 to USD 58,000. Although specific data for the Asia-Pacific region is limited, it is reasonable to infer that similar cost structures exist. These high costs can deter patients and healthcare providers from opting for SCS therapies, especially in countries where healthcare funding and insurance coverage are limited. Consequently, the financial burden associated with SCS devices and procedures serves as a significant restraint on market growth.

Preference for Alternative Therapies

Despite the clinical benefits of spinal cord stimulation, there exists a notable preference for alternative therapies, such as pharmacological treatments and physical therapy, among both patients and healthcare providers. This inclination is often due to factors like familiarity with traditional treatments and perceived risks associated with surgical interventions, and varying levels of awareness regarding the efficacy of SCS. The tendency to opt for non-invasive or less costly treatment options can limit the adoption of spinal cord stimulation devices, thereby restraining regional market expansion.

MARKET OPPORTUNITIES

Rising Incidence of Spinal Cord Injuries (SCI)

The increasing occurrence of spinal cord injuries in the Asia-Pacific region is resulting in the increasing critical need for effective therapeutic interventions such as spinal cord stimulation. According to the World Health Organization (WHO), over 15 million people are living with spinal cord injury (SCI) worldwide. In the Asia-Pacific region, the prevalence of SCI is significant, and a substantial number of cases result from trauma, including falls and road traffic injuries. This growing patient population requires advanced pain management and rehabilitation solutions and is positioning SCS as a viable and essential treatment option. The escalating incidence of SCI thus offers a substantial opportunity for the expansion of the SCS market in the region.

Government Initiatives and Healthcare Investments

Governments across the Asia-Pacific region are increasingly prioritizing healthcare improvements, which is further leading to enhanced infrastructure and accessibility. As per the "Health at a Glance: Asia/Pacific 2022" report of the World Health Organization, many countries have introduced rapid and far-reaching measures to protect people’s health and livelihoods, including investments in healthcare systems. Such initiatives often include funding for advanced medical devices and therapies such as spinal cord stimulation. These governmental efforts to strengthen healthcare services create a conducive environment for the adoption and growth of SCS technologies, which also presents a significant opportunity for market expansion.

MARKET CHALLENGES

Regulatory Barriers and Approval Processes

Navigating the diverse and complex regulatory frameworks across various countries in the Asia-Pacific region presents a considerable challenge for the spinal cord stimulation market. Each nation has its own set of regulations and approval processes for medical devices, which often result in potential delays and increased costs for manufacturers seeking market entry. For instance, the regulatory landscape in countries like China and India requires extensive clinical trials and documentation, which can prolong the time-to-market for new SCS devices. These regulatory hurdles can deter investment and innovation and challenge the market expansion in this region.

Limited Awareness and Accessibility

Despite advancements in medical technology, there remains a lack of awareness about spinal cord stimulation therapies among patients and healthcare providers in certain parts of the Asia-Pacific region. This limited awareness and inadequate healthcare infrastructure in rural and underserved areas restricts the accessibility and adoption of SCS treatments. Additionally, the scarcity of trained medical professionals proficient in neuromodulation techniques further hampers the widespread implementation of spinal cord stimulation therapies.

GEOGRAPHICAL ANALYSIS

China dominated the spinal cord stimulation market in Asia-Pacific in 2023. The prominence of China in the SCS market is attributed to its substantial healthcare investments and a large patient population requiring chronic pain management. The National Health Commission of the People's Republic of China reports continuous improvements in medical infrastructure, facilitating the adoption of advanced therapies like SCS. Additionally, the country's focus on medical innovation and increasing healthcare expenditure underscores its leading position in the region.

Japan is a promising regional segment for spinal cord stimulation in the Asia-Pacific region. The advanced healthcare system and emphasis on medical technology innovation of Japan contribute to its leadership in the SCS market. The Ministry of Health, Labour, and Welfare of Japan highlights the country's commitment to integrating cutting-edge medical devices into patient care. Japan's aging population further increases the demand for effective pain management solutions, reinforcing its significant market share in the Asia-Pacific region.

Australia is expected to do well over the forecast period from this regional market. The well-established healthcare infrastructure of Australia and proactive adoption of new medical technologies position it as a leader in the SCS market. The Australian Institute of Health and Welfare indicates a high prevalence of chronic pain conditions, driving the need for therapies like SCS. Government support for healthcare innovations and a focus on improving the quality of life for patients contribute to Australia's prominent role in the regional market.

KEY MARKET PLAYERS

Companies playing a key role in the Asia-Pacific spinal cord stimulation market include Boston, Medtronic, Nevro, St. Jude Medical, Greatbatch, and Stimwave.

MARKET SEGMENTATION

This research report on the Asia-Pacific spinal cord stimulation market is segmented & sub-segmented into the following categories.

By Product Type

- Rechargeable

- Non-rechargeable

By Application

- Degenerative Disk Disease (DDD)

- Failed Back Syndrome (FBS)

- Unsuccessful Disk Surgery

- Complex Regional Pain Syndrome (CRPS)

- Multiple Back Operations

- Lumbar Adhesive Arachnoiditis

By End Users

- Hospitals

- Ambulatory Surgery Centers (ASC’s)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]