Asia Pacific Waterproofing Membrane Market Size, Share, Trends & Growth Forecast Report By End Use Sector (Commercial, Industrial and Institutional, Infrastructure, Residential), Sub Product [Chemicals – By Technology (Epoxy-based, Polyurethane-based, Water-based, Other Technologies); Membranes – By Technology (Cold Liquid Applied, Fully Adhered Sheet, Hot Liquid Applied, Loose Laid Sheet)], and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Waterproofing Membrane Market Size

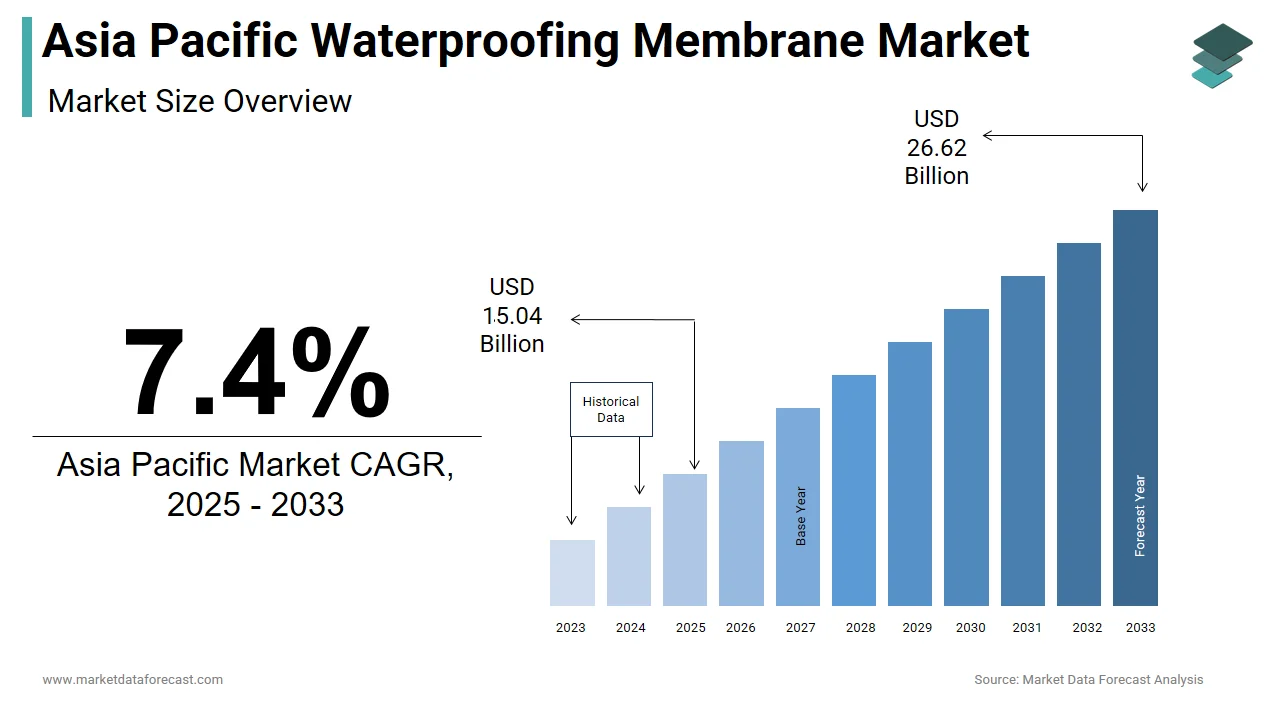

The size of the Asia Pacific waterproofing membrane market was worth USD 14 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 7.4% from 2025 to 2033 and be worth USD 26.62 billion by 2033 from USD 15.04 billion in 2025.

The waterproofing membranes are essential components in protecting foundations, roofs, tunnels, bridges, and underground utilities from moisture damage, structural weakening, and mold development. Common types include bituminous membranes, polyvinyl chloride (PVC), thermoplastic polyolefin (TPO), ethylene propylene diene monomer (EPDM), and liquid-applied membranes. Asia Pacific has emerged as a critical growth region for waterproofing membranes due to rapid urbanization, increasing construction activity, and rising awareness about building durability and sustainability. Countries such as China, India, Japan, South Korea, and Australia are witnessing heightened demand driven by government-backed infrastructure investments and stricter building codes aimed at enhancing climate resilience. According to the Asian Development Bank (ADB), urban populations across Southeast Asia grew by more than 2% annually between 2018 and 2023, by necessitating modern housing and commercial developments that incorporate high-performance waterproofing solutions. Additionally, governments in flood-prone areas like Bangladesh, Indonesia, and the Philippines have initiated large-scale drainage and coastal protection programs that rely heavily on durable waterproofing systems.

MARKET DRIVERS

Rapid Urbanization and Infrastructure Expansion

One of the primary drivers of the Asia Pacific waterproofing membrane market is the rapid pace of urbanization and the corresponding surge in residential, commercial, and public infrastructure development. Governments are investing heavily in affordable housing, transportation networks, and utility infrastructure that require robust waterproofing solutions to ensure longevity and safety as millions migrate to cities in search of employment opportunities.

According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), the region’s urban population is projected to increase by over 600 million people by 2030. Countries like India and Indonesia have launched major housing and smart city initiatives, including India’s Pradhan Mantri Awas Yojana (PMAY) and Indonesia’s National Housing Program. The Ministry of Housing and Urban Affairs in India reported that more than 12 million homes were sanctioned under PMAY between 2015 and 2023, each requiring comprehensive waterproofing measures for rooftops, basements, and bathrooms.

In China, despite a slowdown in its real estate sector, the government continues to invest in metro rail expansions, airport upgrades, and underground infrastructure projects, where waterproofing membranes play a vital role in ensuring structural integrity. The Shanghai Urban Planning and Design Institute noted that nearly all new subway stations built in 2023 incorporated multi-layered PVC and EPDM membranes to prevent groundwater seepage.

Increasing Focus on Green Building Standards and Sustainable Construction

Another critical driver of the Asia Pacific waterproofing membrane market is the growing emphasis on green building standards and sustainable construction practices. Governments and private developers are increasingly adopting eco-friendly and energy-efficient building designs, which integrate advanced waterproofing systems to enhance thermal insulation, reduce water damage, and prolong building lifespan.

In Singapore, the Building and Construction Authority mandates that all new developments meet minimum Green Mark standards, which include provisions for effective waterproofing to minimize maintenance needs and extend service life.

In Japan, companies like Sekisui Chemical and Toray Industries have been developing lightweight, recyclable, and low-emission waterproofing membranes tailored for high-rise residential and commercial applications. According to the Japan Society of Civil Engineers, these materials contribute to improved building energy efficiency by reducing humidity-related heat loss and preventing internal dampness. The waterproofing membrane market is adapting to meet these evolving expectations with sustainability becoming a central theme in architecture and construction.

MARKET RESTRAINTS

High Cost of Advanced Waterproofing Materials

A major restraint affecting the Asia Pacific waterproofing membrane market is the relatively high cost associated with premium waterproofing solutions in emerging economies, where budgetary constraints often dictate material choices. According to the ASEAN Committee on Science and Technology, only 35% of small and medium-sized construction firms in Cambodia, Laos, and Myanmar could afford to implement full-scale waterproofing systems in 2023. Many opted for cheaper alternatives that offered limited durability and effectiveness, leading to frequent repairs and shorter building lifespans. Moreover, in India, the Confederation of Indian Industry (CII) found that even in Tier 1 cities, many affordable housing developers preferred basic coating systems instead of sheet-based membranes due to budget limitations. Unless cost-effective yet durable alternatives become more widely available through localized manufacturing or government subsidies, the adoption of high-performance waterproofing membranes may remain restricted to luxury and institutional projects across the region.

Lack of Skilled Labor and Standardized Application Practices

Another significant constraint on the Asia Pacific waterproofing membrane market is the shortage of trained applicators and the lack of standardized installation protocols, especially in rural and semi-urban areas. As per the International Labour Organization (ILO), less than 30% of construction workers in South and Southeast Asia had received formal training in specialized trades, including waterproofing. In the Philippines, the Technical Education and Skills Development Authority (TESDA) found that improper installation was responsible for nearly 45% of premature waterproofing failures in tropical climates, where heavy rainfall and high humidity place additional stress on building envelopes. In response, some governments have initiated vocational training programs to bridge this gap. For example, the Ministry of Housing and Urban Poverty Alleviation in India launched an initiative in 2023 to certify construction professionals in best practices for waterproofing.

MARKET OPPORTUNITIES

Rise of Smart Cities and Resilient Urban Infrastructure

One of the most promising opportunities for the Asia Pacific waterproofing membrane market lies in the expansion of smart cities and resilient urban infrastructure. There is a growing need for high-performance waterproofing systems that protect critical infrastructure from water damage while supporting long-term operational efficiency as governments across the region prioritize digital integration, environmental sustainability, and disaster preparedness. In China, the Ministry of Housing and Urban-Rural Development mandated that all new smart city projects incorporate advanced waterproofing systems in underground transport hubs, data centers, and energy storage facilities. Similarly, in India, the Ministry of Housing and Urban Affairs reported that over 100 cities had adopted waterproofing guidelines as part of the Smart Cities Mission to enhance building resilience against monsoon flooding and rising groundwater levels.

Integration with Prefabricated and Modular Construction Techniques

Another emerging opportunity for the Asia Pacific waterproofing membrane market is the increasing adoption of prefabricated and modular construction methods, which streamline building processes and enhance material efficiency. According to the Singapore Building and Construction Authority, modular construction now accounts for over 40% of new public housing projects, many of which utilize factory-laminated waterproofing layers to reduce on-site application errors. In Japan, Sekisui House and Daiwa House have pioneered fully modular homes that incorporate pre-treated roof and foundation membranes to ensure leak-proof construction without added field labor.

In Thailand, Siam Cement Group introduced interlocking waterproofing panels specifically designed for modular applications, reducing installation time and dependency on manual labor. The Malaysian Construction Industry Development Board also encouraged the use of pre-fabricated bathroom pods with built-in waterproofing membranes to improve construction consistency.

MARKET CHALLENGES

Regulatory Compliance and Fire Safety Standards

A major challenge confronting the Asia Pacific waterproofing membrane market is the tightening regulatory landscape concerning fire safety, emissions, and material compliance. Governments across the region are implementing stricter building codes that mandate the use of non-combustible and low-smoke emission materials in high-density urban developments and transit infrastructure.

According to the International Code Council (ICC), several Asia Pacific countries have updated their national building regulations to include enhanced fire resistance requirements for waterproofing assemblies, particularly in subterranean and mixed-use buildings. In Australia, after the Grenfell Tower-style fire incidents involving flammable cladding, the Australian Building Codes Board introduced new compliance measures that impacted the approval of certain polymer-based membranes. The Australian Institute of Architects reported that many architects and builders faced delays in obtaining permits due to uncertainty around material classifications.

Impact of Climate Change and Extreme Weather Events

Another pressing challenge for the Asia Pacific waterproofing membrane market is the increasing frequency and intensity of extreme weather events driven by climate change. Typhoons, cyclones, torrential rains, and prolonged heat waves pose significant risks to building envelopes, necessitating the development of more resilient and adaptive waterproofing solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By End Use Sector, Sub Product, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Keshun Waterproof Technology Co., Ltd., Oriental Yuhong, Saint-Gobain, Sika AG, and Soprema. |

SEGMENTAL ANALYSIS

By End Use Sector Insights

The commercial construction segment dominated the Asia Pacific waterproofing membrane market by accounting for 36.3% of the share in 2024, with the rapid development of office complexes, shopping malls, hotels, hospitals, and institutional buildings that require high-performance waterproofing solutions to ensure structural longevity and occupant safety. According to the Colliers Asia-Pacific Real Estate Outlook Report, over 85 million square meters of new commercial floor space was completed in the region in 2023 alone, with a significant portion located in flood-prone or humid areas where moisture resistance is critical. The increasing use of below-grade parking structures and rooftop gardens further amplifies the need for durable membranes.

Another contributing factor is the adoption of international building standards by developers seeking global certifications such as LEED, BREEAM, and Green Mark. In Singapore, the Building and Construction Authority mandated that all new commercial developments meet minimum waterproofing benchmarks under its Green Mark certification program. In India, the Ministry of Housing and Urban Affairs reported a surge in demand for waterproofing membranes among mall and hotel developers aiming to comply with fire and water safety regulations.

The infrastructure development segment is swiftly emerging with a CAGR of 9.4% from 2025 to 2033. A major driver is the expansion of metro rail networks and underground transit systems in China, India, and Thailand, where urban congestion has prompted governments to invest heavily in subterranean transportation. As per the Asian Development Bank (ADB), over 1,200 kilometers of new metro lines were commissioned across the region in 2023, each requiring extensive waterproofing in tunnels, station platforms, and access points. Additionally, rising investment in coastal protection and flood mitigation projects is boosting demand for waterproofing membranes in infrastructure applications.

By Sub Product Insights

The membrane segment was the largest and held 54.3% of the Asia Pacific waterproofing membrane market share in 2024, with the sheet-based materials such as PVC, TPO, EPDM, and bituminous membranes that are widely used in large-scale construction projects due to their durability, ease of installation, and long-term performance benefits. According to the Singapore Building and Construction Authority, nearly 70% of new public housing and industrial projects in Southeast Asia incorporated pre-formed membrane layers in foundations and rooftops to reduce labor dependency and improve reliability.

The chemical segment is expected to grow at a CAGR of 9.8% from 2025 to 2033. This growth is fueled by the rising adoption of liquid-applied waterproofing technologies, including polyurethane, acrylic, and cementitious coatings that offer seamless coverage and adaptability to complex architectural designs. A key driver is the increasing integration of liquid waterproofing chemicals in residential and retrofitting applications, especially in countries like India and Indonesia, where traditional roofing and basement waterproofing methods are being replaced with spray- or brush-on chemical barriers. Another major factor is the use of advanced chemical waterproofing agents in tunnel linings, bridge decks, and airport runways, where conventional membranes may be difficult to install. In South Korea, the Ministry of Land, Infrastructure and Transport mandated the use of reactive chemical sealants in all new highway underpasses to enhance durability against freeze-thaw cycles and vehicular wear.

COUNTRY LEVEL ANALYSIS

China was the top performer in the Asia Pacific waterproofing membrane market by accounting for 33.3% of the share in 2024. As the world's largest construction market, China’s vast portfolio of commercial, residential, and infrastructure projects drives significant consumption of both chemical and membrane-based waterproofing solutions.

A key driver behind China’s dominant position is the scale of its urbanization and infrastructure modernization programs in second- and third-tier cities, where government-led housing and transportation upgrades are accelerating. According to the National Bureau of Statistics of China, over 1.2 billion square meters of new commercial and residential floor space was completed in 2023 by necessitating large volumes of waterproofing products ranging from bituminous sheets to liquid-applied coatings. Another contributing factor is the country’s push toward green building technologies, supported by policy frameworks such as the 14th Five-Year Plan, which promotes the use of sustainable construction materials.

India was positioned second in the Asia Pacific waterproofing membrane market by capturing 19.3% ofthe share in 2024. The country’s strong presence is driven by an unprecedented wave of housing construction, infrastructure renewal, and government-backed urban development schemes aimed at improving building durability and reducing maintenance costs. One of the main drivers of India’s market position is the Pradhan Mantri Awas Yojana (PMAY), which has significantly boosted demand for waterproofing membranes in mass-housing projects. According to the Ministry of Housing and Urban Affairs, over 12 million pucca houses were sanctioned under PMAY between 2015 and 2023, many of which included waterproofing provisions for roofs, basements, and bathrooms.

Japan's waterproofing membrane market growth is likely to have positive growth opportunities in the coming years. A key driver behind Japan’s market strength is the nationwide integration of disaster-resilient construction standards, particularly in response to earthquakes, typhoons, and heavy snowfall. According to the Building Research Institute of Japan, over 40% of new residential and commercial buildings in 2023 included multi-layer waterproofing systems designed to withstand seismic movement and prolonged rainfall without compromising structural integrity.

Another contributing factor is the growing trend of integrating photovoltaic (PV) technology into roofing systems, which requires advanced waterproofing to prevent leaks and corrosion beneath solar panels. The New Energy and Industrial Technology Development Organization (NEDO) reported that solar-integrated roof installations increased by 14% in 2023, reinforcing the need for high-performance membranes.

South Korea's waterproofing membrane market growth is driven by its advanced construction industry, urban renewal programs, and increasing emphasis on smart city infrastructure. Despite its relatively small geographic size, South Korea exerts considerable influence through technological innovation and policy-driven development. Another key factor is the ongoing renovation of aging urban housing stock, particularly in Seoul and Busan, where older apartment complexes are being retrofitted with modern waterproofing systems for improved insulation and leak prevention. The Korea Housing & Urban Guarantee Corporation reported that over 500,000 residential units underwent roof and façade waterproofing renovations in 2023 alone.

Australia's waterproofing membrane market is growing steadily with its focus on environmental compliance, building durability, and extreme weather resilience. Australia plays a pivotal role as an importer and innovator in specialized waterproofing applications.

A key driver behind Australia’s market status is the government-backed initiative promoting bushfire-resistant and cyclone-proof construction, which has led to stricter regulations on building envelope performance. According to the Australian Building Codes Board, new building codes introduced in 2023 require all residential developments in high-risk zones to include Class A fire-rated waterproofing membranes that do not emit toxic fumes when exposed to extreme heat.

Indonesia's waterproofing membrane market is likely to be driven by rapid urbanization, expanding real estate activity, and increasing investments in flood mitigation infrastructure. The country’s tropical climate and susceptibility to seasonal flooding have heightened the need for reliable waterproofing solutions in both private and public construction sectors. Another key factor is the expanding middle class and rising demand for high-rise residential and commercial buildings, where basement waterproofing and rooftop protection are critical considerations.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC waterproofing membrane market profiled in this report are Keshun Waterproof Technology Co., Ltd., Oriental Yuhong, Saint-Gobain, Sika AG, and Soprema.

TOP LEADING PLAYERS IN THE MARKET

One of the leading players in the Asia Pacific waterproofing membrane market is Sika AG, a Swiss multinational with a strong regional presence. The company offers a comprehensive portfolio of membranes and liquid waterproofing solutions tailored for residential, commercial, and infrastructure applications. Sika plays a crucial role in advancing high-performance, sustainable waterproofing systems that meet global building codes and environmental standards.

Another key player is BASF SE, a German chemical giant known for its innovative construction chemicals and polymer-based waterproofing technologies. BASF contributes significantly to the Asia Pacific market by providing advanced membrane solutions that enhance durability and energy efficiency in modern buildings. Its strong R&D focus supports the development of next-generation products that integrate seamlessly into green and smart city initiatives across the region.

Fosroc is headquartered in the UK but with extensive operations in South Asia and Southeast Asia, and also holds a prominent position in the Asia Pacific waterproofing membrane market. Fosroc specializes in high-quality chemical admixtures and sheet membranes designed for extreme weather conditions. The company’s localized technical support and product customization have made it a preferred choice among contractors and developers seeking reliable long-term protection against water ingress.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

A core strategy employed by leading companies in the Asia Pacific waterproofing membrane market is product innovation through material engineering and formulation advancements. Firms are investing heavily in research and development to create membranes that offer superior resistance to moisture, UV exposure, and structural movement while complying with evolving sustainability regulations.

Another major approach is expanding regional manufacturing capabilities and forming strategic partnerships with local construction firms and government agencies. By establishing production hubs closer to high-growth markets in India, China, and Southeast Asia, companies can reduce lead times, comply with regional sustainability mandates, and better serve domestic demand.

Adopting digital tools for customer engagement, project diagnostics, and after-sales service optimization has become a priority for industry leaders. Companies are leveraging mobile applications, cloud-based design tools, and AI-driven performance analytics to improve transparency and assist architects, engineers, and contractors in selecting the most appropriate waterproofing solution for each application.

COMPETITION OVERVIEW

The competition in the Asia Pacific waterproofing membrane market is shaped by a blend of global conglomerates, regional manufacturers, and local suppliers striving to capture market share through differentiation and localized strategies. Multinational firms leverage their technological expertise, extensive distribution networks, and brand recognition to maintain leadership positions, particularly in premium and regulated applications such as underground infrastructure and high-rise developments.

At the same time, regional and domestic players are gaining traction by offering cost-effective, locally adapted solutions tailored to specific climate conditions and construction practices. Additionally, the market is witnessing increased collaboration between membrane suppliers and construction firms to co-develop customized waterproofing systems for large-scale projects.

RECENT MARKET DEVELOPMENTS

- In March 2024, Sika AG launched a new line of eco-friendly, solvent-free liquid waterproofing coatings specifically formulated for tropical climates. This initiative was aimed at addressing environmental concerns and improving adhesion and flexibility in high-humidity environments, positioning Sika as a leader in sustainable waterproofing solutions.

- In February 2024, BASF SE announced a joint venture with a leading Indian construction materials distributor to expand its polymer-modified bitumen membrane business in South Asia. This move was intended to strengthen BASF’s supply chain and increase accessibility to high-performance waterproofing systems in fast-growing urban centers.

- In January 2024, Fosroc commissioned a new technical center in Bangkok dedicated to testing and certifying waterproofing membranes under extreme weather conditions. This investment was designed to support local construction firms with real-time technical assistance and customized system recommendations based on site-specific requirements.

- In May 2024, Mapei Corporation introduced a modular waterproofing kit integrated with self-healing polymers in Australia. This innovation was developed in collaboration with local building authorities and aims to align with national resilience goals for coastal and flood-prone regions.

- In June 2024, GCP Applied Technologies expanded its distribution network in the Philippines to cater to the increasing demand for tunnel and bridge waterproofing membranes. This expansion was part of GCP’s broader effort to provide durable, high-adhesion waterproofing solutions for critical infrastructure projects across Southeast Asia.

MARKET SEGMENTATION

This Asia Pacific waterproofing membrane market research report is segmented and sub-segmented into the following categories.

By End Use Sector

- Commercial

- Industrial and Institutional

- Infrastructure

- Residential

By Sub Product

Chemicals

By Technology:

- Epoxy-based

- Polyurethane-based

- Water-based

- Other Technologies

2. Membranes

By Technology:

- Cold Liquid Applied

- Fully Adhered Sheet

- Hot Liquid Applied

- Loose-Laid Sheet

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What factors are driving the Asia Pacific waterproofing membrane market?

The Asia Pacific waterproofing membrane market is driven by rapid urbanization, massive investments in construction, growing infrastructure projects, and rising awareness of the need for durable, water-resistant building materials

2. What challenges does the Asia Pacific waterproofing membrane market face?

The Asia Pacific waterproofing membrane market faces challenges such as high initial installation costs for advanced membranes, fluctuating raw material prices, regulatory compliance complexities, and a shortage of skilled labor for proper installation

3. What opportunities exist in the Asia Pacific waterproofing membrane market?

Opportunities in the Asia Pacific waterproofing membrane market include the adoption of eco-friendly materials, expansion in residential and infrastructure sectors, and increasing demand for innovative waterproofing solutions in green and sustainable construction

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com