Global Asset Management Market Size, Share, Trends, & Growth Forecast Report by Component (Solution and Service); Asset Type (Digital and In-Transit); Function (Location & Movement Tracking, Check-In/ Check-Out, Repair and Maintenance and Others); Application (Infrastructure Asset Management, Enterprise Asset Management, Healthcare Asset Management, Aviation Asset Management and Others); and Regional - (2025 to 2033)

Global Asset Management Market Size

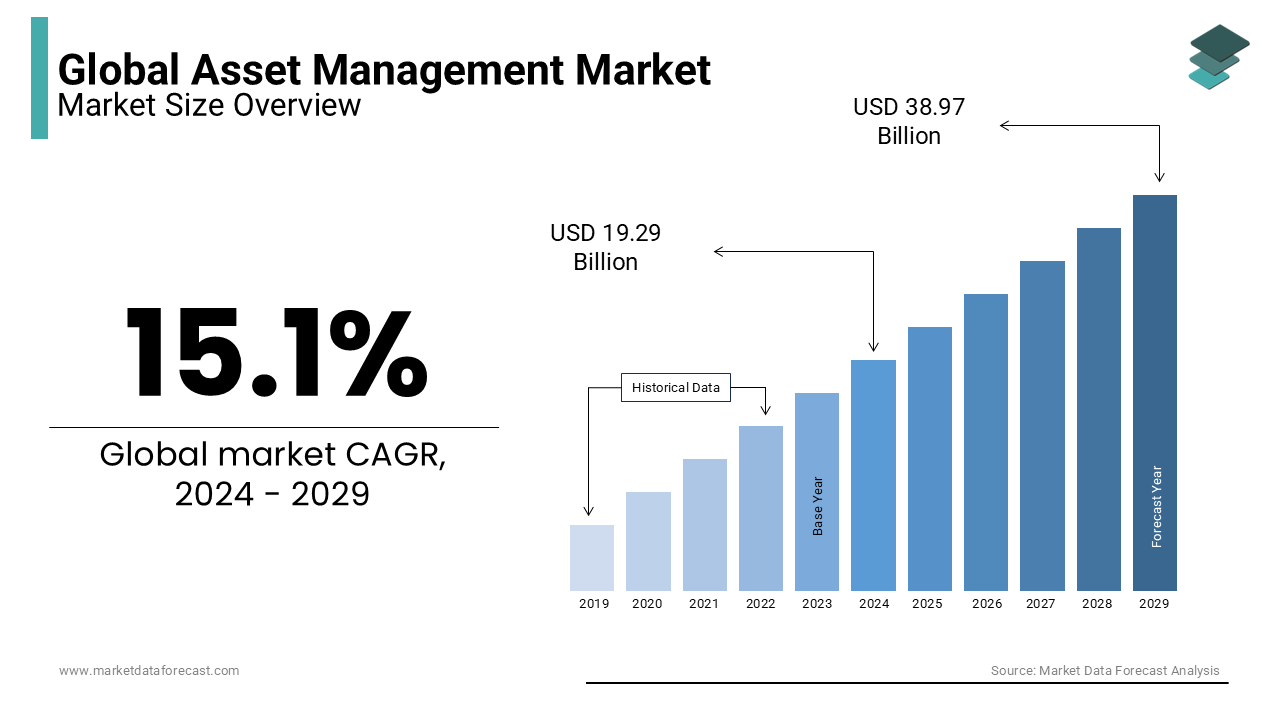

The global asset management market was worth USD 19.29 billion in 2024. The global market is predicted to reach USD 22.20 billion in 2025 and is expected to increase at a CAGR of 15.1% to USD 68.39 billion by 2033.

Reduced equipment downtime and optimal resource utilization requirements are driving the asset management system industry forward. With the increase in terror acts, the need to protect an organization's or business's assets, personnel, and clients or customers has grown. Asset management is a system that oversees, manages, and maintains a company's important assets. By being able to optimize the consumption of its services, the system essentially ensures the highest value return from a certain entity inside the group. This system contains a significant amount of cost management, making it the desired offering. Check-in/check-out, location tracking, and maintenance and repairs are just a few of the functions that asset management systems utilize. They're utilized to track a wide range of assets, including in-transit equipment, IT assets, manufacturing assets, workers and staff, and returnable transportation. Asset management systems are used in a variety of industries, including government, healthcare, hospitality, industrial production, IT services, retail, transportation, and logistics. Barcodes, the Global Positioning System (GPS), Radio-frequency identification (RFID), and the Real-Time Locating System (RTLS) are all common technologies used to integrate these systems. The introduction of RTLS, which has quickly superseded older types of technology, is likely to boost the asset management systems market.

MARKET DRIVERS

The asset management system business is moving forward due to reduced equipment downtime and optimal resource utilization requirements.

Streamlining procedures and maximizing the utilization of current resources can help businesses save money and make more money. By tracking and managing assets in real time, asset management solutions help businesses reduce inventory and stock management costs while also helping them to make greater use of their existing equipment. Personnel tracking software aids businesses in assuring employee productivity and safety, resulting in cost savings. Asset tracking of both equipment and staff is crucial in the healthcare industry to improve patient care. As a result of the implementation of asset management systems, considerable cost savings and a high return on investment (ROI) are realized, as well as optimal resource usage.

MARKET RESTRAINTS

Factors hindering the market include a lack of knowledge of new technology and an inadequate integration of a security solution into a system. High deployment costs could make it difficult for SMEs to use these solutions. Over the projection period, the lack of experienced technicians or engineers to address technical and operational difficulties is projected to limit asset management system market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.1% |

|

Segments Covered |

By Component, Asset Type, Function, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vanguard Group (US), Morgan Stanley (US), JP Morgan Chase (US), UBS Group (Switzerland), Credit Suisse (Switzerland), Allianz Group (Germany), AXA Group (France), Aviva (UK), Sun Life Financial (Canada), Sumimoto Mitsui Trust Holdings (Japan) and Others. |

SEGMENTAL ANALYSIS

By Component Insights

In 2020, the solution category led the market with a revenue share of around 55%. Real-Time Location Systems (RTLS), barcodes, mobile computers, labels, and the Global Positioning System (GPS), among other things, are classified into the solution area. The solution segment is growing market share thanks to the barcode section. Image-based barcode scanners are increasingly being adopted across numerous industries and industry verticals, including healthcare, logistics, food and beverage, and consumer products, due to their 2D code-reading skills, long-term reliability, and multiple code-reading abilities.

Over the forecast period, the service segment is expected to grow at a fast rate. The increased adoption of strategic and operational plans by various businesses around the world is largely responsible for the segment's rise. Strategic management entails managing investments over a long period to increase Return on Assets (ROA). These services are intended to assist organisations in achieving their objectives by ensuring that all functions work together to attain the same objectives.

By Asset Type Insights

In 2020, the digital category led the market with a sales share of about 25%. Businesses are rapidly adopting digital solutions and services to reduce overall operational costs and standardize company processes. Digital solution and service companies will benefit from the ongoing digitalization trend. Increasing volumes and densities of digital assets across enterprises are likely to enhance demand for digital solutions over the forecast period.

Over the projected period, the in-transit segment is expected to grow rapidly. Expanding e-commerce activities worldwide are boosting demand for in-transit solutions for tracking the products supplied by the seller, driving the segment's growth. In-transit management solutions can also assist transportation service companies in tracking and identifying their assets while they are in transit. With the expanding population and continued digitalization, demand for in-transit management solutions is expected to rise.

By Function Insights

In 2020, the location and movement tracking category led the market with a revenue share of 35%. Location and movement tracking solutions are being rapidly deployed by aviation companies, shipping companies, third-party logistics (3PLs), and shared mobility providers to keep track of their assets in real time. Disruptive technologies that provide real-time information on asset health and availability for usage and maintenance are becoming more popular. At the same time, the integration of the Geographic Information System (GIS) and the Global Positioning System (GPS) allows for easier access to spatial data in a single view.

Over the projected period, the repair and maintenance category is expected to increase rapidly. Equipment, machinery, transportation, and infrastructure, among other assets, require routine maintenance to perform properly and last longer. As a result, the demand for support and maintenance services is expected to grow significantly. After installation, development, or production, support and maintenance services take over and play an important role throughout the asset's life cycle. Support and maintenance services may be able to assist firms in increasing their efficiency and, as a result, their overall revenue generation.

By Application Insights

The aviation segment dominated the market in 2020, with a sales share of more than 80%. An increase in air passenger traffic and the introduction of new aircraft models are driving the aviation segment's growth. The aviation industry is built on a network of interconnected assets that must all be managed efficiently to ensure long-term profitability and reliability. Predictive and prescriptive maintenance solutions, GR-aware software packages, and tracking systems are just a few of the key aviation management technologies that are gaining traction.

Over the projection period, the infrastructure industry is expected to grow at a high rate. Infrastructure solutions and services aid in the reduction of costs connected with infrastructure purchase and maintenance. Furthermore, suppliers in the infrastructure management sector are employing a two-track method known as Design-Build and Build-Operate-Transfer. Local suppliers will carry out the construction work, while multinational firms will provide operation and maintenance software and services.

REGIONAL ANALYSIS

North America dominated the market in 2020, accounting for roughly 30% of total sales. North America has gained a significant lead in terms of infrastructural development and technological uptake. A considerable presence of multinational IT businesses in the United States and Canada and fast digitization would drive regional market growth.

The market is also expected to grow as more connected, smart, and secure technologies for asset-centric applications are adopted.

The Asia Pacific region is emerging as one of the fastest-growing regional marketplaces, with enormous potential for market expansion. The regional market is being driven by the increasing adoption and deployment of modern technologies such as cloud-based solutions, AI, IoT, and big data analytics.

The Asia Pacific region also includes developing economies like India and China, which provide considerable prospects for implementing asset management systems and services. The region's large number of SMEs is also driving demand for cloud-based solutions, which are typically very cost-effective.

KEY MARKET PLAYERS

Vanguard Group (US), Morgan Stanley (US), JP Morgan Chase (US), UBS Group (Switzerland), Credit Suisse (Switzerland), Allianz Group (Germany), AXA Group (France), Aviva (UK), Sun Life Financial (Canada), Sumimoto Mitsui Trust Holdings (Japan) and Others.

RECENT MARKET HAPPENINGS

-

Stanley Black and Decker, based in New Britain, increased its profits by around 5% in the third quarter of 2021, as the business announced plans to complete the acquisitions of MTD and Excel Industries by early 2022.

-

Zebra Technologies Corporation, a business innovation with solutions and partners that create a competitive advantage, today announced the industry's most comprehensive picking solution to assist businesses in enhancing their fulfillment processes. FlexShelf, FlexShelf Guide, and RollerTop Guide are three new autonomous mobile robots (AMRs) in the fulfillment solution and a new FetchCore fulfillment software package for order or batch selection.

-

Trimble and Ferguson Waterworks established a partnership today to benefit utility consumers across Ferguson's 1,600-location network. Ferguson municipal and utility customers can now utilize Trimble's digital water solutions, which provide a larger range of technology to complement Ferguson's existing water solutions.

-

Meade Tractor, the Tennessee and Kentucky dealer for John Deere construction and forestry equipment, has signed a multi-year partnership with Topcon Positioning Group to deliver a full array of precise management solutions to Meade Tractor earthworks equipment clients.

MARKET SEGMENTATION

This research report on the global asset management market has been segmented and sub-segmented based on the component, asset type, function, application, and region.

By Component

- Solution

- Service

By Asset Type

- Digital

- In-Transit

By Function

- Location & Movement Tracking

- Check-In/ Check-Out

- Repair and Maintenance

- Others

By Application

- Infrastructure Asset Management

- Enterprise Asset Management

- Healthcare Asset Management

- Aviation Asset Management

By Region

- Asia Pacific

- Europe

- Middle East and Africa

- North America

- Latin America

Frequently Asked Questions

What role does technology play in the evolution of the asset management market worldwide?

Technology is playing a significant role in the asset management industry through the adoption of fintech solutions, including robo-advisors, artificial intelligence for investment analysis, blockchain for fund distribution, and digital platforms for client engagement.

How are environmental, social, and governance (ESG) considerations influencing investment strategies globally?

ESG considerations are increasingly integrated into investment strategies worldwide, driven by investor demand for sustainable and socially responsible investments, regulatory requirements, and the recognition of the material impact of ESG factors on financial performance.

How are asset managers adapting to the changing needs of institutional investors globally?

Asset managers are adapting by offering customized investment solutions, enhancing risk management capabilities, providing greater transparency and reporting, and leveraging technology to improve efficiency and meet the evolving demands of institutional investors.

How does geopolitical instability impact the global asset management market?

Geopolitical instability can create market volatility and uncertainty, affecting investor sentiment and portfolio performance. Asset managers must navigate geopolitical risks by employing robust risk management practices, diversifying portfolios, and staying informed about geopolitical developments worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com