Global Automotive Electronics Market Size, Share, Trends & Growth Forecast Report, Segmented By Component (Electronic Control Unit, Sensors and Current Carrying Devices), Application (ADAS, Infotainment, Body Electronics, Safety Systems and Powertrain Electronics), Sales (OEM And Aftermarket) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From 2025 To 2033

Global Automotive Electronics Market Size

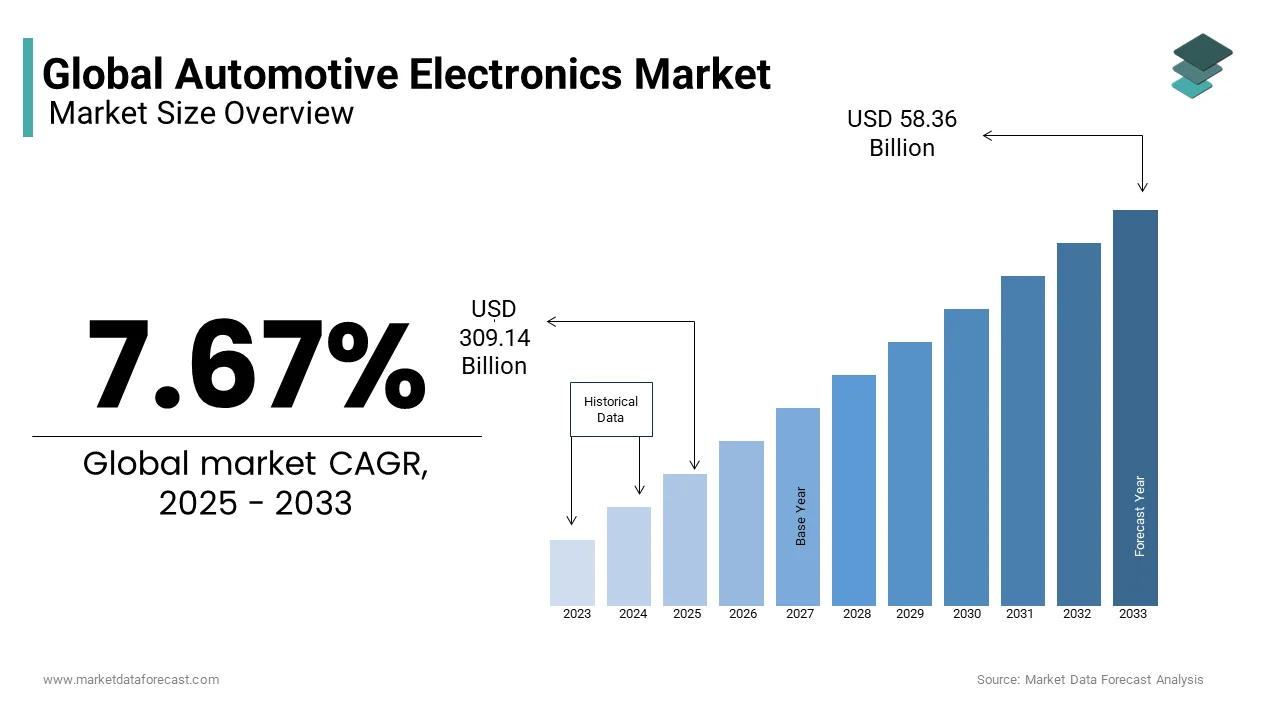

The global automotive electronics market was valued at USD 287.12 billion in 2024 and is anticipated to reach USD 309.14 billion in 2025 from USD 58.36 billion by 2033, growing at a CAGR of 7.67% from 2025 to 2033.

Engine management, ignition, radio, carputers, telematics, in-car entertainment systems, and other electronic systems are examples of automotive electronics. Trucks, motorbikes, off-road vehicles, and other internal combustion-powered machinery such as forklifts, tractors, and excavators all have ignition, engine, and transmission electronics. Similar parts for controlling important electrical systems can also be found in hybrid and electric cars. Power electronics are used in modern electric cars to operate the main propulsion motor as well as manage the battery system. Future self-driving cars will rely on advanced computer systems, a variety of sensors, networking, and satellite navigation, all of which will necessitate the use of electronics.

MARKET DRIVERS

Increased safety concerns, which are driving demand for active safety systems, and the expanding desire for cutting-edge entertainment systems in automobiles are the primary drivers for the automotive electronics industry. New entrants to the sector will benefit from increased demand for more fuel-efficient autos with more entertainment amenities. As the level of autonomy grows and software manufacturers focus on quality and security, the demand for electronics in vehicles will increase. Automobile electronics aid users in data and software security. The automotive industry is shifting away from hardware-driven vehicles and toward software-driven vehicles.

In addition, factors such as the adoption of IoT and AI in automobiles, vehicles equipped with autonomous driving, the desire for in-vehicle safety features, and an increase in demand for entertainment features are fuelling the automotive electronics market growth. The Automotive Electronics Market, on the other hand, is impeded by low acceptance of automotive electronics in newly industrialized countries, as well as an increase in overall end-product costs due to automotive electronics integration. In addition, investments in smart grids for self-driving vehicles are anticipated to be advantageous for the automotive electronics sector.

MARKET RESTRAINTS

During the automotive electronics market analysis, the primary challenges to the automotive electronics market Revenue are concerns about the protection of electronic systems from harm and strict government regulations surrounding car safety. High maintenance and replacement expenses will limit the market's growth. Growing concerns about the safety of electronic gadgets, as well as tight government laws governing vehicle safety, are the key barriers to the industry. Automotive electronics market share, Automotive electronics market growth, and Automotive electronics market trends would be hampered by high maintenance and replacement costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.67% |

|

Segments Covered |

By Component, Application, Sales, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Robert Bosch, RENESAS ELECTRONICS CORPORATION, INFINEON TECHNOLOGIES AG, STMicroelectronics N.V., TEXAS INSTRUMENTS, NXP SEMICONDUCTORS N.V., Continental AG, NVIDIA Corporation, Hitachi, Ltd. (Hitachi Automotive Systems, Ltd.), Aptiv PLC (Delphi Automotive PLC), and Others. |

SEGMENT ANALYSIS

By Component Insights

The current carrying devices segment is expected to hold the dominant share in the global automotive electronics market during the forecast period. Electronic switches, fuses, connectors, and wiring harnesses are examples of current-carrying devices. The huge market share of current-carrying devices in the component sector is due to the high cost and large number of electronic components utilized in the vehicle, such as electronic switches, fuses, connectors, and wiring harnesses. The growing desire for connection, convenience, and safety features in passenger automobiles and commercial vehicles can also be related to the expansion of this market.

Sensors Segment is expected to grow at a high CAGR in the global automotive electronics market during the forecast period. The sensors section includes sensing devices that are used to detect physical factors, vehicle proximity and placement, chemical qualities, and process variables. Revenue growth is likely to be fuelled by favorable government measures for passenger safety and security in many locations. These sensors have become an important aspect of autos because they detect characteristics like heat, speed, and tire pressure and condition while also taking preventative actions in the event of a threat.

By Application Insights

Based on application, the safety systems segment is predicted to carry the dominant share within the global automotive electronics market during the forecast period. Airbags, tire pressure monitoring systems, keyless entry systems, electronic brake distribution, electronic stability control, wattage steering, and suspension control are samples of safety system components. Customer knowledge of technical improvements connected to vehicle safety equipment is predicted to be a possible driver for the protection systems segment's growth.

ADAS Segment is predicted to grow at a high CAGR within the global automotive electronics market during the forecast period. Thanks to the expanding applications and functionality that these sensors provide, the demand for ADAS sensors is growing at an exponential rate. Sensors are a vital component of ADAS. Sensors are used alone or together to accomplish complex duties, starting from basic stereo cameras to the foremost recent LiDAR. As a result, over the anticipated period, the rising need for automated driving is anticipated to spice up the demand for automotive electronic components.

By Sales Insights

The OEM Segment is expected to hold the dominant share of the global automotive electronics market during the forecast period. Electronic components have become more durable and have a longer shelf life. Because electronic components are such an important aspect of vehicles, buyers prefer to purchase them from original equipment manufacturers (OEMs). Furthermore, as the design complexity of these electronic components grows, aftermarket electronic components are likely to account for a smaller share of revenue over the projection period.

During the forecast period, the world automotive electronics market's aftermarket segment is predicted to rise at a high CAGR. Aftermarket refers to the secondary market within the automotive industry for the manufacture, remanufacturing, distribution, retailing, and installation of all vehicle's electrical parts and accessories after the initial equipment manufacturer sold the vehicle to the customer. because the complexity of those electronic components grows the share of aftermarket components is anticipated to say no throughout the projected period.

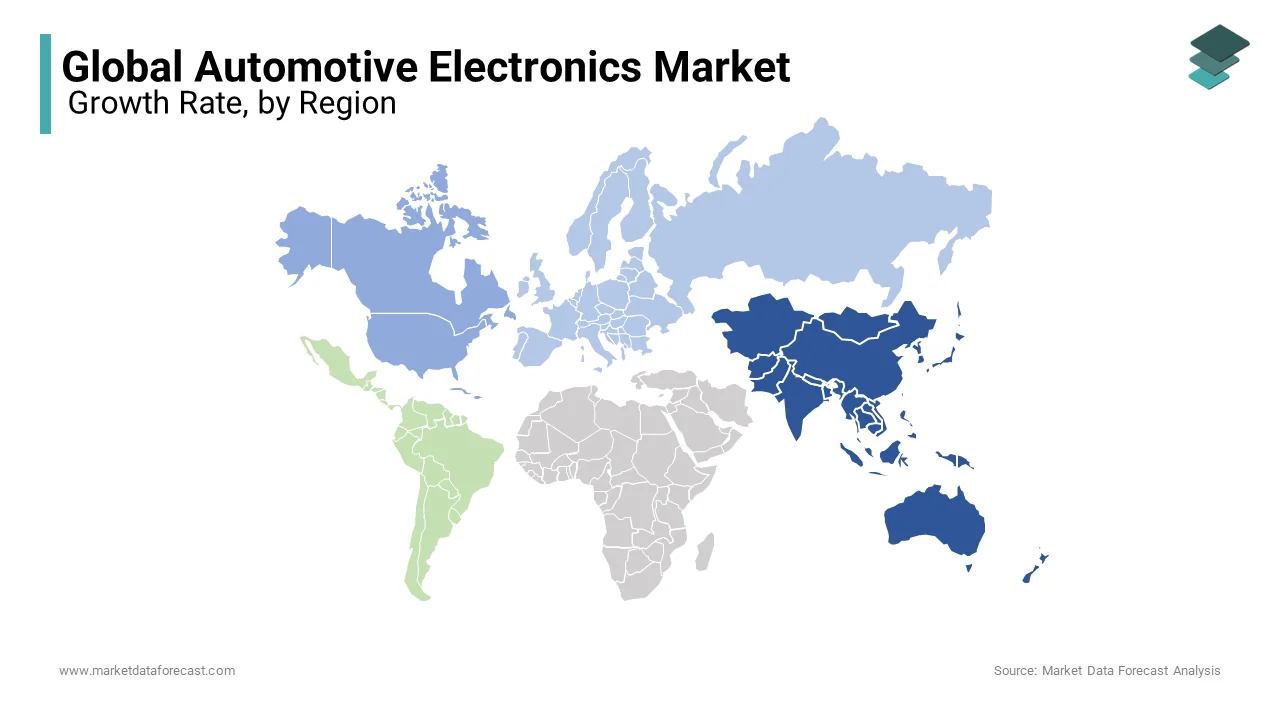

REGIONAL ANALYSIS

Asia-Pacific is expected to hold the dominant share of the global automotive electronics market during the forecast period. Due to expanding electronic component manufacturing operations, countries such as Taiwan, South Korea, Malaysia, and Thailand have contributed considerably to market expansion. China and Japan supply the majority of the automotive electronics needs in the Asia Pacific. The small number of automotive electronics manufacturers, on the other hand, presents an ideal investment opportunity for regional suppliers to capitalize on local demand, making the rest of the Asia Pacific area appealing to investors.

North America is expected to grow at a good CAGR in the global automotive electronics market during the forecast period. Because of the high level of motor vehicle production and the existence of automotive electronic component manufacturers such as TRW Automotive, Continental Corporation, Robert Bosch GmbH, and Autoliv, Inc., the market in North America is likely to increase significantly.

KEY MARKET PLAYERS

Robert Bosch, RENESAS ELECTRONICS CORPORATION, INFINEON TECHNOLOGIES AG, STMicroelectronics N.V., TEXAS INSTRUMENTS, NXP SEMICONDUCTORS N.V., Continental AG, NVIDIA Corporation, Hitachi, Ltd. (Hitachi Automotive Systems, Ltd.), Aptiv PLC (Delphi Automotive PLC) are some of the major key players involved in the global automotive electronics market.

RECENT HAPPENINGS IN THIS MARKET

- For OEMs and suppliers, Avery Dennison Performance Tapes has introduced a new automotive electronics range. The portfolio includes items that are built into interior and exterior car components for purposes like advanced driver assistance systems (ADAS), user experience, illumination, and safety. The portfolio is in line with the larger automotive electrification movement, which aims to make automobiles safer, more efficient, and linked while also improving the entire driving experience.

- Sony Electronics Inc. has unveiled the XAV-AX6000 and XAV-AX4000, two new additions to its range of automobile AV receivers. Both AV receivers now have new vital capabilities like totally wireless smartphone conversion, allowing drivers to use voice control for navigation or music playback while on the road, even if their phone is in their pocket.

MARKET SEGMENTATION

This research report on the global automotive electronics market is segmented and sub-segmented into the following categories.

By Component Insights

- Electronic Control Unit

- Sensors.

- Current Carrying Devices

By Application Insights

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

By Sales Insights

- OEM

- Aftermarket

By Country

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is driving the growth of the global automotive electronics market?

Increasing demand for electric vehicles (EVs), advanced driver-assistance systems (ADAS), and smart infotainment systems.

Which regions are leading in automotive electronics adoption?

North America, Europe, and Asia-Pacific, with China, Germany, and the U.S. being major contributors.

What are the key challenges in the automotive electronics industry?

High development costs, cybersecurity risks, and supply chain disruptions, especially in semiconductor availability.

Who are the major players in the automotive electronics market?

Companies like Bosch, Continental AG, Denso, NXP Semiconductors, and Texas Instruments dominate the industry.

How is AI and IoT shaping automotive electronics?

AI enhances autonomous driving and safety, while IoT enables vehicle connectivity and predictive maintenance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]