Global Automotive Glass Market Size, Share, Trends & Growth Forecast Report, Segmented By Product (Tempered, Laminated and Others), Application (Windscreen, Backlite, Sidelite and Sunroof), End-use (Original Equipment Manufacturer and Aftermarket Replacement), Vehicle (Passenger Car, Light Commercial and Heavy Commercial) and Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Automotive Glass Market Size

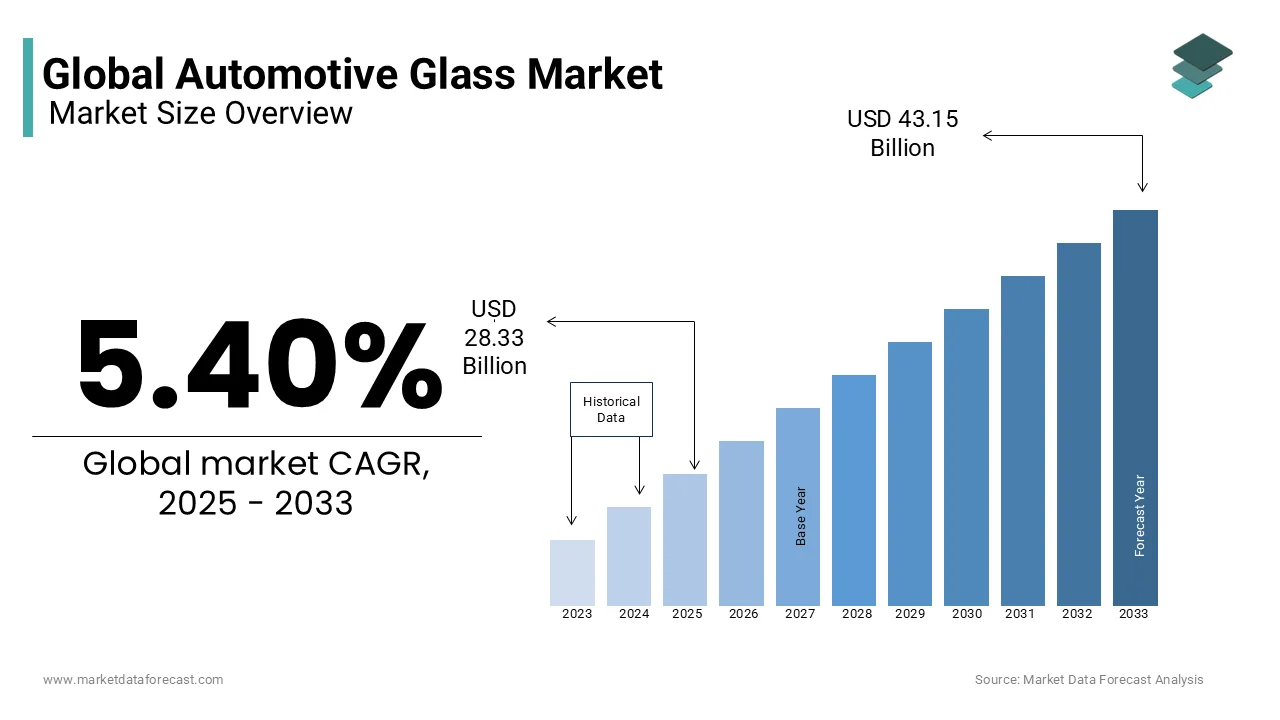

The global automotive glass market was valued at USD 26.88 billion in 2024 and it is anticipated to reach USD 28.33 billion in 2025 from USD 43.15 billion by 2033, growing at a CAGR of 5.40% during the forcats period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL AUTOMOTIVE GLASS MARKET

Vehicle glass ensures both the passengers and the structure of the vehicle by protecting them from outer hindrances. With an expansion in the interest in the vehicle segment year after year, the variables used to construct a vehicle are supposed to be expended more. It is created with the development of innovative highlights, including security from external temperature changes, external commotion, and better visibility. Research exercises relating to vehicle aerodynamics to improve working speed have brought about many propelled designs, further upgrading the item's interest.

Developing accentuation on electric vehicles and new standards, for example, BS-VI in India, which would bring Indian engine vehicle guidelines into an arrangement with European Union guidelines, are foreseen to drive the vehicle glass manufacture over the conjecture time frame.

MARKET DRIVERS

Regardless of the decrease in vehicle manufacture in 2018 and 2019, the global automotive glass market is relied upon to observe development by virtue of the ascent in the manufacture of commercial vehicles and expanding item interest from the aftermarket. The expanding number of vehicles out and about, alongside increasing mishaps, drives the requirement for repair, upkeep, and substitution, which would, in this way, drive the interest in glass. Development and innovative progressions are the key elements driving market development. Different latest developments are being seen in the utilization of vehicle glass.

However, fluctuating costs of crude materials are a crucial factor expected to control the growth of the global automotive glass market over the foreseen time.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.40% |

|

Segments Covered |

By product, application, end-user, vehicle, and region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Saint-Gobain (France), Asahi Glass (Japan), Fuyao Glass (China), Samvardhana Motherson (India), Webasto (Germany), Xinyi Glass (China), Nippon Sheet Glass (Japan), Gentex Corporation (US), Corning (US), and Magna International (Canada), and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Laminated glass has significant application in vehicle glass. Laminated side coating in cars is one of the most wanted vehicle advancements. Some European OEMs, for example, BMW and Mercedes, have normalized side coating in a portion of their top-selling models. It gives upgraded well-being to passengers in case the vehicle turns over in a mishap.

Tempered glass overwhelmed the product sector in 2019. Quickly developing commercial vehicle manufacturers in the Asia Pacific region are relied upon to drive the interest for tempered glass over the conjecture time frame.

By Application Insights

Sunroof is the biggest and quickest developing smart glass application in the global vehicle glass market.

It gives the client more control over overseeing the characteristic light in the vehicle. Savvy glass innovation in sunroof is being utilized by Daimler and Mercedes-Benz models, for example, SL and SLK arrangements. Innovative progressions, the presence of intrigued industry players, and the popularity of energy-effective items additionally assume a significant job in the development of the market for sunroofs.

Sidelights will exhibit critical development prospects because of the development of laminated glass on the side windows. Expanded awareness about vehicle security is relied upon to advance the interest in superior items, further affecting the vehicle glass market size.

By End-use Insights

The OEM sector represented a portion of about 80.0% in 2019, which is attributable to the developing interest in commercial vehicles and the vehicle glass market.

Expanding interest in vehicle upgrading and the use of substitute glass because of climate and mishaps will principally drive the aftermarket section. Item accessibility with similar shapes; however, various thicknesses, durability, and color combinations will affect item entrance. Additionally, shifting customer inclinations towards using practical items with improved quality will bring about higher gains.

By Vehicle Insights

The passenger vehicles section will dominate the market share and represent over 60% of the general utilization in 2018.

Passenger cars use automotive glass to give assurance from the outside environment and upgrade the stylish highlights of the vehicle. Changing the way of life has prompted an expansion in the purchasing intensity of clients, further bringing about vehicle customization. The rising middle-class portion in developing economies will build the fragment share.

Heavy Commercial vehicles will observe noteworthy development inferable from the refreshed security standards and gauges relating to standard glass thickness. Multiplying cargo transport combined with rising globalization is noticeably affecting the expanded deals of heavy-duty trucks. Urbanization has prompted an expansion in the construction of buildings, streets, and highways, prompting the need for substantial commercial vehicles, further expanding the section size.

REGIONAL ANALYSIS

Europe's automotive glass market share will develop at 5% CAGR from 2020 to 2026. Expanding electric vehicle manufacture alongside the strong presence of vehicle producers is the key factor in improving territorial development. Progressions and advancements in vehicle structure, alongside developing prominence for the decrease in vehicle body weight and carbon emanations, will unmistakably enlarge the item penetration.

Nations in the Asia-Pacific area, similar to China and India, are estimated to be the quickest-developing vehicle glass markets. Some of the major factors driving the development of the market are an ascent in deals of passenger vehicles in the ASEAN nations, expanding deals of premium vehicles in nations like China and India, and the mounting need and inclination for a sunroof in the minimal cost automobiles. China, despite a battling economy (for the most recent couple of years), is likely to keep on being the driver of the market, with Japan being the center point of innovation in the vehicle area. These are promoting the expansion of the Asia Pacific market's business in the automotive industry.

KEY MARKET PLAYERS

The major key players in the automotive glass market include Saint-Gobain (France), Asahi Glass (Japan), Fuyao Glass (China), Samvardhana Motherson (India), Webasto (Germany), Xinyi Glass (China), Nippon Sheet Glass (Japan), Gentex Corporation (US), Corning (US), Magna International (Canada), are playing a dominant role in the global market.

RECENT HAPPENINGS IN THIS MARKET

- Saint-Gobain Sekurit's song ClimaCoat is a heated, intelligent windshield that improves vehicle occupants' prosperity while additionally diminishing CO2 discharges. Solace and environment both feature unequivocally in automakers' and drivers' requests.

- Saint-Gobain Sekurit and Corning Incorporated declared that they have consented to an arrangement to build up a selective joint endeavor, similarly possessed by Saint-Gobain and Corning, to develop, produce and sell lightweight vehicle coating arrangements.

- Japan's Asahi Glass, which claims somewhat over 22% of Asahi India Glass, is in cutting-edge discussions to purchase our accomplice Sanjay Labroo as a feature of a plan to assume responsibility for the joint endeavor.

MARKET SEGMENTATION

This research report on the global automotive glass market has been segmented and sub-segmented into the following categories.

By Product

- Tempered

- Laminated

- Others

By Application

- Windscreen

- Backlite

- Sidelight

- Sunroof

By End-Use

- Original Equipment Manufacturer (OEM)

- Aftermarket Replacement (ARG)

By Vehicle

- Passenger Car

- Light Commercial

- Heavy Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the latest technological advancements shaping the automotive glass industry?

Innovations such as smart glass, Heads-Up Display (HUD) windshields, solar control glass, and lightweight laminated glass are revolutionizing vehicle safety and efficiency.

How does the rise of electric and autonomous vehicles impact the demand for automotive glass?

EVs and self-driving cars require larger, high-performance glass surfaces for aerodynamics, infotainment displays, and enhanced safety features, boosting market growth.

What are the key factors influencing the pricing of automotive glass worldwide?

Factors include raw material costs (silica, soda ash), manufacturing processes, demand for safety standards (laminated & tempered glass), and supply chain dynamics.

Which regions are witnessing the fastest growth in the automotive glass market, and why?

Asia-Pacific leads due to expanding automobile production, urbanization, and rising disposable income, followed by North America and Europe, driven by technological adoption.

Who are the major players in the global automotive glass industry, and how are they staying competitive?

Companies like AGC Inc., Saint-Gobain, Fuyao Glass, Nippon Sheet Glass, and Guardian Glass are investing in R&D, sustainability initiatives, and partnerships with automakers to maintain market leadership.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]