Global Automotive Smart Factory Market Size, Share, Trends, And Growth Forecasts Report, Segmented By Component (Industrial Robots, Machine Vision, Sensors, 3D Printing), Solution (SCADA, PLC, DCS, MES, PLM, ERP, HMI, PAM), Vehicle Type (Passenger Vehicles and Commercial Vehicles) By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Automotive Smart Factory Market Size

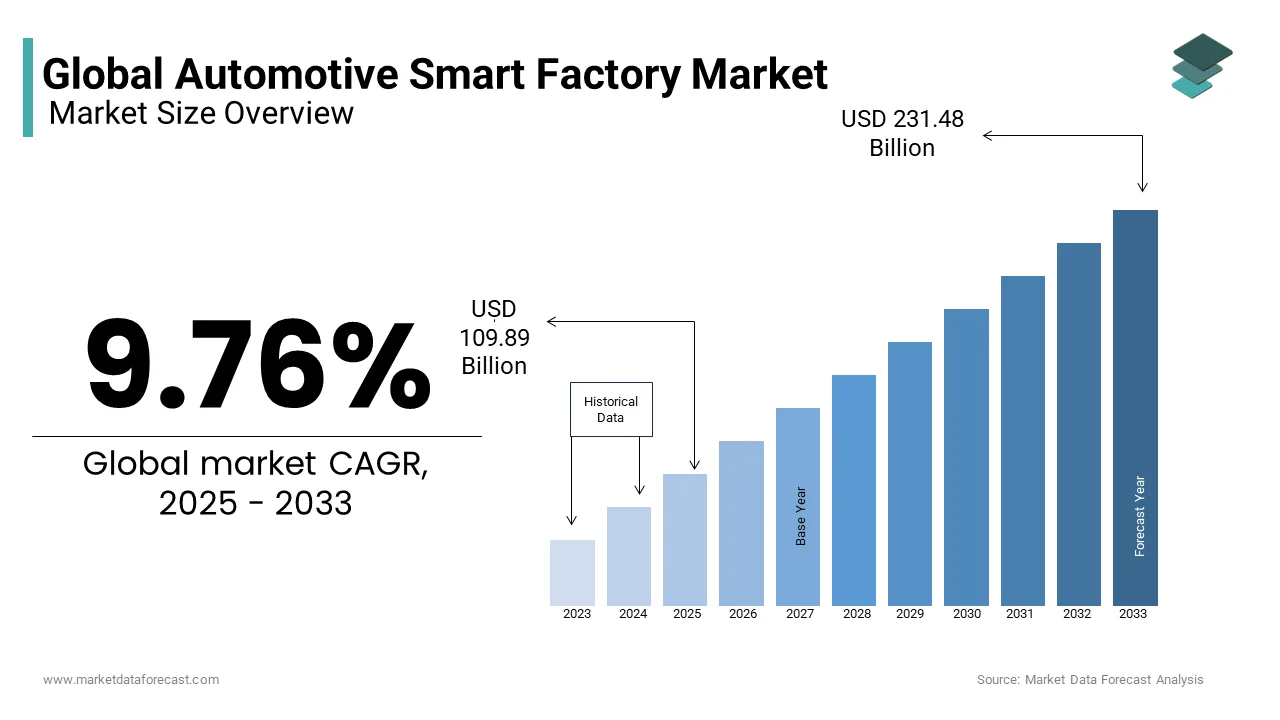

The global automotive smart factory market was valued at USD 100.12 billion in 2024 and is anticipated to reach USD 109.89 billion in 2024 from USD 231.48 billion by 2033, growing at a CAGR of 9.76% during the forecast period from 2025 to 2033.

Smart Factory is an advanced foundry that has cyber-physical systems where materials are often moved efficiently across the factory floor. This automation is often deployed within 60 days so as to streamline and track the materials flow through the power of production. Smart Factory provides data models and factory-specific & MES templates for rapid use.

The expansion of the global automotive smart factory market is propelled by the evolution of the Internet of Things (IoT), increasing the use of enabling technologies in automotive, rising adoption of commercial robots in the manufacturing sector, and connected enterprises alongside production to cater to the increasing population.

MARKET DRIVERS

The factors that are driving the expansion of the global automotive smart factory market are the rising practice for the advanced base for manufacturing, increased specialization in energy consumption, and improved efficiency of production. The booming industry of refurbished robots and untapped fields like industrial robots and RFID are predicted to create a lot of opportunities for the expansion of the market.

However, the factors that are hampering the expansion of the market are a lack of interoperability & standardization, along with the shortage of trained workers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2024 to 2033 |

|

CAGR |

9.76% |

|

Segments Covered |

By Component, Solution, Vehicle Type, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Schneider Electric, ABB, FANUC, Emerson Electric, General Electric, Yokogawa Electric, Honeywell International, Rockwell Automation, Mitsubishi Electric, Siemens, and Robert Bosch. |

SEGMENT ANALYSIS

By Component Insights

Industrial Robot is the most substantial revenue-generating segment thanks to differentiated products for various purposes. The marketplace for industrial robots is likely to account for the largest share of the worldwide automotive smart factory market during the forecast period. Implementing industrial robotics in smart manufacturing processes can improve productivity, reduce human errors, and increase production volume.

By Solution Insights

Enterprise resource planning (ERP) is the largest revenue-generating segment because of the usage of software applications to embody the processes and products, relationships between activities & functions, procedures, and knowledge flow. The recent trends that are seen within the global automotive smart factory market are the development of producing Execution Systems (MES), data models for rapid usage, and factory-specific templates. Moreover, increasing industries of refurbished robots are projected to make lucrative growth opportunities within the global automotive smart factory market.

By Vehicle Type Insights

Of the two vehicle types, the passenger vehicles held the most substantial portion of the global automotive smart factory business in terms of revenue in the review period. This segment is also expected to augment with a remarkable growth rate in the foreseen years due to the increasing demand for passenger cars in both developed and developing regions. In addition, the rising production units of car manufacturers and investments in research and development activities to introduce innovative products in the market will create enormous growth potential for the call of passenger cars around the world. However, the commercial vehicles segment is also projected to experience a considerable demand in the coming years, attributed to the increased trade activities in several parts of the world.

REGIONAL ANALYSIS

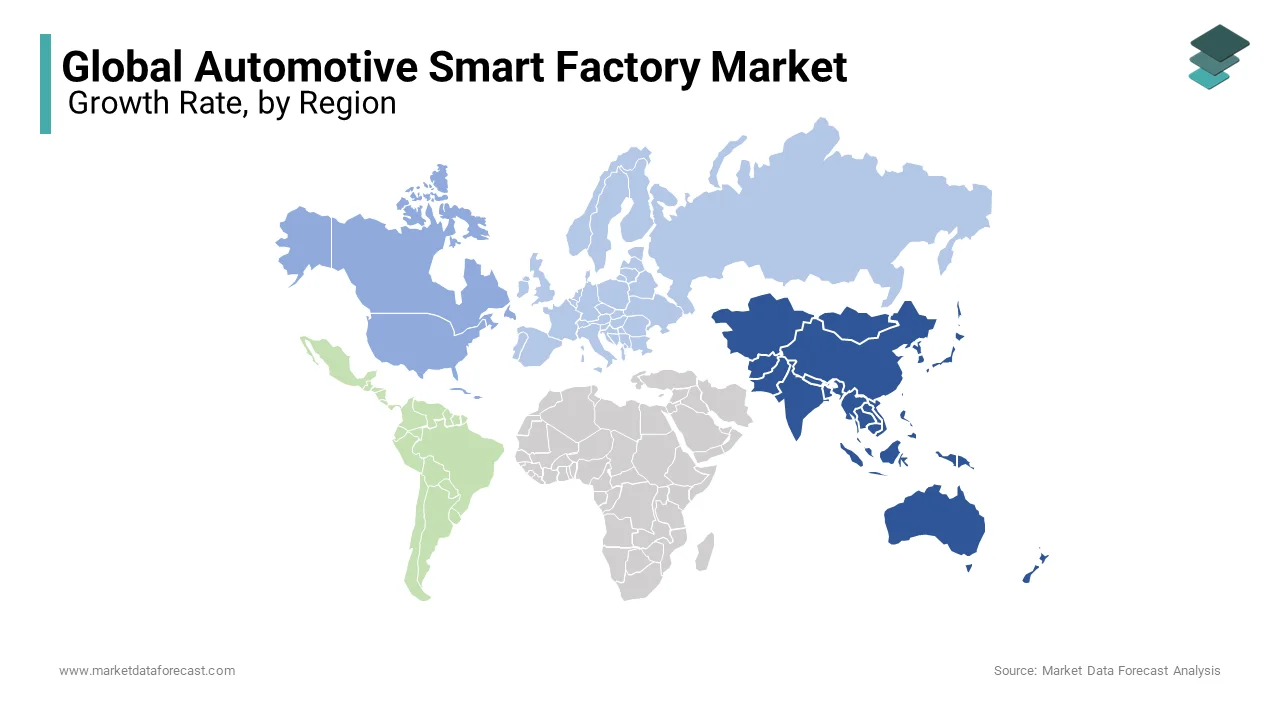

Asia Pacific, followed by North America, is the largest revenue-generating region in the global automotive smart factory market because of its increasing adoption of Smart factories within the automotive industry. Among the varied developing economies in the Asia Pacific, China has been using advanced industrial practices by implementing automation technologies in the manufacturing sector. Information integration and intellectualization are the central focus of government policies, which also contributed to the growth of the Asia Pacific automotive smart factory market. Moreover, various research institutions and organizations are working together to enhance vehicle manufacturing processes in China. Japan is additionally playing a big role in boosting growth in this market. Several leading giants in the automotive industry are opening their production units in the Asia Pacific region, supporting the business expansion.

KEY MARKET PLAYERS

Some of the leading players in the global automotive smart factory market include Schneider Electric, ABB, FANUC, Emerson Electric, General Electric, Yokogawa Electric, Honeywell International, Rockwell Automation, Mitsubishi Electric, Siemens, and Robert Bosch. Some of the market players dominating the

RECENT HAPPENINGS IN THIS MARKET

- BSES Yamuna Power Ltd Limited (BYPL) and Schneider Electric have signed an agreement to supply safety and residential automation products. The partnership envisages making electricity usage safer, smarter, and more sustainable using technology and creating awareness. This may be accomplished through two programs and dealing firmly with the Resident Welfare Associations (RWAs), Industrial Welfare Associations, and nominated local electricians in East and Central Delhi. Consumers also will be offered Schneider Electric's Residual Current Circuit Breakers (RCCB), a fireguard that detects earth leakage in one's premises, automatically tripping and disconnecting electricity supply to the premises/equipment, preventing severe mishaps. It also detects the faulty and intermixing of internal wiring.

- Japan's robot revolution aimed toward compensating for its elderly population and the aging workforce. Advances in robotic computing power, the power to recognize voices and pictures, and machine learning could help the country overcome the handicap of a fast-aging populace. Panasonic has developed a robot that transforms from a bed to a wheelchair while a startup, Cyberdyne, has created devices that help the infirm move around.

MARKET SEGMENTATION

This research report on the global automotive smart factory market is segmented and sub-segmented into the following categories.

By Component

- Industrial Robots

- Machine Vision

- Sensors

- 3D Printing

By Solution

- SCADA

- PLC

- DCS

- MES

- PLM

- ERP

- HMI

- PAM

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is an Automotive Smart Factory?

An automotive smart factory integrates advanced technologies like AI, IoT, and robotics to enhance production efficiency, quality, and automation in vehicle manufacturing.

What are the key drivers of the Automotive Smart Factory Market?

Increased demand for automation, Industry 4.0 adoption, cost reduction, and improved production efficiency are major growth drivers.

Which technologies are transforming smart factories in the automotive industry?

AI, IoT, digital twins, robotics, 5G connectivity, and cloud computing are revolutionizing automotive manufacturing.

What challenges does the Automotive Smart Factory Market face?

High initial investment, cybersecurity risks, workforce skill gaps, and integration complexity are key challenges.

Which regions are leading in smart factory adoption?

North America, Europe, and Asia-Pacific (especially China, Japan, and Germany) are at the forefront of smart factory implementation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com