Global Baby Care Products Market Research Report – Segmented By Product (Skincare, Hair Care, Bath Products, Toiletries and Food & Beverages), Distribution Channel (Hypermarket/Supermarket, Convenience Store and Online Platform), Category (Economy and Premium) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Analysis on Market Size, Share, Trends & Growth Forecast from 2024 to 2032

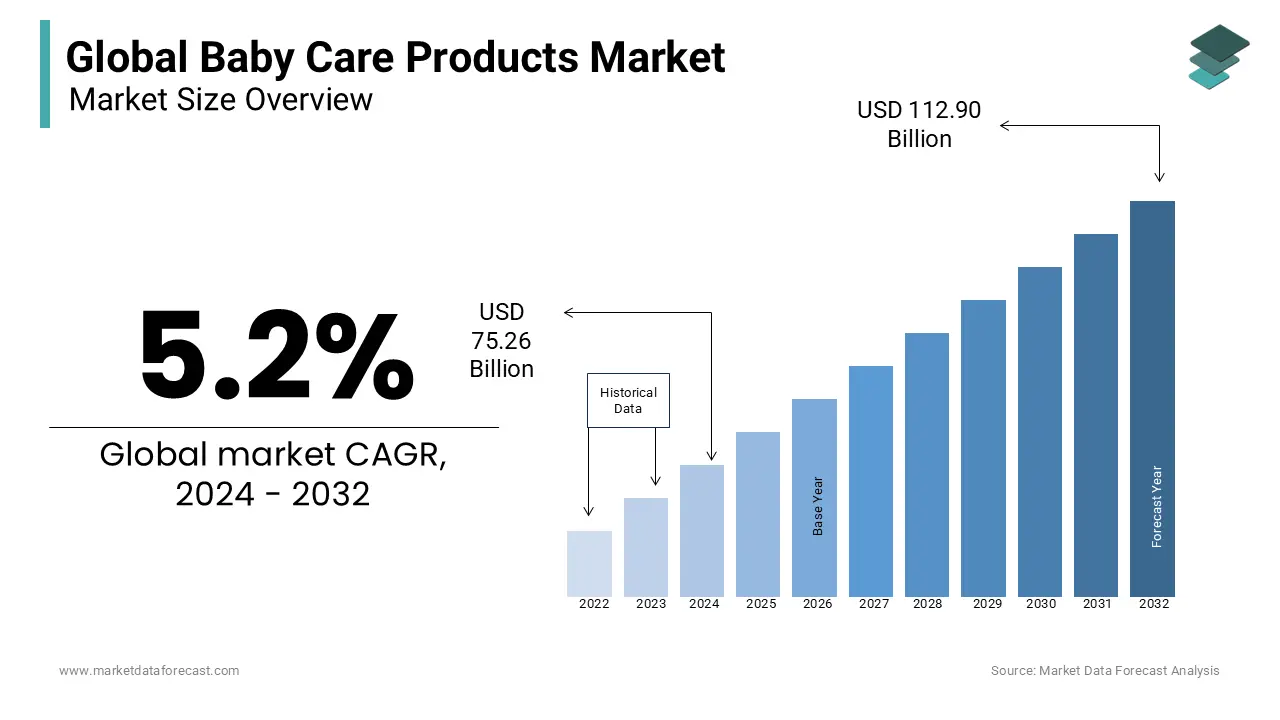

Global Baby Care Products Market Size (2024 to 2032)

The Global Baby Care Products market was valued at USD 71.54 billion in 2023. The global market size is expected to grow at a CAGR of 5.2% from 2024 to 2032 and be worth USD 112.90 billion by 2032 from USD 75.26 billion in 2024.

Current Scenario of the Global Baby Care Products Market

Baby care products are used for baby hygiene under three years old, as they are not irritating or mild. Baby care products include skincare products and baby hair care products. The upbringing market consists of supplies for parents explicitly used for babies. Product lines include baby powder, shampoos, body lotions, massage oils, bath gels, and wipes. These products undergo several clinical tests before going to market.

MARKET DRIVERS

The increasing birth rate of babies worldwide drives the baby care products market growth.

According to a survey in 2022, almost 25% of income in working families is spent on baby care. The shifting trend to provide high-quality products for the baby, along with an increasing number of newborn babies, is anticipated to leverage the market growth rate. According to a recent survey, nearly 139 million babies are born in a year, whereas approximately 3,85,000 are born per day roughly. For the next 50 years, this count will be stable.

The growing prominence of organic and gluten-free baby food products further fuels the growth rate of the baby care products market.

With rising awareness over using organic baby food products that do not harm babies like other chemical products, the demand for the baby care products market is growing exponentially. It is highly recommended for parents to buy organic-based cosmetics as other products may have chemicals that are very harmful to newborn babies.

An increasing number of working women worldwide contributes to the global market growth.

The sales of baby care kits have increased with the growing number of working women worldwide. Working mothers usually depend on instant baby products and look over high quality, which is a crucial attribute prompting market growth. According to the global labor force, the status of women working around the world is about 47%. Therefore, the increasing independence of mothers worldwide is directly surging the sales of baby care products.

Increasing spending on baby care escalates the market’s growth rate.

With the rising number of working families, the demand to adopt essential baby care kits is also increasing. This shows that the demand for the baby care products market is increasing at a rapid rate. Growing awareness over the use of ultimately safe products for babies in both developed and developing countries is elevating the growth rate of the market. Also, rising disposable income in urban areas is likely to fuel market growth in the coming years.

The rising awareness of childcare and income levels in emerging economies are notable vital factors propelling the baby care products market growth.

The emerging countries offer an excellent market opportunity for baby care products. Some NGOs carry out campaigns, such as diaper banks, to explain the importance and benefits of using quality diapers. It also encourages the use of eco-friendly diapers, such as biodegradable variants, for complete baby health care. The key market participants are focusing on developing innovative products that are eco-friendly using advanced technologies. The awareness of hygiene and the health of babies persists into the launch of innovative products that are quietly promoting the sales of baby care products. Focus on safe and natural-based products among parents is attributed to set several growth opportunities for the baby care products market. The launch of paraben and harsh chemical-free products is ascribed to boost the demand for baby care products worldwide and contribute to the global market growth in the coming years.

MARKET RESTRAINTS

The growing awareness among parents regarding the use of certain chemicals that can be harmful to babies is limiting the market growth.

In addition, another critical challenge for the leading international players in the global baby products market is competition with local players. Due to the high production cost of these products, local companies produce low-priced and low-quality products, affecting the overall demand for baby care products and hampering the global market growth. Growing concerns over the safety of babies are increasing among consumers, which is a challenging factor for the market participants in the global market. Also, the high cost of branded products that common people cannot afford, especially in underdeveloped countries, is impeding the growth rate of the baby care products market.

Furthermore, some babies with very sensitive skin show allergic reactions to the chemicals used. This factor is attributed to restraining the growth rate of the baby care products market. Stringent rules and regulations by government authorities in approving the products are slowly degrading the shares of the market. Also, there is a growing number of lawsuits against many branded companies, and those are lowering their product sales. This is ascribed to limit the baby care products market. In 2022, Johnson & Johnson announced that they would discontinue the manufacturing of the talc powder as they are receiving a huge number of lawsuits. Many lawsuits claimed that this company is using a harmful chemical, asbestos, in talc powder. The use of this chemical will lead to ovarian cancer and other diseases among children.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.2% |

|

Segments Covered |

By Product, Distribution Channel, Category, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

|

Key Market Players |

Kimberly Clark Corporation, Procter & Gamble Company, Mothercare PLC, Johnson & Johnson, Unilever PLC, Nestle SA, Avon Products Inc., Himalaya Drug Company, Artsana SPA, and Dabur International Limited |

SEGMENTAL ANALYSIS

Global Baby Care Products Market Analysis By Product

The skincare segment is leading with the largest share of the baby care products market and the domination of the segment is likely to continue in the coming years owing to the growing urbanization and increasing prominence for the safety of babies in developed countries. Skin care products include baby oils, baby lotions, baby creams/moisturizers, and baby powders. With the growing popularity of maintaining healthy skin for newborn babies, the demand for these products is growing at a healthy rate.

The F&B segment is likely to post a promising growth rate during the forecast period. It is essential to provide nutritional value for the food that includes iron, calcium, zinc, and vitamins. Hence, the demand to use nutrients in the baby food fortification process is growing exponentially.

Global Baby Care Products Market Analysis By Distribution Channel

The hypermarkets and supermarkets segment is gaining traction and is anticipated to account for the leading share of the global market during the forecast period, whereas the online platforms segment is likely to have the fastest growth rate. Growing awareness over the use of high-quality products where the consumers are particular in selecting the products by checking details and selecting the products is a crucial factor for the hypermarkets and supermarkets segment to grow. The penetration of online shopping in emerging countries like India, China, and Japan and the growing knowledge of the usage of these applications in smartphones are boosting the demand for the online platforms segment.

Global Baby Care Products Market Analysis By Category

The premium category is expected to witness a higher CAGR during the forecast period. The economy segment is expected to rule the baby care products market during the forecast period based on category owing to the increasing number of middle-class families across the world.

REGIONAL ANALYSIS

North American baby care products market held a prominent share of the worldwide market in 2023. The domination of the North American region in the global market is anticipated to continue in the coming years owing to rising per capita income. The U.S. and Canada are major contributors to the North American market and accounted for the largest share of the North American market in 2022. The growing prevalence of the production of safety products with the increasing concerns from consumers is greatly influencing the demand in the US baby care products market. In 2022, The market value in the US was USD 18.97 billion, and it is expected to grow at a CAGR of 4.3% during the forecast period 2023 to 2028. Increasing expenditure on baby products in Canada is likely to showcase growth opportunities for the market.

The baby care products market in the APAC region is estimated to witness the fastest CAGR among all the regions in the global market during the forecast period. The increasing population in emerging countries like India and China is a primary factor for the market to grow in the Asia-Pacific region. In China, the female working population is growing at a steady pace. In 2022, around 62% of women population are working. This is anticipated to surge the demand for quality baby food products.

The European baby care products market is growing at a prominent CAGR during the forecast period due to the growing awareness among parents over baby care products. The presence of key players in Germany, the UK, and Italy is majorly contributing to the growth rate of the market in Europe.

Latin America, and Middle East & Africa are likely to have significant growth opportunities during the forecast period.

KEY PLAYERS IN THE GLOBAL BABY CARE PRODUCTS MARKET

Kimberly Clark Corporation, Procter & Gamble Company, Mothercare PLC, Johnson & Johnson, Unilever PLC, Nestle SA, Avon Products Inc., Himalaya Drug Company, Artsana SPA, and Dabur International Limited are some of the notable companies in the global baby care products market.

RECENT HAPPENINGS IN THE MARKET

- In 2023, Procter & Gamble Co. announced the adoption of the predictive analysis to manufacture perfect diapers. This process captures real-time data about manufacturing the diapers where it can find the impending failures before they happen using Microsoft IoT and edge analytics. This procedure is anticipated to leverage the product portfolio of the company to the extent.

- In 2023, The Himalaya Drug Company is setting up new goals in ramping up the sales of baby care products. The company targeted to reach the mark of USD 1 billion by the end of 2024.

DETAILED SEGMENTATION OF THE GLOBAL BABY CARE PRODUCTS MARKET INCLUDED IN THIS REPORT

This research report on the global baby care products market has been segmented and sub-segmented into the following categories.

By Product

- Skincare

- Baby Oils

- Body Lotions

- Baby Creams/Moisturizers

- Baby Powders

- Haircare

- Baby hair oils

- Shampoos

- Conditioners

- Bath Products

- Baby Soap

- Bath gel for bath/shower

- Toiletries

- Diapers

- Wet Wipes

- Baby Perfumes

- Baby Hand Washes

- Food and Beverages

- Bbottled Foods

- Fruit and Vegetable Juices

- Pure Foods

- Baby food Cereals

- Baby Dairy Products

- Baby soups

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Platforms

By Category

- Economy

- Premium

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the drivers of baby care products market?

One of the main trends in the market for baby care products is the high demand for products that contain natural ingredients, compared to chemicals

What are the major key players involved in Baby Care Products Market

- Kimberly Clark Corporation

- Procter & Gamble Company

- Mothercare PLC

- Johnson & Johnson

- Unilever PLC

- Nestle SA

- Avon Products Inc.

- Himalaya Drug Company

- Artsana SPA

- Dabur International Limited

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com