Global Bakery Premixes Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product (Complete Mix, Dough-Base Mix, And Dough Concentrates), Application (Bread Products And Bakery Products (Cakes, Pastries, Muffins, Donuts, And Pancakes)), Distribution Channel (Direct Sales, Indirect Sales), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Bakery Premixes Market Size

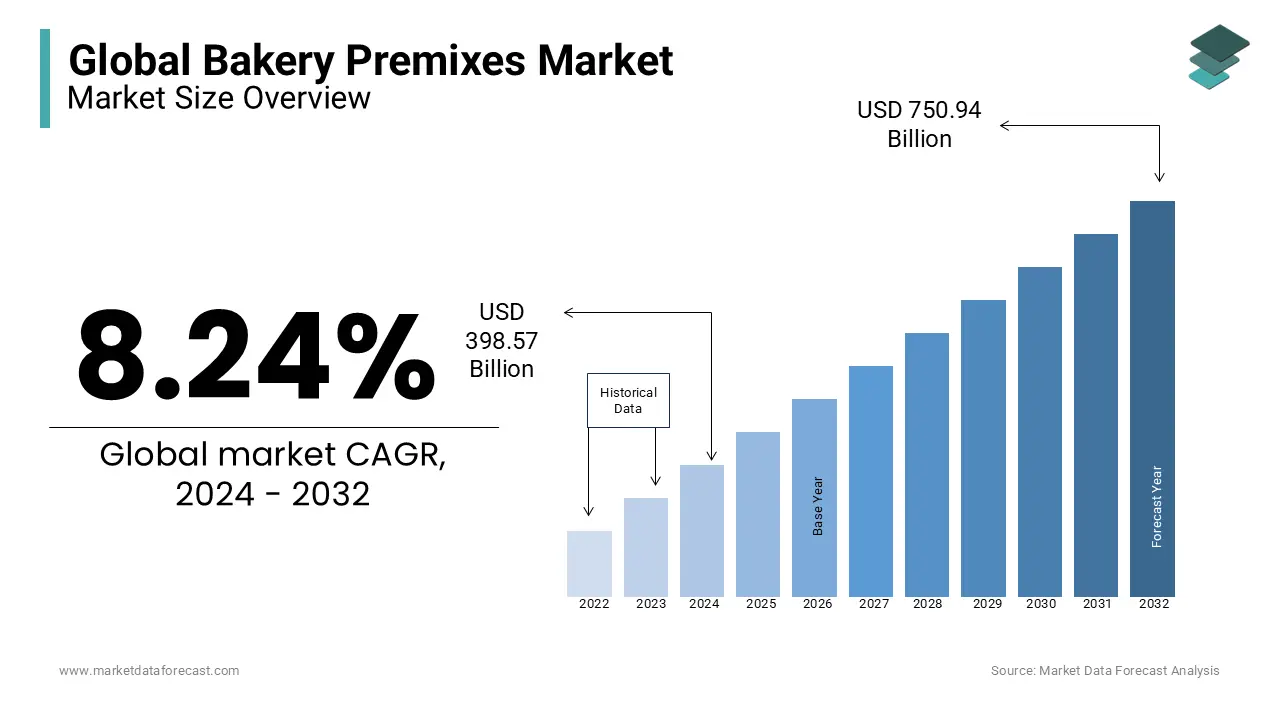

The global bakery premixes market size was worth USD 398.57 million in 2024, and is anticipated to be worth USD 812.82 billion by 2033 from USD 431.41 billion In 2025, growing at a CAGR of 8.24% during the forecast period.

Bakery premixes are substances that contain a combination of ingredients (typically 40-60%) of the final product, in which only flour is added for the production of various bakery products. Bakery premixes contain a unique mix of baking ingredients that provide a variety of flavors, textures, and colors to bakery products, including cakes, pies, buns, baking flour, muffins, bakery improvers, donuts, and muffins. Bakery premixes offer a variety of benefits to manufacturers, including better product consistency the potential for incorrect weighing of raw materials used in the processing of bakery products, and reduced labor and inventory costs. They also include fermentation and combinations of flours and types of flours found in various products. The global bakery premix market is gaining momentum in several places due to the development and profitability of the food service industry.

MARKET DRIVERS

As the prevalence of various diseases increases, the demand for gluten-free products increases, including bakery premixes.

These products help prevent multiple diseases, such as obesity, heart disease, numerous types of cancer, and metabolic syndrome, so the higher your knowledge of health, the higher your demand. As the urbanized population increases, sales of bread and bakery products increase, which is supposed to force the bakery premix market worldwide. Additionally, market growth will increase during the forecast period as awareness of the bakery premix among the food service industry and consumers increase to meet the demand for a variety of custom bakery products. As demand for prepared foods increases in developing and developing countries, sales of bakery premixes worldwide are assumed to increase to meet changing consumer preferences.

In addition, the expansion of the market will be complemented by favorable properties, such as perfect consistency, to reduce the possibility of measuring the wrong raw materials used in the process. Along with the addition of essential ingredients such as vitamins, minerals, and other essential nutrients, increasing consumer awareness of the benefits of custom premixes in bakery products will strengthen market value, as well as the development of the global bakery premix market during the forecast period. The reduced labor or inventory costs of using the bakery premix are advantageous to manufacturers of these premixes.

MARKET RESTRAINTS

Rising research and development costs, increasing costs of fortified and concentrated foods, and rigorous government-approved processes are critical constraints in the global market for bakery premixes.

One factor that is presumed to hinder the growth of the bakery premix market is the high initial investment, along with the demand for skilled workers for these machines.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.24% |

|

Segments Covered |

By Product, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Karl Fazer AB, Premia Food Additives Pvt. Ltd, Trans Standard International, Puratos, Corbion, Bakels Group, Nestle, KCG Corporation, Nisshin Seifun Group Inc, Cargill, Lesaffre, Winner Group, GK Ingredients, Archer Daniels Midland Company, and Midas Food |

SEGMENTAL ANALYSIS

Global Bakery Premixes Market Analysis By Product

By product, the complete mix segment is anticipated to make up a large part of the global market. It is expected to drive growth in this sector as demand for complete mix increases in commercial baking applications. The mass-based premix segment is suspected of posting moderate growth in the coming years. This type of premix requires water, eggs, butter, and other ingredients to make bakery products.

Global Bakery Premixes Market Analysis By Application

Based on the applications, the bread products segment is expected to register significant growth in the global bakery premix market. In developed countries, demand for bread products such as whole wheat bread, toast, white bread and specialty pieces of bread is supposed to drive growth in this segment. The bread-free products segment is presumed to record a steady increase in the global market. Non-bread products include cakes, muffins, pancakes, cakes, and donuts.

Global Bakery Premixes Market Analysis By Distribution Channel

By distribution channel, indirect sales accounted for 35.0% of the market share in 2018, which includes supermarkets, convenience stores, specialty stores, and online retailers. The supermarket sub-segment leads the market by rapidly converting traditional grocery stores into supermarkets. The grocery segment is expected to witness rapid growth as the number of independent health food or health food stores increases. The grocery store has easy access to multiple items under one roof.

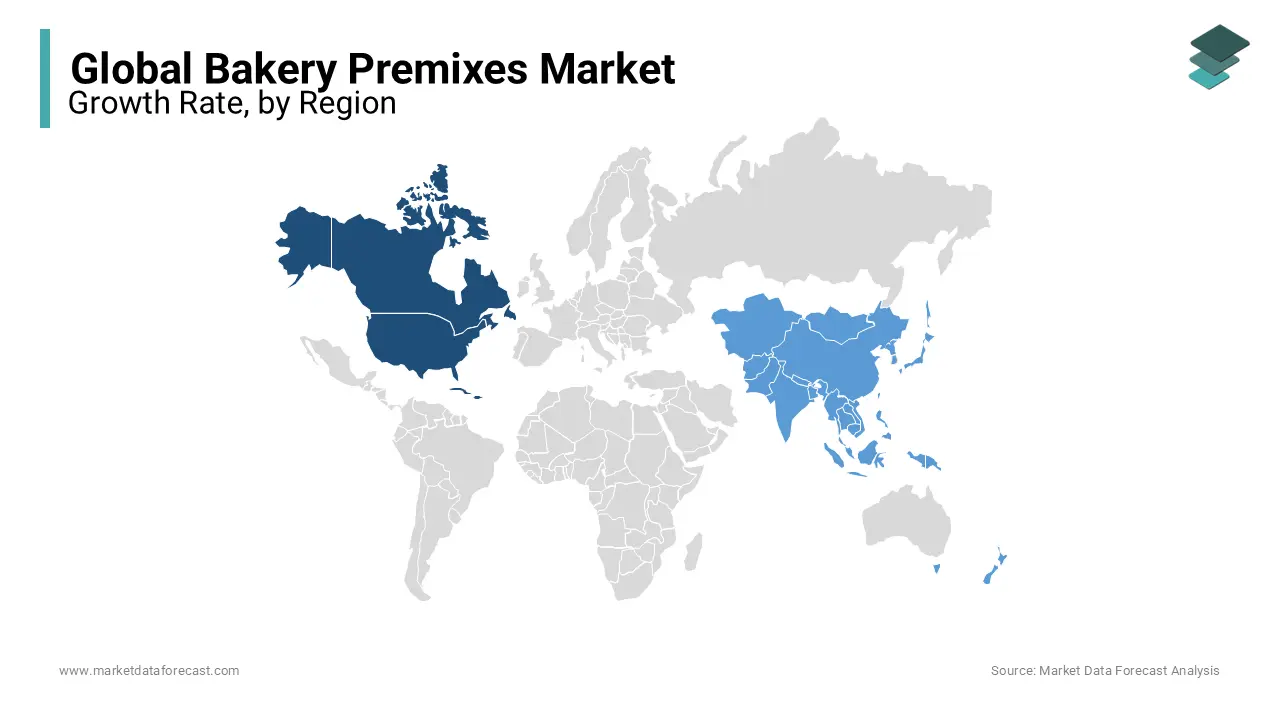

REGIONAL ANALYSIS

The North American bread premixes market is anticipated to play a significant role in the global business in the coming years. If the demand for bakery products as the primary food increases in the countries of the region, the need for bakery premixes in North America is presumed to increase. As the preference for bakery products increases during festivals and special events, strong distribution channels and full product availability are expected to drive growth in the target market. North America is estimated to be the leading market for bakery premixes, followed by the European bread premixes market. The European market is anticipated to grow modestly during the forecast period. Increased demand for ready-mix products in the region is expected to support the growth of the European market for bakery premixes.

The Asia Pacific bakery premix market is anticipated to grow significantly in the coming years. The growth of the Asia Pacific market is attributed to the growth of the bakery products industry. The trend of westernization in the region, along with changes in individual food preferences, is projected to drive the growth of the bakery premix market in the Asia Pacific region.

KEY PLAYERS IN THE GLOBAL BAKERY PREMIXES MARKET

Major Key Players in the Global Bakery Premixes Market are Karl Fazer AB, Premia Food Additives Pvt. Ltd, Trans Standard International, Puratos, Corbion, Bakels Group, Nestle, KCG Corporation, Nisshin Seifun Group Inc, Cargill, Lesaffre, Winner Group, GK Ingredients, Archer Daniels Midland Company, and Midas Foods

RECENT HAPPENINGS IN THE MARKET

- In April 2019, Karl Fazer launched two new bakery products: Fazer Suklaamarenkileivos and Fazer Kinuskimarenkileivos.

- In April 2019, Lesaffre opened a new baking center in Austria with a focus on developing industrial baking solutions.

- In March 2019, ADM launched a new line of organic flour. This new flour line includes all-purpose organic flour and organic premium breadcrumbs, plus additional natural processed products that will be launched on the market in the coming years.

- In 2018, Dow and DuPont, one of the most famous stationery providers on the planet, became major stimulants in the gluten-free bakery space.

DETAILED SEGMENTATION OF GLOBAL BAKERY PREMIXES MARKET INCLUDED IN THIS REPORT

This research report on the global bakery premixes market has been segmented and sub-segmented based on product, application, distribution channel, & region.

By Product

- Complete Mix

- Dough-Base Mix

- Dough Concentrates

By Application

- Bread Products

- Bakery Products (Cakes, Pastries, Muffins, Donuts, And Pancakes)

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the bakery premixes market?

Factors such as busy lifestyles, demand for ready-to-use products, growing bakery chains, and technological advancements in premix formulations contribute to the market's growth.

2. What are the key challenges faced by the bakery premixes market?

Challenges include maintaining product freshness, meeting diverse dietary preferences (gluten-free, vegan, etc.), and competition from traditional baking methods.

3. What is the future outlook for the bakery premixes market?

The market is expected to grow, driven by urbanization, changing consumer preferences, e-commerce, and ongoing product innovations catering to health-conscious consumers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com