Global Bathroom and Toilet Assist Devices Market Size, Share, Trends & Growth Forecast Report By Product Type (Commodes, Shower Chairs and Stools, Bath Lifts, Toilet Seat Raisers, Bath Aids, Bath Boards, Transfer Aids and Handgrips and Grab Bars) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Bathroom and Toilet Assist Devices Market Size

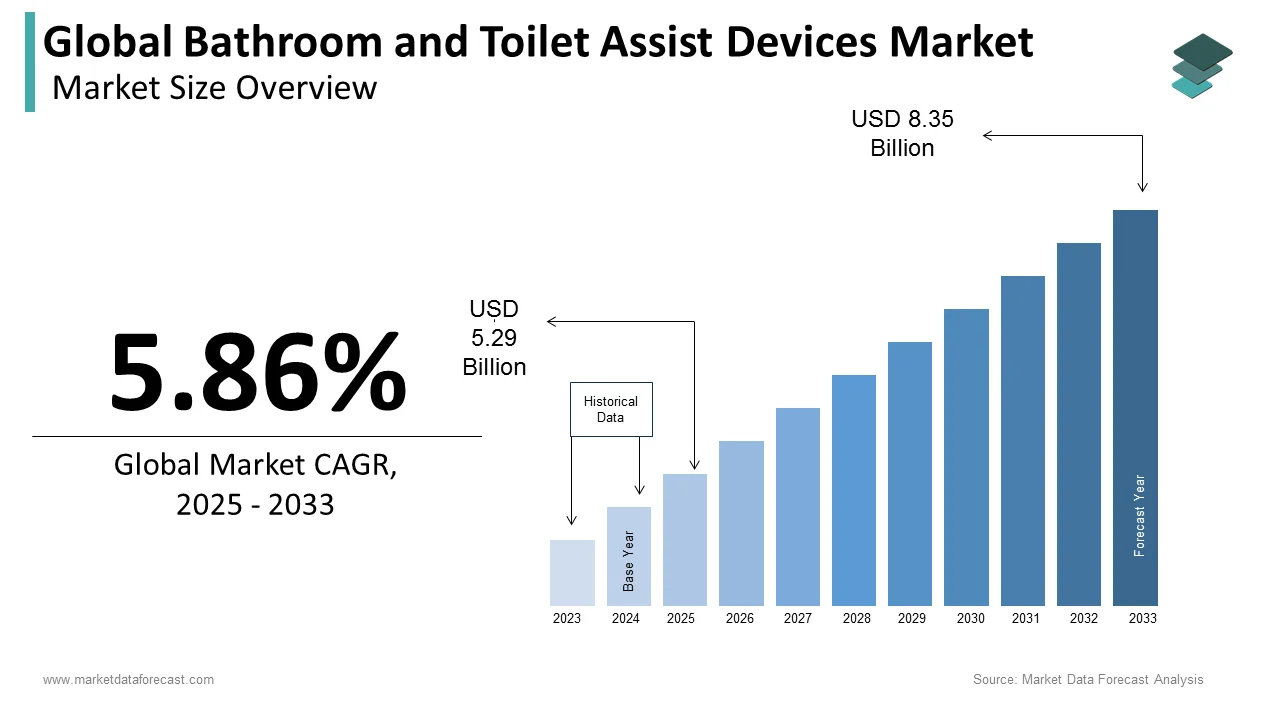

The global bathroom and toilet assist devices market was worth US$ 5 billion in 2024 and is anticipated to reach a valuation of US$ 8.35 billion by 2033 from US$ 5.29 billion in 2025, and it is predicted to register a CAGR of 5.86% during the forecast period 2025-2033.

MARKET DRIVERS

Y-o-Y growth in awareness among people regarding the benefits of these devices propels the bathroom and toilet assist devices market growth.

The rising aging population worldwide has the most requirements for these devices, which governs the market for these devices. According to the World Health Organization (WHO), the population over 60 years of age is anticipated to reach 1.4 billion by 2030. The incidence of chronic diseases, dementia, Alzheimer's, and osteoporosis is high among the aging population. People with such devices would not be able to perform their own duties on their own. In such cases, the bathroom and toilet assist devices can assist them to a considerable level. According to SHARE (Survey on Healthcare, Aging, and Retirement in Europe), an estimated 37% of the aging population was suffering from at least two chronic diseases in 2017 among EU countries. Furthermore, the rise in disabled people due to the increasing population and accidents is also a significant factor in these devices' growth. In addition, government initiatives to enhance home healthcare will enhance market growth further. Improving living standards in developing nations leads to an increment in the adoption of various assisting devices, especially the bathroom and toilet assist devices, which are becoming popular among senior citizens, leading to the generation of several opportunities for the stakeholders operating in the bathroom toilet assist devices market. Furthermore, the emergence of advanced assisting devices is due to increased initiatives to escalate technological developments by organizations continuously striving to develop inexpensive devices to expand their customer base. With this, the market is expected to provide lucrative opportunities for the people operating in this market during the forecast period.

MARKET RESTRAINTS

The high costs of bathroom and toilet assist devices are a significant factor hampering the market for these devices.

The expensive nature of toilet and bathroom devices is limiting certain sections of people to avoid the purchase of bathroom assisting devices, which is eventually restricting the growth of the market. In addition, a lack of awareness among the illiterate population in developing countries about bathroom assisting devices is still a challenge that is slowing down the progression of the global market. Furthermore, frequent changes in the economic strategies in some countries may also hamper the growth of the bathroom and toilet assist devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.86% |

|

Segments Covered |

By Product Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ArjoHuntleigh, Bischoff & Bischoff GmbH, Etac AB, DIETZ GmbH, Medical Depot, Inc. (Drive Medical), Handicare, Hewi Heinrich Wilke GmbH, Invacare Corporation, MEYRA GmbH, Patterson Medical Holdings, Inc., Pushchair Medical Limited, Pride Mobility Products Corp., Prism Medical, RCN Medical and Rehabilitation GmbH, Sunrise Medical (US) LLC., Ortho XXI, K Care Healthcare Equipment, GF Health Products., Juvo Solutions, and Spectra Care Group., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The commodes segment is the major contributor to the market share of bathroom and toilet assist devices regarding products as they are effortless to use. These look like ordinary chairs. These devices are used by people who cannot move to the bathroom independently. The demand for advanced chairs is continuously increasing at a high pace. These chairs also have wheels and advanced sensors, driving the segment's growth. Its market is expected to witness rapid growth during the forecast period due to the rise in older people's population and the increasing rate of accidents and other diseases.

The shower chairs and stools market segment is rapidly growing. It contributes significantly to the global market due to the increasing elderly population. In addition, these shower stools and chair usage is increased in recent years due to increasing bathroom accidents. Most older people and people who are very sick are prone to these accidents, falling or slipping while bathing, leading to severe injuries to the head, hand, and legs and sometimes death. These devices are also used by pregnant women who have to take more care during pregnancy. By considering all these factors, the segment has the highest market share. The emergence of the latest technologies in every sector will likely bolster the demand for bathroom and toilet assist devices. Escalating expenditure on healthcare is also one of the factors impacting the growth of the market positively.

Bath lifts are further subdivided into Fixed bath lifts, Reclining bath lifts, and Lying bath lifts. Bath lifts are expected to grow at a favorable rate in the future. This is because the increase in disposable income has allowed people to use these devices for the increasing population and thus contributed to the growth.

Toilet seat raisers are expected to contribute significantly to the market, and their growth will likely increase during the forecast period. The elderly and disabled populations have increased in European and Asian countries. The increasing living standards of people in these regions have made them aware of this segment and its benefits, thus increasing the market growth rate.

Bath aids are further subdivided into Bath boards and Transfer aids. The growth rate is expected to be positive during the forecast period, mainly due to its counterparts' collective impact.

Handgrips and Hand bars are rising in popularity, but their market share may seem limited due to their low cost and less innovation scope. These devices are generally used by older adults and people with physical problems. This device helps them move and stand, thus helping them avoid significant accidents. The entry of new companies will make the market more competitive.

REGIONAL ANALYSIS

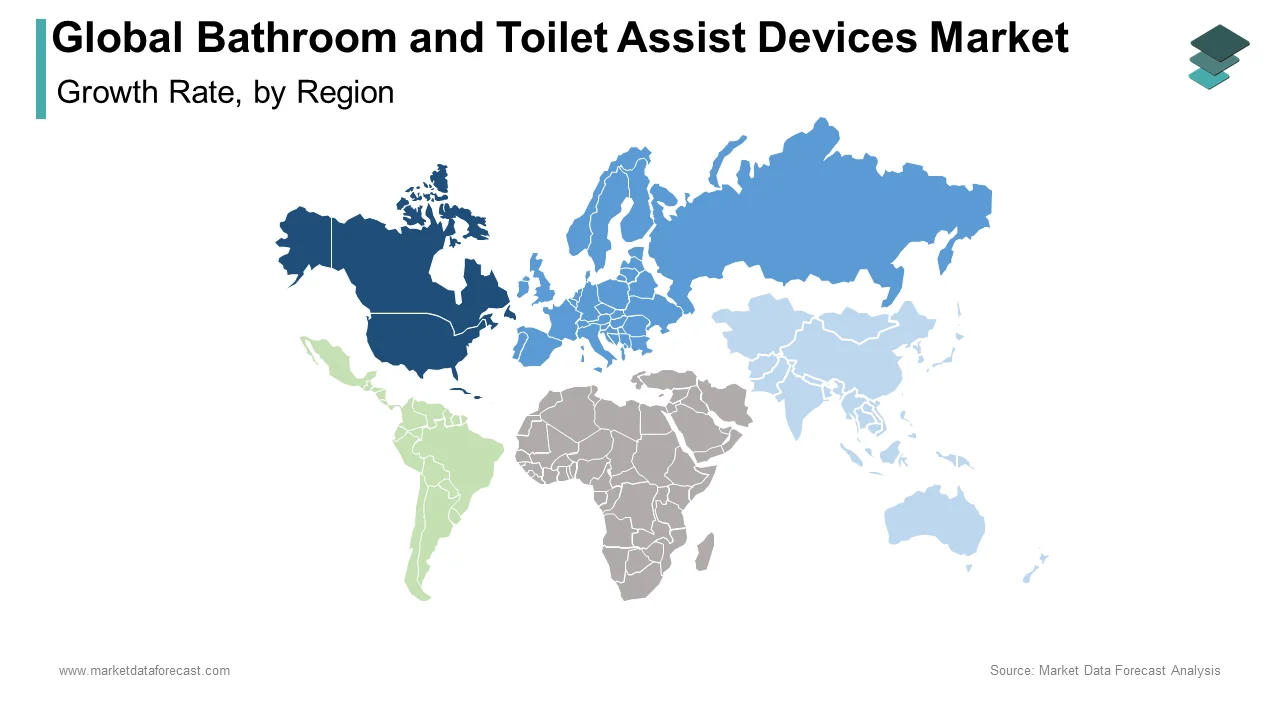

The North American region dominated the global bathroom and toilet assist devices market in 2024, accounting for a significant global market share, with the US accounting for a considerable share.

North America's lead is warranted by the increasing adoption of technologically-equipped devices in North American countries compared to other regions. The rise in population and people with disabilities is a significant factor contributing to the growth. The increased standard of living is also a factor responsible for the high growth rate. The increase in chronic diseases in the US drives the bather and toilet assist devices market. Nearly 60 percent of people are suffering from at least one chronic disease in the US, such as diabetes, heart problems, and cancer. People suffering from joint diseases in the US use these bathrooms to assist in their daily activities. Using these devices can reduce joint stress by not standing a long time in the bathroom for their activities. Canada's Canada Care Medical bathroom products and equipment are designed to help disabled people. These devices help maintain and improve quality of life and independence. Increasing the production of new and innovative products by the primary key player and making personalized devices based on the patient's requirement drives the market forward in this Region.

The European region had the second-largest share of the global market in 2024. The rise in the elderly population in European countries is a significant factor in the increased popularity of bathroom assist devices. Government initiatives will further help boost the devices market in Europe. Germany holds the maximum share of the market. Germany's government has conducted programs on using bathroom and toilet assist devices mainly for the senior population's safety. They conduct these programs and make people aware of the importance of using these devices. As a result, the government has approved most of the devices for usage in their Region.

However, the Asia-Pacific region is expected to expand at the highest CAGR during the forecast period because of a vast population base, increasing adoption of advanced technologies, and the low manufacturing costs of Bathroom and Toilet Assist Devices in the emerging economies of the Region. The increasing older population in the Asia Pacific region drives the market forward during the forecast period. According to a recent survey, 415 million people in Asia are above 60 years old. In most homes, doing the daily functioning of older people in the bathroom is a significant problem. These bathroom and toilet assist devices are helpful to these people in doing their work. The rise in population in countries like India and China is the primary reason for the growth. This population also comprises the growing elderly population of China, and thus, the country is a massive market for these devices. Rising government initiatives to make people more aware of these benefits will support market growth. Increasing public health in China in recent years and increasing people's awareness of health have resulted in the use of advanced technology in bathrooms and toiled assist devices in Chinese public bathrooms. These advanced assist devices help people prevent the spread of the virus from one person to another by using their advanced cleaning process after a person's usage. These devices also have advanced features like toilet seat raisers, handles to hold for support, etc. Due to the increasing number of accidents in India, this market has the largest market share in this Region. The people who met an accident have lost their hands or legs or any other body part, making them unable to do their tasks. People with spinal cord injuries use these devices for work support during the day. Every year, nearly 10,000 cases are reported in India as spinal cord injuries.

The market in Middle East Africa also has moderate growth due to changing lifestyles and increasing awareness about these devices. In this Region, these devices are used mainly by disabled people.

In the Latin America market, Brazil holds the largest market share. Due to increasing chronic diseases such as cancer and cardiovascular disease among many people, People who are more at risk in these derives cannot perform their tasks without any support in the bathroom, which drives the market forward in this Region. Additionally, increasing online stores also drives that market forward. Most people buy these devices online of their own choice and revies.

KEY MARKET PLAYERS

Companies leading the global bathroom and toilet assist devices market profiled in this report are ArjoHuntleigh, Bischoff & Bischoff GmbH, Etac AB, DIETZ GmbH, Medical Depot, Inc. (Drive Medical), Handicare, Hewi Heinrich Wilke GmbH, Invacare Corporation, MEYRA GmbH, Patterson Medical Holdings, Inc., Pushchair Medical Limited, Pride Mobility Products Corp., Prism Medical, RCN Medical and Rehabilitation GmbH, Sunrise Medical (US) LLC., Ortho XXI, K Care Healthcare Equipment, GF Health Products., Juvo Solutions, and Spectra Care Group.

RECENT MARKET HAPPENINGS

- Limerston Capital completed the acquisition of Prism Medical in December 2019. This acquisition helped the former expand its product portfolio in terms of bathroom-assisting devices.

- Carex Company rebranded and redesigned its website in November 2019. It helps the company improve website navigation and enhance the customer experience. The company mainly focuses on digital marketing to expand its business and cater to a large section of the customer base.

MARKET SEGMENTATION

This research report on the global bathroom and toilet assist devices market has been segmented and sub-segmented into the following categories.

By Product Type

-

Commodes

-

Electric commode

- Fixed commode

- Folding commode

- Transit commode

-

- Shower Chairs and Stools

- Bath Lifts

- Fixed bath lifts

- Reclining batch lifts

- Lying Bath Lifts

- Toilet Seat Raisers

- Bath Aids

- Bath Boards

- Transfer Aids

- Handgrips and Grab Bars

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region dominated the bathroom and toilet assist devices market in 2024?

North America led the bathroom and toilet assist devices market in 2024.

Which segment by product had the major share in the bathroom and toilet assist devices market in 2024?

The commodes segment dominated the bathroom and toilet assist devices market in 2024.

What was the size of the bathroom and toilet assist devices market worldwide in 2024?

The global bathroom and toilet assist devices market size was valued at USD 5 billion in 2024.

What are some of the promising players in the bathroom and toilet assist devices market?

ArjoHuntleigh, Bischoff & Bischoff GmbH, Etac AB, DIETZ GmbH, Medical Depot, Inc. (Drive Medical), Handicare, Hewi Heinrich Wilke GmbH, Invacare Corporation, MEYRA GmbH, Patterson Medical Holdings, Inc., Poshchair Medical Limited, Pride Mobility Products Corp., Prism Medical, RCN Medical and Rehabilitation GmbH, Sunrise Medical (US) LLC., Ortho XXI, K Care Healthcare Equipment, GF Health Products., Juvo Solutions, and Spectra Care Group are a few of the leading players in the bathroom and toilet assist devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com