Global Home Healthcare Market Size, Share, Trends & Growth Forecast Report By Product Type, Type (Home Telehealth Monitoring Devices, Home Telehealth Services and Home Telehealth Software), Services Type, Software and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2055 to 2033

Global Home Healthcare Market Size

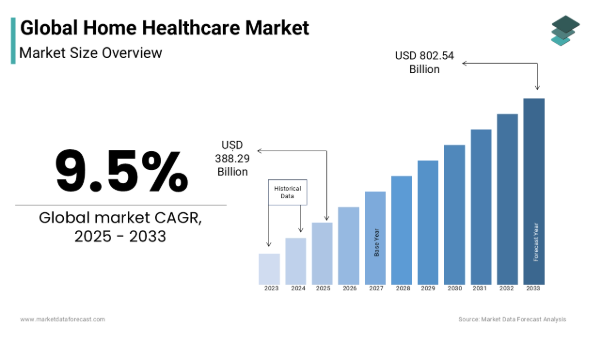

The global home healthcare market was valued at USD 354.6 billion in 2024 and is expected to expand at a CAGR of 9.5% during the forecast period. The market size is estimated to be worth 388.29 billion USD in 2025 and 802.54 billion USD by 2033.

The healthcare services provided to the patients at the convenience of the client’s home are known as home healthcare. Nurses who specialize in giving multidimensional care to patients at their homes are a way of promoting effective and efficient treatment that speeds up the recovery process. A wide range of services is included in home healthcare, such as wound care, disease management, medical equipment, therapy, and patient education. Patients who cannot do daily activities need home healthcare services to lead a quality life. The necessity for the home healthcare service is going beyond in today’s world culture. The launch of tailored services according to the patient’s condition and requirement shall also boost the growth rate of the home healthcare market. In emerging countries like India and China, home healthcare services are the latest trend, and the need for rehabilitation after hospitalization is setting up new opportunities for the market to grow in the coming years.

According to the National Library of Medicine, the demand for home healthcare services in China is presently booming in a way that reduces the cost for patients who are seeking medical treatment in remote areas. In China, it is estimated that by the end of 2030, 17% of the population will be above the age of 80 years, and the necessity for home healthcare services is likely to expand. In China alone, 46% and 38% of people are suffering from multiple diseases and functional impairment, respectively. Studies also reveal that the demand for home healthcare services in Japan and the United States is dramatically increasing with respect to the shortage of hospital beds for inpatients.

MARKET DRIVERS

The growing aging population, rising prevalence of chronic diseases and increasing demand for personal medical care services propel the home healthcare market growth. The population entering the age group of 60 and above is rapidly growing in parts of the world. Unlike the younger generation, aged people are more likely to visit hospitals for healthcare needs. As it is difficult to visit hospitals, people have been migrating towards home healthcare. According to the World Health Organization (WHO), there were 703 million people over the age of 65 in 2019. The number of older people to double by 2050 to 1.5 billion.

Technological advancements in-home medical devices, a growing patient population suffering from chronic diseases, a rising preference for home-based care among patients, and the cost-effectiveness of home healthcare compared to hospital care are boosting the growth rate of the global home healthcare market.

The comfort and familiar environment associated with home healthcare to patients, the shift towards value-based healthcare models, growing healthcare access in rural areas, increasing demand for palliative and end-of-life care, and increasing awareness among people regarding the impact of home healthcare in reducing readmission rates are supporting the expansion of the home healthcare market. The demand for agency management software is growing rapidly in the global home healthcare market due to its increasing use in roaster planning, billing, remote patient monitoring, and operational record keeping. The rising medical costs, increasing demand for affordable treatment, rapid adoption of technological improvements in the pharmaceutical and medical science fields, and growing support for home healthcare from the governments of various countries are boosting the expansion of the global market. The adoption of home healthcare is on the rise among patients suffering from cancer and kidney diseases and growth in the patient population suffering from these diseases is estimated to contribute to the global market growth.

MARKET RESTRAINTS

Reluctance to adopt home healthcare services in undeveloped countries due to various aspects hinders market growth. Due to a lack of complete knowledge of the advantages of nursing services at home, few people show interest in receiving quality services in hospitals. The rising number of unlicensed nursing people is another factor that can impede the market’s growth rate. Lack of transparency among healthcare professionals and continuously rising healthcare costs, which is a burden for the common people, shall limit the growth rate of the home healthcare market. According to the American Medical Association (AMA), the cost of healthcare is rising every year in unusual ways, which is becoming a huge burden to the provision of advanced treatment for the common people. This association estimates that healthcare costs will rise by about 4.5% annually in the United States.

In addition, the difficulty of arranging highly experienced nursing care for people at affordable prices hurts the home healthcare market’s growth rate. Giving high-quality medical services at a specific time is impossible for caregivers. The physician has to spend more time treating the patient, and only a few patients can cover it during the day; therefore, the payment for these services is very high comparatively. Besides this, there is a huge risk concerning the patient, as it is slightly difficult for the nurses to keep the environment as hygienic as in the hospital. Also, the communication gap between the caregiver and the patient may stinge the growth rate of the home healthcare market.

MARKET OPPORTUNITIES

The emergence of the most advanced technologies in the healthcare industry is a boom for expanding home care services with the integration of various software solutions. The integration of I.T. with the healthcare industry is posing many growth opportunities for the market to grow soon. The world is swiftly adopting new technologies to lead a happy and healthy life. The growing expenses in healthcare and the rising prominence of favorable insurance policies by both the private and public sectors, especially in emerging countries like India and China, are likely to fuel the growth rate of the home healthcare market. For instance, the partnerships between the public and private sectors in China, especially in the healthcare industry, are attributed to prompting new opportunities to expand home healthcare services in China. The partnership between the public and private sectors in the healthcare industry shall focus on improving the healthcare infrastructure with huge investments. Healthcare expenditure is steadily increasing, especially in India and China, which is accounted for, prompting the growth rate of the home healthcare market. In 2021, the National Health Commission and the National Administration of Traditional Chinese Medicine jointly made efforts to promote home-based healthcare services, especially for geriatric people.

In addition, the launch of various healthcare insurance policies in favor of the public is leveraging the new opportunities for home healthcare services. For instance, more than 92% of people in the United States have health insurance policies that further help in having prominent healthcare services.

MARKET CHALLENGES

The high cost of installation and maintenance of the equipment, which is highly necessary for some of the patients who are suffering from chronic diseases and need continuous support, is likely to be one of the challenging factors for the market. The most advanced home care services are not for middle-class economy people due to their high-cost factor. Alongside, the rising global economy prices may also act as a barrier for the growth rate of the market in the coming years. According to the United Nations World Economic Situation and Prospects (WESP), developed and developing countries are facing huge uncertainties due to the emergence of COVID-19, the war between Ukraine and Russia, and others. However, many top companies are investing considerable amounts to launch affordable homecare services with advanced technology that will progress the market's growth opportunities in the coming period. People’s interest in living a more independent life with the help of these services is likely to overcome all the challenges with the adoption of advanced technologies in the near future.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Type, Services Type, Software and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

Almost Family Inc., Amedisys Inc., General Electric Company (GE), Kinner Software Inc., Omron Corporation, Linde Group, Roche Holding AG, Philips Healthcare, Mckesson Corporation, LHC Group Inc., Kindred Healthcare, Fresenius Se & Co Kgaa, Abbott Laboratories, and Apria Healthcare Group. |

SEGMENTAL ANALYSIS

By Product Type Insights

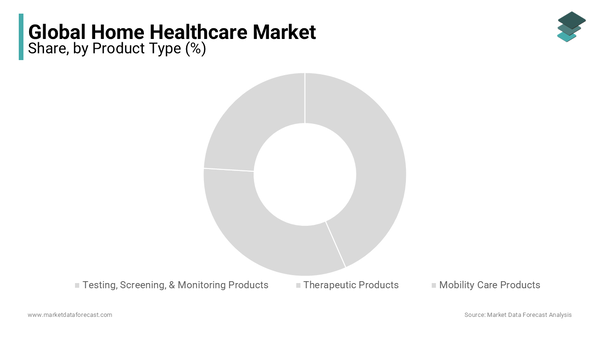

The testing, screening & monitoring segment dominated the market and accounted for 46.2% of the worldwide market share in 2024 and is expected to grow at a CAGR of 6.44% during the forecast period. The growing emphasis on preventive healthcare and the rising prevalence of chronic diseases are primarily propelling the expansion of the worldwide market's testing, screening, and monitoring segment. For instance, more than 70% of patients prefer home monitoring devices for managing chronic conditions. The rising awareness about early disease detection and prevention among consumers is further contributing to the segmental growth.

The mobility care products segment is anticipated to rapidly expand during the forecast period, growing at a CAGR of 8.44%. People who are aged have a higher incidence of mobility-related health issues. Therefore, the growing aging population worldwide is one of the major drivers of the growth of the mobility care products segment in the global market. For instance, 80% of seniors prefer to age in place. An increase in government initiatives to promote home healthcare and accessibility for the elderly and disabled and the growing adoption of technological advancements to develop innovative and lightweight mobility devices further support the growth rate of the mobility care products segment in the global market.

By Type Insights

The home telehealth monitoring devices segment led the market and occupied 40.9% of the worldwide market share in 2023. The domination of the home telehealth monitoring devices segment is majorly attributed to the rising preference for home-based healthcare solutions due to convenience and cost-effectiveness, increasing patient population suffering from various diseases, and growing adoption of technological developments such as wearable devices and IoT integration to enhance the capabilities and accuracy of home monitoring.

The home telehealth software segment is expected to grow at the fastest and showcase a CAGR of 13.88% during the forecast period. The growing demand for comprehensive electronic health record (EHR) systems for remote patient monitoring and management and integration of artificial intelligence (AI) and machine learning to offer personalized healthcare insights and predictive analytics are contributing to the growth of the home telehealth software segment.

By Software Insights

Based on software, the agency software segment accounted for 43.7% of the global market share in 2024 and is expected to grow at a healthy CAGR during the forecast period. Agency software streamlines administrative tasks, enhances communication between caregivers and patients, and ensures compliance with regulations. Over 70% of home healthcare agencies worldwide utilize agency software for scheduling, billing, and patient management.

The clinical management systems segment is another promising segment and is estimated to grow at a notable CAGR during the forecast period owing to the growing emphasis on integrating electronic health records (EHR) and clinical management systems. There is no doubt that Information Technology (I.T.) is enhancing home healthcare services with various designs, which is attributed to elevating the growth rate of the market. In this modern era, people are more aware of the availability of various treatment procedures, which is deemed to raise the R&D activities to launch even more innovative treatment procedures simply at home at affordable prices.

REGIONAL ANALYSIS

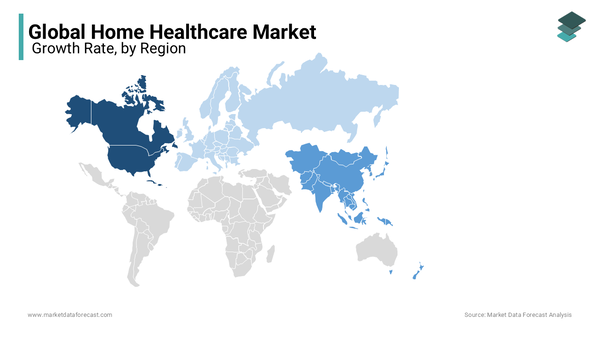

North America outperformed all the other regions and emerged as the most dominating regional segment for home healthcare worldwide, accounting for 40.1% of the worldwide market share. The North American region is also expected to grow at a healthy CAGR during the forecast period owing to the growing demand for home healthcare services, favorable reimbursement policies, technological advancements, and the shift towards value-based care models. The U.S. occupied the largest share of the North American market in 2023 and is predicted to continue the trend throughout the forecast period due to the rapid adoption of home healthcare services. For instance, more than 12 million individuals receive home healthcare services annually in the U.S. According to the Centre for Medicare and Medicaid Services (CMS), more than 2.4 billion people in the U.S. benefit from home healthcare services.

The Asia-Pacific region is predicted to grow rapidly during the forecast period and witness a CAGR of 11.48% during the forecast period. Factors such as the growing elderly population, rising healthcare expenditures, increasing awareness about home-based care options, initiatives of Asia-Pacific governments to improve healthcare access, growing investments in healthcare infrastructure, and quick advancements of healthcare technologies are propelling the home healthcare market growth in the Asia-Pacific region. China, India, and Japan are estimated to account for the major share of the Asia-Pacific market during the forecast period. In the last couple of years, the Healthcare industry in India has emerged with the latest advancements, like quickly adopting digital health applications that are making people adopt home healthcare services post-hospitalization. The government supports home care professionals by recognizing them as allied healthcare professionals, which is ascribed to leveraging the growth rate of the market. The rising number of elderly people is likely to fuel the growth rate of the home healthcare market. According to the United Nations Population Fund, the elderly population in India is expected to reach 347 million by the end of 2050. The growing economy is also one of the factors leading to the growth rate of the home healthcare market in India. Indian government is far looking to possible ways in launching various schemes that help elderly people like National Programme for Health Care for Elderly (NPHCE), and National Social Assistance Programme (NSAP) among others.

Europe was the second-largest regional segment in the global home healthcare market in 2023 and is estimated to grow at a prominent CAGR during the forecast period. Factors such as the increasing number of initiatives from the governments of European countries to support home-based care, growing investments in healthcare infrastructure, rising emphasis on reducing healthcare costs and improving patient outcomes, and rapid adoption of technological advancements in remote monitoring and telemedicine are propelling the growth of the European market. Germany is expected to hold the major share of the European market during the forecast period due to the growing number of patients availing of home healthcare services.

KEY MARKET PARTICIPANTS

Companies playing a key role in the global home healthcare market include Almost Family Inc., Amedisys Inc., General Electric Company (G.E.), Kinner Software Inc., Omron Corporation, Linde Group, Roche Holding AG, Philips Healthcare, Mckesson Corporation, LHC Group Inc., Kindred Healthcare, Fresenius Se & Co Kgaa, Abbott Laboratories, and Apria Healthcare Group.

RECENT MARKET DEVELOPMENTS

In 2023, Omron Corporation in India collaborated with AliveCor to create awareness of the prevention of heart-related diseases. AliveCor is a global leader in introducing the technology of the FDA-cleared and CE-marked personal electrocardiogram. Both aim to launch new devices with new AI-based technology that can detect or manage the signs of heart attacks as early as possible. Detecting the early signs of heart attacks with these devices helps in combating the risk of death by providing the essential treatment procedure in the meantime.

In 2024, GE Healthcare is likely to extend its reach to patient monitoring tech with the help of virtual care company Biofourmis. These companies' collaborations shall deliver innovative care-at-home solutions with FDA-approved AI algorithms, clinical-grade wearable devices, and in-home services. This agreement is estimated to leverage GE’s product portfolio in supporting patient care at home with the most advanced technologies.

MARKET SEGMENTATION

The global home healthcare market research report has been segmented and sub-segmented based on product type, service type, software, and region.

By Product Type

- Testing, Screening, & Monitoring Products

- Therapeutic Products

- Mobility Care Products

By Type

- Home Telehealth Monitoring Devices

- Home Telehealth Services

- Home Telehealth Software

By Services Type

- Rehabilitation Therapy Services

- Infusion Therapy Services

- Unskilled Care Services

- Respiratory Therapy Services

- Pregnancy Care Services

- Skilled Nursing Care Services

- Hospice

- Palliative Care Services

By Software

- Agency Software

- Clinical Management Systems

- Hospice Solutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How large is the home healthcare market?

As per our research report, the size of the global home healthcare market is predicted to achieve USD 802.54 billion by 2033.

Is home healthcare market on the rise?

Yes, the global market for home healthcare is expected to rise at a CAGR of 9.5% from 2025 to 2033.

Which region led the home healthcare market in 2024?

The North American regional market accounted for the largest share of the global home healthcare market in 2024.

Does this report include the impact of COVID-19 on the home healthcare market?

Yes, this report includes the COVID-19 impact on the global home healthcare market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com