Global Biomass Power Generation Market Research Report – Segmented By Feedstock (Solid, Liquid and Biofuels), By Technology (Combustion and Gasification) and By Region (North America, Europe, Asia Pacific, Latin America, & Middle East - Africa) – Industry Forecast 2024 to 2032.

Global Biomass Power Generation Market Size (2024 to 2032):

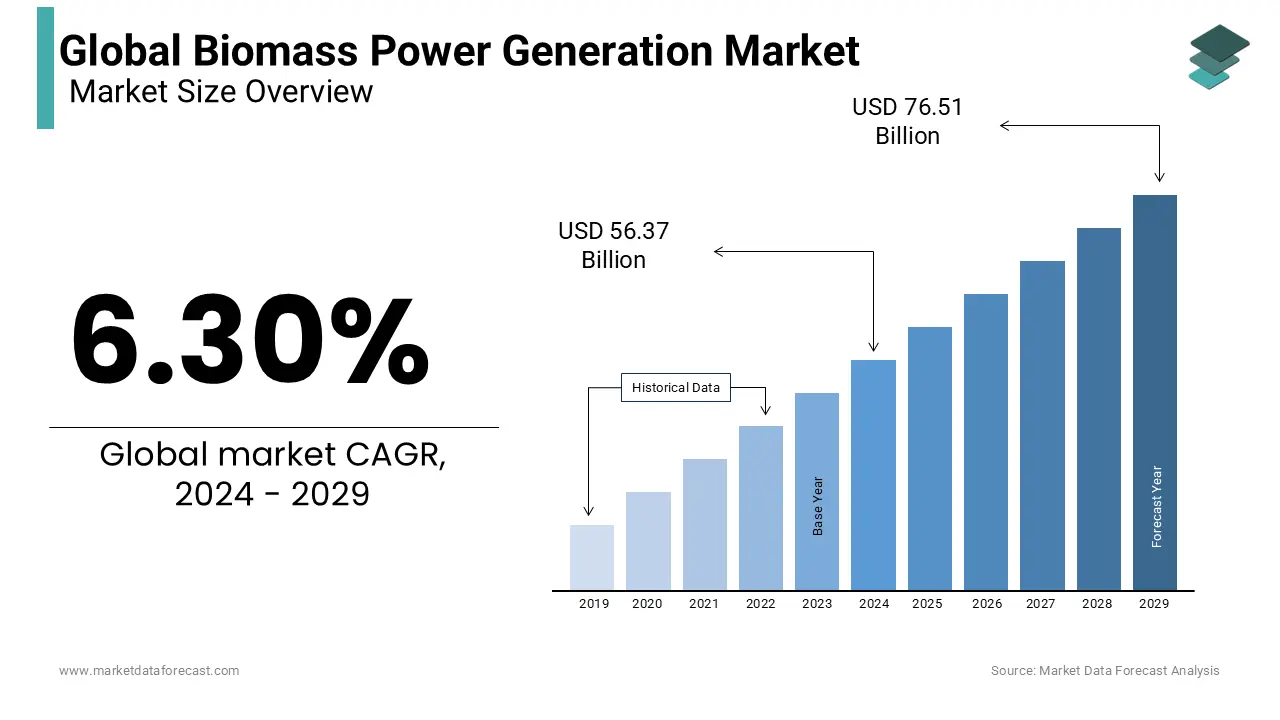

The Global Biomass Power Generation Market size was valued at USD 53.03 billion in 2023 and is projected to reach a valuation of USD 91.90 billion by 2032 from USD 56.37 billion in 2024 and is projected to exhibit a compound annual growth rate (CAGR) of 6.30% from 2024 to 2032.

Current Scenario of the Global Biomass Power Generation Market

The market is currently driven due to the abundant availability of biomass or raw materials, reduction of dependence on fossil fuels, absence of harmful emissions, and greater attention to the use of clean energy. Biomass gasification is the process by which solid fuels (biomass) such as wood, wood waste, and agricultural residues are converted into a mixture of combustible gases known as producer gas or synthesis gas. This is done through a sequence of thermochemical reactions using heat, pressure, and partial combustion that occur when the supply of air (O2) is less than adequate to complete the biomass combustion process.

MARKET TRENDS

Biomass refers to waste from the food processing industries, urban and industrial waste, agricultural and wood waste, lumber, sawdust, short rotation woody crops, and a number of other materials. It is employed as an energy source for the production of electricity, the supply of heat, and as a fuel in the transport sector. Biomass is a green, carbon-neutral, and sustainable source of electricity generation with significant potential to reduce dependence on fossil fuels.

MARKET DRIVERS

Favourable government regulations encouraging thermal power plants to switch from coal to cleaner fuels such as biomass are predicted to play a critical role in expanding the biomass power generation market during the foreseen period.

Biomass generates bioenergy that is employed in various end-use markets to minimize dependence on fossil fuels, reduce greenhouse gas (GHG) emissions, and improve the security of the energy supply. Furthermore, the decrease in the use of coal, as well as the escalating use of woody biomass for decentralized electricity generation, is predicted to have a positive influence on the industry outlook. Furthermore, new developments to use more biomass as fuel are predicted to drive expansion in the regional market. Biomass serves as a sustainable, low-carbon alternative to conventional fossil fuels while allowing local groups to utilize nationally available biomass sources. It enables the efficient use of crop residues, unemployed portions of municipal waste, and wood manufacturing residues.

MARKET OPPORTUNITIES

The US biomass power generation market is predicted to experience substantial expansion due to the escalating implementation of climate change laws that require the use of renewable sources for power generation. Biomass fuels are employed as the main source of energy in the United States and are derived primarily from biomass derived from wood and municipal residual biomass. Government organizations are emphasizing the use of biomass for power generation as part of energy efficiency and security strategy. These initiatives aim to increase the share of clean renewables in the overall energy mix of national economies. Market developments and recent policy changes in emerging countries are predicted to provide positive prospects for biomass power generation market expansion.

IMPACT OF COVID-19 ON THE BIOMASS POWER GENERATION MARKET

The coronavirus has definitely pushed the O&G industry to sit down and reconsider what should be included in business continuity plans. However, leaders who take this opportunity to start thinking about the pervasive changes needed to their operating models, using a combination of an agile operating mindset, a long-term vision, and partner ecosystems, faster than others, will probably come out stronger as the dust settles. The O&G industry is generally competent in disaster response and its effectiveness has been demonstrated in a variety of disaster scenarios in the past. With COVID-19 as well, the industry has performed quite well so far, as evidenced by near-continuous operations and the availability of different fuels, almost throughout the country. However, most O&G CXOs believe that the sector's recovery is likely to be longer than predicted.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.30% |

|

Segments Covered |

By Feedstock, Technology, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Acciona SA, Ameresco Inc., Andritz AG, Babcock & Wilcox Enterprises Inc., E.ON SE, General Electric Co., John Wood Group Plc, Thermax Ltd., Valmet Oyj, Vattenfall AB, and Others. |

SEGMENTAL ANALYSIS

Biomass Power Generation Market Analysis By Feedstock:

The solid biofuels segment accounted for the majority of revenues with 81.1% in 2021. Solid biomass, such as crop residues, sawdust, and wood, is employed directly or transformed into charcoal and briquettes for power generation, kitchen, and heating. However, burning solid biomass leads to a worsening of serious climate change problems, which may hamper segment expansion during the foreseen period. Liquid biofuels include ethanol produced from grains and biodiesel produced from trans-esterified vegetable oils blended with diesel. Biofuel is employed as an alternative to internal combustion engines fueled by kerosene, diesel, or gasoline, including its use in aeroplanes, ships, trucks, and passenger vehicles. Furthermore, advanced liquid biofuels can provide an 80% reduction in emissions in aviation, heavy cargo, and shipping. The commercialization of the technology is predicted to stimulate the expansion of advanced biofuels during the foreseen period.

Biomass Power Generation Market Analysis By Technology:

In 2023, the combustion segment held the largest share of revenue with over 79%, and will maintain the dominant position for the anticipated years. Direct biomass combustion technology has relatively simple operations, higher reliability, and lower cost compared to other advanced Biomass Power technologies. However, the segment may experience a decline with other efficient technologies taking over the market. The gasification segment is predicted to achieve the fastest expansion rate during the foreseen period due to the high operating efficiency of the process. The gasification segment is predicted to achieve the fastest expansion rate during the foreseen period due to the high operating efficiency of the process. The process converts solid biomass into gaseous fuels that are then employed to generate electricity, with the remaining gas employed as synthesis gas in chemical industries.

REGIONAL ANALYSIS

Europe is currently the largest Biomass Power Generation market accounting for 35% of total energy production from biomass, followed by North America. Europe accounted for the largest share of 36.1% in 2023 due to favourable environmental regulations implemented in the region to maximize bioenergy potential in various countries. Countries such as Finland, France, Sweden, and Germany have abundant availability of forest residues and large forest industries, which will ensure the strong expansion of the regional Biomass Power Generation market during the foreseen period. North America is predicted to experience considerable expansion over the next several years, with the United States being the largest contributor to revenue. The growing trend to produce electricity from biomass provides valuable waste disposal services, which would otherwise be openly burned, thus reducing environmental impact and supporting the call for the Biomass Power Generation market in the region.

Asia-Pacific is supposed to be the fastest growing region from 2024 - 2032 due to the abundant availability and large base of biomass feedstocks in emerging economies such as China and India. Furthermore, biogas digesters are heavily subsidized in some parts of the region. The production of biogas by anaerobic digestion allows the systematic management of large amounts of animal manure and the efficient production of gas for power generation, lighting, and cooking. APAC was the largest biomass power generation market in 2023, and the region will provide several expansion opportunities to market providers during the foreseen period. The abundance of various forms of waste, such as agro-industrial waste, woody biomass, agricultural waste, municipal solid waste, and animal waste, will significantly drive the expansion of the biomass power generation market in this region during the conjecture period. 50% of the market expansion will come from APAC during the foreseen period. China and India are the main markets for electricity generation from biomass in the APAC region. Market expansion in this region will be faster than market expansion in other regions.

KEY PLAYERS IN THE GLOBAL BIOMASS POWER GENERATION MARKET

Companies playing a prominent role in the global biomass power generation market include Acciona SA, Ameresco Inc., Andritz AG, Babcock & Wilcox Enterprises Inc., E.ON SE, General Electric Co., John Wood Group Plc, Thermax Ltd., Valmet Oyj, Vattenfall AB, and Others.

RECENT HAPPENINGS IN THE GLOBAL BIOMASS POWER GENERATION MARKET

- IT Tech Packaging, Inc. begins construction of a combined biomass heat and power project.

- Cuba launched the first biomass power plant. The facility will burn bagasse, sugarcane grinding residues, and chips from the invasive marabou grass that Cuba has been trying to contain for years because it extends beyond agricultural lands.

DETAILED SEGMENTATION OF THE GLOBAL BIOMASS POWER GENERATION MARKET INCLUDED IN THIS REPORT

This global biomass power generation market research report has been segmented and sub-segmented based on feedstock, technology and region.

By Feedstock:

- Solid

- Liquid

- Biofuels

By Technology:

- Combustion

- Gasification

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Biomass Power Generation Market growth rate during the projection period?

The Global Biomass Power Generation Market is expected to grow with a CAGR of 6.30% between 2024-2032.

2. What can be the total Biomass Power Generation Market value?

The Global Biomass Power Generation Market size is expected to reach a revised size of USD 91.90 billion by 2032.

3. Name any three Biomass Power Generation Market key players?

General Electric Co., John Wood Group Plc, and Thermax Ltd are the three Biomass Power Generation Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com