Global Biomass Boiler Market Research Report – Segmented By Feedstock (Woody Biomass, Agricultural Biomass, Urban Residue), By Technology (Stoker Boiler, Fluidized Bed Boiler) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032)

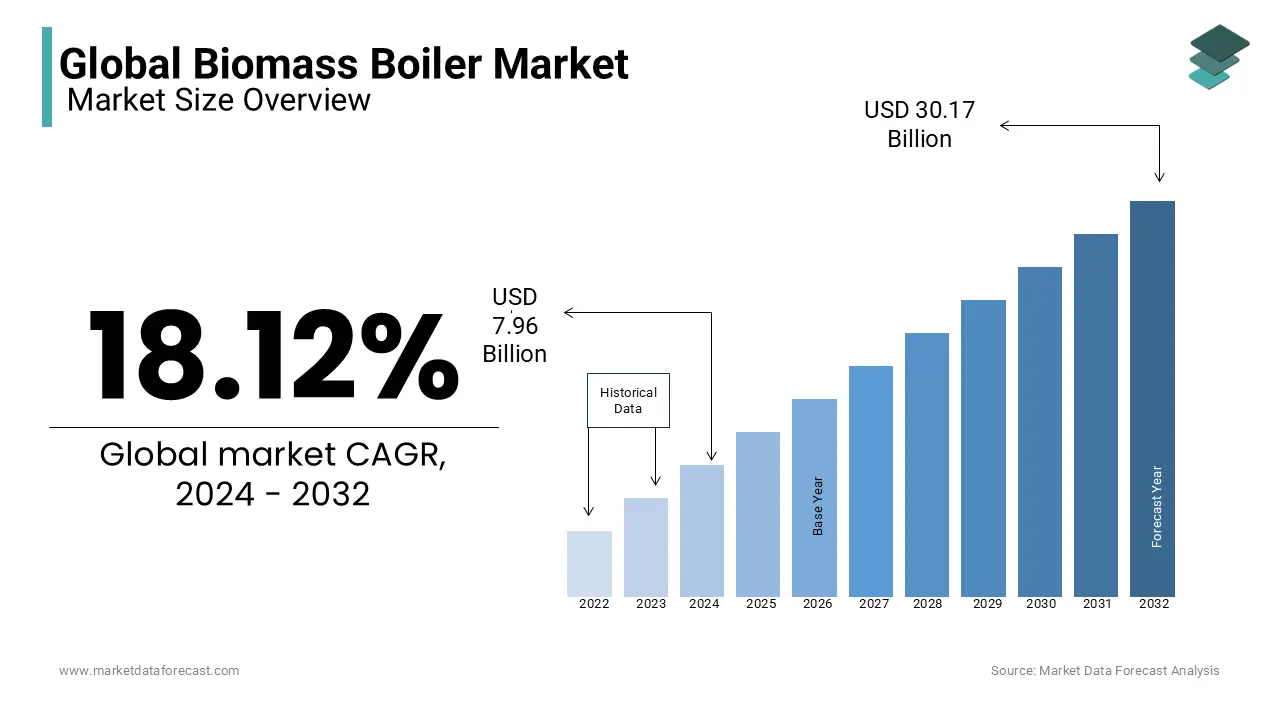

Global Biomass Boiler Market Size (2024-2032):

The size of the global biomass boiler market was worth US$ 6.74 billion in 2023. The global market is anticipated to grow at a CAGR of 18.12% from 2024 to 2032 and be worth US$ 30.17 billion by 2032 from US$ 7.96 billion in 2024.

MARKET SCENARIO

The biomass boiler is defined as a biomass heating system. It generates heat by burning agricultural and forestry residues, burning logs, wood pellets, and more. It produces heat mainly by burning wood. Biomass boilers are widely employed by hotels, farms, homes, and others. In addition, biomass boilers help reduce greenhouse gas emissions due to their low carbon footprint. Biomass boilers are employed to burn logs, chips, or pellets to generate heat to heat water or electrically heat. The installation of a biomass boiler is very simple. This is a larger gas than normal, so it will take up enough space for fuel storage and the boiler. Biomass boilers are very popular because they emit little carbon dioxide. Biomass boilers are installed in many areas such as commercial buildings, district heating, universities, hospitals, hotels, farms, community centres, and homes. Also, the factors driving the expansion of the biomass boiler market include increasingly stringent government regulations along with an escalated awareness that increases environmental risks. Additionally, woody biomass by feedstock type is the largest feedstock segment in 2021 for heat production and is supposed to continue to dominate by the end of 2026. Furthermore, the biomass driver by product type accounted for the largest market share in 2023.

MARKET TRENDS

The implementation of boiler standards across the world during the foreseen period is supposed to drive high investments in the global biomass boiler market. The regulatory framework and government support in the form of subsidies and tax rebates for power generation projects around the world using cleaner energy sources are also predicted to boost the worldwide biomass boilers market. The escalated call for efficient heating systems is the main driver of the expansion of this market. Due to improving living standards and colder climatic conditions, heating systems have become a necessity in both developed and developing countries. Therefore, the governments of these countries support the installation of energy production facilities from renewable resources through incentives, subsidies, and regulations.

MARKET DRIVERS

Biomass boilers offer a variety of economic and environmental benefits due to the renewable and low-carbon nature of biomass. The renewable nature of biomass has made it necessary to increase the installation of biomass boilers in developed and developing countries. In addition, various government policies that aim to increase the call for renewable energy as an important step towards regulating carbon emission levels are another factor leading to market expansion. Additionally, regulatory frameworks and government subsidies provide investment subsidies and tax benefits to industries that use renewable energy. This encourages biomass heating companies to switch to biomass at a higher level, leading to the expansion of the biomass boiler market.

MARKET RESTRAINTS

The decline in overall biomass efficiency over time, along with escalated pollutant emissions and ash deposition, are some of the issues likely to hamper market expansion. However, despite the number of advantages of the biomass system, there are some concerns about the local environment, which can have a negative impact due to the atmospheric emissions of the biomass systems. It can negatively affect local air quality and human health, which is predicted to hamper market expansion. Furthermore, the control of biomass boilers is complex and significantly more complex than the control of a gas or oil heating system, which also limits the expansion of the market.

MARKET OPPORTUNITIES

One of the main factors driving the expansion of this market is escalated capacity additions in the sugar, rice, biorefinery, and pulp and paper industries. These industries generate a significant amount of agricultural waste and wood biomass, which can be burned as fuel in biomass plants. The call for ethanol increases the need for agricultural waste biomass boilers and biomass wood. Therefore, adding capacity from these industries will support biomass boiler market expansion during the foreseen period.

MARKET CHALLENGES

Wood mass is one of the most widely employed fuels in biomass power plants because it is readily available. However, its transportation cost to the industrial site is high due to its high calorific value.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

18.12% |

|

Segments Covered |

By Feedstock, Technology, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alstom, Amec Foster Wheeler, Baxi, Eco Vision, Hurst, Bharat Heavy Electricals, Ansaldo, Siemens, Innasol Limited, WDS Green Energy Limited, Dongfang Electric, Mitsubishi Hitachi Power Sytems, IHI, Harbin Electric, Doosan Heavy Industries, Thermax, and Others. |

SEGMENTAL ANALYSIS

Global Biomass Boiler Market Analysis By Feedstock

The woody biomass segment is estimated to represent more than 52% of the total market share in 2026. The escalated use of short-rotation woody crops, which recycle nutrients and help conserve water and soil, is a critical factor that stimulates prospects for the expansion of this market segment during the foreseen period.

Global Biomass Boiler Market Analysis By Technology

In this market study, analysts estimated that the heating boiler segment was the largest market segment during the foreseen period. Its ability to burn a type of fuel for heat production is a notable factor driving its adoption during the foreseen period. Furthermore, advantages such as its high efficiency and low cost of ownership will translate into an impressive market share of this segment of more than 79% by 2026.

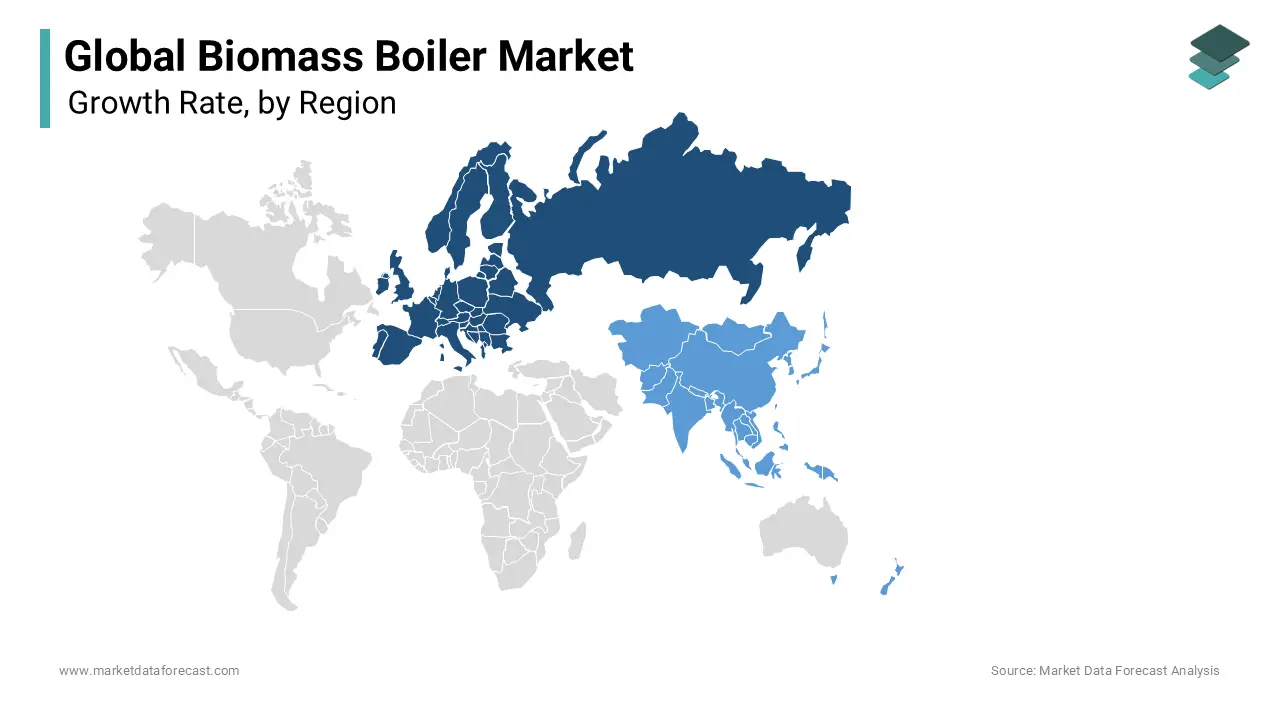

REGIONAL ANALYSIS

In geographical terms, Europe is predicted to dominate the worldwide biomass boiler market during the foreseen period. Furthermore, the Europe region in 2021 accounted for the highest market share of 36% in the overall biomass boiler market. Europe is predicted to experience significant expansion due to the strict regulations adopted by the government regarding greenhouse gas emissions. The main countries that have seen an increase in the call for biomass boilers are the United Kingdom and France. In addition, the implementation of government programs such as Renewable Heating Incentives (RHI) to reduce the use of fossil fuels is also planned to support the expansion of the biomass boiler market in this region. North America is the second largest market for biomass boilers due to the growing awareness among the population to adopt energy-saving solutions like biomass boilers to reduce greenhouse gas emissions. Furthermore, the United States is the dominant country in this region.

Asia-Pacific is predicted to be the fastest-growing biomass boiler market during the foreseen period. Furthermore, rapid urbanization and the escalating adoption of renewable heating solutions by consumers are predicted to foster the expansion of the biomass boiler market in this region. China and Japan are the dominant countries in this region due to the expansion of the infrastructure sector.

KEY PLAYERS IN THE GLOBAL BIOMASS BOILER MARKET

Companies playing a prominent role in the global biomass boiler market include Alstom, Amec Foster Wheeler, Baxi, Eco Vision, Hurst, Bharat Heavy Electricals, Ansaldo, Siemens, Innasol Limited, WDS Green Energy Limited, Dongfang Electric, Mitsubishi Hitachi Power Sytems, IHI, Harbin Electric, Doosan Heavy Industries, Thermax, and Others.

RECENT HAPPENINGS IN THE GLOBAL BIOMASS BOILER MARKET

- Cochran Launches Latest Biomass Boiler Offering. Many companies have introduced biomass products to the market in recent years, but many of them do not contribute much in terms of continuous support to the system and, in particular, integration with conventional industrial boilers.

- The Russian company Onega-Energy JSC launched the fourth biomass boiler. The new biomass boiler will have a production capacity of 14 MW and has almost completed the process of replacing inefficient heat sources at Onega-Energy JSC, such as coal.

DETAILED SEGMENTATION OF THE GLOBAL BIOMASS BOILER MARKET INCLUDED IN THIS REPORT

This research report on the global biomass boiler market has been segmented and sub-segmented based on feedstock, technology and region.

By Feedstock

- Woody Biomass

- Agricultural Biomass

- Urban Residue

By Technology

- Stoker Boiler

- Fluidized Bed Boiler

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com