Global Biometrics Market Size, Share, Trends, & Growth Forecast Report by Technology (Unimodal Biometrics, Multimodal Biometrics, Behavioural Biometrics), Component (Hardware, Software, Services), Application (Government and defense, Healthcare, Financial Services, Consumer Electronics, Transportation and Logistics), and Regional - (2025 to 2033)

Global Biometrics Market Size

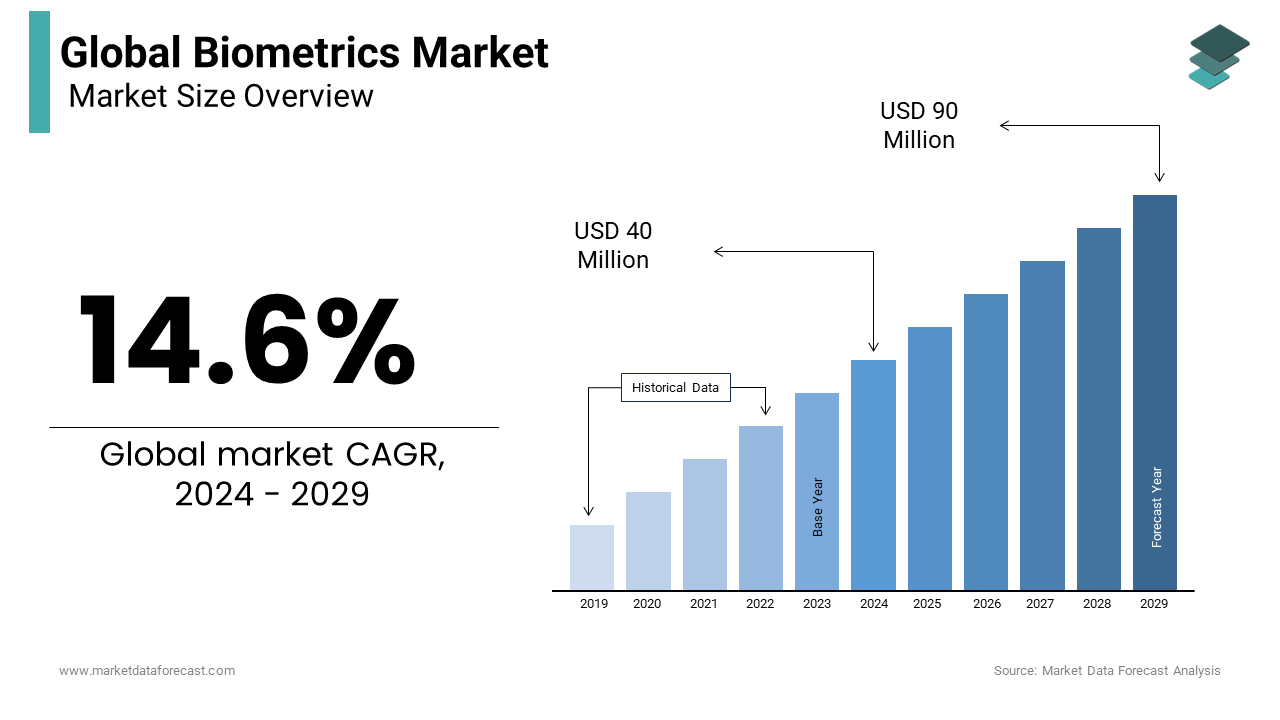

The global biometrics market was worth USD 40 million in 2024. The global market is predicted to reach USD 46 million in 2025 and USD 136 million by 2033, growing at a CAGR of 14.6% during the forecast period.

Biometrics refers to the use of distinctive physical or behavioral characteristics to identify individuals. This technology utilizes unique biological traits such as fingerprints, facial features, iris or retinal patterns, voiceprints, and even behavioral attributes like typing patterns or gait for authentication and identification purposes. Biometric systems capture and analyze these unique traits to verify or recognize an individual's identity, providing secure access to devices, systems, or facilities. It's widely used in security systems, access control, identity verification, and authentication processes due to the reliability and uniqueness of these biological features.

MARKET DRIVERS

Technological advancement acts as a transformative driver in the growth of the biometrics market. Notably, the integration of multimodal biometrics, a fusion of multiple identification methods, has significantly enhanced accuracy in identity verification.

Improved algorithms have played a pivotal role in refining the precision and reliability of biometric systems. The market's expansion is further propelled by the relentless pursuit of faster processing speeds, ensuring swift and efficient authentication processes. These advancements cater to diverse industry needs, from bolstering security in government initiatives to fortifying financial transactions and elevating user authentication experiences on consumer devices.

The Biometrics market is thriving due to escalating security concerns. Governments worldwide are increasingly adopting biometric systems for national identification and border control, propelling the market growth. Moreover, industries like banking, healthcare, and finance are integrating biometrics to fortify transaction security. As technological advancements continue and regulatory compliance becomes more stringent, the biometrics market stands at the forefront, providing innovative and secure solutions to address the evolving landscape of digital security.

MARKET RESTRAINTS

High implementation costs can significantly restrain the demand for biometrics. The adoption of biometric systems necessitates significant upfront investments in hardware, software, and infrastructure upgrades, posing a potential barrier to entry, particularly for smaller organizations. The financial commitment to deploying reliable biometric authentication solutions may strain limited budgets, hindering the widespread adoption of these technologies. Finding a balance between affordability and cutting-edge technology will be instrumental in fostering broader accessibility to biometric authentication across diverse industries and organizational sizes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.6% |

|

Segments Covered |

By Technology, Component, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

NEC Corporation, Fujitsu Limited, Thales Group, IDEMIA, HID Global, Gemalto, Crossmatch, Suprema, BioKey International, Aware Inc., Morpho (Safran Identity & Security), SecuGen, ZKTeco, Cognitec Systems, Iris ID Systems Inc., BioCatch, Nuance Communications, Auraya Systems, CyberLink, and others. |

SEGMENTAL ANALYSIS

By Technology Insights

Unimodal biometrics has the dominant market share as it involves the use of a single biometric characteristic, such as fingerprint, facial features, iris patterns, or voice, for identification or authentication. This approach is prevalent, especially in applications where a single mode of biometric data is sufficient. Unimodal biometrics are often simpler to implement, and they have found success in scenarios where a specific trait provides adequate accuracy. Common examples include fingerprint recognition for smartphone unlocking and facial recognition for access control.

Multimodal biometrics are the second dominant technology in the growth of the biometrics market. This approach improves reliability and reduces the chances of false positives or false negatives associated with individual modalities. It also offers a more robust solution by leveraging the strengths of multiple biometric characteristics.

Behavioral biometrics is to have a prominent growth rate in the biometrics market. It involves the analysis of an individual's unique behavioral patterns, such as keystroke dynamics, gait, or voice patterns, for identification. Behavioral biometrics add a layer of security by assessing patterns that are unique to individuals. This technology is often utilized in scenarios where continuous authentication or passive identification is desirable, such as in financial services for fraud prevention.

By Component Insights

Hardware holds the largest share in the biometrics market. Due to the tangible nature of the technologies involved, it is often a dominant component. The demand for biometric hardware is driven by the need for physical devices that capture and process biometric data.

Software is second in leading the prominent biometrics market value. The software's role in processing and analyzing biometric data is essential for accurate identification and authentication. Continuous advancements in algorithms contribute to improved accuracy and reliability. Software's dominance reflects the emphasis on innovation and algorithmic improvements within the industry.

Services, including deployment, maintenance, and support, are integral to the success of biometric systems. Biometric services are essential for the implementation and ongoing management of biometric systems.

By Application Insights

Due to national security concerns, the government and defense sector often dominate the biometrics market growth. Governments deploy biometrics for border control, identity verification, and access control. Defense applications include secure access to facilities and systems. Governments prioritize biometrics to enhance security, prevent fraud, and ensure accurate identification. Large-scale national ID programs and border control initiatives contribute to the dominance.

Healthcare holds the second largest market share in the area of biometrics, particularly for patient identification and secure access to medical records. Biometrics in healthcare aims to enhance data security and patient safety. The healthcare sector adopts biometrics to mitigate identity fraud, ensure accurate patient identification, and streamline access to sensitive medical information.

REGIONAL ANALYSIS

North America has been the most dominant in the biometrics market. The region strongly focuses on technological innovation, has a high level of awareness regarding security issues, and has widespread adoption in sectors such as government, finance, and enterprise.

Europe is the second most dominant player in the biometrics market due to advancements in technology and a robust regulatory environment. The General Data Protection Regulation has shaped the use of biometrics in compliance with data protection laws, fostering responsible and secure deployment.

The Asia-Pacific has seen rapid growth in biometrics adoption. China, in particular, has been a major contributor due to extensive government initiatives, large-scale projects, and a growing emphasis on technology-driven solutions.

Latin America has also shown a growing interest in biometrics, with increased adoption in sectors such as finance and government. However, economic conditions and regulatory frameworks vary across countries.

The Middle East, particularly the Gulf countries, has witnessed a rise in biometric adoption, driven by initiatives for national security and identity management.

KEY MARKET PLAYERS

NEC Corporation, Fujitsu Limited, Thales Group, IDEMIA, HID Global, Gemalto, Crossmatch, Suprema, BioKey International, Aware Inc., Morpho (Safran Identity & Security), SecuGen, ZKTeco, Cognitec Systems, Iris ID Systems Inc., BioCatch, Nuance Communications, Auraya Systems, CyberLink, and others.

MARKET SEGMENTATION

This research report on the global biometrics market has been segmented and sub-segmented based on the technology, component, application, and region.

By Technology

- Unimodal Biometrics

- Multimodal Biometrics

- Behavioural Biometrics

By Component

- Hardware

- Software

- Services

By Application

- Government and Défense

- Healthcare

- Financial Services

- Consumer Electronics

- Transportation and Logistics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the primary applications of biometric technology globally?

Biometric technology finds applications across various sectors such as government, banking and finance, healthcare, retail, and transportation for identity verification, access control, time and attendance tracking, and secure transactions.

What are the emerging trends shaping the global biometric market landscape?

Trends such as multimodal biometrics, AI-driven biometric systems, integration with IoT devices, and the use of biometrics in emerging technologies like blockchain and edge computing are shaping the evolution of the biometric market globally.

What are the major factors driving the adoption of biometric technology in emerging economies?

Factors such as increasing government initiatives for national ID programs, rising security concerns, the need for efficient authentication solutions in banking and finance, and the expanding smartphone market are driving biometric technology adoption in emerging economies globally.

How are advancements in biometric technology enhancing user experience globally?

Continuous advancements in biometric technology, such as faster and more accurate recognition algorithms, improved sensor technologies, and seamless integration with existing systems, are enhancing user experience by providing convenient, secure, and frictionless authentication solutions across various applications globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com