Global Biosensors Market Research Report - Segmentation By Type (Wearable, Non-Wearable), By Technology (Thermal, Optical, Electrochemical & other), By End-Use Industry (PoC, Food and Beverages, Home Diagnostics & Others), By Region (North America, Latin America, Europe, Asia Pacific and Middle East & Africa) - Global Industry Size, Share, Demand, Strategy, Growth & Forecast Report | 2024 to 2032.

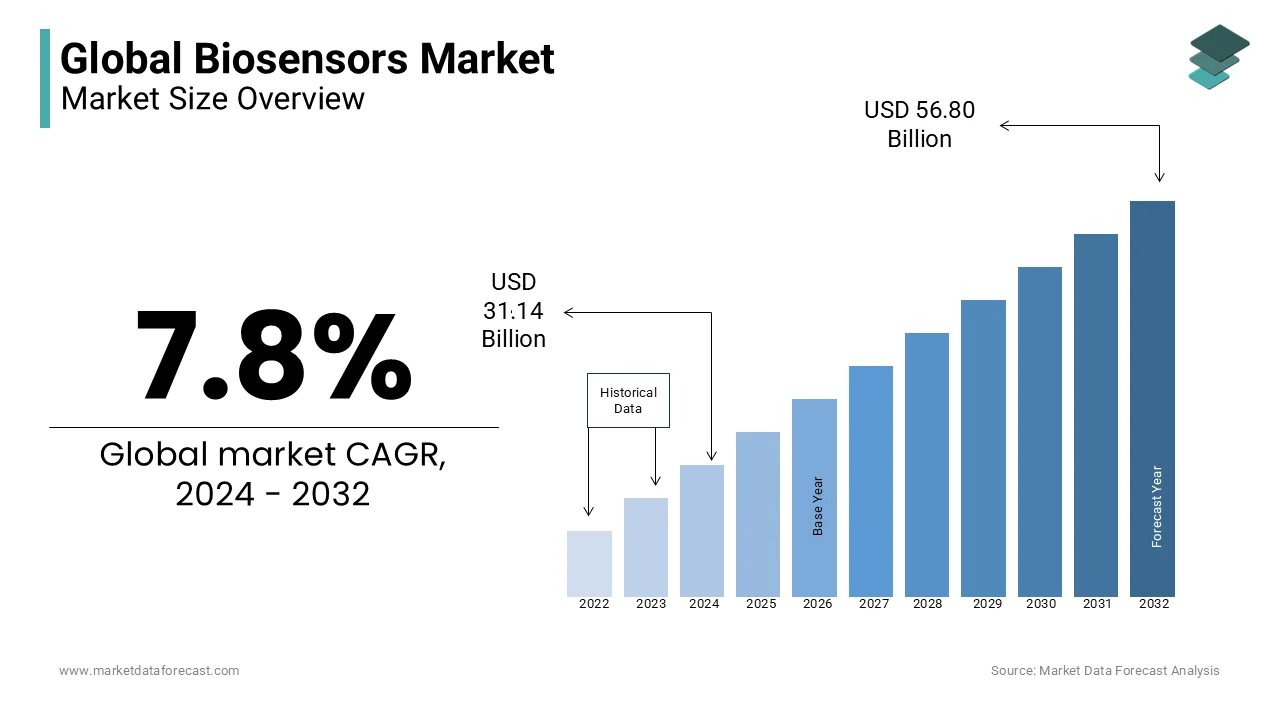

Global Biosensors Market Size (2024 to 2032)

The global biosensors market size was valued at USD 28.89 billion in 2023 and is projected to reach USD 56.80 billion by 2032 from USD 31.14 billion in 2024, with a compound annual growth rate (CAGR) of 7.8% from 2024 to 2032.

MARKET SCENARIO

Biosensors are the devices used in various sectors for the detection of biological analytes like microorganisms, and biomolecules in the medical sector and in the food industry to detect the contamination of food and external items or toxic metals. The devices used in the therapeutic and diagnostic segment would drive the biosensors market in the medical sensors segment. The market is expected to grow due to advances in technologies and new product innovations into the market.

MARKET DRIVERS

Biosensors are used in the diagnosis of the disease, point-of-care testing, and preparation of personalized medicine.

The diagnosis of the disease is very crucial in the medical sectors and has a large scope for biosensors as certain diseases like diabetes, and cancer infectious diseases require frequent diagnosis. An accurate and rapid diagnosis is possible with the point-of-care testing that can be done on-site. By monitoring the patient response biosensors are used in development of the personalized medicine. Hence, the demand for the biosensors market is growing at higher level.

The world has noticed an increased number of diabetes cases that boost the biosensors market. Diabetes increase is associated with the factors like unhealthy lifestyle, resistance to antimicrobials, smoking, and increased alcohol consumption. According to the reports of the World Health Organization (WHO) and Centers for Disease Control and Prevention (CDC), many people are expected to likely be diagnosed with diabetes which could cause the death of million due to the diabetes across world. Increased diabetes cases in the world drive the biosensors market.

MARKET RESTRAINTS

The research and development of biosensors require high costs that could limit the biosensors market.

Biosensors are associated with large data and lack of standardization limits the market demand. There is a need for software that could be compatible to work with a single-task tool of the biosensors. Government agencies and other institutions deal with large data and there is a need for a user-friendly database to reduce the time and efforts of people in analyzing them. Overcoming the statistical challenges in the integration of data and analysis requires enhanced methods. Along with this in the public sequences database, there is a constant addition of new genomes that could lead to errors and a lack of standardization for the optimum result. These limitations could impede the biosensors market growth.

MARKET OPPORTUNITIES

The Biosensors market has a good opportunity for growth as market players are introducing technology-advanced products into the market. The continuous need for the monitoring of diseases will be a demand for biosensor products. Increasing the number of wearable sensors which are having a large market share due to their usage outside of the clinical setting. The development of the new advanced biosensors in the point-of-care segment would lead the market into a positive growth phase and the increasing availability of these sensors will increase the market users across the world. With ongoing advances in technology and increasing awareness of the potential benefits of biosensors, there are significant opportunities for innovation and growth in this field.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.8% |

|

Segments Covered |

By Product, Technology, Application, and End User, and region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bio-Rad Laboratories Inc., Medtronic, Abbott Laboratories, Biosensors International Group, Ltd., Johnson & Johnson, Koninklijke Philips N.V., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, and Others. |

SEGMENTAL ANALYSIS

Global Biosensors Market Analysis By Product

The non-wearable product is expected to have a maximum share of the product segment in the Biosensor Market during the forecast period. The expected rise in the sensors could be due to the increase in the sensor’s requirement in nonclinical activities for real-time monitoring of the production process. Environmental monitoring, soil quality testing, and water quality checking are some areas where sensors can be used.

Global Biosensors Market Analysis By Technology

The electrochemical category is expected to have a large market share in the Biosensors Market. In 2022, this category has a 70.8% share. It can be used in most measurements and analyses of biochemical and biological processes. The benefits of the use of electrochemical category sensors are low detection limit, excellent stability, and wide linear response range which helps to penetrate the market. The next high market share category is the optical segment as the need for optical biosensors is expected to increase over a period. These factors can analyze the receptor-cell interaction, fermentation monitoring, concentration, and structure research could make the optical biosensors increase their market share.

Global Biosensors Market Analysis By Application

The medical testing category is expected to have a high market share in the biosensor application segment during the forecast period. In 2022, it had a market share of around 66%. It is used to analyze cholesterol testing, check blood glucose, pregnancy test, drug discovery, and various finding various health disorders. Used in the applications like identification and monitoring of various medical disorders like diabetes and cancer. Agriculture is the next expected high market share category. To identify the natural threats and bioterrorism occurring in livestock and crops biosensors are used as they can identify the causal organism quickly and accurately. The identification of the heavy metal, the presence of herbicides and insecticides/pesticides in the groundwater, or the soil biosensors are the best method.

Global Biosensors Market Analysis By End User

The point-of-care category is expected to have a high market share during the forecast period. In terms of the revenue in 2022, it had a share of 46.6%. The introduction of innovative products and technological advancement would be a key driver for the category to be outstanding in the end-user segment. It can be used to detect organic fluids like urine, saliva, and blood. The next fast-growing category would be the food industry. Due to its wide application in the food industry like the food processing sector including the hygiene analysis. It can be used in the fast analysis of the freshness of the product.

REGIONAL ANALYSIS

North America is expected to have a high global revenue share during the forecast period. In 2022, the revenue of 38.7% is noticed. The presence of many key players and increasing targeted diseases would drive the market in this region. The region has improved technology and increased market penetration by introducing diagnostic equipment like Electronic Medical Records (EMR).

Middle East and Africa is the next high revenue-generating region in the biosensors market. This region has significant medical equipment used in the medical treatment of target diseases like cancer, diabetes, and others. There has been a noticeable increase in health care expenditures and increased awareness among the people of this region, which has increased the market growth.

KEY PLAYERS IN THE GLOBAL BIOSENSORS MARKET

Companies playing a prominent role in the global biosensors market include Bio-Rad Laboratories Inc., Medtronic, Abbott Laboratories, Biosensors International Group, Ltd., Johnson & Johnson, Koninklijke Philips N.V., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, and Others.

RECENT HAPPENINGS IN THE GLOBAL BIOSENSORS MARKET

-

In August 2022, the first commercially available protein-responsive nano biosensors had developed by NanoDx, Inc., and SkyWater Technology.

-

In 2020, the first antibody test for SARS-CoV-2 is released by Roche Diagnostics in collaboration with SD Biosensors Inc. The first antibody test for SARS-CoV-2 is used in the Point-of-care category.

-

In 2020, the Europe biosensors market will have the Libre Sense glucose sports biosensors according to Abbott Laboratories. The most advanced technology called CGM technology is used in this to aid the sports person understand the relationship between blood glucose levels and performance in sports. This would help the company expand in consumer numbers.

DETAILED SEGMENTATION OF THE GLOBAL BIOSENSORS MARKET INCLUDED IN THIS REPORT

This research report on the global biosensors market has been segmented and sub-segmented based on product, technology, application, end-user, and region.

By Product

- Wearable

- Non-Wearable

By Technology

- Electrochemical

- Optical

- Thermal

- Piezoelectric

- Nanomechanical

By Application

- Medical Testing

- Industrial Process

- Food Toxicity

- Environment

- Agricultural Testing

By End User

- Point-of-Care Testing

- Home Diagnostics

- Research Laboratories

- Security and Bio-Defense

- Food Industry

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What was the Biosensors market size in 2023, and what is the projected size by 2029?

The Biosensors market was valued at USD 28.89 billion in 2023 and is projected to reach USD 45.34 billion by 2029, with a compound annual growth rate (CAGR) of 7.8% from 2024 to 2029.

What are the primary drivers and opportunities fueling the growth of the Biosensors Market?

Biosensors are crucial for disease diagnosis, point-of-care testing, and personalized medicine. The increasing prevalence of diseases like diabetes is driving market growth. Opportunities lie in technology advancements, wearable sensors, and point-of-care segment development.

How has COVID-19 impacted the Biosensors Market, and what are some recent developments?

COVID-19 increased the demand for biosensors due to their use in early symptom detection. Recent developments include the introduction of protein-responsive nano biosensors, antibody tests for SARS-CoV-2, and glucose sports biosensors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com