Global Blockchain in Telecom Market Size, Share, Trends, & Growth Forecast Report by Provider (Application Providers, Middleware Providers, and Infrastructure Providers), Application (OSS/BSS Processes, Identity Management, Connectivity Provisioning), Organization Size (SMEs, and Large-scale enterprises) and Regional - (2025 to 2033)

Global Blockchain in Telecom Market Size

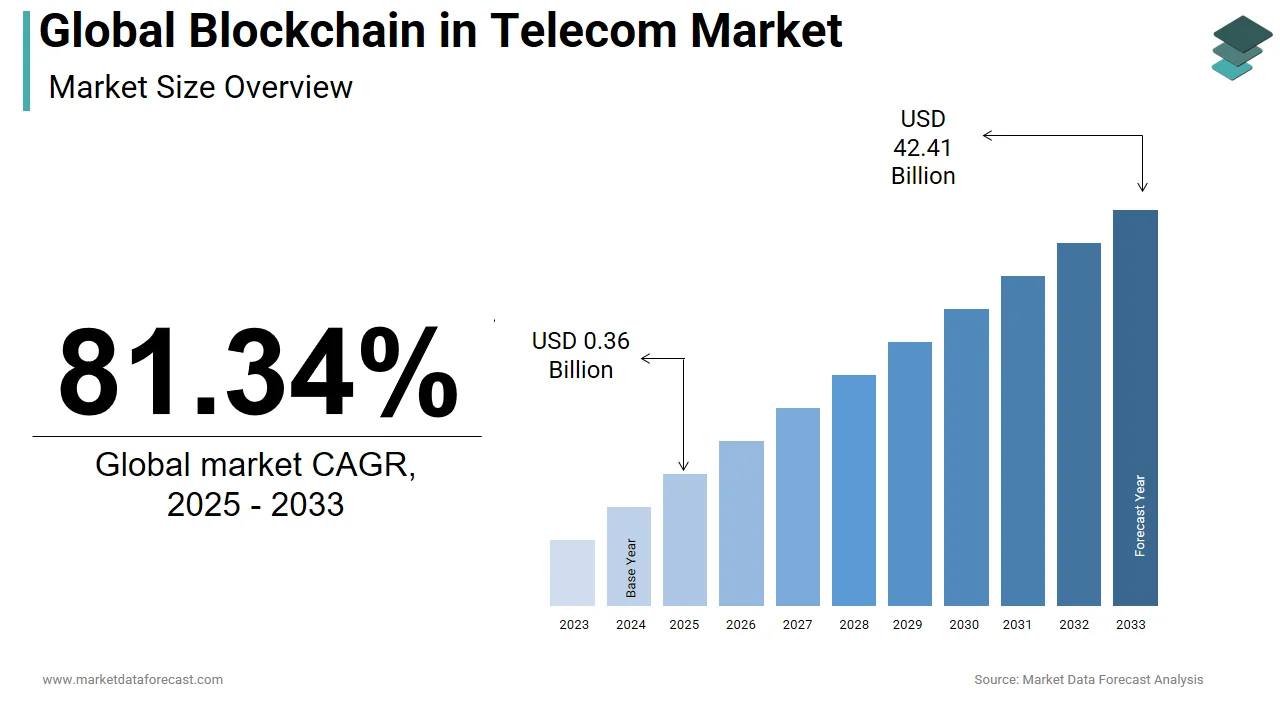

The global blockchain in telecom market was valued at USD 0.20 billion in 2024. The global market size is estimated at USD 0.36 billion in 2025 and USD 42.41 billion by 2033, growing at a CAGR of 81.34% during the forecast period.

MARKET DRIVERS

The market is growing mainly because of the significant presence and existence of various telecommunication operators who have skilfully adopted blockchain technology to reduce identity and fraud and improve the customer experience. Besides, the market is also receiving support as a result of increased venture capital funding, a significant increase in the number of start-ups entering the market, and the willingness of governments to regulate the blockchain.

MARKET RESTRAINTS

However, the main factors limiting blockchain growth in the telecommunications market are the growing concern about the authenticity of users, the uncertain status of regulations, and the lack of common standards. Besides, the restrictions imposed by government agencies on the adoption of blockchain technology and the lack of common standards may hinder market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

81.34% |

|

Segments Covered |

By Provider, Application, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AWS (US), Guardtime (Estonia), IBM (US), Microsoft (US), SAP (Germany), Bitfury (US), Cegeka (Netherlands), Clear (Singapore), Reply (Italy), ShoCard (US), Abra (US), Auxesis Group (India), Blockchain Foundry (Singapore), BlockCypher (US), Blocko (South Korea), Blockpoint (US), Blockstream (US), Chain (US), Filament (US), Huawei (China), Oracle (US), RecordsKeeper (Spain), Sofocle (India), SpinSys (US), and TBCASoft (US) and Others. |

REGIONAL ANALYSIS

North America dominates the global telecom blockchain market, followed by Asia Pacific, which is growing rapidly and registering some high growth rates during the forecast period.

KEY MARKET PLAYERS

The major blockchain in telecom market vendors include AWS (US), Guardtime (Estonia), IBM (US), Microsoft (US), SAP (Germany), Bitfury (US), Cegeka (Netherlands), Clear (Singapore), Reply (Italy), ShoCard (US), Abra (US), Auxesis Group (India), Blockchain Foundry (Singapore), BlockCypher (US), Blocko (South Korea), Blockpoint (US), Blockstream (US), Chain (US), Filament (US), Huawei (China), Oracle (US), RecordsKeeper (Spain), Sofocle (India), SpinSys (US), and TBCASoft (US).

RECENT MARKET HAPPENINGS

- In April 2018, SK Telecom, the largest telecommunications operator in South Korea, announced it would provide services relating to asset management using blockchain technologies and create a platform for matching growing blockchain start-up companies and investors for the growth of technology and the associated sector.

- In August 2018, the Carrier Blockchain Study Group (CBSG) announced Axiata, PLDT, PT. Telin, Turkcell, Viettel, and the Zain Group have agreed to jointly explore and build a multi-operator global cross-carrier platform and ecosystem.

- In March 2017, the technology giant IBM made a collaboration announcement with European banks to set up a platform for financial negotiations and trading based on blockchain technology.

Recently, the Ripple Foundation took over XRP (the best-performing crypto in 2017) and signed a contract with the largest banks to offer Ripple products. This will pave the way for the integration of cryptos in the banking sector. Binance, which has covered several countries to position itself as a global leader, has announced its intention to launch a beta version of its decentralized exchange (DEX) in early 2019. This, they say, is in anticipation of the development of portfolios of a guard that they feel are inevitable in the future. Custody portfolios will enable P2P commerce while continuing to deliver channel chain transactions. Meanwhile, heavyweights like IBM, Starbucks, and International Exchange (IEC) started accepting crypto payments on their platforms.

MARKET SEGMENTATION

The global blockchain in telecom market research report is segmented and sub-segmented based on the provider, application, organization size, and region.

By Provider

- Application Providers

- Middleware Providers

- Infrastructure Providers

By Application

- OSS/BSS Processes

- Identity Management

- Connectivity Provisioning

- Payments

- Smart contracts

By Organization Size

- SMEs

- Large-scale enterprises

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How does blockchain enhance the security of IoT devices connected to telecom networks worldwide?

Blockchain ensures the integrity and security of IoT devices by enabling tamper-proof data recording and authentication mechanisms. It helps prevent unauthorized access, tampering, and data manipulation, thereby safeguarding IoT deployments in the telecom sector.

How does blockchain enable telecom companies to combat counterfeit devices in the global market?

By leveraging blockchain's immutable ledger and cryptographic verification, telecom operators can track the entire lifecycle of devices, from manufacturing to distribution and resale. This helps prevent the circulation of counterfeit products, ensuring authenticity and quality for consumers worldwide.

Can blockchain technology help streamline the supply chain processes of telecom equipment manufacturers on a global scale?

Yes, blockchain enhances supply chain transparency and traceability by recording transactions and product movements in an immutable ledger. Telecom equipment manufacturers can use blockchain to verify the authenticity of components, track shipments, and ensure compliance with regulatory standards across borders.

How do telecom regulatory frameworks worldwide impact the adoption and implementation of blockchain technology in the industry?

Regulatory frameworks vary across jurisdictions, affecting the adoption of blockchain in telecom differently. Some regions have embraced blockchain innovation with supportive policies, while others face regulatory uncertainty or stringent compliance requirements. Collaborative efforts between regulators and industry stakeholders are essential to fostering a conducive environment for blockchain adoption in telecom globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com