Global Blockchain Market Size, Share, Trends, and Growth Forecast Report By Component (B-a-a-S and Platform/Solution), Type (Public, Private and Consortium), Deployment (Pilot, Production, and Proof of Concept), Application (Payments, Digital Identity, Supply Chain Management, Smart Contracts, and Others), Industry (BFSI, Government, Energy & Utilities, Manufacturing, Healthcare and Life Sciences, Travel and Transportation, Telecom, Retail & Consumer Goods, Media & Entertainment, and Others) & Region - Industry Forecast From 2025 to 2033

Global Blockchain Market Size

The global blockchain market was worth USD 23.55 billion in 2024. The global market is anticipated to be worth USD 34.19 billion in 2025 and to reach USD 675.6 billion by 2033, growing at a CAGR of 45.2% during the forecast period.

Blockchain is a digital, distributed ledger that records transactions and maintains identical copies of data on numerous systems owned by different entities. Every system in the blockchain network is in direct touch with every other system in the network. Every transaction in the network is recorded in the ledger continuously and sequentially, forming a chain of transactions. It is made up of blocks that each store a batch of legitimate transactions. Each block has a timestamp and is connected to the one before it. A chain-like structure is formed by the linked blocks. As a result, the term "blockchain" was coined. Data can't be removed from a blockchain database in any way after it's been entered. Blockchain is designed to be safe, transparent, fault-tolerant, auditable, and efficient. By sharing, an accurate and verifiable record of every transaction ever made and the information contained therein is kept safe from tampering and change. It helps decentralize technology and reduce bureaucracy by allowing value to be exchanged inside a network without intermediaries or third parties.

The blockchain market has quickly risen. Though it has grown rapidly, the number of its users is still low. According to Demagesaga, only 3.9 per cent of individuals across the world use it which makes over 300 million people globally utilise blockchain. Moreover, it is claimed to disrupt nearly every research field and industry. Its user base grows considerably because it is part of the next fourth industrial revolution, unlike other technologies. While eminent technologies, like the Internet of Things and artificial intelligence (AI), have already demonstrated their calibre and significance in several applications, blockchain uses have collected only limited interest.

The United States and China are the two nations propelling inventive activity in this market, after evaluating the global blockchain patent applications between 2009 and 2020 from the International Breeding Ground (IBG) index and the National Breeding Ground (NBC) index. In the fourth quarter of 2023, this technology continues to thrive and expand. These two countries are robust international and national breeding grounds. Especially, Asia Pacific economies accelerate inventions or new developments in blockchain. European nations contribute slightly to the patent landscape of this technology and, also along with the United States of America they are falling behind APAC.

- According to a study by Damagesaga, about one out of twenty people around the world utilise blockchain. In terms of region, 160 million individuals in Asia employ this technology, on the other hand only 1 million public in Oceania employ it.

MARKET DRIVERS

Following the debut of Bitcoin, blockchain technology exploded, and it is now being used by a variety of financial institutions to conduct transactions.

In the last couple of years, blockchain technology solutions have exploded in popularity for a variety of commercial applications, including payments, exchanges, smart contracts, documentation, and digital identification. Many startups have entered the market and begun developing blockchain-based solutions.

- According to the research, it is projected that 10 per cent of world GDP will be comprised of tokenized illiquid assets worth over 16 trillion US dollars in the best possible scenario. This value can climb to 68 trillion US dollars.

The tokenization of assets, like fine art and real estate, is anticipated to considerably rise. Illiquid assets, for example, private equity, fine art, natural resources, commodities, land, and real estate, cause problems like legal issues, incapability to fractionalize, and insufficient affordability to investors. But, once tokenized, these assets can be partly owned and are cost-effective to small shareholders, improving their liquidity.

Blockchain technology offers enormous potential in a variety of fields, including banking, cybersecurity, and the Internet of Things. IoT devices are widely used in numerous application areas, such as smart city projects, smart transportation, vehicular networking and autonomous vehicles, smart grids, and smart homes. IoT devices are becoming more prevalent, and numerous businesses are developing new technology use cases based on IoT devices. Several pioneers are using blockchain solutions to construct a decentralized network of IoT devices, eliminating the requirement for a central site to manage device connectivity. Blockchain technology is supposed to allow devices to connect directly, obviating the need for additional monitoring systems.

MARKET RESTRAINTS

In the blockchain market, regulatory ambiguity is still a problem. The lack of rules and the ensuing ambiguities are some of the most significant barriers to blockchain adoption in most verticals.

Some governments have outlawed the use of initial coin offerings (ICOs). One of the most difficult aspects of modernizing transaction systems is regulatory acceptance. With the rapid advancement of technology, regulatory agencies must evaluate what gaps exist in current regulations and how they affect total technological applications. Financial institutions from across the world are collaborating to develop blockchain technology standards.

The distributed ledger technology is still in its infancy, which creates concerns among regulators and policymakers at both the national and international levels. Regulators remain dubious about blockchain IoT technology's potential because the technology as a whole cannot be regulated; only technological use cases such as payments, smart contracts, documentation, and digital identity can be regulated. Only the application cases of blockchain technology that can be regulated are money, smart contracts, documentation, and digital identification. The regulatory status of blockchain technology is questionable due to challenges such as standardization and interoperability. Furthermore, the blockchain technology market is heavily impacted by ambiguous rules. There is currently no agreed set of standards for executing cryptocurrency transactions.

Blockchain technology has the potential to disrupt and revolutionize transactions, but to reap the benefits, businesses must overcome key security, privacy, and control challenges. Hackers can profit from a bigger attack surface to obtain access to crucial and sensitive information since blockchain transactions are recorded in a distributed public ledger. If a blockchain solution holds sensitive contract or payment data, copying the file could provide hackers more access. In both a hub-and-spoke and a distributed database, a key can be used to access the database if a key is compromised. The need for more adoption of cryptographic solutions is mostly due to the privacy issue with blockchain solutions.

- According to a study published in UpGuard, a 51% attack consists of a hostile blockchain coup by obtaining 51 per cent of the connection’s mining strength. A single person or group with 51% of the mining power of a blockchain has command of the ledger or account and can exploit or falsify it.

MARKET OPPORTUNITIES

Stablecoins hold potential opportunities for the expansion of the blockchain market. With cryptocurrency emerging as the top category of blockchain technology in the financial sector, the uncertainty and variability of the majority of cryptocurrencies continue to prevent or discourage people from being fully committed to the crypto landscape. This is the point where stablecoins come into the light. These are non-fickle digital currencies or bitcoin, different from most forms of crypto. This is due to they are frequently linked to assets such as Commodities or currencies, increasing their value more reliably than other options.

Furthermore, government establishments or bodies are unsure and adverse when it comes to the talks or discussions regarding the laws and rules of crypto assets. Despite this, in 2024, the AICPA released a reporting framework specifically for stablecoins. This shows how these are turning into more acceptable and satisfactory in the financial sector. Additionally, with the damaging ecological effect of digital assets, the widespread appeal of sustainable cryptocurrency is surging and will remain in this course to rise in the coming years. Therefore, the future of blockchain is bright and is believed to thrive and expand.

MARKET CHALLENGES

Coding loopholes are one of the major challenges to the expansion of the blockchain market. Apart from hacking attacks, blockchain systems are also prone to coding gaps. Centralized blockchains are generally more susceptible or exposed as all the hackers or cybercriminals have to do is weaken certain points of failure. In numerous cases, parties or bodies keeping the blockchain keys (like private keys) are aimed. Getting entry to those keys enables hackers to transfer or move assets to wallets which are owned by the systems.

- According to the World Economic Forum (WEF), a group of experts has detected around 500 cybersecurity attacks, taking into account cryptocurrencies only, with financial losses arriving at 9 billion dollars. Security from these attacks is hard and demanding primarily because of the openness and decentralization of blockchain.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

45.2% |

|

Segments Covered |

By Component, Type, Deployment, Application, Industry, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM (US), AWS (US), Intel (US), SAP (Germany), TCS (India), Infosys (India), Accenture (Ireland), Bitfury (Netherlands), Cegeka (Netherlands), Applied Blockchain (UK), and others |

SEGMENTAL ANALYSIS

By Component Insights

Developers of digital ledger networks and applications can utilize the platform/solution to create customized distributed ledger (DLT) networks for end-users. Because of rising demand in many industries for platforms such as Hyperledger Fabric, Ethereum, R3 Corda, Ripple, and others, the platform/solutions are expected to expand significantly. Due to increased enterprise use of cloud-based services such as smart contracts, crowdfunding, crypto wallet development, and others, B-a-a-S is expected to grow at the quickest rate.

- As per a 2023 Financial services survey by Finastra, worldwide, almost half, i.e. 48 per cent of financial institutions or establishments have either implemented Blockchain as a service (BaaS) or enhanced their abilities in this field in the last 12 months, a notable rise from the 35 per cent in 2022.

By Type Insights

The private category is expected to have the largest market share because it can limit transaction engagement and consensus procedures. Businesses can save money using private solutions and services to reverse transactions and change legislation. A consortium, also known as a federated digital ledger, is useful when multiple organizations operate in the same industry and use a single platform to streamline operations. The consortium concept provides a forum for significant corporations to collaborate to foster innovation. The public type is predicted to increase with the fastest CAGR throughout the projection period. The rise can be ascribed to multiple institutions and governments' increasing focus on developing efficient and open transactions.

By Deployment Insights

The proof of concept is predicted to have the greatest market share due to the increasing implementation of proof of concept for improving online transaction services in a variety of sectors. Production deployment is likely to have the highest CAGR over the forecast period. This is due to the growing need for simplified business processes and integrated supply chain management software.

By Application Insights

The digital identity application is predicted to expand at the fastest CAGR during the forecast period. The increase is attributed to an increase in the number of worldwide identity scams and cyber-attacks. Supply chain management using digital ledger technology is projected to promote openness and reduce fraud on expensive products like pharmaceutical medications and diamonds. The technology will assist businesses in reducing the impact of counterfeit products on consumers. As a result, supply chain management is expected to become a prominent market application.

The payment app, on the other hand, is predicted to have a bigger blockchain market share. The surge can be attributed to the growing use of cloud services in payment and transaction processes. Because of the technology, payment systems become more transparent, cost-effective, and operationally efficient.

By Industry Insights

The BFSI industry is predicted to have a substantial market share due to banks' and other financial institutions' rising adoption of digital ledger solutions and services to streamline company processes and reduce operating costs. Moreover, blockchain technology transforms traceability and accessibility which are essential elements of the banking and financial sector by facilitating an immutable and available ledger that documents each transaction in a transparent and secure way. In addition, due to its decentralized architecture, blockchain enables approved entities to access linked or appropriate information rapidly, streamlining procedures such as customer verifications, compliance checks, and audits.

The retail and consumer products business is expected to grow at the fastest rate during the estimated period. Healthcare and life sciences, energy and utilities, government, manufacturing, travel and transportation, and telecommunications are among the other industries that are predicted to grow rapidly.

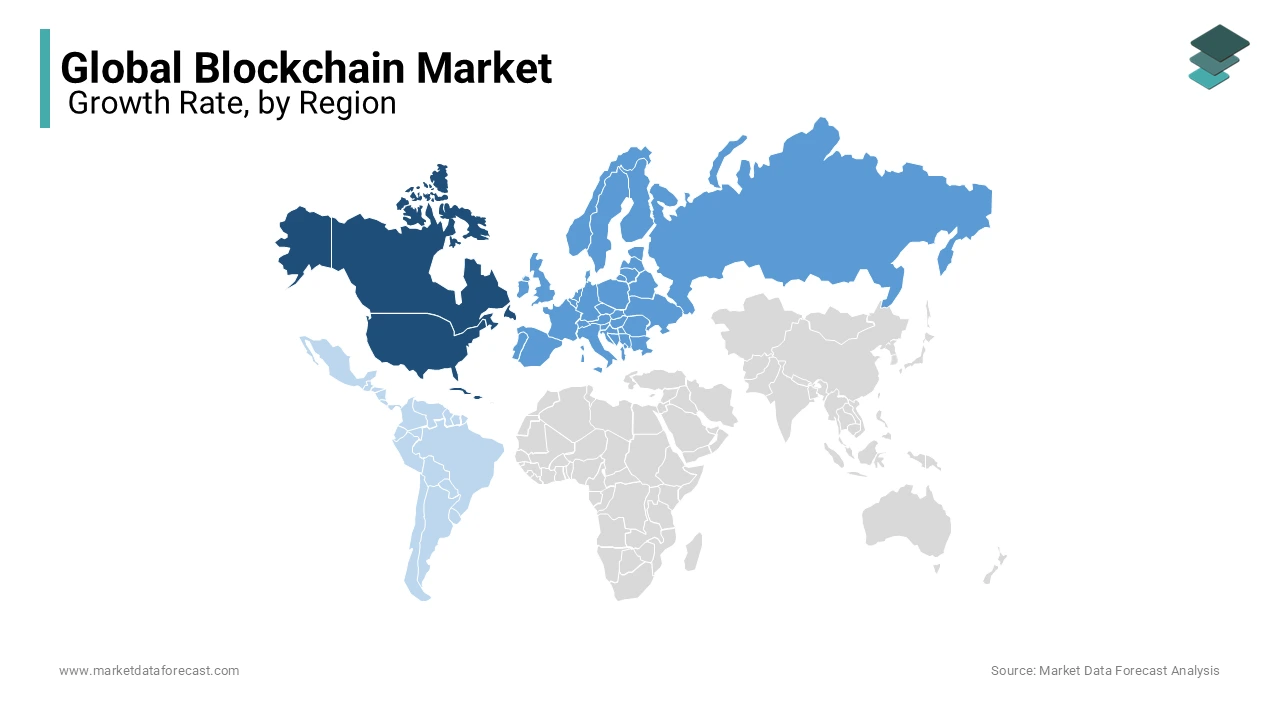

REGIONAL ANALYSIS

North America is predicted to grow at a 30.5% compound annual growth rate (CAGR) in the global blockchain industry during the forecast period. The expansion of the Blockchain market in this area has been fuelled by high investments in research and development activities and increased usage of blockchain technology. Rising IT sector growth and widespread adoption of blockchain solutions in industries such as retail, e-commerce, and others are driving considerable market growth in this area.

- According to the state of the country survey in 2023 by Finastra, the United States is spearheading the path in Blockchain as a Service (BaaS) and embedded finance, with 64 per cent, i.e. almost two-thirds possessing enhanced or installed BaaS, substantially high than in the majority of other regions. The financial services sectors in Saudi Arabia (53 per cent) and Vietnam (55 per cent) have also witnessed especially high standards of operation in this area throughout the past year in 2022.

Europe is the second-largest market, with growth expected to be modest throughout the foreseeable period. Governments and private companies in France, Germany, Italy, Spain, Luxembourg, the Netherlands, and other nations are heavily investing in digital currencies. Businesses in the industry are concentrating on growing their global footprint by providing bespoke digital ledger services to clients all over the world. According to the

- According to Adan, in France, about 6.5 million individuals or 12 per cent of the country’s population, presently own crypto assets in contrast to 9.6 per cent in 2023. Overall, 15 per cent of people in France have ownership of these assets at a certain moment in time against 13 per cent in 2023.

Asia Pacific is expected to grow at the fastest rate during the projected period. Manufacturing firms in China, Japan, Oceania, South Korea, and Southeast Asia are boosting their technological investments. In addition, these countries have a considerable number of digital ledger technology vendors.

- According to Triple-A, the ownership of crypto is the biggest in Asia among all other regions, holding more than 326.8 million dollars. The worldwide crypto ownership is valued at 562 million dollars. Moreover, the United Arab Emirates is leading in the Middle East with an index of about 25.3 per cent then by Saudi Arabia at 15 per cent. In Asia, Singapore is at the top with 24.4 per cent, then Thailand at approximately 17.6 per cent, Vietnam at 17.4 per cent. Both Hong Kong and Malaysia are at 14.3 per cent, on the other hand, Indonesia and South Korea are at 13.9 and 13.6 per cent, respectively.

During the forecast period, Latin America is expected to grow steadily. The market is thought to be transitioning due to increased government and important player investment in the oil and gas, energy and utilities, and transportation sectors. Similarly, due to an increasing number of startups and local enterprises engaging in the creation of digital currencies, the Middle East African market is still in its early phases. The development of new solutions for industries such as oil and gas, information technology, and transportation is a priority for key stakeholders.

KEY MARKET PLAYERS

Companies playing a promising role in the global blockchain market include IBM (US), AWS (US), Intel (US), SAP (Germany), TCS (India), Infosys (India), Accenture (Ireland), Bitfury (Netherlands), Cegeka (Netherlands) and Applied Blockchain (UK).

RECENT MARKET HAPPENINGS

- In September 2024, PayPal Holdings, Inc. reported it is allowing their United States dealers or traders to purchase, hold and sell cryptocurrency straight from their PayPal business account.

MARKET SEGMENTATION

This research report on the global blockchain market has been segmented and sub-segmented based on component, type, deployment, application, industry, and region.

By Component

- Blockchain-as-a-Service

- Platform/Solution

By Type

- Public

- Private

- Consortium

By Deployment

- Pilot

- Production

- Proof of Concept

By Application

- Payments

- Digital Identity

- Supply Chain Management

- Smart Contracts

- Others

By Industry

- BFSI

- Government

- Energy & Utilities

- Manufacturing

- Healthcare and Life Sciences

- Travel and Transportation

- Telecom

- Retail & Consumer Goods

- Media & Entertainment

- Others

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Frequently Asked Questions

How does Blockchain ensure security?

Blockchain ensures security through cryptographic hashing and decentralized consensus mechanisms. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. This chaining of blocks makes it extremely difficult for anyone to alter the information without being detected. Additionally, consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS) require network agreement for transactions to be validated.

What are the main applications of Blockchain technology?

The main applications of Blockchain technology include cryptocurrencies (e.g., Bitcoin, Ethereum), supply chain management, healthcare records, identity verification, smart contracts, voting systems, and financial services. These applications benefit from Blockchain’s transparency, security, and efficiency.

What are the challenges facing Blockchain adoption?

The challenges facing Blockchain adoption include scalability issues, regulatory uncertainty, interoperability between different Blockchain networks, and public perception. Technical complexities and the need for significant infrastructure changes also pose barriers to widespread adoption.

What is the future outlook for the Blockchain market?

The future outlook for the Blockchain market is promising, with continuous advancements and increasing adoption across various sectors. Innovations in scalability solutions, interoperability protocols, and more sustainable consensus mechanisms are expected to drive growth. Additionally, regulatory clarity and institutional acceptance will further bolster the Blockchain market’s expansion globally.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com