Global Blood Testing Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Complete Blood Count, Blood Chemistry Tests, Blood Enzymes Tests and Blood Clotting Tests), Disease, Method (Manual Blood Culture Testing and Automated Blood Culture Testing), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Blood Testing Market Size

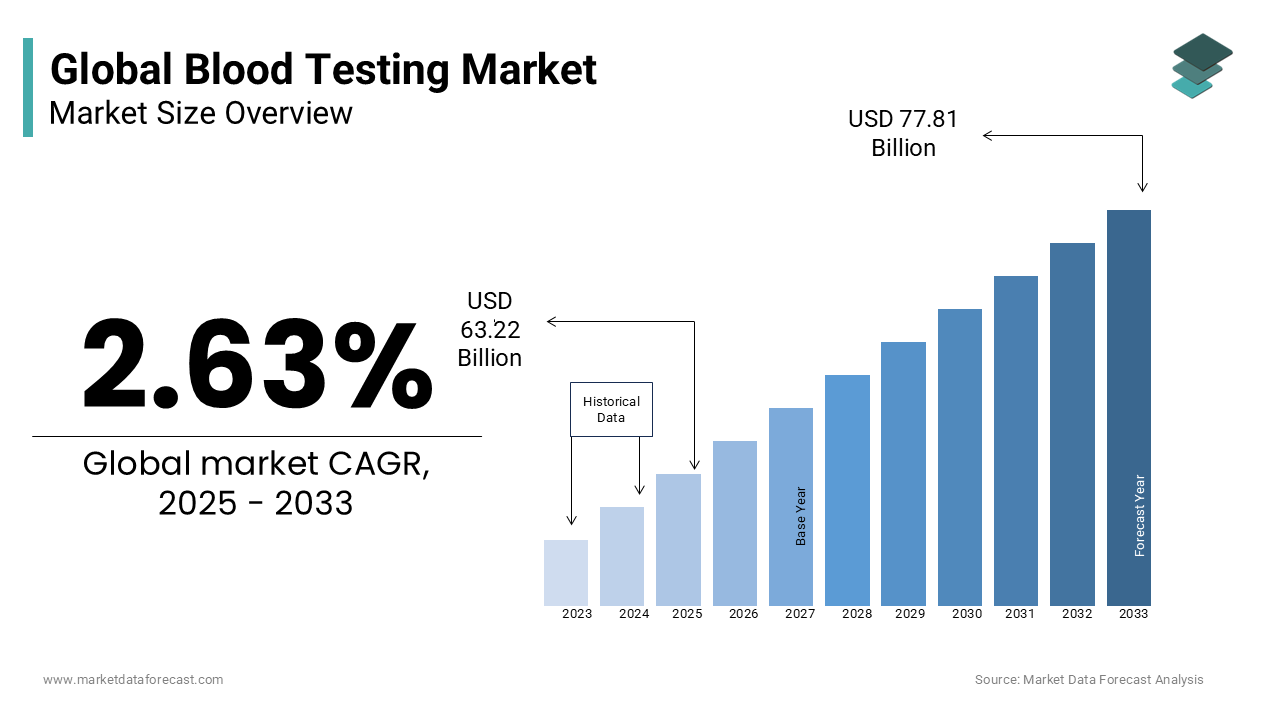

The global blood testing market size was valued at USD 61.60 billion in 2024. The blood testing market is forecasted to be worth USD 77.81 billion by 2033 and USD 63.22 billion in 2025, growing at a CAGR of 2.63% from 2025 to 2033.

A blood test is a basic check-up and a very common step to diagnose any disease primarily. The results help doctors to diagnose the disease and give precise treatment options accordingly. The sample blood collected from the patient will undergo laboratory analysis for multiple tests like glucose tests, cholesterol tests, or any others. There are many numbers of tests available to diagnose tests using blood samples. Doctors do order the type of test according to their health-related issues for accurate diagnosis. The prominence of the blood tests is going at random rats across the world.

- According to the American Clinical Laboratory Association, more than 7 million people in the US take blood tests every year, and the number may even increase in the next period due to rising consciousness over health-related issues.

The future of blood testing is associated with the shifting trend towards the adoption of at-home services. Modern technology in healthcare technology is attributed to making indefinite things possible. ‘At home testing’ service allows patients to get tested without even going to the centers physically. These facilities reduce the number of patient visits to healthcare providers.

MARKET DRIVERS

The growing prevalence of target diseases such as diabetes and CVDs is contributing significantly to the growth of the global blood testing market.

According to the statistics published by Diabetes Research Clinical Practice, an estimated 463 million people have diabetes globally, estimated to reach 700 million by 2045. According to WHO, an estimated 17.9 million people die yearly from CVDs. The prevalence and incidence of these diseases are significantly growing year over year and favoring the growth of the blood testing market. The method of carrying out blood test procedures has immensely improved over the past few years, resulting in the growth of the global blood testing market. The automated method of carrying blood tests is less time-consuming and less complicated than manual techniques. So, the feasibility of automated blood test procedures will eventually help to drive market growth.

Technological advancements and the steady demand for enhanced blood testing technologies have intensified global competition.

High growth in the global blood testing market can be accredited to the rising number of blood donations and donors, increasing awareness about the safety of donated blood, increasing demand for donated blood, and growing infectious diseases. The rise in the number of patients worldwide has an increased opportunity for the global blood testing market. Furthermore, the increase in people suffering from these diseases will create a better chance for market growth. In addition, many pharmaceutical and biotechnology companies provide growth opportunities for the global blood testing market.

The different kinds of blood tests available in the market for common diagnostic purposes will provide significant growth opportunities for the blood testing market growth. Furthermore, correct criteria in diagnosing significant diseases help increase revenue share and will likely have lucrative opportunities during the foreseen period.

The growing number of people diagnosed with diabetes and thyroid across the world is lucratively one of the common factors to showcase huge opportunities for the blood testing market in coming years. Diabetes and thyroid have affected a huge number of people in the past few years, and creating awareness among people with support from government authorities is subsequently elevating the growth rate of the market. People are now aware of the risk due to chronic illnesses, which eventually increases the prominence of diagnosis through simple blood tests. For instance, more than 136 million adults in China are suffering from different types of thyroid, which is augmented to elevate the growth rate of the blood testing market to the next level.

MARKET RESTRAINTS

Lack of complete knowledge among medical technicians, especially in laboratories due to fewer training programs, is a factor that is hindering the growth rate of the market.

It is highly difficult for technicians to adopt new technologies quickly, especially those who work in remote areas. The lack of proper technicians in rural areas and increasing concern about privacy substantially elevate the growth rate of the market.

The growing advanced technologies are constantly one of the major factors driving market growth, but the limitations of remote-work capabilities are quietly inhibiting the growth rate of the market.

In recent times, there has been a high risk of transmission of various blood-borne diseases, due to which the availability of the workforce is slowly declining in the laboratories. The decreasing workforce in laboratories is another factor that is hampering the growth rate of the market.

The rising complexity of cases is becoming one of the challenging factors for technicians who want to analyze blood samples according to the available techniques. It is highly difficult to analyze the blood sample of a patient infected with a new variant or new virus. Along with this, the rising number of blood sample volumes and the prevalence of analyzing more samples in less time are somehow difficult and challenging for medical technicians, which shall degrade the growth rate of the market to the extent.

Poor healthcare infrastructure in undeveloped countries is a specific challenging factor for the market. Tackling the burden of increasing testing volumes is proportionate to the availability of minimum resources in the laboratories. The lack of these facilities in these countries shall interrupt the fastest growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Disease, Method, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Bio-Rad Laboratories Inc. (U.S.), Siemens Healthcare (Germany), Grifols (Spain), Nanosphere Inc. (U.S.), BioMérieux (France), Dickinson and Company (U.S.), Ortho Clinical Diagnostics Inc. (U.S.) |

SEGMENTAL ANALYSIS

By Type Insights

The complete blood count (CBC) segment has been leading with the largest share of the market for the past few years. It is a very common and basic blood test that measures different cells in blood, which is important to analyze overall health. Doctors can identify the underlying disease from the wide range of analyses through this report, which helps them to treat more effectively. The rising prevalence of leukemia in many parts of the world is quietly associated with the increasing market share. The blood chemistry tests segment is likely to grow at a faster rate during the forecast period with the growing number of elderly people. Age-related issues like kidney functioning and others will be most common among elderly people, and there will be a huge necessity to take proper medications accordingly, where it is highly important to take blood tests more often. This is contributing to escalating the growth rate of the market to an extent.

By Disease Insights

The infection segment is ruling with the largest share of the market with the growing prevalence of various infectious diseases. Nowadays, there are various types of infectious diseases that are elevating the risk factors that are even leading to death.

According to the National Institute of Health, infectious diseases are one of the leading causes of mortality and morbidity across the world, resulting in more than 52 million deaths every year. The report also suggests that more than half of the population is at risk due to infectious diseases. Around 14 million children's deaths occurred only due to these diseases in 2023 worldwide.

The leukemia segment is expected to have a prominent growth rate by the end of the forecast period. The rapidly increasing cases of leukemia are enhancing the growth rate of the market. Government support through reimbursement in healthcare and increasing awareness among the public over the availability of advanced treatment procedures are additionally to boost the growth rate of the market.

By Method Insights

The manual blood culture testing segment is leading with the dominant share of the market. Though there is rapid adoption of the most advanced technologies in healthcare, many of the clinical laboratories are still bound to use only traditional methods for accuracy. The automated blood culture testing segment has witnessed a steady growth rate throughout the forecast period. In developed countries like the US and others, the demand for research and development activities is huge, and the prominence of launching innovative drugs or medicines by scrutinizing infectious diseases with blood samples from patients shall bolster the growth rate of the market.

REGIONAL ANALYSIS

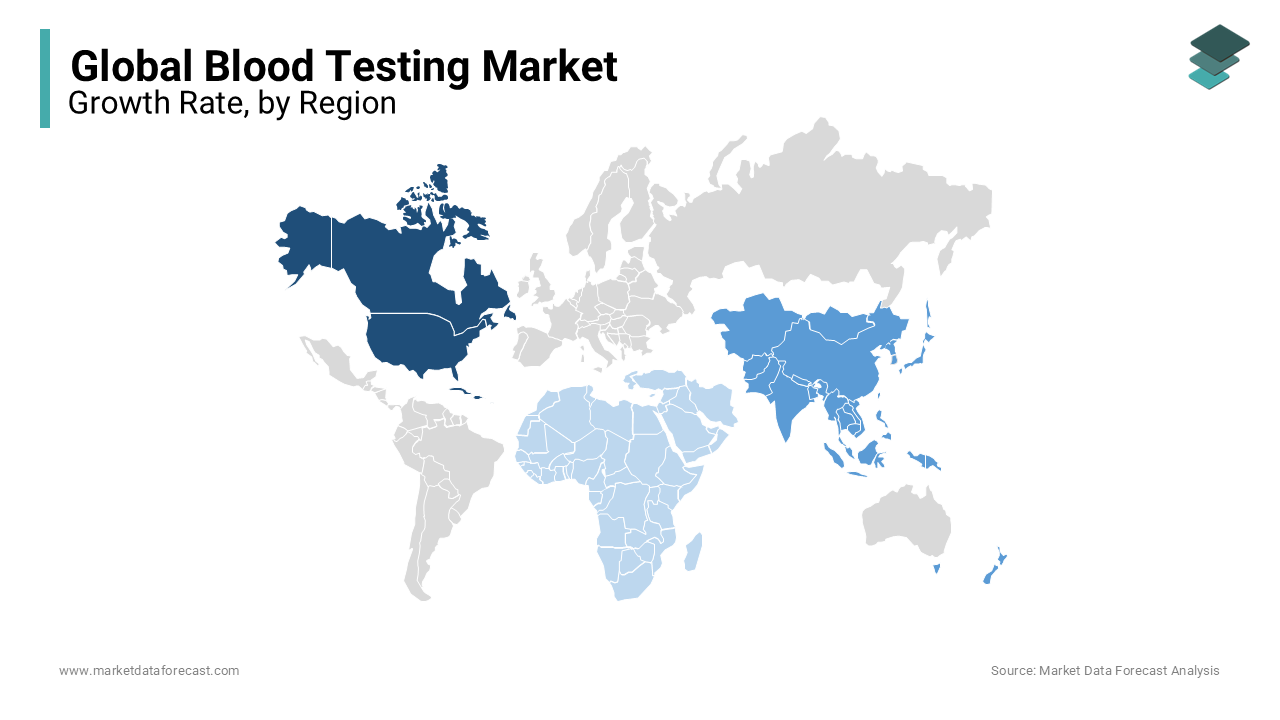

North America is expected to dominate the global blood testing market during the forecast period, with the U.S. being the most significant supporter. The U.S. is recognized as home to several prominent players operating in space. This, in turn, has resulted in the highest turnover in this regional market. Also, government initiatives and CLIA waivers on POC testing devices are estimated to be important factors in increasing acceptance levels for these devices in this region. The North American market is further expected to be driven by new government initiatives, developing healthcare infrastructure, increasing the number of complex surgical activities, a rise in the geriatric population, the upsurge of diseases, and technological advancements related to the market. In addition, an increase in several geriatric populations suffering from diabetes, cancer, and cardiovascular diseases will also rapidly help the blood testing market grow in the North American region.

On the other hand, the market in the Asia-Pacific region is poised to grow at a maximum CAGR during the forecast period. The growing occurrence and incidence of infectious diseases, high demand for donated blood, and improved awareness among people about the safety of donated blood propel the blood testing market in this region. In addition, the rise in the population suffering from infectious and other lifestyle diseases will help boost the market in Asia.

Europe is expected to grow at a lucrative pace due to untapped market potential and growing awareness amongst the population regarding early disease detection tests. Furthermore, increasing the number of government schemes to curb the rising healthcare expenditures in emerging economies is expected to drive regional market growth. Germany governs the blood screening industry because there is a rise in awareness about blood donation, the presence of high-quality infrastructure for hospitals and clinical laboratories, and major market players.

Latin America has been calculated at USD 5.72 billion in 2023, expected to grow at a CAGR of 2.79%. The market for blood testing continued to grow under the influence of the aging population, the rise in incidences of various diseases such as hepatitis, human immunodeficiency virus (HIV) infection, cancer, thyroids, genetic disorders, and bacterial and viral allergic disorders, and expanding application of blood testing in other diagnostic areas.

The market in MEA is expected to hold a moderate share of the worldwide market during the forecast period. A shift in healthcare provider's focus from treatment towards early exposure to diseases, particularly in cardiovascular and endocrinology medicine, has poised the industry to observe lucrative growth during the forecast period.

KEY MARKET PLAYERS

A few of the promising companies operating in the global blood testing market profiled in this report are Bio-Rad Laboratories Inc. (U.S.), Siemens Healthcare (Germany), Grifols (Spain), Nanosphere Inc. (U.S.), BioMérieux (France), Dickinson and Company (U.S.), Ortho Clinical Diagnostics Inc. (U.S.), Roche Diagnostics (Switzerland), Alere Inc. (U.S.), Bruker Corporation (U.S.), Abbott Laboratories (U.S.), Thermo Fisher Scientific Inc. (U.S.) and Beckman Coulter (U.S.)

RECENT HAPPENINGS IN THE MARKET

- In February 2020, Ortho Clinical Diagnostics announced the launch and availability of VITROS XT 3400, which completes its VITROS XT solutions and helps labs obtain consistently fast, accurate, and reliable results.

- In September 2019, The US FDA approved Cobas Babesia, Roche's first whole-blood test for donor screening; following May 2019, FDA-updated industry guidance recommending screening and testing for Babesia.

- In February 2019, Grifols received FDA approval for the Procleix Babesia Assay for donor screening on its Procleix Panther System.

- In June 2017, Siemens Healthineers agreed to acquire Epocal Inc. A subsidiary of Epocal Inc. develops and provides a point-of-care blood diagnostic system for healthcare enterprises, including the epocBllod Analysis System.

- In June 2016, Luminex Corporation announced that it had completed its previously announced acquisition of Nanosphere, Inc., providing support and services in molecular and microbiology diagnostic markets.

MARKET SEGMENTATION

This market research report on the global blood testing market has been segmented and sub-segmented based on type, disease, method, and region.

By Type

- Complete Blood Count

- Red Blood Cells

- White Blood Cells

- Hemoglobin

- Haematocrit

- Platelets

- Blood Chemistry Tests

- Electrolytes

- Blood Glucose

- Calcium

- Test for Kidney Function

- Blood Enzymes Tests

- Troponin

- Creatine Kinase

- Blood Clotting Tests

- Prothrombin time

- Activated Partial Thromboplastin time

- Blood Coagulation

By Disease

- Anemia

- Infection

- Leukemia

- Hypokalemia

- Kidney Disorders

- Heart Attack

- Coronary Heart Disease

By Method

- Manual Blood Culture Testing

- Automated Blood Culture Testing

- Automated Blood Culture System

- Blood Culture Instruments

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the blood testing market worldwide in 2023?

The global blood testing market was worth USD 60.03 billion in 2023.

Which region had the most significant share in the global blood testing market in 2023?

Geographically, the North American region dominated the market in 2023.

Which segment by test type led the blood testing market in 2023?

Based on the test type, the complete blood count segment had the major share of the blood testing market in 2023.

Who are a few of the promising players in the blood testing market?

Bio-Rad Laboratories Inc. (U.S.), Siemens Healthcare (Germany), Grifols (Spain), Nanosphere Inc. (U.S.), BioMérieux (France), Dickinson and Company (U.S.), Ortho Clinical Diagnostics Inc. (U.S.), Roche Diagnostics (Switzerland), Alere Inc. (U.S.), Bruker Corporation (U.S.), Abbott Laboratories (U.S.), Thermo Fisher Scientific Inc. (U.S.) and Beckman Coulter (U.S.) are playing a significant role in the global blood testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com