Brushless DC Motor Market Research Report - Segmentation By Type (Inner Rotor and Outer Rotor), End-user (Consumer Electronics, Automotive, Manufacturing, Medical Devices, and Others), Speed (<500 RPM, 501-2000 RPM, 2001-10000 RPM, >10000 RPM), and Region - Industry Forecast 2024 to 2029

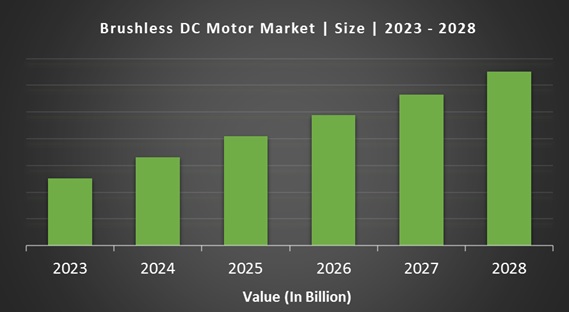

Brushless DC Motor Market Size (2024-2029):

The Global Brushless DC Motor Market size is estimated at USD 22.15 billion in 2023, and it is expected to reach a revised size of USD 38.39 billion by 2029, with a CAGR of 11.63% over the foreseen period of 2024 - 2029.

Market Overview:

Market Drivers:

Heating, ventilation, and air conditioning (HVAC) systems provide thermal comfort and maintain indoor air quality. They are one of the essential components of modern infrastructure, especially for large office buildings or shopping centers. DC electric motors are widely used in HVAC systems to achieve high efficiency in air circulation systems and maximize their service life and power. The demand for HVAC systems is increasing in the APAC region, especially in China and India due to the continued growth of their industrial and commercial sectors. The deployment of smart technologies, such as the use of smartphone applications, helps users control lighting, ventilation, and other systems from one point of control. All of these factors fuel the use of brushless DC motors in HVAC applications. The expansion of commercial spaces, the development of new offices, business centers, residential buildings, and organized outlets, and the increase in income levels of the middle-class population of East Asian countries. The Southeast and the Middle East make HVAC equipment highly accessible to a large number of consumers. The gradual growth of the housing industry in the United States and Western Europe is also expected to drive demand for HVAC equipment, such as vacuum contactors. Therefore, this increased demand for HVAC systems is expected to generate increased revenue for brushless DC motors, driving worldwide business growth.

Market Restraints:

Brushless DC motors are more expensive than other types of motors because they require electrical drivers to keep them running smoothly. These motors were designed for use in applications where they must replace inexpensive brushed DC motors.

Market Recent Developments:

-

In November 2019, Allied Motion published its KinetiMaxTM High Power Density (HPD) motor series. These new outer rotor brushless motors are designed for high torque, low gear applications such as robotics, AGVs, and hand power tools.

-

In July 2018, Dunkermotoren, a division of AMETEK Advanced Motion Solutions, introduced its new BG 65/BG 66 drove servomotors as the next addition to their BG 65 (S) servomotors that comprises fully integrated motor electronics.

BRUSHLESS DC MOTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 – 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2029 |

|

CAGR |

11.63% |

|

Segments Covered |

By Type, End-User, Speed, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMETEK (US), Allied Motion (US), Nidec Corporation (Japan), Johnson Electric (China), and Minebea Mitsumi (Japan) are the leading players in the brushless DC motor market. Maxon Motor (Switzerland), Regal Beloit Corporation (US), Oriental Motor (Japan), Portescap (US), ElectroCraft (US), and Others. |

Market Segmentation:

Brushless DC Motor Market - By Type:

- Inner Rotor

- Outer Rotor

The inner rotor segment is supposed to be the largest contributor to the brushless DC motor market during the foreseen period. In internal rotor-type motors, the rotors are placed in the center of the motors and are surrounded by a stator winding to prevent thermal insulation from entering, and as such, heat is easily dissipated. This leads to the production of a large amount of torque by inner rotor brushless DC motors.

Brushless DC Motor Market - By End-User:

- Consumer Electronics

- Automotive

- Manufacturing

- Medical Devices

The consumer electronics segment is expected to experience the fastest growth during the outlook period. With the advent of Industry 4.0, global industrial manufacturing has undergone significant changes. Data digitization, machine automation, and connectivity between manufacturing plant assets are driving the evolution of technology infrastructure. Increasing competition in the consumer electronics industry is prompting companies to adopt innovative technologies and analytics to ensure optimal use of their resources.

Brushless DC Motor Market - By Speed:

- <500 RPM

- 501-2000 RPM

- 2001-10000 RPM

- >10000 RPM

The 2001-10,000 rpm segment is likely to be the largest contributor during the projection period. Brushless DC motors with speeds ranging from 2000 RPM to 10,000 RPM are widely used in medical equipment such as diaphragm pumps for gas analyzers, dental instruments, pumps, anesthesia ventilators, and respiratory system pumps. They are also used in industrial applications such as laser scanning instruments, industrial laser barcode readers, CNC machine spindle rotors, and industrial automation actuators.

Market Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The Asia Pacific market is expected to record the highest CAGR of 8% during the forecast period. This growth can be attributed to higher spending on infrastructure development and manufacturing facilities. Increasing industrialization in the developing economies of China, India, and Indonesia is expected to fuel their regional demand by 2026. Additionally, Latin America, the Middle East, and Africa are estimated to witness significant growth during the prediction period due to changes in the regulatory scenario and increased awareness about the use of sustainable and environmentally friendly products. Also, the pressing need to increase power generation capabilities to efficiently meet the demands of the growing population has driven the adoption of brushless DC motors in many applications in the Middle East. The untapped potential of downstream activities in developing countries, including Kuwait, the United Arab Emirates, and Qatar, offers new growth avenues for the market during the envisioned period. The regional markets of North America and Europe captured more than 35% of the overall market share in 2021.

Impact of COVID-19 on the Brushless DC Motor Market:

The coronavirus pandemic has had a negative impact on the global manufacturing industry and has caused the closure of industrial production units in various industries in recent months. The drop in demand for industrial equipment caused by supply chain disruptions due to lockdowns imposed in different countries to mitigate the spread of the virus is expected to have a negative impact on the growth of the brushless DC motor market. Investments in the launch of new products are also expected to decline during the COVID-19 pandemic.

Market Key Players:

- AMETEK (US)

- Allied Motion (US)

- Nidec Corporation (Japan)

- Johnson Electric (China)

- MinebeaMitsumi (Japan)

- Maxon Motor (Switzerland)

- Regal Beloit Corporation (US)

- Oriental Motor (Japan)

- Portescap (US)

- ElectroCraft (US)

Frequently Asked Questions

1. What is the Brushless DC Motor Market growth rate during the projection period?

The Global Brushless DC Motor Market is expected to grow with a CAGR of 11.63% between 2024-2029.

2. What can be the total Brushless DC Motor Market value?

The Global Brushless DC Motor Market size is expected to reach a revised size of US$ 38.39 billion by 2029.

3.Name any three Brushless DC Motor Market key players?

Johnson Electric (China), MinebeaMitsumi (Japan), and Maxon Motor (Switzerland) are the three Brushless DC Motor Market key players.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com