Global Cellular IoT Market Size, Share, Trends, & Growth Forecast Report By Component (Hardware and Software), Cellular Technology (3G, 4G, LTE-M, NB-IoT, 5G, and others), End-Use (Agriculture, Healthcare, Retail, Energy, Automotive and Transportation, Infrastructure, etc.) & Region - Industry Forecast From 2025 to 2033

Global Cellular IoT Market Size

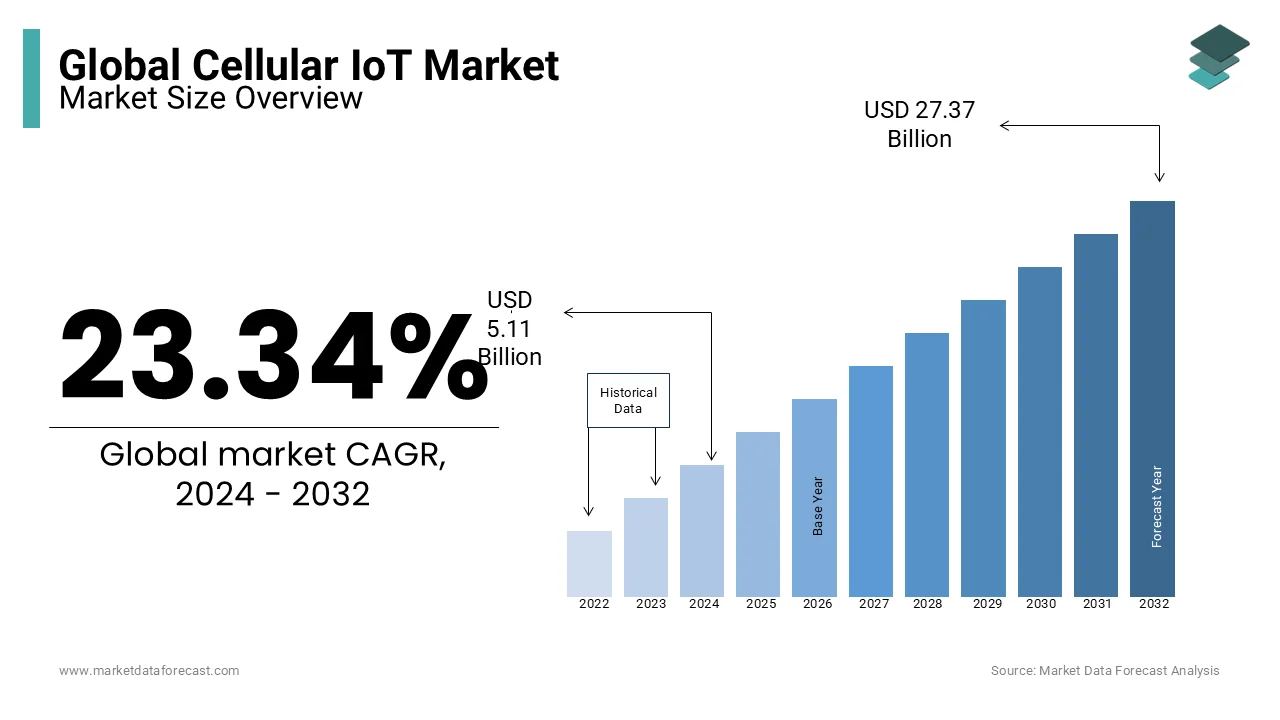

The global cellular IoT market was worth USD 5.11 billion in 2024. The global market is foreseen to reach USD 6.30 billion in 2025 and USD 33.76 billion by 2033, growing at a CAGR of 23.34% during the forecast period.

Cellular IoT is defined as a way to connect physical devices to the Internet around the world. These advanced technologies used for connectivity include 3G, 4G, 5G, and LPWA (Low Power Wide Area) cellular technologies such as NB-IoT and LTE-M. They provide advantages like global coverage, reliability, and affordable hardware crucial for cellular IoT connections.

As with the IoT landscape, connectivity plays an important role, which is why mobile operators are in an excellent position to have a share of the greatest added value in the IoT market. The size of this slice of the pie depends on the operator's different roles in the IoT ecosystem. The operator can look for different monetization models, such as network providers, end-to-end solution providers, system integrators, etc.

Due to machine-to-machine communication and machine-to-person communication, a large amount of data will be generated. To support the operation in the IoT network, proper data storage, interpretation, and transfer are required at minimal cost in reality. Cellular technologies such as GSM, WCDMA, LTE, and the future 5G have evolved with new features and a new narrowband IoT radio access technology designed from an attractive solution for Emerging Low Power Extended Applications (LPWA).

MARKET TRENDS

Cellular Vehicle-to-Everything (C-V2X) in the automotive industry is growing due to the increasing demand for safe and reliable road transport, the growing adoption of autonomous vehicles, and the rising demand for automotive telematics as a part of logistics and transport companies. There is a growing demand to enable highly reliable real-time communications at high speeds and in high-density traffic. Taking advantage of the comprehensive coverage of secure and well-established LTE networks is one of the factors driving the demand for cellular IoT for C-V2X.

Advances in 5G technology would allow 5G-V2X applications to provide better cybersecurity performance and process a large number of messages in congested traffic environments. Another factor that would boost the cellular IoT segment is the cost associated with hardware components. In January 2019, Audi, Ducati, and Ford introduced the C-V2X technologies. Such developments would accelerate the commercial deployment of cellular IoT on C-V2X technology.

MARKET DRIVERS

Increasing digitization and automation in industries across various verticals, such as manufacturing, automotive, energy, and utilities, are the major drivers expected to drive the growth of the global cellular IoT market. In addition, the growing demand for extended network coverage, the growing trend for business expansion beyond mobile broadband, and the need to accommodate large numbers of connected devices among businesses around the world are some of the other important factors expected to boost the growth of the cellular IoT market. The growing implementation of advanced cellular IoT technologies and the growing demand for connected devices are some of the major growth drivers of the global cellular IoT market.

MARKET RESTRAINTS

However, the high cost of IoT infrastructure and issues related to legal regulation and rights are identified as the major constraints affecting the growth of the cellular IoT market globally, especially in some developing economies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.34% |

|

Segments Covered |

By Component, Cellular Technology, End Uses, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Qualcomm Inc. (United States), Gemalto NV (Netherlands), Sierra Wireless (Canada), U-Blox Holding AG (Switzerland), MediaTek Inc. (Taiwan), Telit Communications PLC (UK), ZTE Corporation (China), Mistbase (Sweden), Sequans Communications (France), CommSolid GmbH (Germany), and Others. |

SEGMENTAL ANALYSIS

By Components Insights

The global cellular IoT market is bifurcated into hardware and software. The software segment is likely to occupy a prominent position in the international market and increase at a CAGR of 27.6% over the envisioned timeframe. The hardware segment is expected to post a CAGR of 26.5% during the conjecture period.

By Cellular Technology Insights

The cellular IoT market is divided into 3G, 4G, LTE-M, NB-IoT, and 5G. The NB-IoT segment's cellular IoT market revenue contribution is expected to increase at a CAGR of 35.3% in the coming years. The LTE-M segment is also expected to post a CAGR of 31.0% in the estimated period.

By End-Uses Insights

The global cellular IoT market is divided into agriculture, healthcare, retail, energy, automotive, transportation, infrastructure, etc. The contribution to revenue in the energy segment is expected to increase at a CAGR of 28.1% over the forecast period.

REGIONAL ANALYSIS

North America is expected to become the largest market in the global cellular IoT market. Most of the IoT providers, such as Qualcomm and Texas Instruments, are based in the North American region and are also investing in the local market IoT ecosystem area. For example, BMW Group, Intel, and Mobileye have partnered to provide autonomous driving.

KEY MARKET PLAYERS

This report provides valuable information on the ecosystem of this market, including chipset and device manufacturers. The main players in the global cellular IoT market are Qualcomm Inc. (United States), Gemalto NV (Netherlands), Sierra Wireless (Canada), U-Blox Holding AG (Switzerland), MediaTek Inc. (Taiwan), Telit Communications PLC (UK), ZTE Corporation (China), Mistbase (Sweden), Sequans Communications (France), CommSolid GmbH (Germany), and others.

RECENT MARKET HAPPENINGS

-

In March 2020, Sequans Communications and NXP Semiconductors collaborated to integrate the Internet of Things (IoT) LTE into NXP's microcontroller (MCU) ecosystem. The hub of the partnership will be the combination of NXP's LPC5500 microcontroller series with Sequans' Monarch GM01Q and NB01Q modules, providing a development platform that includes LTE-M and NB-IoT connectivity for IoT devices.

-

In November 2019, Telit presented new modules that were ideal for the transition to 4G NB-IoT. The new modules are created for users wishing to switch from 2G to 4G NB-IoT. Telit claims the new modules offer more efficient power consumption and improved connectivity coverage.

MARKET SEGMENTATION

This research report on the global cellular IoT market has been segmented and sub-segmented based on the component, cellular technology, end users, and region.

By Components

-

Hardware

-

Software

By Cellular Technology

-

3G

-

4G

-

LTE-M

-

NB-IoT

-

5G

By End-Uses

-

Agriculture

-

Retail

-

Healthcare

-

Energy

-

Automotive and Transportation

-

Infrastructure

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What are the primary applications of Cellular IoT technology globally?

Cellular IoT technology finds applications across various sectors such as agriculture, healthcare, automotive, smart cities, industrial automation, and utilities. These applications include smart farming, remote patient monitoring, connected cars, asset tracking, and smart grid management.

How does the emergence of 5G impact the Cellular IoT Market globally?

The rollout of 5G networks enhances the capabilities of Cellular IoT by providing higher data speeds, lower latency, and increased network capacity. This enables more sophisticated IoT applications and services, fostering the growth of the Cellular IoT Market globally.

How are enterprises leveraging Cellular IoT solutions to enhance operational efficiency globally?

Enterprises across various industries are leveraging Cellular IoT solutions to streamline operations, improve asset tracking and management, enhance predictive maintenance capabilities, optimize resource utilization, and enable remote monitoring and control of equipment and processes.

How do environmental sustainability concerns influence the adoption of Cellular IoT solutions worldwide?

Environmental sustainability concerns drive the adoption of Cellular IoT solutions by enabling efficient resource management, reducing energy consumption, minimizing waste, and facilitating environmentally friendly practices across various sectors such as agriculture, smart buildings, and transportation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com