Global Ceramics Market Size, Share, Trends, & Growth Forecast Report By Product (Traditional, Advanced), Application, End-use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Ceramics Market Size

The global ceramics market was worth USD 245.80 billion in 2024. The global market is expected to reach USD 396.29 billion by 2033 from USD 259.20 billion in 2025, rising at a CAGR of 5.45% from 2025 to 2033.

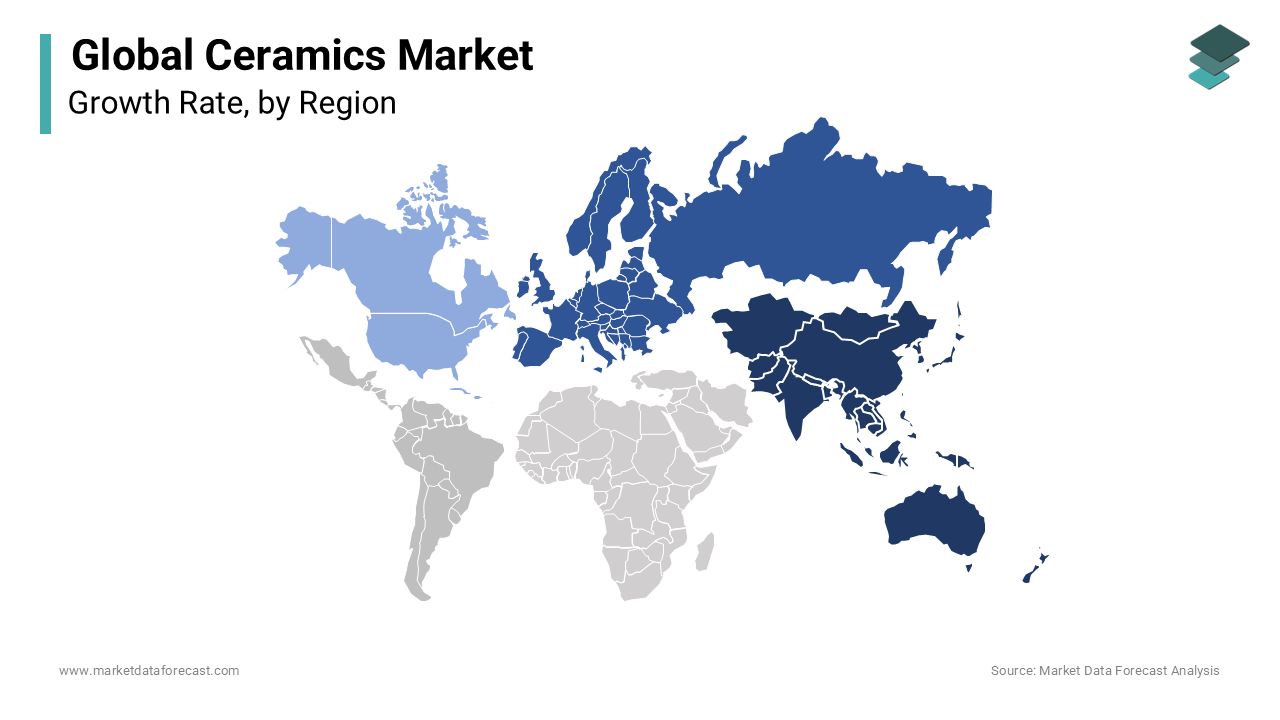

The global ceramics market has grown consistently in the last few years, with Asia-Pacific leading the pack. Asia-Pacific accounted for the most significant share of the global ceramics market in 2024, owing to the robust demand from countries like China, India, and Japan. As per the Ceramic World Review, China alone produces approximately 60% of the world’s ceramic tiles, underscoring its dominance in traditional ceramics. Europe follows closely, supported by high demand for advanced ceramics in industries like automotive and aerospace. The European Ceramic Society states that Germany contributes nearly 30% of the region’s ceramics production, leveraging its expertise in high-performance materials. Meanwhile, North America is witnessing steady growth due to increasing investments in construction and infrastructure projects, with the U.S. Department of Commerce estimating a 4% annual increase in ceramic tile imports since 2021. Emerging markets in Latin America and Africa are also gaining traction, fueled by urbanization and industrialization. For instance, Brazil ranks among the top five producers of ceramic tiles globally, generating revenues exceeding $5 billion annually.

MARKET DRIVERS

Rising Demand in Construction and Infrastructure

The rising demand for construction and infrastructure development is one of the major factors propelling the growth of the global ceramics market. According to studies, the global construction industry was valued at over $11 trillion in 2022 and this industry heavily relies on ceramics for applications such as flooring, roofing, and wall cladding. In regions like Asia-Pacific, rapid urbanization has spurred residential and commercial construction projects, driving ceramic tile consumption to exceed 15 billion square meters annually, as reported by the Ceramic Tiles of Italy Association. Governments worldwide are investing in infrastructure to support economic growth. For example, the U.S. Infrastructure Investment and Jobs Act allocates $1.2 trillion for projects like roads, bridges, and public transit systems, creating opportunities for ceramics in structural components. Additionally, advancements in ceramic coatings enhance durability and energy efficiency, making them indispensable in modern architecture.

Technological Advancements in Advanced Ceramics

Technological advancements are further fueling the growth of the global ceramics market, particularly in advanced ceramics. The demand for advanced ceramics has been growing rapidly owing to the innovations in materials science. Industries like aerospace, healthcare, and electronics rely on advanced ceramics for their superior properties, including heat resistance, electrical insulation, and biocompatibility. For instance, zirconia-based ceramics are widely used in dental implants. Similarly, silicon nitride ceramics are critical for manufacturing jet engine components, contributing to a 10% reduction in fuel consumption, according to the International Journal of Applied Ceramic Technology. These breakthroughs attract significant investment from both private and public sectors, fostering innovation and broadening access to transformative solutions.

MARKET RESTRAINTS

High Energy Costs in Production

The high energy costs associated with production processes are one of the key factors hindering the growth of the global ceramics market. Ceramics manufacturing is energy-intensive, with kilns requiring temperatures exceeding 1,200°C for firing raw materials. According to the International Energy Agency (IEA), energy expenses account for approximately 30% of total production costs, making profitability challenging for smaller manufacturers. Fluctuations in energy prices exacerbate this issue. For example, the global energy crisis of 2022 led to a 20% increase in natural gas prices, forcing many European ceramic producers to reduce output or halt operations temporarily. This volatility not only impacts operational efficiency but also limits market expansion, particularly in developing regions where energy infrastructure is underdeveloped. Addressing these challenges requires investments in energy-efficient technologies and renewable energy sources.

Environmental Regulations and Sustainability Concerns

Environmental regulations and sustainability concerns are further inhibiting the growth of the global ceramics market. Traditional ceramics production generates significant carbon emissions and waste, prompting stricter regulatory measures. According to the European Environment Agency, the ceramics industry contributes to approximately 5% of industrial CO2 emissions in the EU, leading to mandates for cleaner production practices. Additionally, raw material extraction, particularly for clay and silica, raises ecological concerns. A study published in Resources, Conservation and Recycling highlights that unsustainable mining practices have degraded over 2 million hectares of land globally, impacting biodiversity. Compliance with international standards, such as ISO 14001 for environmental management, increases operational costs, particularly for small-scale producers.

MARKET OPPORTUNITIES

Growth in Automotive Applications

The growing use of ceramics in the automotive industry, particularly for lightweight and heat-resistant components is one of the promising opportunities for the global ceramics market. The demand for automotive ceramics is expected to have a promising demand over the forecast period due to the shift toward electric vehicles (EVs) and hybrid models. Ceramics like silicon carbide and aluminum oxide are integral to EV battery systems, enhancing thermal management and extending lifespan. For instance, Tesla’s adoption of ceramic-based cooling systems has improved battery efficiency by 15%, as reported by the Journal of Power Sources. Additionally, the rise of autonomous vehicles creates demand for advanced ceramic sensors and actuators, ensuring precision and reliability. By targeting these niche yet lucrative applications, ceramics manufacturers can tap into a burgeoning market, fostering innovation and contributing to global decarbonization efforts.

Expansion into Renewable Energy Applications

Another lucrative opportunity exists in the renewable energy sector, where ceramics play a critical role in enhancing efficiency and durability. Solar panels, wind turbines, and fuel cells increasingly rely on ceramic components for their thermal and electrical properties. For example, piezoelectric ceramics are essential for converting mechanical energy into electricity in wind turbines, achieving conversion efficiencies exceeding 40%, as per the International Renewable Energy Agency. Similarly, solid oxide fuel cells (SOFCs) utilize ceramic electrolytes to generate clean energy, reducing carbon emissions by 50% compared to conventional systems.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Scarcity

Supply chain disruptions and raw material scarcity represent a significant challenge for the ceramics market, particularly in post-pandemic scenarios. According to the World Bank, global supply chain bottlenecks caused a 15% increase in raw material costs in 2022, impacting ceramics production. For instance, shortages of high-purity alumina, a key ingredient in advanced ceramics, delayed shipments and increased lead times. Geopolitical tensions further compound this issue. The Russia-Ukraine conflict disrupted exports of rare earth elements, which are critical for manufacturing specialized ceramics, as reported by the International Trade Centre. Additionally, logistical inefficiencies, such as port congestion and labor shortages, hinder the timely delivery of finished products. These obstacles not only affect profitability but also limit accessibility for end consumers, creating barriers to market growth.

Limited Awareness of Advanced Ceramics

Limited awareness about the benefits and applications of advanced ceramics remains a formidable barrier, particularly among smaller manufacturers and end-users. Many businesses lack understanding of how advanced ceramics can optimize their processes, leading to underutilization of the technology. According to a study by Springer Nature, less than 40% of SMEs in the manufacturing sector are familiar with advanced ceramics beyond conventional uses like abrasives and refractories. This knowledge gap results in missed opportunities for innovation and cost savings. For instance, companies specializing in medical devices might overlook ceramics’ potential for creating biocompatible implants, despite their superior wear resistance and compatibility with human tissues. Similarly, emerging industries like flexible electronics remain largely unaware of ceramics’ versatility in enabling high-performance components. Without targeted educational campaigns, this lack of awareness stifles broader adoption and market penetration.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Mohawk Industries, RAK Ceramics, Ceramica Saloni, Villeroy & Boch, Kajaria Ceramics, Grupo Lamosa, SCG Ceramics, Johnson Tiles, Saint-Gobain, and Imerys Ceramics. |

SEGMENTAL ANALYSIS

By Product Insights

The traditional ceramics segment captured the leading share of 68.8% of the global ceramics market in 2024. This segment includes products like tiles, bricks, and sanitaryware, which are widely used in construction and household applications. The global demand for ceramic tiles alone exceeds 15 billion square meters annually, driven by urbanization and infrastructure development, particularly in Asia-Pacific. Key factors propelling this leadership include affordability and widespread availability. For instance, countries like China and India leverage economies of scale to produce cost-effective tiles, catering to both domestic and international markets. Additionally, advancements in glazing and decorative techniques enhance aesthetic appeal, meeting evolving consumer preferences.

The advanced ceramics are another major segment and are anticipated to witness the fastest CAGR of 8.12% over the forecast period owing to their unique properties, such as high strength, thermal stability, and electrical insulation, making them indispensable in high-tech industries. For example, the aerospace sector utilizes silicon nitride ceramics for turbine blades, achieving fuel efficiency improvements of up to 10%, as stated by the International Journal of Applied Ceramic Technology. Emerging applications in healthcare and electronics further accelerate adoption. Zirconia-based ceramics are widely used in dental implants, with the global market expected to reach $3 billion by 2027. Similarly, piezoelectric ceramics enable precise actuation in robotics and sensors. These innovations position advanced ceramics as a transformative force within the industry.

By Application Insights

The tiles segment was the largest segment and accounted for 51.5% of the global market share in 2024. The leading position of the tiles segment in the global market is driven by its widespread use in residential, commercial, and infrastructure projects. According to the Ceramic Tiles of Italy Association, global tile consumption exceeded 15 billion square meters in 2022, with Asia-Pacific accounting for over 70% of this demand. The urbanization and construction booms in emerging economies is further boosting the expansion of the tiles segment in the global market. For instance, China and India are leading producers and consumers of ceramic tiles, leveraging cost-effective manufacturing processes to meet domestic and international needs. Additionally, advancements in digital printing technologies have enhanced aesthetic appeal, enabling manufacturers to offer customizable designs that cater to diverse consumer preferences. Government investments in infrastructure, such as affordable housing projects, further boost demand.

The abrasives segment is anticipated to witness the fastest CAGR of 10.4% over the forecast period owing to their critical role in industrial applications like metal fabrication, automotive manufacturing, and surface finishing. The growing automation in manufacturing processes that require high-performance materials for precision grinding and polishing is also propelling the expansion of abrasives segment in the global market. For example, advanced ceramic abrasives, such as alumina-based products, are preferred for their durability and heat resistance, reducing downtime in machining operations. Additionally, the rise of electric vehicles (EVs) has created demand for abrasives in battery production, where they are used to refine electrode materials.

By End-Use Insights

The industrial end-use segment led the market by holding the major share of the global ceramics market in 2024. The dominance of the industrial segment is majorly driven by their versatility of ceramics in applications like machinery components, refractories, and thermal insulation. According to the International Energy Agency (IEA), the global industrial sector accounts for over 40% of energy consumption, driving demand for heat-resistant materials like silicon carbide and zirconia ceramics. The shift toward energy-efficient manufacturing practices is also propelling the growth of the industrial segment in the global market. For instance, industries like steel and cement rely on ceramic linings in kilns and furnaces to improve thermal efficiency, reducing energy costs by up to 20% annually. Additionally, advancements in additive manufacturing have expanded the use of ceramics in creating lightweight, durable components for aerospace and automotive sectors.

The medical segment is anticipated to exhibit the fastest CAGR of 10.4% over the forecast period owing to the increasing adoption of biocompatible ceramics in healthcare applications such as dental implants, orthopedic devices, and surgical instruments. Key factors include aging populations and rising healthcare expenditures. For example, zirconia-based ceramics are widely used in dental prosthetics due to their strength and aesthetic resemblance to natural teeth, addressing the needs of over 700 million people aged 65+ globally, as per the United Nations. Additionally, innovations in nanoceramics enable precise drug delivery systems, enhancing treatment efficacy.

REGIONAL ANALYSIS

Asia-Pacific dominated the ceramics market by holding 51.7% of the global market share in 2024. China leads production, accounting for 60% of global ceramic tile output, while India and Japan are emerging as key players in advanced ceramics. A study by the Ceramic World Review reveals that Asia-Pacific consumes approximately 70% of all ceramic tiles globally, driven by urbanization and infrastructure development. Technological advancements in manufacturing processes further boost this dominance. For instance, China’s adoption of automated kilns has improved energy efficiency by 20%, reducing production costs. Additionally, Japan’s expertise in zirconia ceramics supports its leadership in medical applications, with the growing demand for dental ceramics.

Europe accounts for a prominent share of the global ceramics market over the forecast period. According to the European Ceramic Society, Germany produces nearly 30% of the region’s ceramics, leveraging its expertise in advanced materials for industrial applications. Italy, on the other hand, dominates the global tile market, exporting over 350 million square meters annually, as reported by the Ceramic Tiles of Italy Association. The shift toward sustainable manufacturing practices is further boosting the expansion of the European ceramics market. For example, Italian manufacturers have adopted digital printing technologies, reducing water usage by 30% during tile production. Additionally, the rise of electric vehicles (EVs) has spurred demand for ceramic components in battery systems, enhancing thermal management efficiency by 15%, according to BloombergNEF.

North America holds a significant position in the global ceramics market. The United States leads consumption trends, driven by its robust construction and automotive industries. The U.S. ceramics market is projected to grow at a CAGR of 4.5% over the forecast period owing to the investments in infrastructure and renewable energy projects. The adoption of advanced ceramics in high-tech sectors in North America is further fueling the expansion of the North American market. For instance, silicon nitride ceramics are widely used in jet engine components, contributing to a 10% reduction in fuel consumption, as stated by the International Journal of Applied Ceramic Technology. Additionally, government initiatives like the Infrastructure Investment and Jobs Act allocate $1.2 trillion for construction projects, creating opportunities for traditional ceramics like tiles and bricks.

Latin America is anticipated to account for a considerable share of the global ceramics market over the forecast period. According to the Brazilian Association of Ceramic Industries, Brazil ranks among the top five producers of ceramic tiles globally, generating revenues exceeding $5 billion annually. Mexico follows closely, supplying cost-effective products to North American markets under trade agreements like USMCA. Key drivers include urbanization and construction booms. For example, Brazil’s affordable housing programs have increased tile consumption by 10% annually, as reported by the National Institute of Statistics. Additionally, advancements in glazing techniques enhance product durability, meeting international quality standards.

The ceramics market in the Middle East and Africa is projected to exhibit a steady CAGR over the forecast period, with Egypt and Saudi Arabia leading production. According to the African Development Bank, Egypt produces over 1 million metric tons of ceramic tiles annually, supported by government subsidies and technological upgrades. Meanwhile, Saudi Arabia’s Vision 2030 initiative emphasizes diversification into manufacturing, boosting ceramics exports. A major driver is the rise of infrastructure projects, such as Dubai’s Expo 2020, which utilized advanced ceramics for architectural facades. Additionally, collaborations with European firms enhance local expertise, ensuring compliance with international standards.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Mohawk Industries, RAK Ceramics, Ceramica Saloni, Villeroy & Boch, Kajaria Ceramics, Grupo Lamosa, SCG Ceramics, Johnson Tiles, Saint-Gobain, and Imerys Ceramics are some of the key market players in the ceramics market.

The Omega-3 market is characterized by intense competition, with established giants and emerging players vying for dominance. Key participants leverage their expertise in sourcing, purification, and formulation to differentiate themselves. Consolidation through mergers and acquisitions is common, enabling companies to expand geographically and diversify product portfolios. For instance, BASF’s acquisition of Equateq strengthened its position in high-concentration Omega-3 supplements.

Meanwhile, startups disrupt traditional dynamics by introducing plant-based and algae-derived Omega-3 alternatives, appealing to vegan demographics. Regional players also pose a threat, capitalizing on localized expertise to challenge global leaders. This competitive landscape drives continuous innovation, benefiting end-users through improved product quality, affordability, and sustainability.

Top Players in the Ceramics Market

Mohawk Industries

Mohawk Industries is a global leader in ceramic flooring solutions, offering a diverse portfolio of tiles and slabs for residential and commercial applications. The company leverages advanced digital printing technologies to create customizable designs, catering to evolving consumer preferences. Mohawk’s focus on sustainability is evident in its use of recycled materials, reducing environmental impact while maintaining product quality. With a strong presence in North America and Europe, Mohawk continues to innovate, addressing shifting market demands effectively.

Rak Ceramics

Rak Ceramics excels in producing high-quality ceramic tiles and sanitaryware, serving over 150 countries worldwide. The company operates one of the largest ceramic manufacturing facilities globally, ensuring steady supply chain resilience. Rak’s investment in R&D has led to breakthroughs in glazing and finishing techniques, enhancing aesthetic appeal and durability. Collaborations with architects and designers demonstrate its commitment to meeting diverse customer needs, strengthening its competitive edge.

Kajaria Ceramics

Kajaria Ceramics is India’s largest manufacturer of ceramic tiles, known for its innovative designs and cost-effective solutions. The company supplies products for both domestic and international markets, leveraging economies of scale to maintain affordability. Kajaria prioritizes sustainability, adopting energy-efficient kilns that reduce carbon emissions by 20% annually. With a strong focus on customization and quality, Kajaria continues to expand its footprint in emerging economies.

Top Strategies Used by Key Market Participants

Sustainability Initiatives

Leading players prioritize sustainability to align with global environmental goals and consumer preferences. For example, Mohawk Industries has invested in recycling programs, utilizing over 500 million pounds of recycled materials annually. These initiatives not only enhance brand reputation but also comply with stringent regulations, ensuring long-term competitiveness. Additionally, certifications like ISO 14001 reinforce their commitment to eco-friendly practices, attracting environmentally conscious buyers.

Technological Advancements

To stay ahead, companies invest heavily in R&D to develop cutting-edge products. Rak Ceramics, for instance, introduced nanoglaze technology, improving scratch resistance and gloss retention by 30%. Similarly, Kajaria Ceramics adopted automated production lines, increasing output efficiency by 25%. These innovations address unmet needs while fostering customer loyalty, positioning players as leaders in quality and performance.

Strategic Partnerships and Expansions

Strategic partnerships and geographic expansions strengthen market presence and operational efficiency. In April 2024, Rak Ceramics acquired a Turkish tile manufacturer, expanding its footprint in Europe. Such moves enhance supply chain resilience and foster knowledge sharing. Additionally, collaborations with local distributors ensure accessibility and affordability, meeting regional demands effectively.

REGIONAL ANALYSIS

- In April 2024, BASF acquired Equateq, a Scottish producer of high-purity Omega-3 concentrates. This move expanded BASF’s product portfolio and solidified its leadership in the nutraceutical sector.

- In June 2024, DSM launched a new line of plant-based Omega-3 supplements derived from algae, targeting the growing vegan demographic. This initiative diversified its offerings and addressed shifting consumer preferences.

- In August 2024, Croda International partnered with a Norwegian biotech firm to develop sustainable Omega-3 extraction methods using microbial fermentation, reducing reliance on fish oil. This innovation aligned with sustainability goals and strengthened its competitive edge.

- In October 2024, Aker BioMarine announced a $100 million investment in krill harvesting technologies, improving yield and environmental performance. This reinforced its commitment to eco-friendly practices.

- In December 2024, Nutrinova signed a distribution agreement with Amazon, enabling direct-to-consumer sales of its Omega-3 capsules. This partnership expanded accessibility and tapped into the booming e-commerce segment.

MARKET SEGMENTATION

This research report on the global ceramics market is segmented and sub-segmented into the following categories.

By Product

- Traditional

- Advanced

By Application

- Sanitary Ware

- Abrasives

- Bricks & Pipes

- Tiles

- Pottery

- Others

By End Use

- Building & Construction

- Industrial

- Medical

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving growth in the ceramics market?

Growth is driven by rising construction activities, increased demand for durable and aesthetic flooring, advancements in ceramic technologies, and expanding use in medical and industrial applications.

What are the challenges faced by the ceramics market?

Challenges include high energy consumption during production, environmental concerns, and volatile raw material prices.

What is the future outlook for the ceramics market?

The market is expected to grow steadily due to increasing urbanization, smart infrastructure projects, and expanding uses in healthcare and electronics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]