Global Cholesterol Testing Services Market Size, Share, Trends & Growth Forecast Report By Type of Customer and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Cholesterol Testing Service Market Size

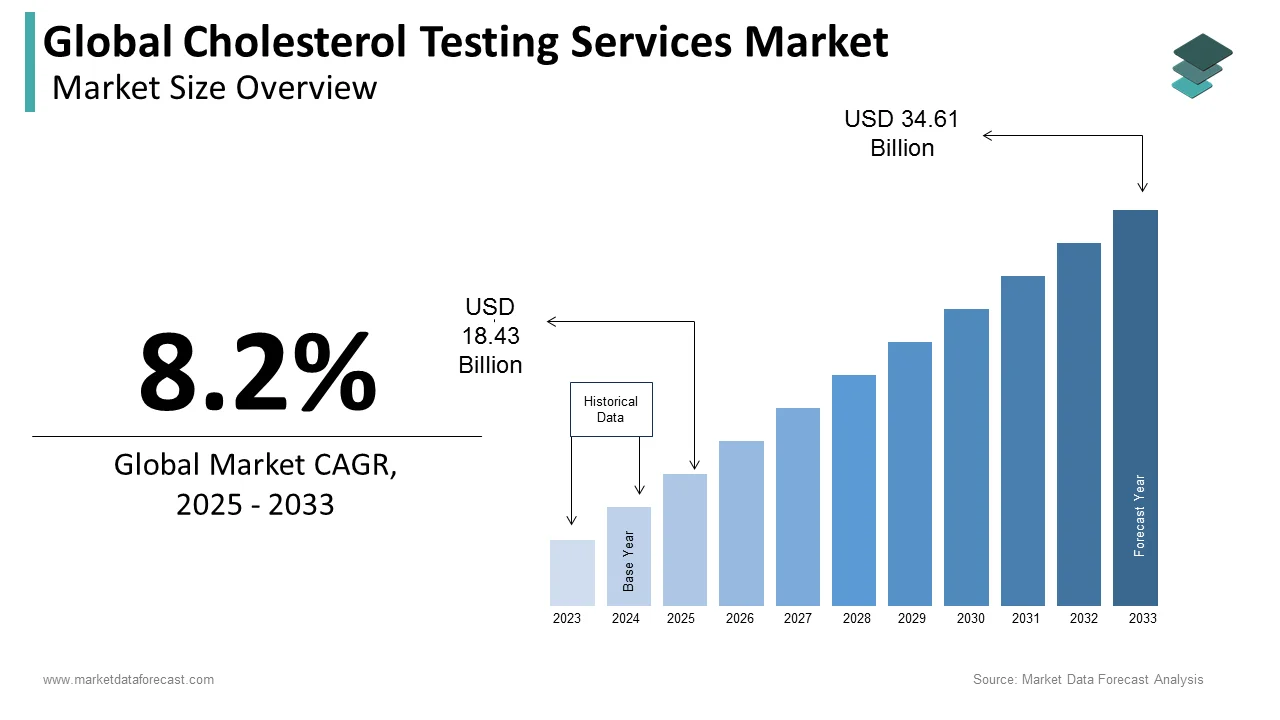

The size of the global cholesterol testing services market was worth USD 17.03 billion in 2024. The global market is anticipated to grow at a CAGR of 8.2% from 2025 to 2033 and be worth USD 34.61 billion by 2033 from USD 18.43 billion in 2025.

Cholesterol is a waxy, fat-like substance found in every cell of our body. If you have too much cholesterol in your blood, it can combine with other elements in your blood to form plaque that sticks to the walls of the arteries. A complete cholesterol test is also referred to as a lipid panel or lipid profile. Your doctor will measure the amount of "good" and "bad" cholesterol and triglycerides, a type of fat in the blood. High cholesterol levels lead to health hazards such as the acute risk of stroke and heart disease and cause many deaths. Cholesterol screening services enable the early detection of high-cholesterol-related problems to avoid complications and increase patient survival.

MARKET DRIVERS

The growing incidence of cardiovascular disease, rising adoption of a sedentary lifestyle, an increase in the geriatric population, and government initiatives to improve healthcare delivery are majorly propelling the growth of the global cholesterol testing services market.

The global cholesterol testing services market is further driven by doctors' preference for laboratory testing over self-testing and the rise in healthcare spending. A significant risk of stroke and heart disease, both of which cause a substantial number of deaths, are increased by high cholesterol levels. The expansion of the cholesterol testing services market is fuelled by discovering issues early to avoid complications, gradual awareness of the dangers of cholesterol and education about the importance of these tests, technological advancements in cholesterol laboratory testing services, and enhancing the patient's chances of life. Because high cholesterol has no symptoms, comprehensive cholesterol testing is required. Total cholesterol, high-Density Lipoprotein (HDL), low-Density Lipoprotein (LDL), and triglycerides are the four lipids measured in the blood. Measurements of blood cholesterol helps to reduce the risk of heart attack, stroke, and peripheral artery disease.

Another disease associated with high cholesterol is obesity. The need for these tests will grow as the incidence of cholesterol-related illnesses rises, boosting the global laboratory cholesterol testing market. Cholesterol lab testing services provide for early diagnosis of issues, avoiding complications, and improving patients' chances of life. The market for cholesterol lab testing services is projected to expand as a result of this. Because of their increased focus on preventive care and early detection to avert major illness problems, the government agencies segment is anticipated to develop significantly in the coming years. The major companies in the market collaborate with federal, state, and local government organizations to deliver high-quality diagnostic testing services worldwide. According to the Centers for Disease Control and Prevention (CDC), adults aged 40 to 59 have the highest total cholesterol. This is mostly due to a sedentary lifestyle, which has been linked to the development of several diseases, including obesity, diabetes, and heart disease. As a result, it is expected that there would be a greater awareness of the importance of routine cholesterol testing and treatment.

MARKET RESTRAINTS

In addition to the restrictions presented by the development of non-invasive cholesterol testing techniques, the existence of home or self-test kits might limit expansion. Therefore, leading companies are concentrating on developing new and sophisticated monitoring devices to overcome the challenges of existing equipment, resulting in intense competition in the worldwide cholesterol testing services market.

Impact Of Covid-19 On The Global Cholesterol Testing Services Market

The current pandemic of coronavirus disease-19 (COVID-19) is caused by the severe acute respiratory syndrome coronavirus. Patients with cardiovascular disease (CVD), hypertension, and overweight/obesity tend to have a more severe clinical course (COVID-19) when infected with the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) that produces coronavirus illness-19. This risk rises when your arteries become blocked with too much bad cholesterol, leading them to constrict. Plaque is a kind of plaque that inhibits blood flow to and from your heart and other organs. High cholesterol has been related to an increased risk of developing various diseases. There's even some indication that elevated cholesterol levels cause higher mortality in some COVID-19 patients. People are becoming fatter, and their chances of developing cardiovascular illnesses are growing after the advent of the COVID-19 pandemic. On the other hand, the government is spending billions on improving healthcare infrastructure and promoting a healthier lifestyle, which has been proven to be a market growth driver. Considering all factors, the market has moderately grown during the COVID-19 pandemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.2% |

|

Segments Covered |

By Type of Customer and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Laboratory Corporation of America Holdings (Lab Corp.) (USA), Quest Diagnostics Incorporated (USA), Eurofins Scientific (Luxembourg) and Spectra Laboratories Inc. (USA), Unilabs (Switzerland), SYNLAB International GmbH (Germany), Bio-Reference Laboratories Inc. (USA), Clinical Reference Laboratory, Inc. (CRL) (USA), ACM Medical Laboratory (USA) and Adicon Clinical Laboratory (China)., and Others. |

SEGMENTAL ANALYSIS

By Type of Customer Insights

The physicians, providers, and hospital segments are estimated to account for most of the market share during the forecast period. Factors such as growing reimbursement scenarios, physicians' assurance on cholesterol test outcomes making the cardiovascular disease risk assessments, and treatment-based decisions are forecasted to accelerate the growth of these segments.Besides the above, the patient segment is expected to be another lucrative segment and is predicted to register a healthy growth rate during the forecast period. The easy availability of diagnostic lab centers for test services and rising healthcare awareness are expected to boost this segment. Moreover, factors such as access to lab test reports, easy accessibility of lab tests without physician intervention, increased government measures in developing the testing quality, the rising aging population, and the obese population support market growth.

REGIONAL ANALYSIS

Geographically, North America is expected to dominate the market for cholesterol testing in 2024, and the United States is an essential part of it. However, Asia is expected to be the fastest-growing region in CAGR over the forecast period due to the large population base, the increase in cardiovascular disease, and the increasing number of test facilities in Asia.

KEY MARKET PLAYERS

Notable companies leading the global cholesterol testing service market profiled in this report are Laboratory Corporation of America Holdings (Lab Corp.) (USA), Quest Diagnostics Incorporated (USA), Eurofins Scientific (Luxembourg) and Spectra Laboratories Inc. (USA), Unilabs (Switzerland), SYNLAB International GmbH (Germany), Bio-Reference Laboratories Inc. (USA), Clinical Reference Laboratory, Inc. (CRL) (USA), ACM Medical Laboratory (USA) and Adicon Clinical Laboratory (China)., and Others.

RECENT MARKET HAPPENINGS

Quest Diagnostics launched a non-fasting cholesterol test with an enhanced LDL calculation technique in 2017 to increase accuracy and patient comfort.

MARKET SEGMENTATION

This research report on the global cholesterol testing service market has been segmented and sub-segmented based on the type of customer and region.

By Type of Customer

- Physician

- Provider

- Hospital

- Employer

- Health Plan

- MCO

- Government

- ACO

- IDN

- Patient

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the growth rate of the global cholesterol testing services market?

The global cholesterol testing services market is estimated to grow at a CAGR of 8.2% from 2025 to 2033.

Which geographical region led the cholesterol testing services market?

Geographically, the North American region accounted for the most significant share of the global market in 2024.

Who are the key players in the cholesterol testing services market?

Laboratory Corporation of America Holdings (Lab Corp.) (USA), Quest Diagnostics Incorporated (USA), Eurofins Scientific (Luxembourg) and Spectra Laboratories Inc. (USA), Unilabs (Switzerland), SYNLAB International GmbH (Germany), Bio-Reference Laboratories Inc. (USA), Clinical Reference Laboratory, Inc. (CRL) (USA), ACM Medical Laboratory (USA) and Adicon Clinical Laboratory (China) are some of the noteworthy players in the global cholesterol testing services market.

How much is the global cholesterol testing services market going to be worth by 2033?

As per our research report, the global cholesterol testing services market size is projected to rise by USD 34.61 billion by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]